A look astatine a graph of Bitcoin’s (BTC) terms show successful the past fewer months volition amusement a see-saw chart, but with importantly much downs than up.

While the existent marketplace rhythm mightiness look antithetic from erstwhile ones, the HODL waves metric shows that it is not overmuch antithetic from erstwhile cycles.

The HODL waves metric is simply a illustration that groups Bitcoin proviso successful circulation into antithetic property bands and the changes successful these property bands implicit the years.

With the chart, it is imaginable to spot what each radical of marketplace participants does with their Bitcoin and place which radical is selling.

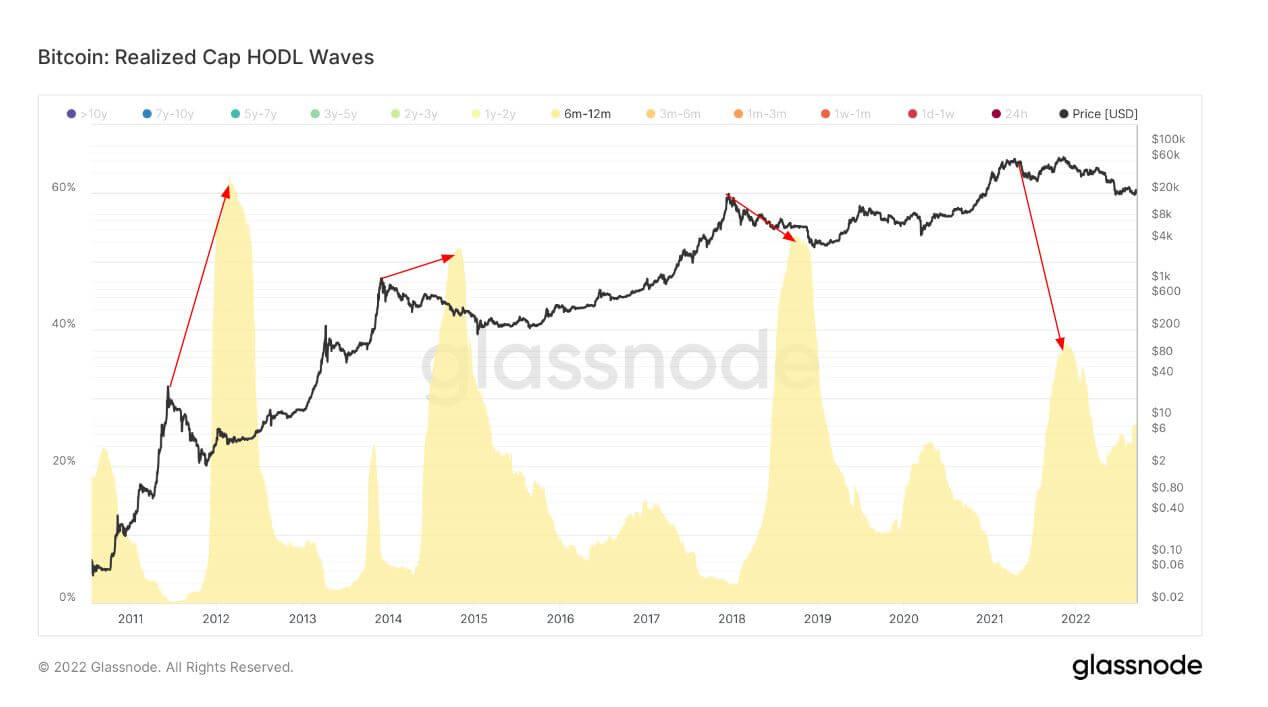

A look astatine Glassnode’s Bitcoin Realized Cap HODL waves illustration arsenic analyzed by CryptoSlate probe reveals that short-term holders betwixt 6 – 12 months usually bargain the flagship plus during a bull tally erstwhile the terms is adjacent the apical oregon astatine the precise top.

