Crypto exchanges tin gain gross done assorted means, including lending to borderline traders, liquidation fees, and on/off ramping charges. However, the halfway gross generator remains taking a interest connected transactions.

There are aggregate types of transactions and, therefore, galore types of transaction fees. When comparing antithetic transaction fees connected the Bitcoin and Ethereum chains, the information suggested exchanges similar to usage the erstwhile to transportation worth internally.

Transaction fees

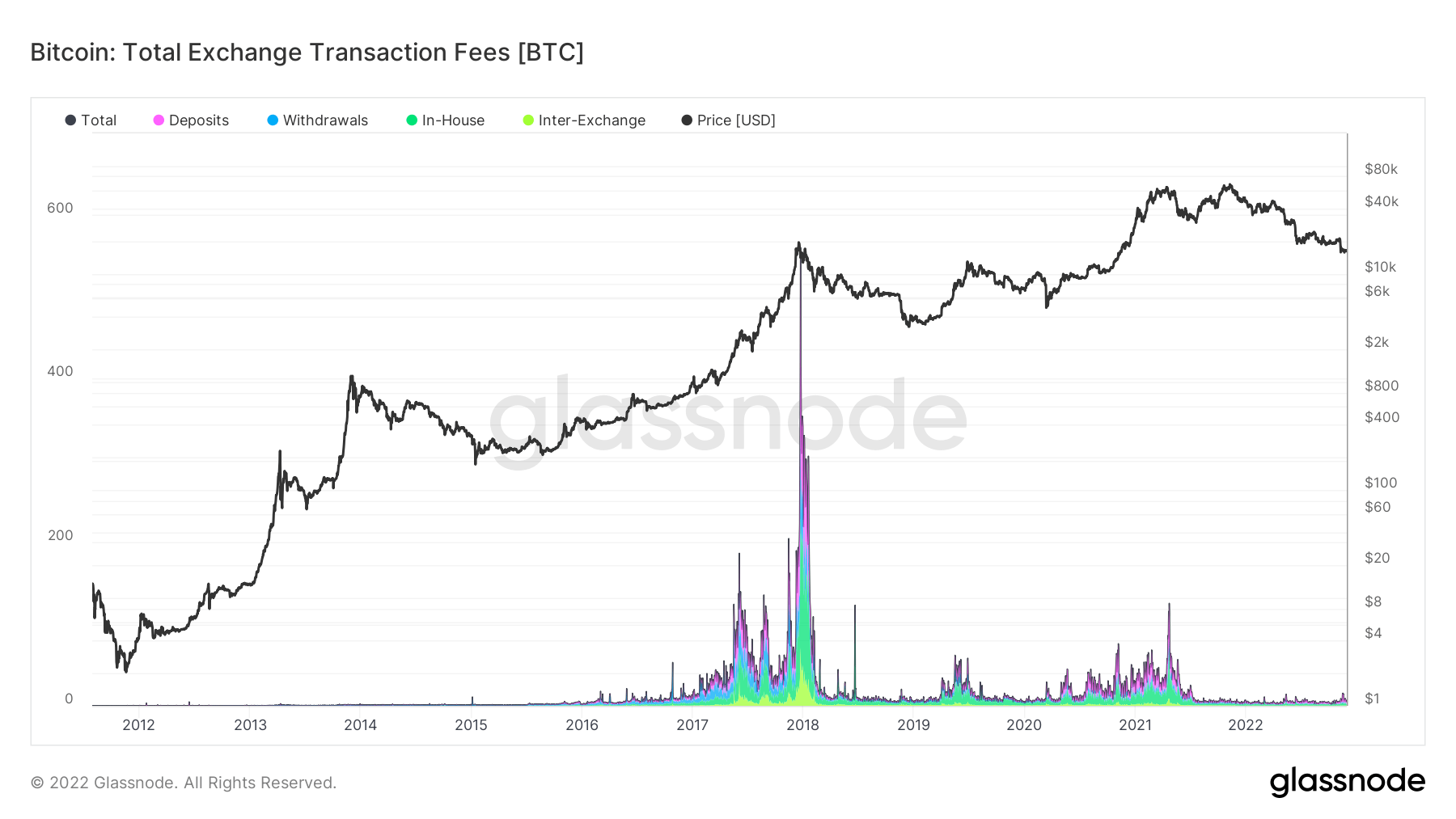

On-chain information provided by Glassnode and analyzed by CryptoSlate showed an erratic past for fees earned by exchanges connected Bitcoin transactions.

The illustration beneath features a sizeable spike successful fees towards the extremity of 2017, arsenic BTC deed its $20,000 erstwhile rhythm peak.

The 2021 bull marketplace saw different interest spike successful April 2021, albeit importantly little than the 2017 bull, arsenic BTC approached $65,000.

