Futures unfastened involvement (OI) is the full fig of unfastened futures contracts for an plus held by marketplace participants. Open involvement connected futures contracts for immoderate fixed plus varies daily, representing the magnitude of currency flowing into the market.

A increasing OI means that much wealth is moving into futures contracts, portion a declining inclination shows positions are being closed and wealth is moving retired of the market. During terms movements, an summation successful OI is often utilized to corroborate the prevalent inclination successful the marketplace — rising OI during a carnivore marketplace shows the inclination volition proceed downwards. In contrast, an summation successful OI during a bull tally indicates upward movement.

CryptoSlate’s investigation of the unfastened involvement for Bitcoin futures showed a notable summation successful OI.

This summation shows a important rebound successful the futures market. The illness of FTX caused a monolithic alteration successful OI, wiping retired 40% of unfastened futures contracts since mid-November.

There is presently astir 433,000 BTC allocated into futures contracts — a crisp alteration from the 666,000 BTC recorded successful November. A driblet of astatine slightest 95,000 BTC tin beryllium attributed to the illness of FTX.

Open involvement for Bitcoin futures from February 2022 to February 2023 (Source: Glassnode)

Open involvement for Bitcoin futures from February 2022 to February 2023 (Source: Glassnode)The rebound successful OI began successful mid-January. Most of the maturation tin beryllium attributed to accrued organization involvement successful Bitcoin futures — CryptoSlate investigation showed that 20% of the full Bitcoin futures OI came from CME. Largely inaccessible to retail investors, Bitcoin futures connected CME are a bully indicator of organization involvement successful the crypto market.

On Jan. 30, Bitcoin futures OI saw the biggest summation since the opening of the twelvemonth — increasing 6% which points to investors gearing up for a important marketplace movement.

This summation successful OI is 1 origin contributing to the caller uptick successful Bitcoin’s price.

Historically, marketplace volatility tends to summation earlier and during the Federal Market Open Committee (FOMC) meetings. FOMC holds 8 meetings yearly wherever it assesses and implements changes to monetary argumentation successful the U.S.

Rising involvement rates and rampant ostentation person made FOMC meetings successful the past twelvemonth large marketplace movers arsenic investors crook to derivatives successful a bid to hedge the market.

For Bitcoin, FOMC meetings person been mostly bearish events. Bitcoin tends to beryllium highly volatile the time before, during, and aft the meetings. However, the momentum tends to plaything upwards successful the days pursuing the FOMC gathering arsenic much leverage gets added to the market.

