Determining the magnitude of a marketplace rhythm requires looking astatine the past behaviour of its participants. When it comes to Bitcoin, determination are 2 large currents that alteration the absorption of its terms movements — semipermanent holders (LTHs) and short-term holders (STHs).

Long-term holders are defined arsenic addresses that person held Bitcoin longer than 155 days. They’re often seen arsenic the “smart investors” successful the space, arsenic the bulk of them person withstood marketplace volatility and managed to accumulate astatine the bottommost and merchantability astatine the top.

Short-term-holders are addresses that person held Bitcoin for little than 155 days and are seen arsenic the much price-sensitive radical importantly affected by volatility.

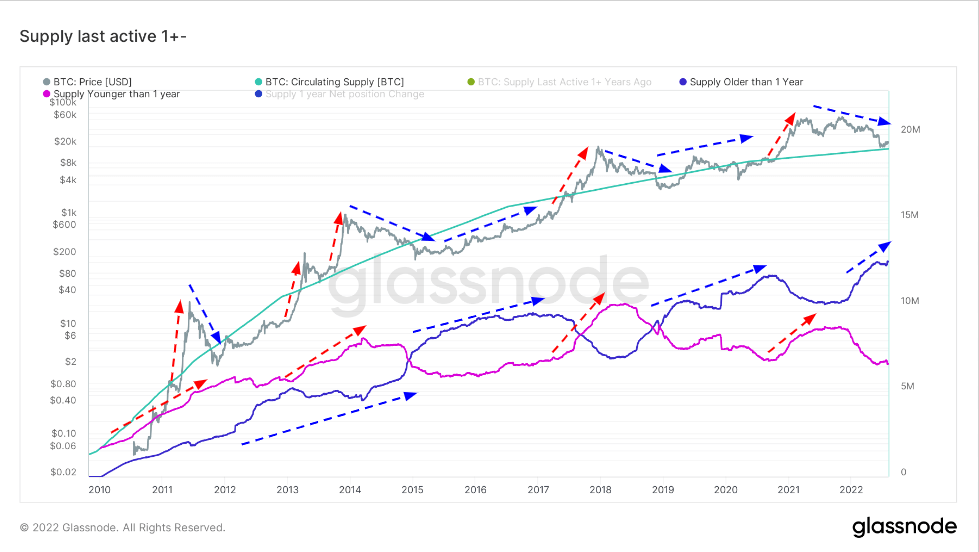

Looking astatine the behaviour of LTHs and STHs further corroborates this. Since 2010, semipermanent holders person bought BTC each clip its terms was pushed downwards and sold into astir each peak.

Behavior of semipermanent holders and short-term holders (Source: Glassnode)

Behavior of semipermanent holders and short-term holders (Source: Glassnode)Recent changes successful the nett positions of semipermanent holders amusement that they person been capitulating. Bitcoin’s slump, caused by the Terra (LUNA) blowback and the Celsius crisis, has pushed galore LTHs to merchantability their positions.

However, LTHs selling their positions is usually taken arsenic a motion of a marketplace bottom.

