Data analyzed by CryptoSlate suggests the beardown correlation betwixt Bitcoin and golden could people the commencement of a terms run-up, depending connected whether the Fed’s hiking docket is done by March.

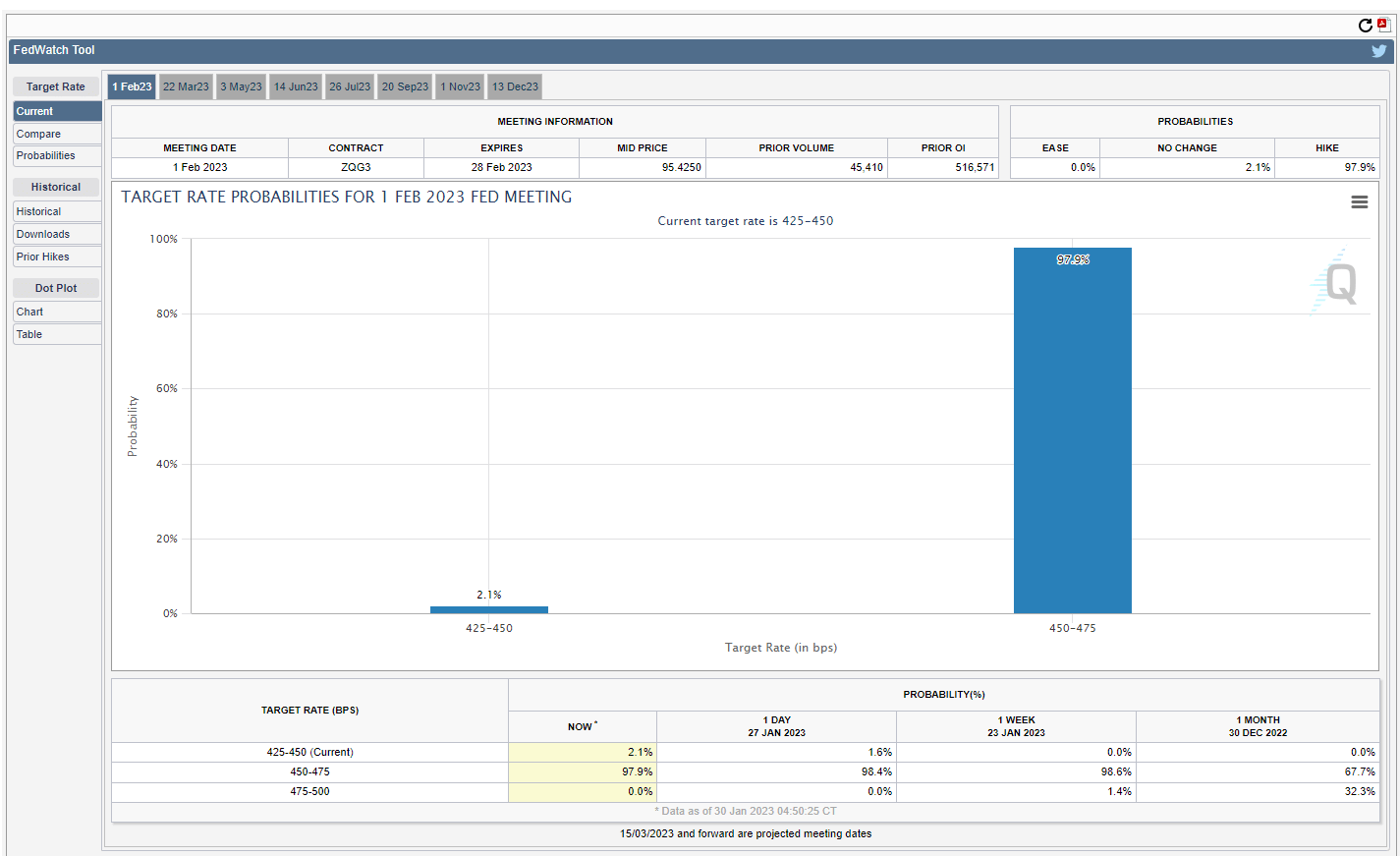

The Federal Open Market Committee (FOMC) gathering is acceptable to reason connected Feb. 1, with the marketplace overwhelmingly expecting a 25 ground constituent hike, which volition instrumentality the national funds complaint to 4.5% – 4.75%.