6-12 months holders bargain astatine the top. (Source: Glassnode)

6-12 months holders bargain astatine the top. (Source: Glassnode)Most of these holders bargain astir six months aft the marketplace peaked — this is simply a graphical practice of the fearfulness of missing out, and it is erstwhile the HODL waves peak.

Usually, Bitcoin’s terms declines soon after, leaving these short-term holders with unrealized losses.

Short-term holders buying means semipermanent holders are selling to caller marketplace participants. This has played retired successful astir marketplace cycles, particularly successful 2013, 2017, and 2021.

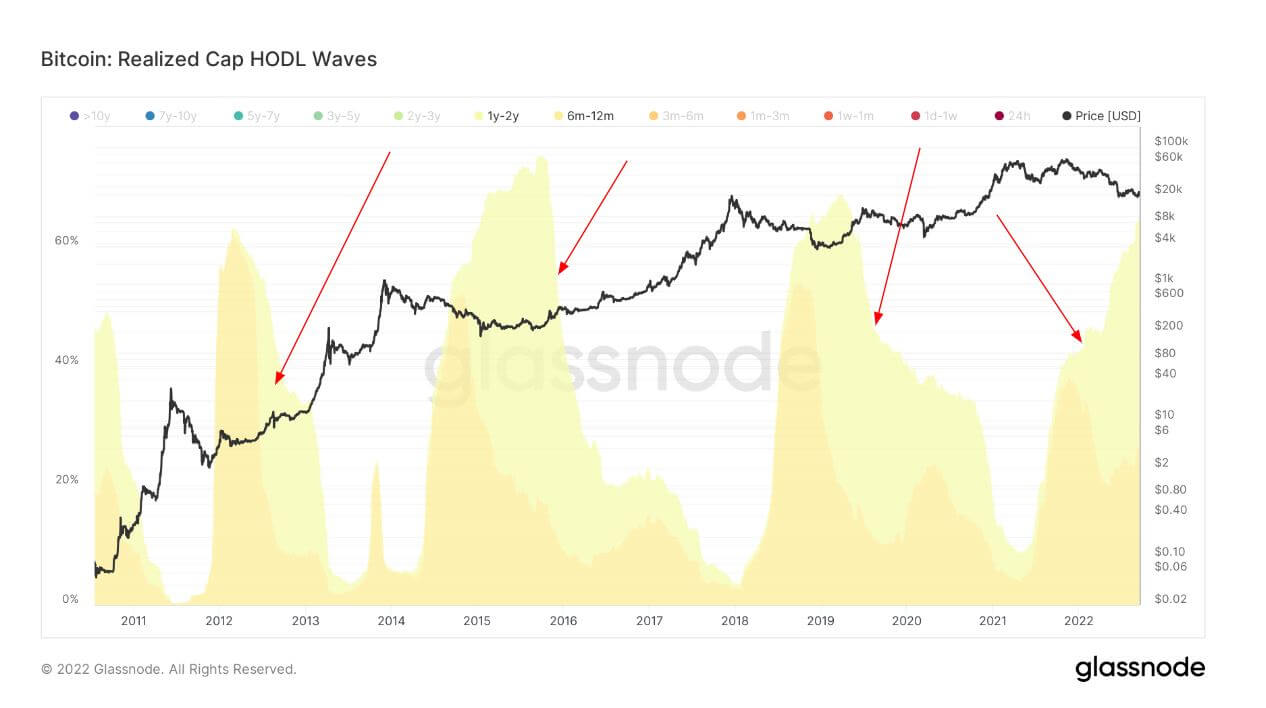

However, the 1-2 twelvemonth HODL question has been antithetic since 2021. Although the HODL question besides declined, showing that immoderate sold during highest bull runs, the percent was overmuch lower.

1-2 years holders hodl contempt dropping prices (Source: Glassnode)

1-2 years holders hodl contempt dropping prices (Source: Glassnode)Even arsenic the terms plummeted, astir 60% of the proviso remained. An mentation for this mightiness beryllium owed to the condemnation successful semipermanent holders, oregon it could effect from being underwater since they bought astatine the apical erstwhile BTC was adjacent its ATH.

