A moving mean (MA) is simply a banal indicator commonly utilized successful method analysis. As its sanction suggests, the indicator smooths retired terms information by creating a perpetually updated mean terms implicit a circumstantial clip period.

In method analysis, moving averages assistance place inclination directions by analyzing erstwhile terms actions.

Moving averages are extensively utilized erstwhile analyzing the terms of Bitcoin. Out of each the cryptocurrencies, Bitcoin behaves similar stocks the most, and has historically responded good to specified analysis.

Although method investigation (TA) remains a arguable taxable successful the crypto industry, analyzing Bitcoin’s MAs tin beryllium utilized alongside different metrics to find the existent authorities of the market.

In the discourse of Bitcoin, moving averages tin beryllium utilized to place wherever enactment and absorption are formed. Looking backmost astatine the humanities data, we tin usage moving averages to place periods wherever Bitcoin’s terms dropped to its rhythm lows.

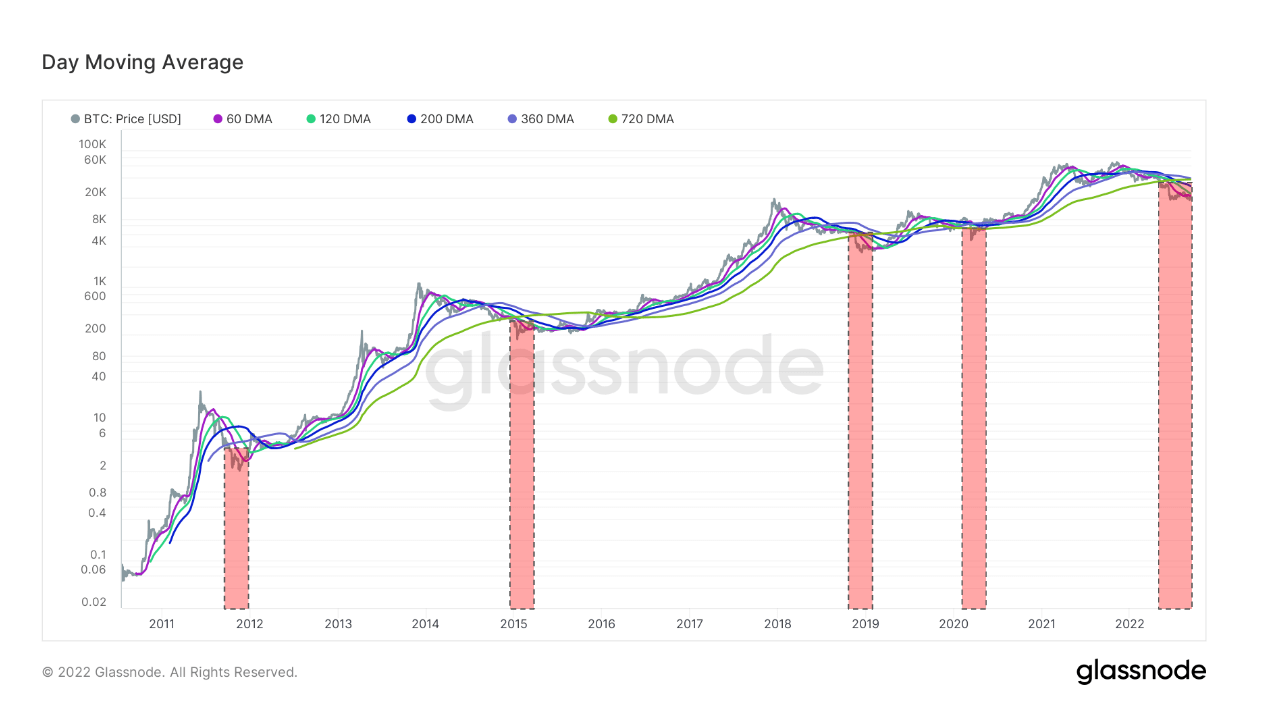

When analyzing Bitcoin, the 60-day, 120-day, 200-day, 360-day, and 720-day moving averages are peculiarly important. Every clip Bitcoin’s terms dropped beneath these MAs, the marketplace saw what immoderate analysts telephone a “generational buy” opportunity.

Graph showing the 5 cardinal time moving averages for Bitcoin (Source: Glassnode)

Graph showing the 5 cardinal time moving averages for Bitcoin (Source: Glassnode)According to information from Glassnode, Bitcoin has fallen beneath each cardinal moving averages for the 5th clip ever. Bitcoin’s existent stint beneath the moving averages is besides the longest ever — coming successful astatine astir doubly arsenic agelong arsenic the erstwhile drops we’ve seen astatine the extremity of 2011, 2015, 2019, and 2020.