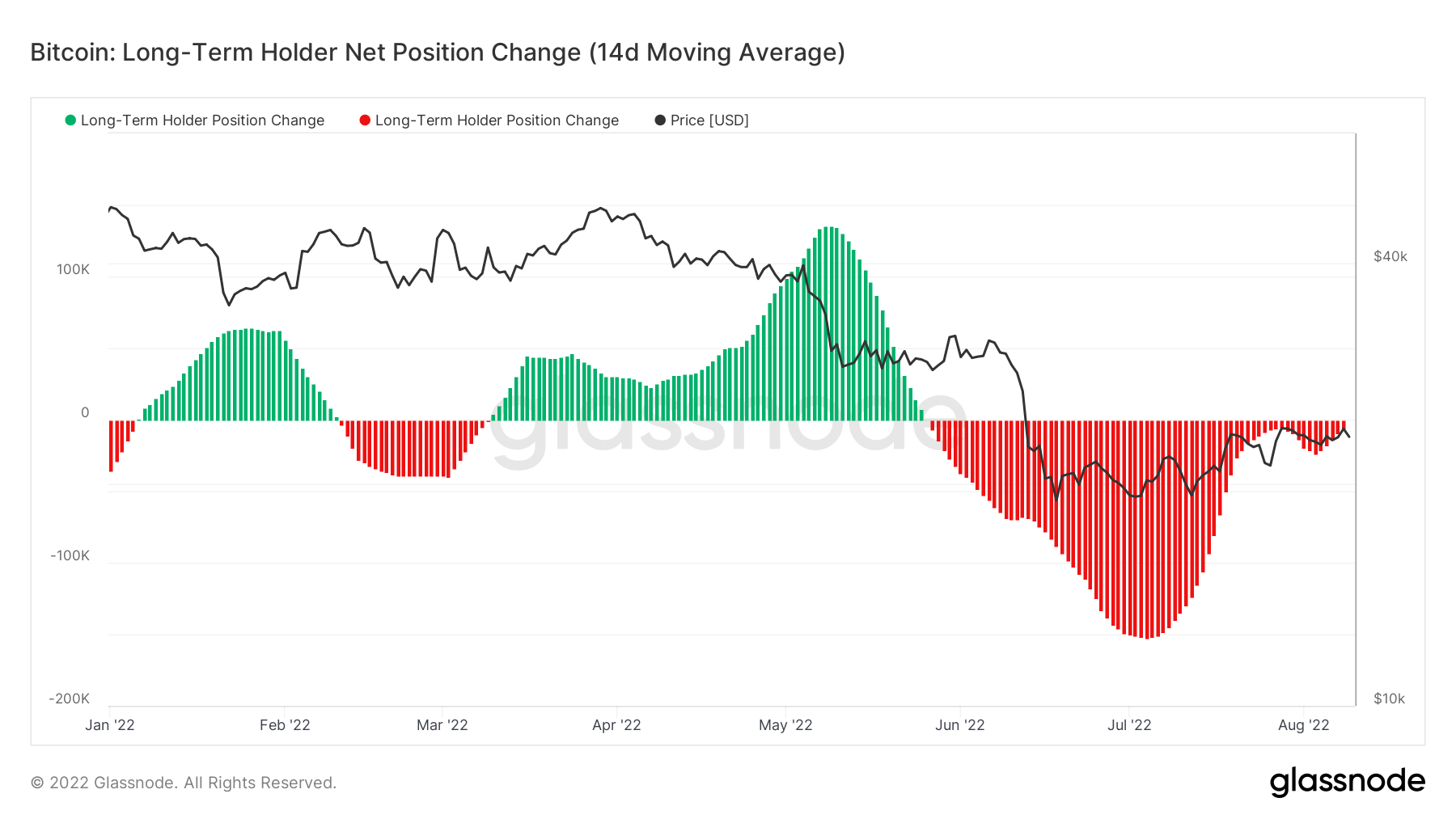

According to information from Glassnode, the sell-off that began successful May reached its highest successful July and is present tapering off. The graph beneath illustrates the alteration successful presumption for semipermanent holders, with the reddish highlights showing a alteration successful the wide presumption and the greenish highlights showing an summation successful their holdings.

Net presumption alteration for semipermanent holders successful 2022 (Source: Glassnode)