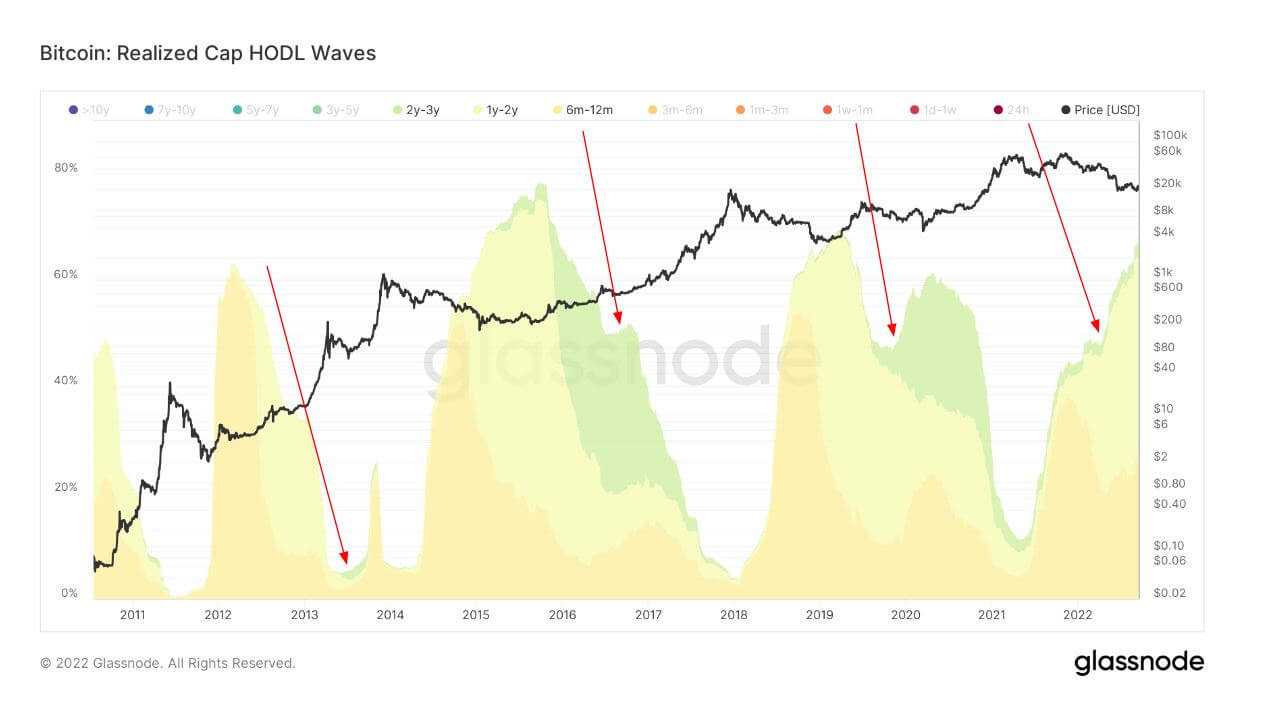

2-3 twelvemonth holders signifier a bigger percent of the holding proviso (Source: Glassnode)

2-3 twelvemonth holders signifier a bigger percent of the holding proviso (Source: Glassnode)Meanwhile, the 2-3 twelvemonth holders signifier a bigger percent of the holding supply. However, this rhythm is importantly smaller than the different 2 erstwhile cycles. So we inactive request to hold for this cohort to mature arsenic this volition let the web to go adjacent stronger with radical who bought the 2021 highest top.

In conclusion, the HODL question metrics amusement that this rhythm is the aforesaid arsenic others with nary difference.

The station Research: Bitcoin HODL waves amusement that this rhythm is wholly the aforesaid arsenic each others appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)