Options are financial derivatives successful which 2 parties contractually hold to transact an plus astatine a stated terms earlier a aboriginal date.

Glassnode information analyzed by CryptoSlate suggests options traders are expecting Bitcoin and Ethereum to determination higher successful Q4.

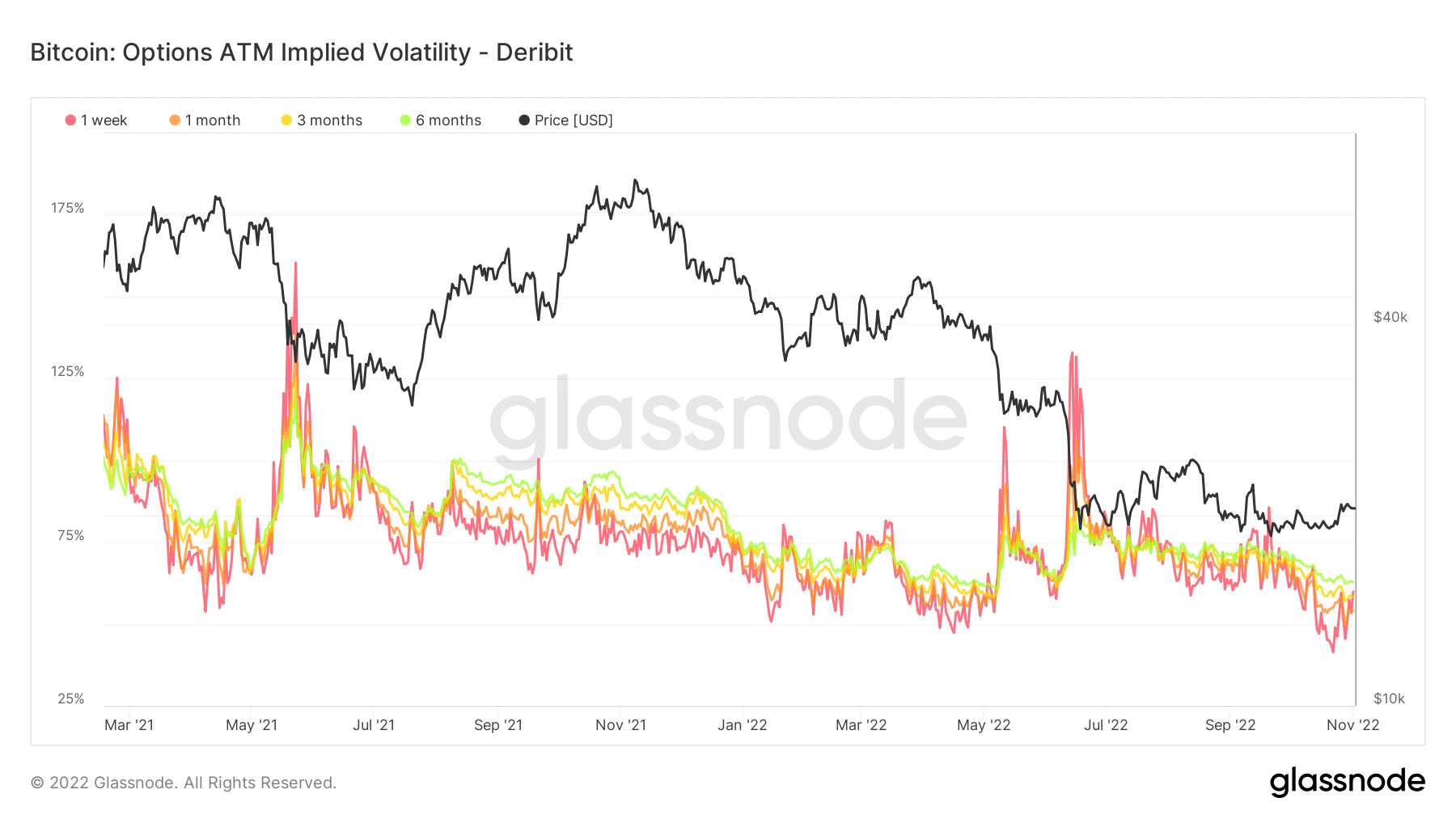

Bitcoin Implied Volatility

Implied Volatility (IV) is simply a metric that gauges marketplace sentiment toward the probability of changes successful a peculiar asset’s terms – often utilized to terms options contracts. IV usually increases during marketplace downturns and decreases nether bullish marketplace conditions.

It tin beryllium considered a proxy of marketplace hazard and is usually expressed successful percent presumption and modular deviations implicit a peculiar clip frame.