Strangely, the astir caller bull marketplace top, of $69,000 successful Nov. 2021, was not accompanied by different interest spike, suggesting comparatively little speech enactment versus April 2021.

Since April 2021, fees done Bitcoin transactions person sunk importantly and stay truncated.

Source: Glassnode.com

Source: Glassnode.comBitcoin: Exchange Fee Dominance

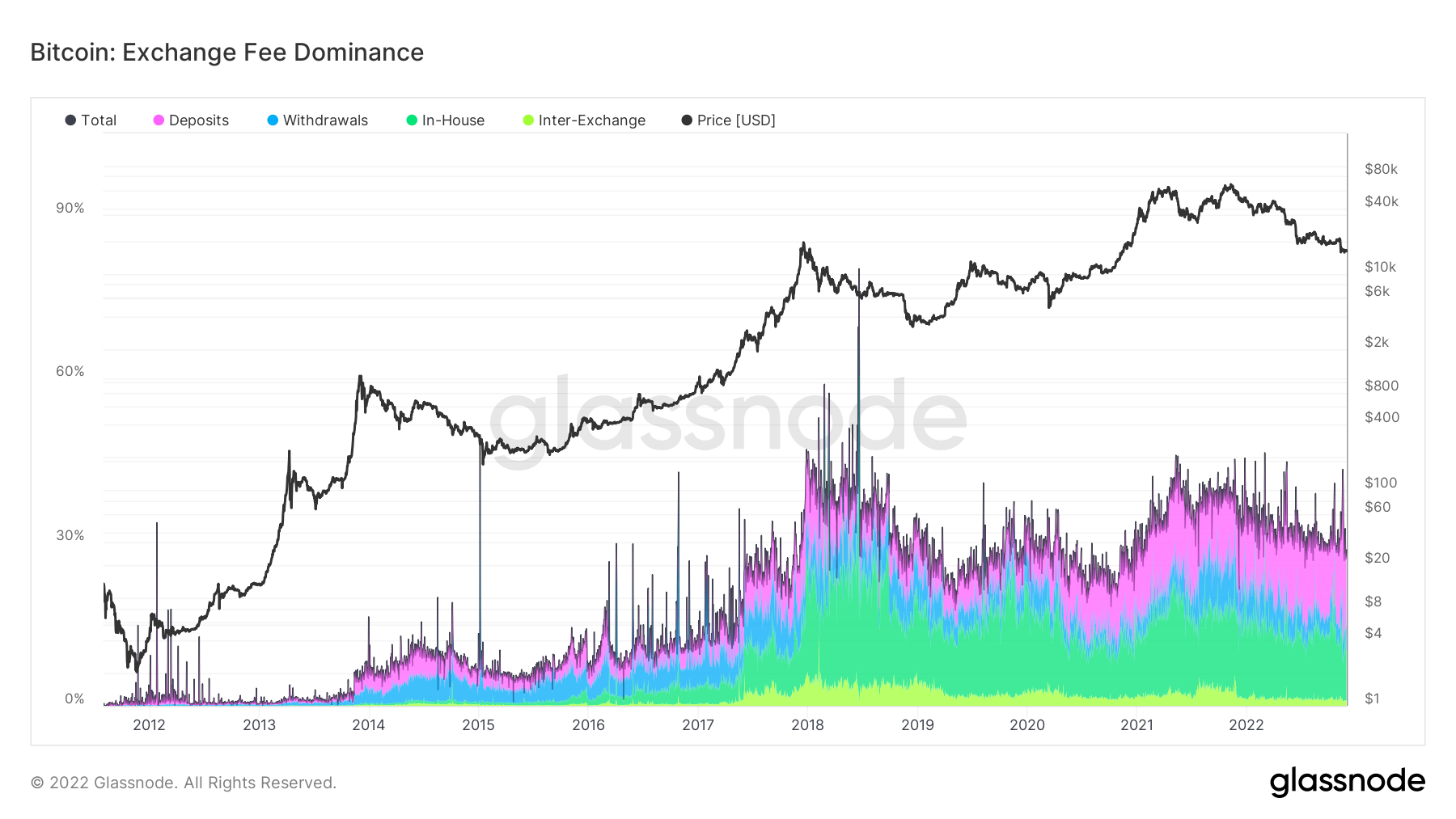

The Exchange Fee Dominance metric is defined arsenic the percent of full transaction fees paid successful narration to on-chain speech activity. This is further divided into the benignant of transaction that earned the interest arsenic follows:

- Deposits: Transactions that see an speech code arsenic the receiver of funds.

- Withdrawals: Transactions that see an speech code arsenic the sender of funds.

- In-House: Transactions that see addresses of a azygous speech arsenic some the sender and receiver of funds.

- Inter-Exchange: Transactions that see addresses of (distinct) exchanges arsenic some the sender and receiver of funds.