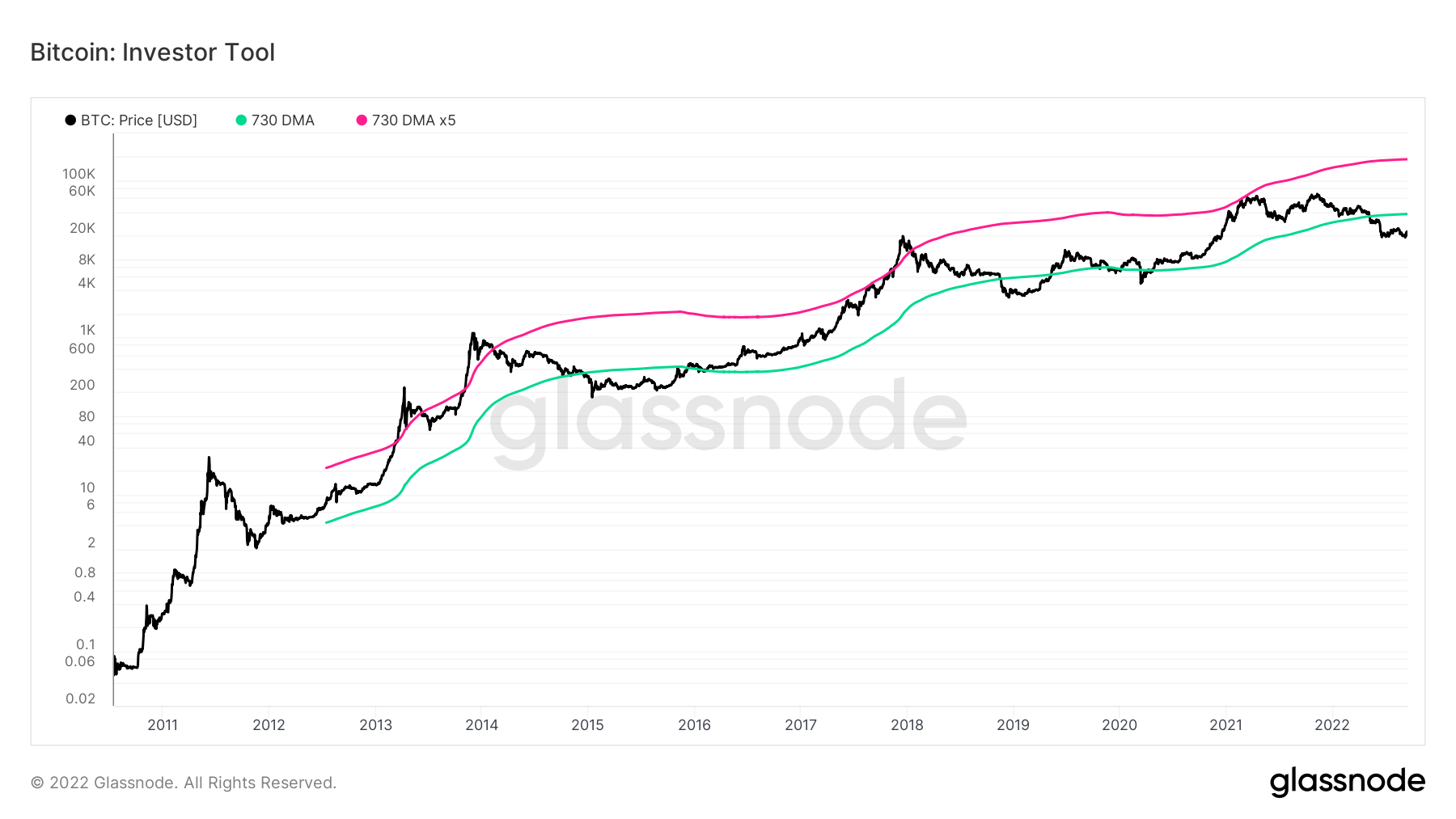

Moving averages are besides portion of different cardinal indicators for determining the Bitcoin marketplace cycle. One of those indicators is the Bitcoin Investor Tool, created by expert Philip Swift. Intended arsenic a instrumentality for semipermanent investors, the indicator consists of 2 elemental moving averages of Bitcoin’s terms — the 2-year MA and a 5x aggregate of the 2-year MA.

These moving averages are utilized arsenic the ground for determining undervalued and overvalued conditions successful the market. It indicates periods wherever prices are apt to attack cyclical tops and bottoms.

Bitcoin’s terms trading beneath the 2-year MA has historically generated outsized returns and signaled carnivore rhythm lows. When the terms traded supra the 2-year MA x5, it signaled bull rhythm tops and a portion wherever semipermanent investors de-risk.

Graph showing the Bitcoin Investor Tool (Source: Glassnode)

Graph showing the Bitcoin Investor Tool (Source: Glassnode)Since the Terra (LUNA) illness successful May, Bitcoin has remained beneath the 730-day MA. Since 2011, BTC went beneath the 730-day MA lone 3 times — betwixt 2015 and 2016, successful 2019, and concisely successful 2020. Each clip BTC spent beneath the 730-day MA was shorter than the erstwhile one. Its driblet successful March 2020 was measured successful days, not months. Bitcoin’s existent stint nether the MA has breached this signifier and is entering its 4th consecutive month.

Bitcoin recovered from each driblet beneath the 730-day MA. If its humanities patterns repeat, it’s besides acceptable to retrieve from this drop. However, it’s inactive aboriginal to archer however accelerated its betterment volition be. The existent crypto marketplace uncertainty is worsened by deteriorating macro conditions, making it hard to foretell what the incoming wintertime volition bring.

The station Research: Bitcoin falls beneath each cardinal moving averages for the 5th clip ever appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)