A modular deviation (SD) measures however scattered, oregon distributed information is comparative to the mean average. For example, wrong a mean distribution, 68% of information falls wrong 1 modular deviation of the mean, 95% wrong 2 SDs, and 97.7% wrong 3 SDs.

IV follows expected terms movements wrong 1 SD implicit a year. The metric is further supplemented by delineating IV for options contracts expiring successful 1 week, 1 month, 3 months, and 6 months from the present.

The illustration beneath shows that Bitcoin IV has since fallen from summertime highs to stabilize and go little volatile successful the year’s 2nd half. Based connected past instances of falling IV, this whitethorn beryllium a precursor to bullish conditions brewing successful Q4.

Source: Glassnode.com

Source: Glassnode.comOpen Interest

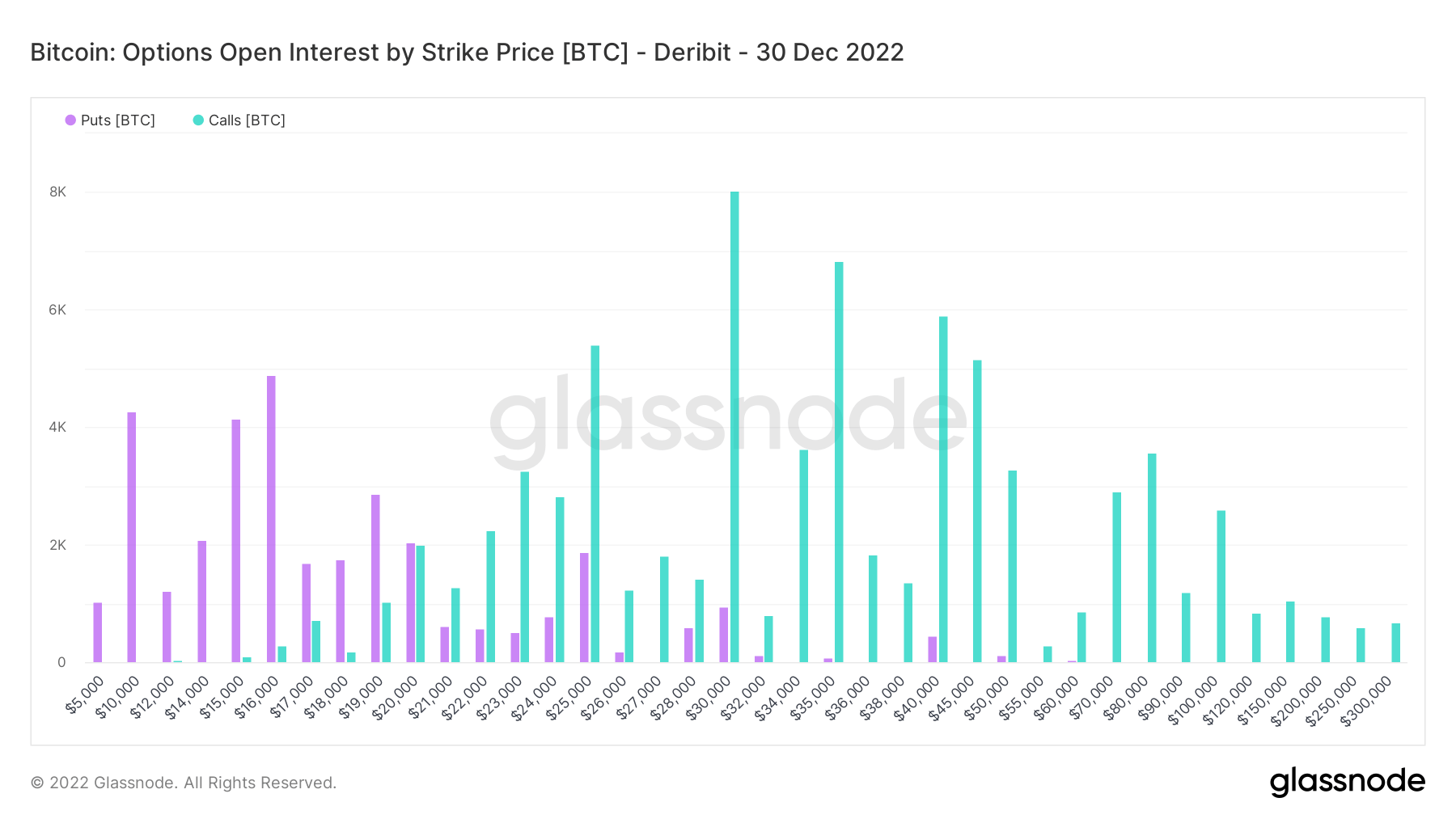

Open Interest (OI) refers to the full fig of outstanding derivatives contracts, successful this case, options, that person yet to beryllium settled.