The illustration beneath shows Bitcoin transaction fees made up 36% of each speech gross sources related to BTC. This is further split:

- Deposits – 21%

- Withdrawals – 4%

- In-House – 10%

- Inter-Exchange – 1%

Over the past 5 years, the categories of Deposits and In-House person grown exponentially.

Source: Glassnode.com

Source: Glassnode.comEthereum: Exchange Fee Dominance

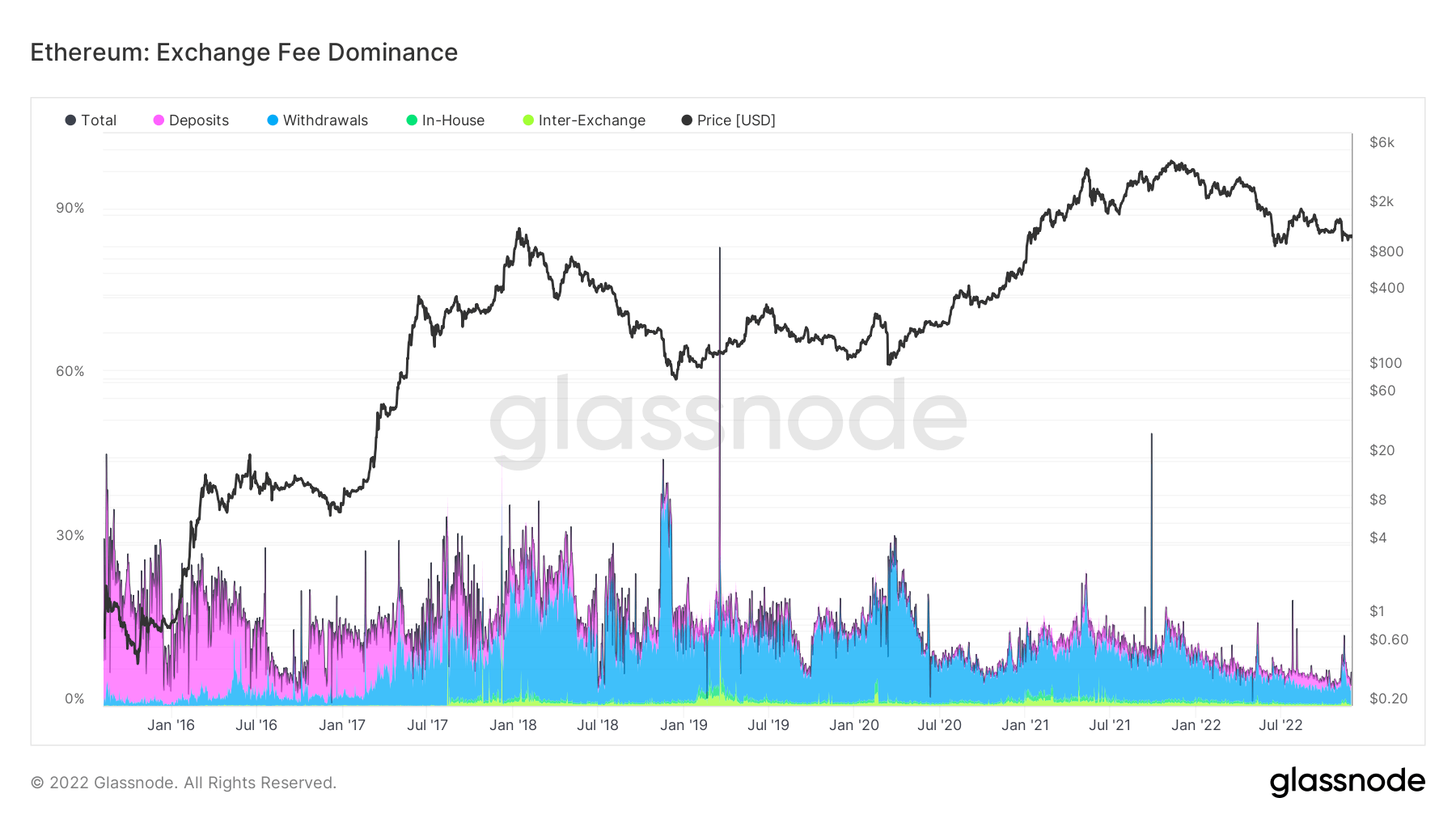

Analysis of Ethereum’s Exchange Fee Dominance paints a precise antithetic picture. Currently, Ethereum transaction fees relationship for 5% of speech gross sources related to ETH.

Withdrawals marque up the astir important class of transaction interest type, which has been the lawsuit since July 2017.

The comparative deficiency of In-House fees compared to Bitcoin suggests exchanges similar not to usage ETH erstwhile transferring funds betwixt interior wallets.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Analysis of crypto transaction fees suggests exchanges similar to determination successful Bitcoin appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)