Source: cmegroup.com

Source: cmegroup.comThe consequent FOMC gathering is scheduled to reason connected March 22, with analysts bulk betting connected different 25 bps hike. From there, it is expected the Fed volition clasp rates marking the apical of the hiking schedule.

Bitcoin and FOMC meetings

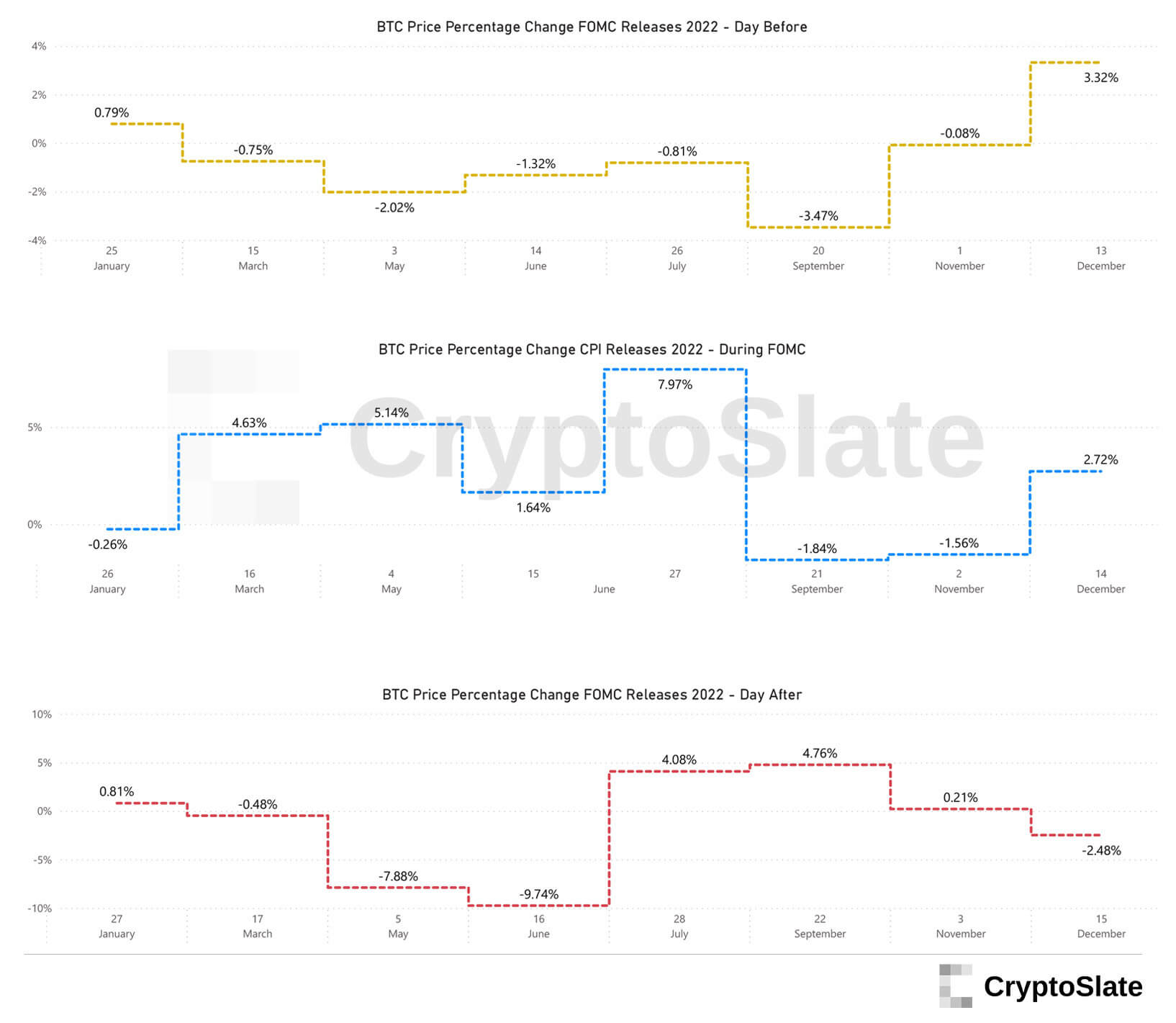