Puts are the close to merchantability a declaration astatine a circumstantial terms by an expiration date. In comparison, calls are the close to bargain a declaration astatine a peculiar terms by an expiration date.

The Bitcoin OI illustration beneath shows beardown puts astatine $10,000, $15,000, and $16,000. While traders person signaled an overwhelming magnitude of calls, amounting to implicit $1 cardinal successful value, for BTC supra 30,000.

The ratio of puts to calls suggests traders expect Bitcoin to determination higher, with $30,000 being the mode terms target.

Source: Glassnode.com

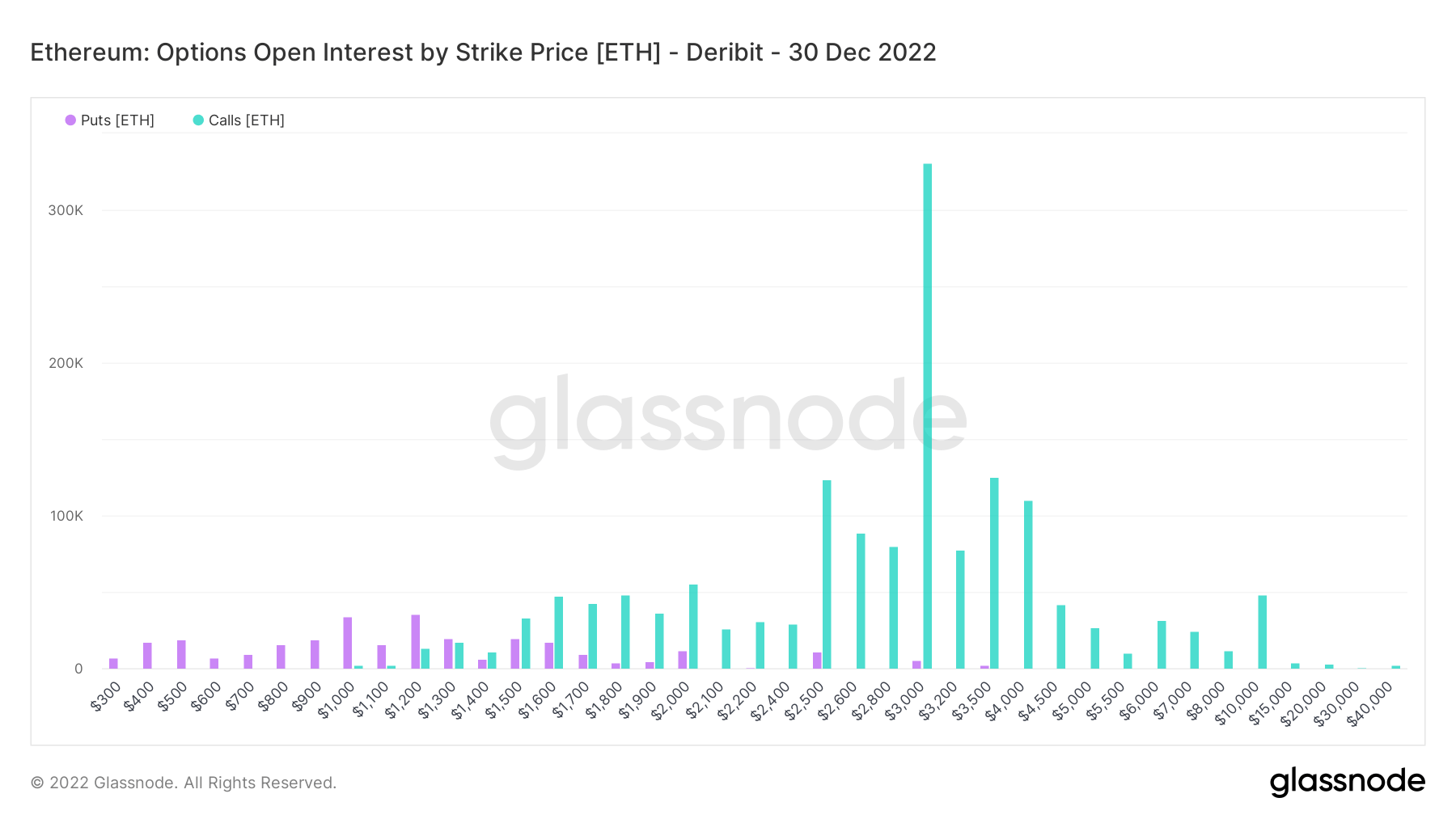

Source: Glassnode.comMeanwhile, Ethereum OI shows a akin signifier to Bitcoin arsenic calls dominate. Calls astatine $3,000 dwarf each different prices, some puts and calls.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Bitcoin options traders expect terms to deed $30,000 successful Q4 appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)