Stablecoins are cryptocurrencies that peg their worth to notation assets, including fiat currencies, commodities, oregon different cryptocurrencies.

They signifier an integral portion of the crypto ecosystem by offering terms stableness successful an different volatile market. Cycling into and retired of stablecoins, users supply liquidity and exit positions.

This cycling narration betwixt Bitcoin and stablecoins tin supply penetration into marketplace sentiment and bespeak periods of buying and selling pressure.

Data from Glassnode and analyzed by CryptoSlate shows a cleanable tempest of imaginable buying unit building. However, macro uncertainty continues to measurement heavily.

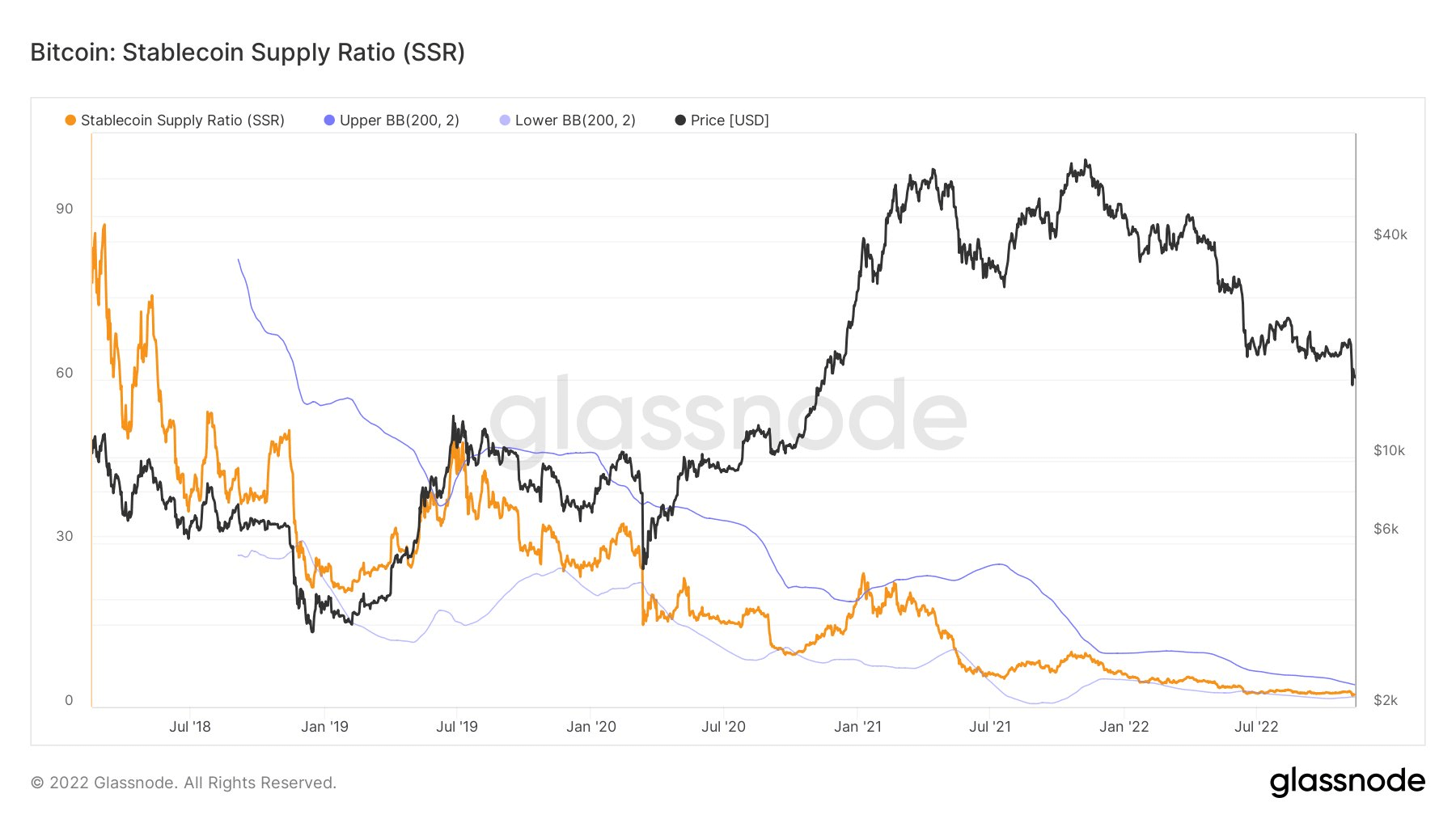

Bitcoin: Stablecoin Supply Ratio

The Stablecoin Supply Ratio (SSR) is calculated by dividing the Bitcoin marketplace headdress by the marketplace headdress of each stablecoins. By comparing the marketplace caps of Bitcoin and stablecoins, the SSR tin beryllium considered a measurement of spot betwixt the two.

