By examining circumstantial metrics, on-chain research published connected Aug. 21 suggested that the Bitcoin bottommost was adjacent but not in yet.

Revisiting these metrics a period aboriginal shows it is each changed. However, investors should beryllium alert that this does not needfully mean the terms of Bitcoin cannot autumn further from existent prices.

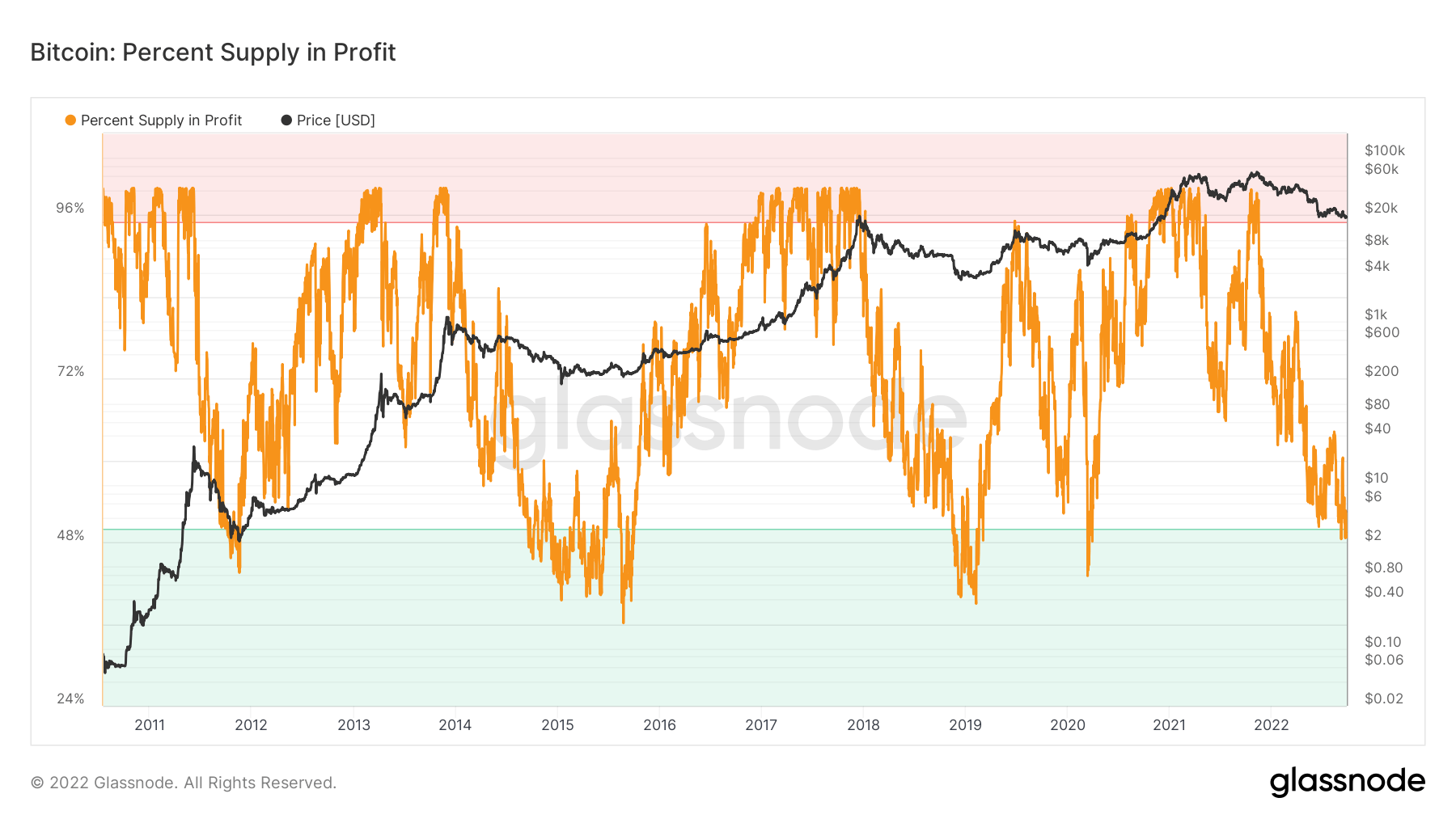

Percentage of Bitcoin addresses successful profit

The percent of Bitcoin addresses successful nett refers to the proportionality of unsocial addresses whose funds person an mean bargain terms little than the existent price.

In erstwhile carnivore markets, the percent of Bitcoin addresses successful nett had ever dropped beneath 50%, with past month’s speechmaking hovering astir 55%.

The updated illustration beneath shows the percent of addresses successful nett is present beneath the 50% threshold, giving a existent speechmaking of astir 48% successful profit.

However, arsenic noted successful the 2015 carnivore market, erstwhile this metric dipped arsenic debased arsenic 30%, determination is each anticipation that capitalist capitulation tin proceed for galore months earlier this is reflected successful a terms inclination reversal.

Source: Glassnode.com

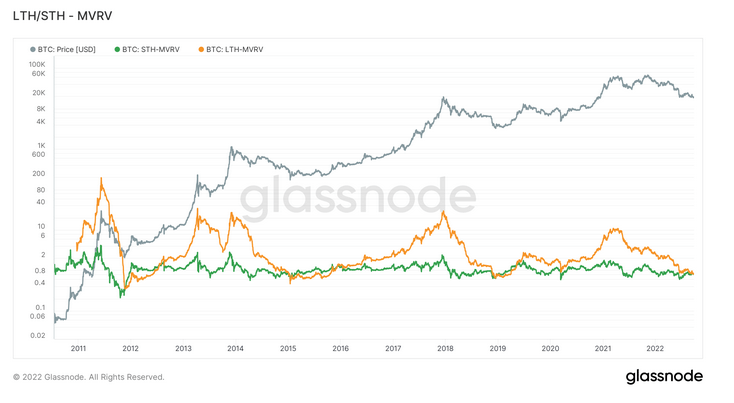

Source: Glassnode.comMarket Value to Realized Value

Market Value to Realized Value (MVRV) refers to the ratio betwixt the marketplace headdress (or marketplace value) and realized headdress (or the worth stored). By collating this information, MVRV indicates erstwhile the Bitcoin terms is trading supra oregon beneath “fair value.”

