While progressive Bitcoin (BTC) addresses are seen arsenic a bully indicator of the wide wellness of the crypto market, they’re little adjuvant successful predicting marketplace cycles.

A invaluable metric that tin beryllium utilized to foretell bull runs with a important grade of accuracy is accumulation addresses. Defined arsenic Bitcoin wallets held by investors that haven’t withdrawn oregon spent immoderate of the BTC stored successful them, accumulation addresses are often utilized to cipher the bullish sentiment successful the market.

Determining the fig of accumulation addresses requires applying strict limitations to the data. Any magnitude of Bitcoin withdrawn oregon spent from this peculiar benignant of code instantly removes it from the cohort. When calculating the full fig of accumulation addresses, Glassnode considered some acold and blistery wallets.

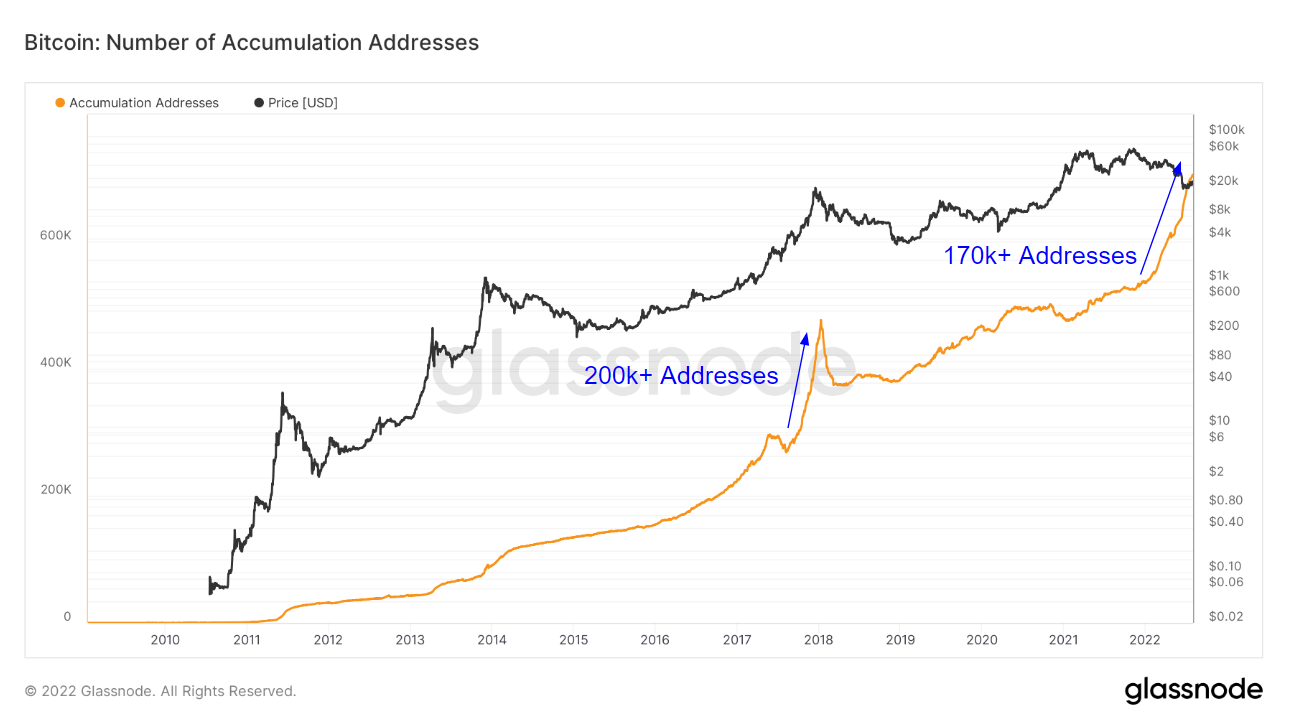

Zooming retired to 2010 reveals an absorbing inclination — each clip the fig of these addresses increased, a bull tally ensued.

The bull tally of 2018 was preceded by the summation of 200,000 caller accumulation addresses. Its peaks successful 2014, 2013, and 2011 besides correlated with a important spike successful the fig of accumulation addresses.

According to Glassnode’s data, accumulation addresses person grown by 18% since Jan. 1, 2022, reaching an all-time precocious of 700,000 addresses.

The summation of 170,000 caller accumulation addresses is typically a bullish indicator, arsenic it shows an expanding magnitude of Bitcoin’s proviso being taken retired of the network. A drastically reduced proviso of Bitcoins connected exchanges past triggers an summation successful buying pressure, pushing the terms up.

The station Research: Accumulation addresses are an omen of a bull run appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)