A precocious SSR indicates debased imaginable buying unit and is considered bearish. In contrast, a debased SSR means precocious imaginable buying unit making this concern bullish.

The illustration beneath shows the SSR connected a macro downtrend since the commencement of 2018, moving importantly little from July 2021 onwards and sinking further into 2022.

A existent speechmaking of 2.28 shows for each $1 successful stablecoins, determination are $2.28 of Bitcoin – a concern of precocious imaginable buying unit for Bitcoin.

Source: Glassnode.com

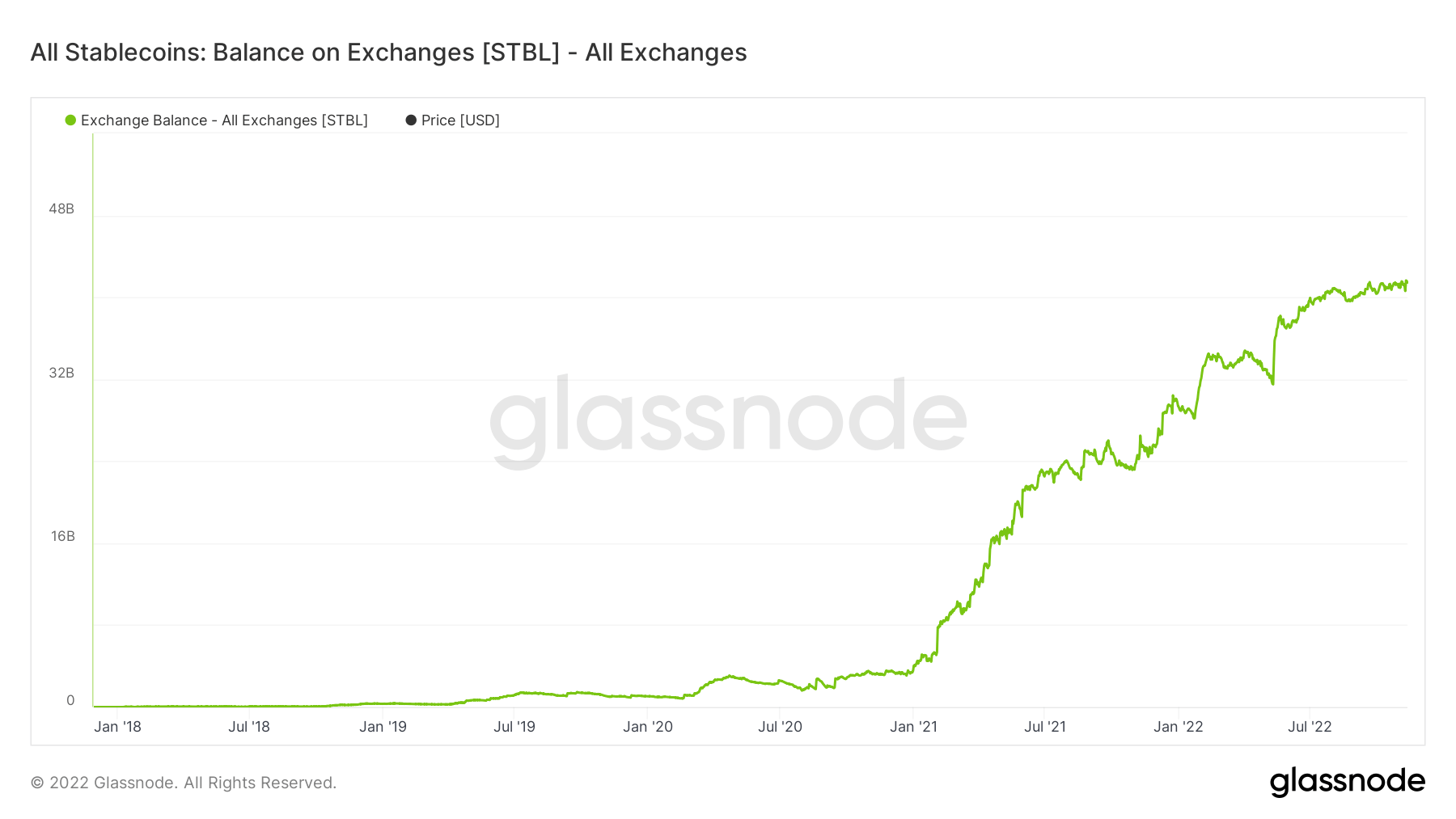

Source: Glassnode.comStablecoin: Balance connected Exchanges

Stablecoins: Balance connected Exchanges (SBoE) looks astatine the full fig of stablecoins held connected exchanges. Rising SBoE is considered bullish, indicating a continual build-up of sidelined liquidity acceptable to pounce.

SBoE began trending higher from January this twelvemonth to highest astatine astir $46 cardinal astatine present.