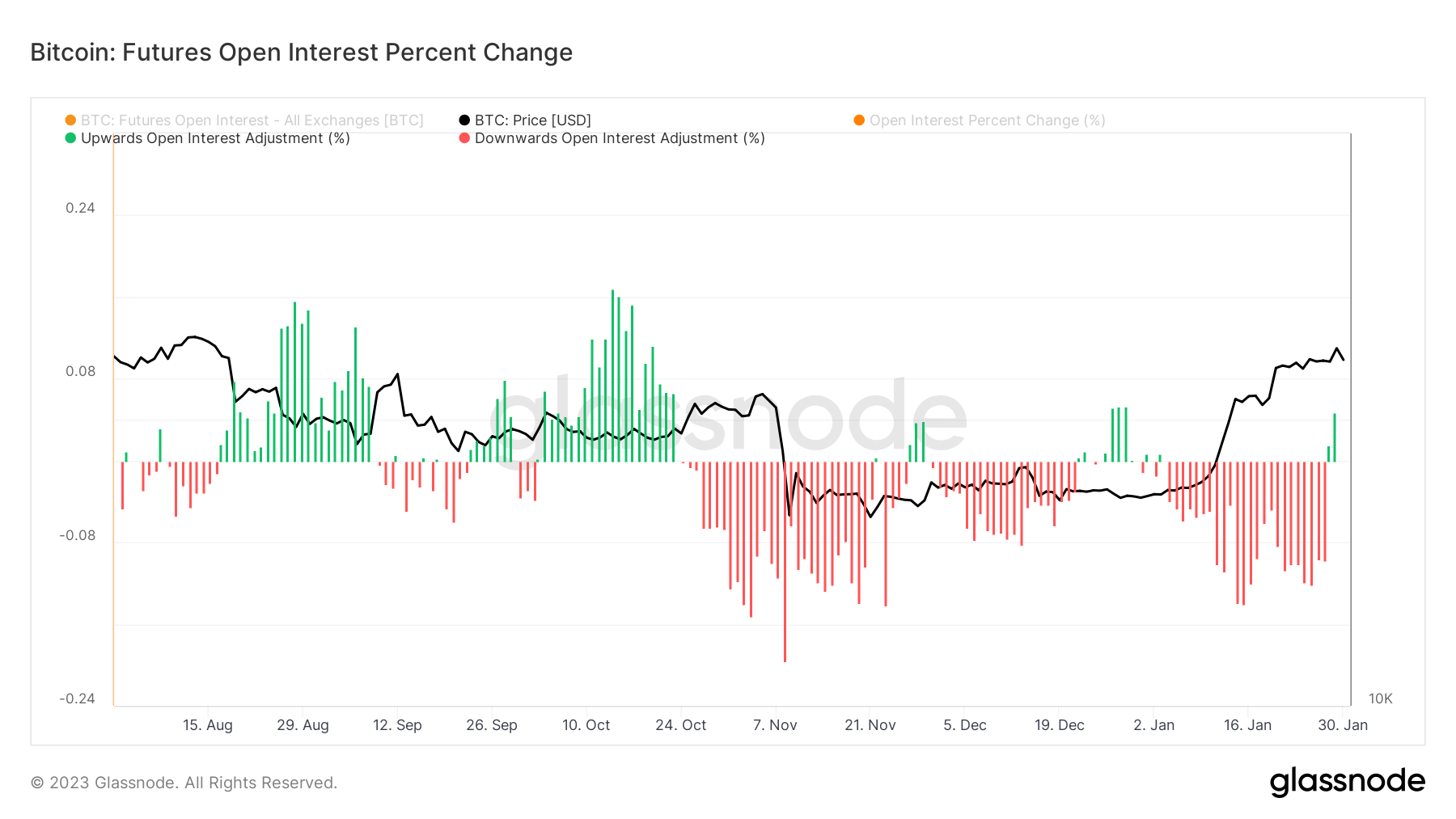

Graph showing the percent alteration successful Bitcoin futures unfastened involvement from Aug. 2022 to Feb. 2023 (Source: Glassnode)

Graph showing the percent alteration successful Bitcoin futures unfastened involvement from Aug. 2022 to Feb. 2023 (Source: Glassnode)Diving deeper into the futures marketplace shows that the ongoing marketplace volatility has the imaginable to crook into affirmative terms enactment pursuing the FOMC meeting.

Market movements beryllium connected the quality betwixt agelong and abbreviated futures contracts. Market swings thin to beryllium affirmative erstwhile longs predominate OI, portion OI dominated by shorts often leads to antagonistic terms movements.