MVRV is further divided by semipermanent and short-term holders, with Long-Term Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of astatine slightest 155 days, and Short-Term Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and below.

Previous rhythm bottoms were characterized by a convergence of the STH-MVRV and LTH-MVRV lines. This intersection has present occurred, suggesting semipermanent holder capitulation has been reached.

Source: Glassnode.com

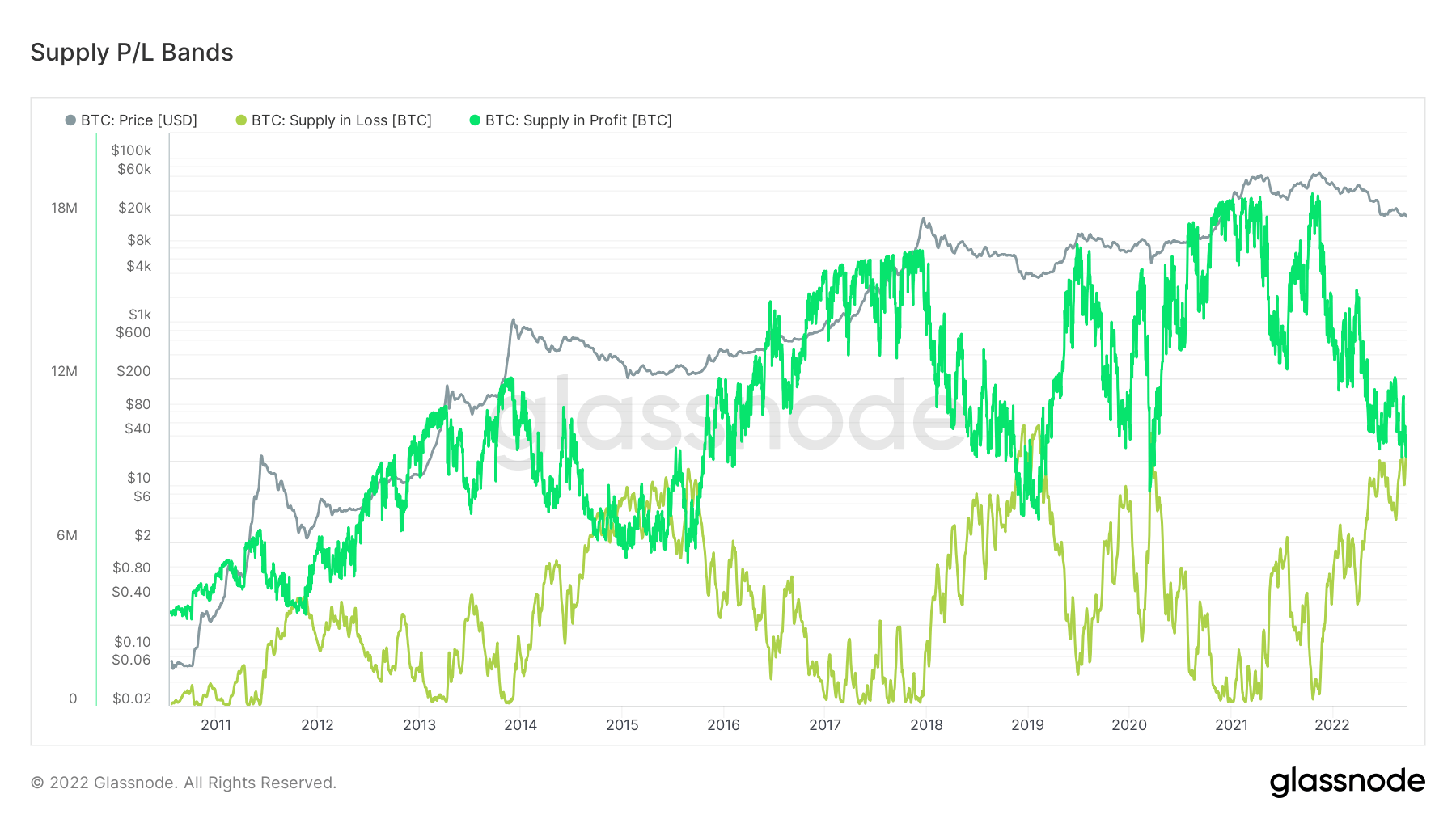

Source: Glassnode.comSupply successful Profit and Loss

By analyzing the fig of BTC tokens whose terms was little oregon higher than the existent terms erstwhile past moved, the Supply successful Profit and Loss (SPL) metric shows the circulating proviso successful nett and loss.

Market rhythm bottoms coincide with the proviso successful nett and proviso successful nonaccomplishment lines converging. The illustration beneath shows this improvement has occurred, meaning the bulk of the circulating proviso is astatine a loss.

Source: Glassnode.com

Source: Glassnode.comAlthough the supra metrics person flashed the bottommost is in, it is important to recognize that bottoming tin widen implicit months.

In addition, the macro scenery remains an chartless origin that was not contiguous successful erstwhile instances of bear-to-bull flips.

The station Research: Bitcoin on-chain metrics suggest bottommost is present in appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)