Given macro uncertainty, it is apt that sidelined liquidity is waiting for a bottommost successful bequest markets earlier cycling into Bitcoin and different cryptocurrencies.

Source: Glassnode.com

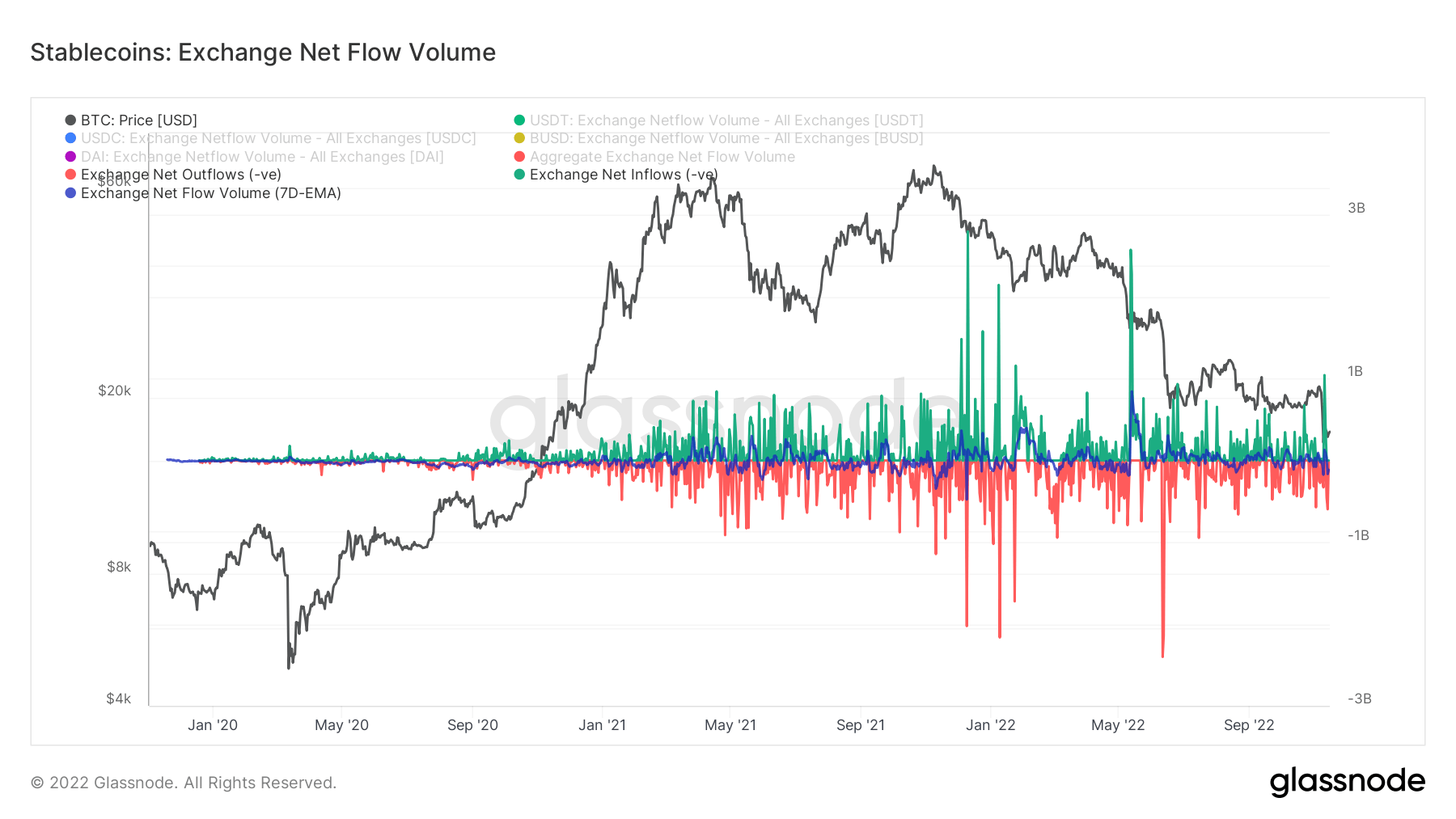

Source: Glassnode.comStablecoin: Exchange Net Flow Volume

The Stablecoin: Exchange Net Flow Volume shows the regular nett question of stablecoins into and retired of exchanges for the apical 4 stablecoins. Those are USDT, USDC, BUSD, and DAI, but the information lone includes movements via the Ethereum blockchain.

Positive nett travel (green) refers to inflows of stablecoins into exchanges, expanding the proviso held. Negative nett travel (red) is erstwhile exchanges acquisition wide outflows.

The illustration beneath shows existent inflows travel successful astatine implicit $1 billion, marking the seventh-highest inflows to day – providing further confirmation of traders readying to pounce erstwhile favorable marketplace conditions present.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Bitcoin bargain unit mounts arsenic stablecoin speech proviso moves higher appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)