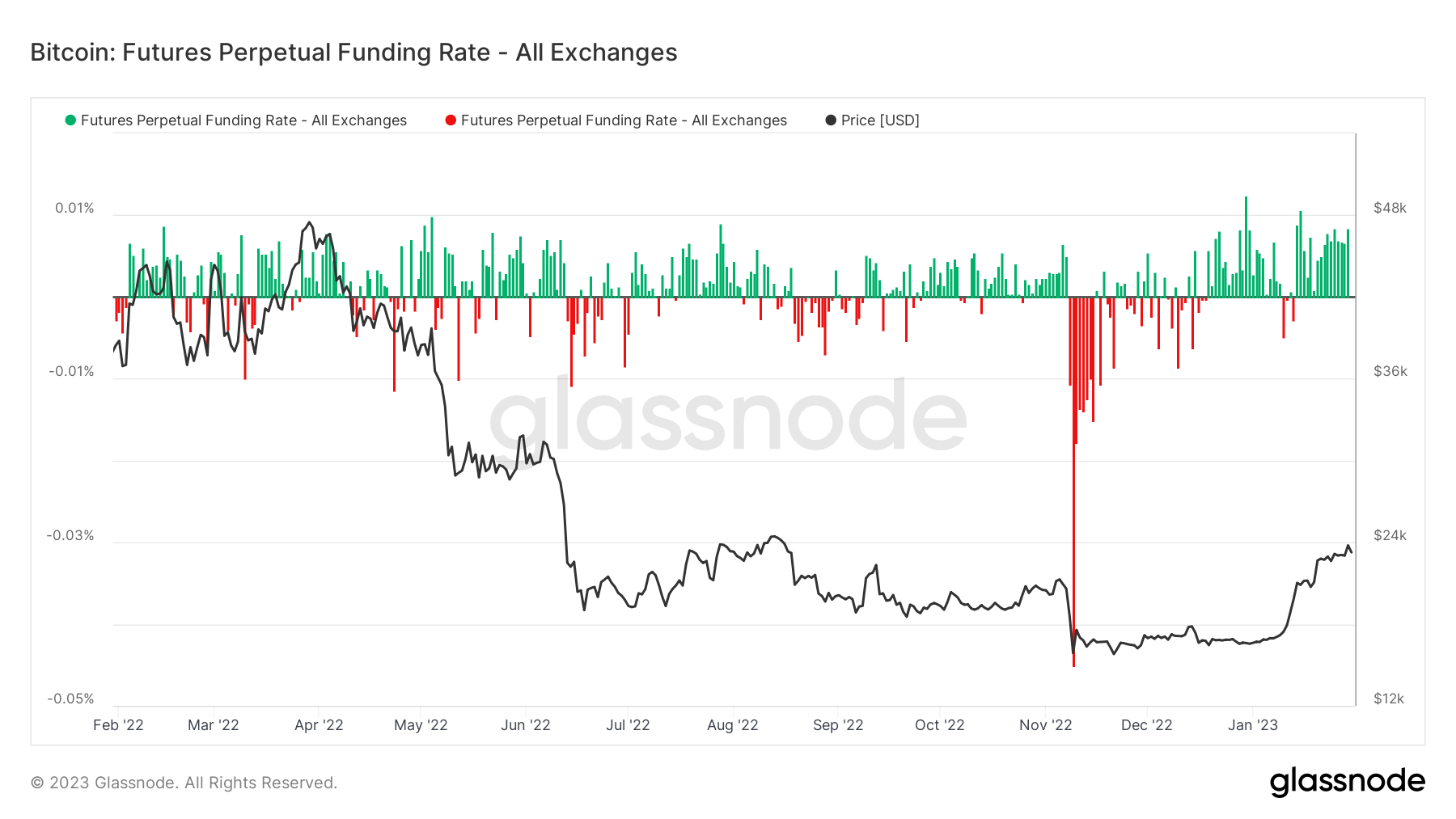

The perpetual backing complaint is the mean backing complaint acceptable by exchanges for perpetual Bitcoin futures contracts. When the complaint is positive, agelong positions wage the backing complaint to abbreviated positions. A antagonistic complaint means that abbreviated positions request to wage the complaint to agelong positions to support the worth of the contracts comparatively stable.

Graph showing the backing complaint for Bitcoin perpetual futures from Feb. 2022 to Feb. 2023 (Source: Glassnode)

Graph showing the backing complaint for Bitcoin perpetual futures from Feb. 2022 to Feb. 2023 (Source: Glassnode)Data analyzed by CryptoSlate showed a affirmative perpetual backing rate, with longs dictating the market. The increasing affirmative perpetual backing complaint follows a play of assertive shorting that peaked during the FTX collapse.

Aggressive shorting is often a bottommost awesome successful a carnivore market, particularly erstwhile followed by an wide summation successful OI. If this signifier continues into the pursuing weeks, it could mean that Bitcoin bottomed astatine astir $15,500 pursuing the FTX illness and could proceed its upward trajectory good into the archetypal quarter.

The station Research: Bitcoin futures unfastened involvement grows up of FOMC meeting appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)