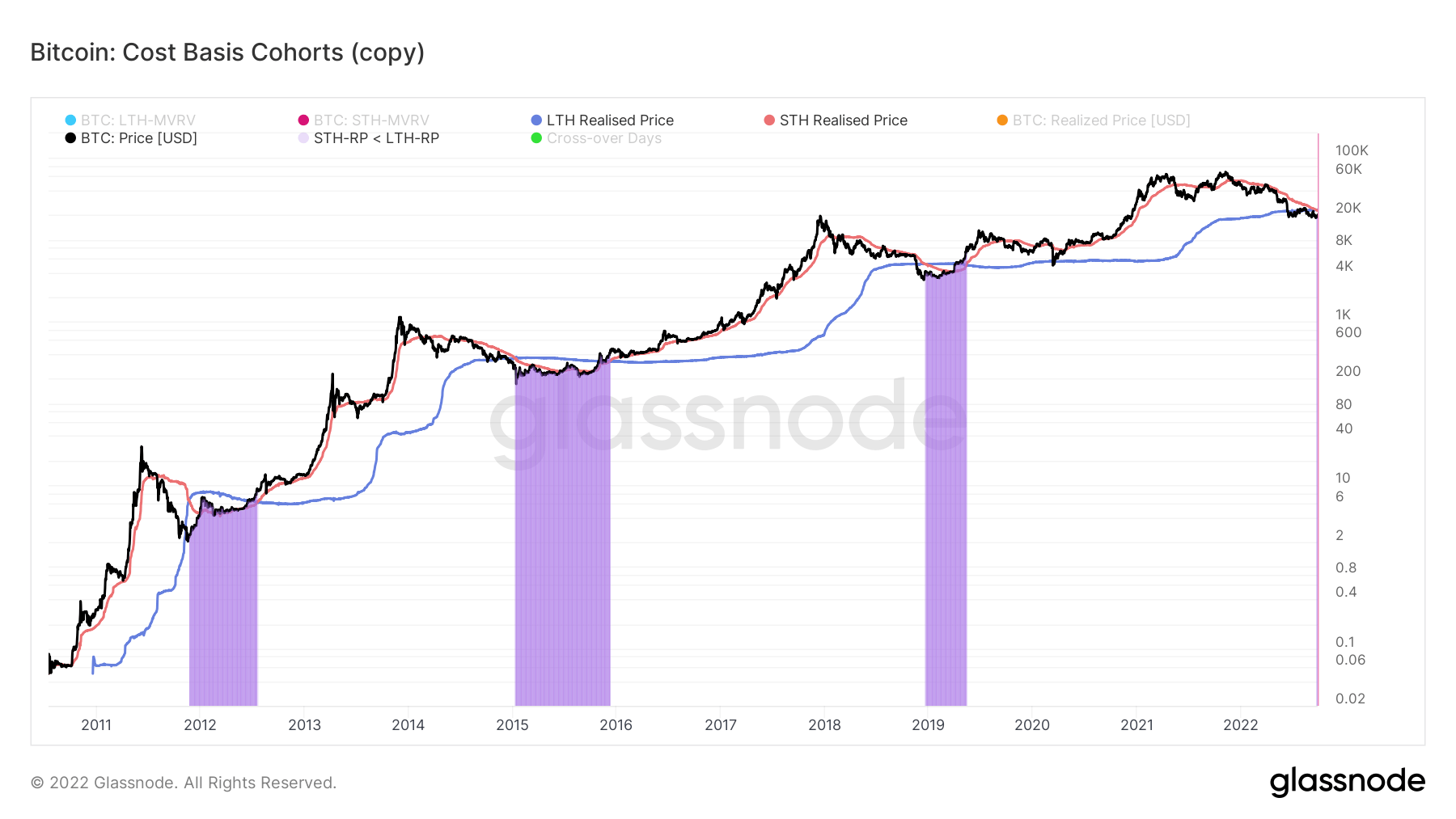

The Bitcoin: Cost Basis metric, besides known arsenic the realized price, is divided into the semipermanent holder (LTH) and short-term holder (STH) cohorts.

Cost ground refers to the accumulated just marketplace worth of the cryptocurrency token acquired, positive the profits astatine the clip sold. It is mostly utilized to cipher taxation liability by determining whether a nett oregon nonaccomplishment was made during the holding period.

LTHs are defined arsenic tokens held for longer than 155 days, and STHs arsenic tokens held for 154 days and below.

Bitcoin: Cost Basis metric

Analysts usage the LTH/STH ratio to find bull and carnivore cycles, frankincense marketplace bottoms and tops. When the ratio is:

- Uptrending: STHs recognize losses astatine a greater complaint compared to LTHs. This concern is associated with carnivore marketplace accumulation.

- Downtrending: LTHs are spending tokens and transferring them to STHs. This mostly occurs during bull marketplace distribution.

- Trading > 1.0: The outgo ground for LTHs is higher than that of STHs, typifying the precocious stages of carnivore marketplace capitulation.

Historically, erstwhile the ratio is little than 1, a marketplace bottommost has been reached. Currently, this is the lawsuit arsenic the STH realized terms is starting to dip beneath the LTH realized price, signifying a play of nonaccomplishment of religion by short-term holders.

However, marketplace bottoms tin span galore months earlier an uptrend successful terms is reflected. This concern has occurred connected lone 3 different occasions successful the past.

Source: Glassnode.com

Source: Glassnode.comWith the DXY up 6% since the commencement of September, continuing dollar spot puts further unit connected risk-on markets successful the adjacent term.

The station Research: Bitcoin Cost Basis metric indicates short-term holder capitulation appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)