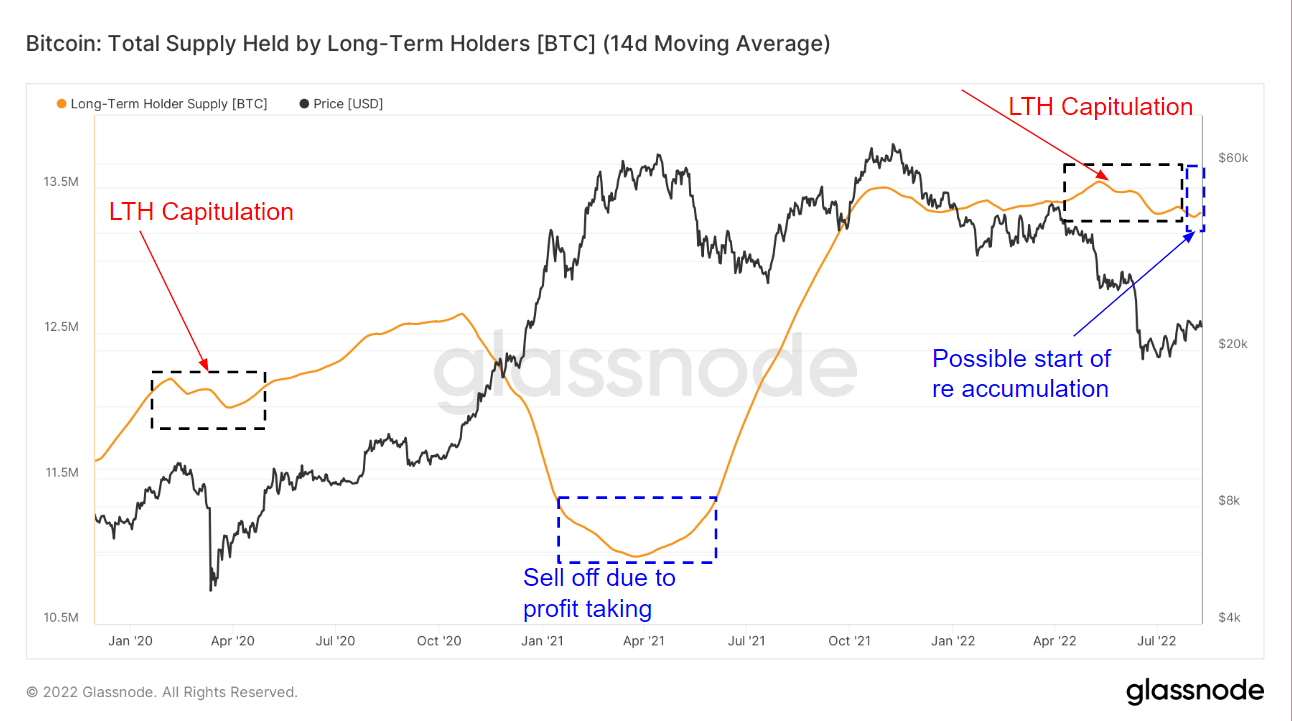

Net presumption alteration for semipermanent holders successful 2022 (Source: Glassnode)Zooming retired reveals different periods that pushed semipermanent holders to merchantability disconnected their holdings. In March 2020, erstwhile the onset of the COVID-19 pandemic crushed planetary markets, semipermanent holders capitulated retired of fearfulness and uncertainty. Their capitulation acceptable disconnected a crisp terms driblet that took until July that twelvemonth to recover.

The adjacent large sell-off happened betwixt January 2021 and May 2021. However, with Bitcoin heavy successful a bull run, the sell-off meant semipermanent holders were taking important profits.

The capitulation we’ve seen statesman successful April 2022 is inactive ongoing. Like the 1 successful March 2020, this capitulation has besides triggered a monolithic terms drop, pushing Bitcoin down to $20,000 for the amended portion of the summer. And portion we’ve seen selling subdue since August began, the accumulation complaint remains small.

We are yet to spot whether this is the commencement of different accumulation period and whether the tiny uptick successful the accumulation complaint volition overtake the sell-off. If the erstwhile carnivore cycles repeat, Bitcoin’s terms could spot a gradual rise, followed by an summation successful the magnitude of BTC accumulated by LTHs.

Changes successful the full proviso held by semipermanent holders (Source: Glassnode)

Changes successful the full proviso held by semipermanent holders (Source: Glassnode)The station Research: Bear marketplace cycles spot semipermanent holders capitulate and past accumulate appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)