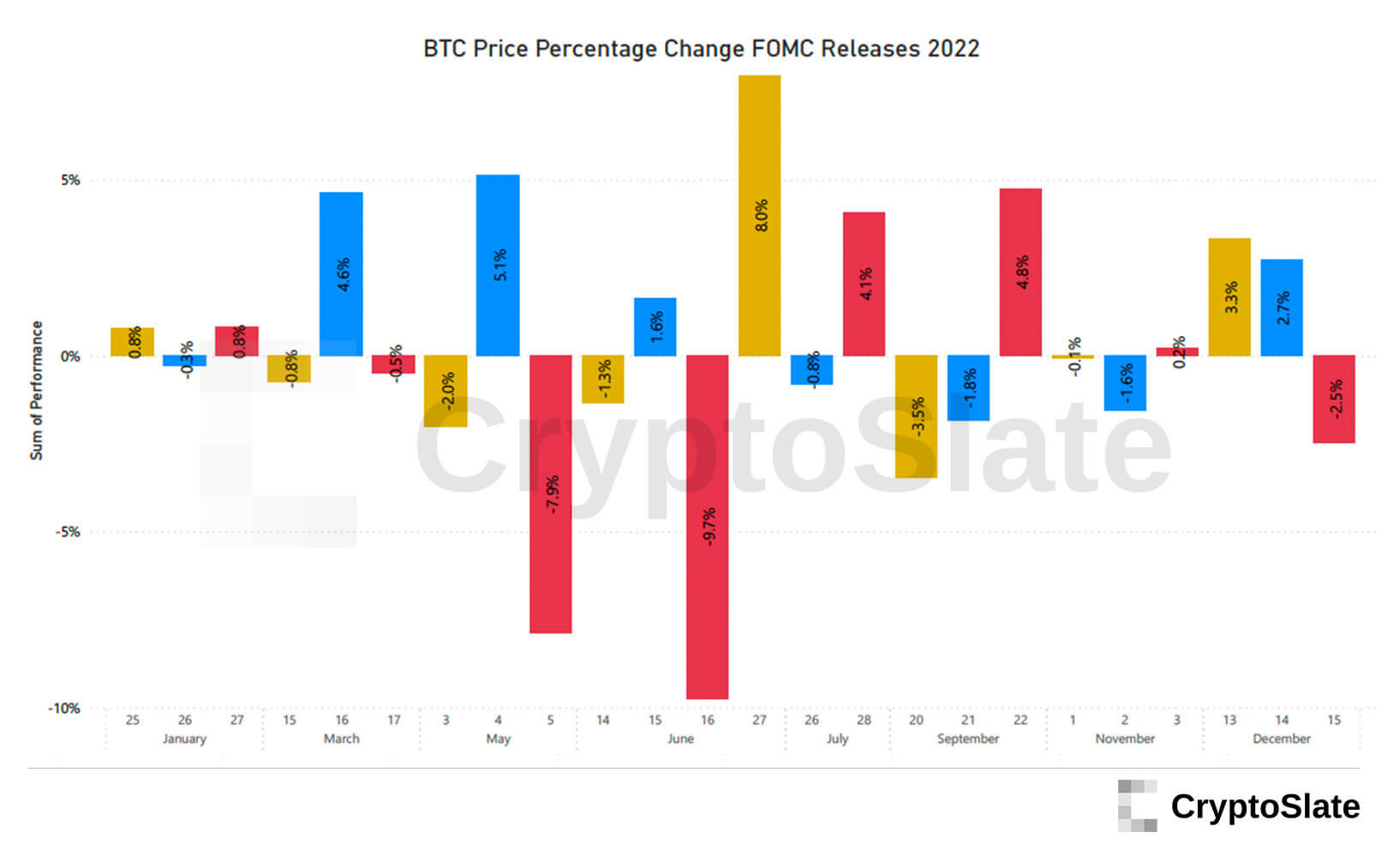

Examining the Bitcoin terms percent alteration for each 2022 FOMC gathering the time earlier the event, during, and after, 13 of the 24 instances resulted successful a drawdown for the starring cryptocurrency.

When the Fed archetypal began raising rates, a antagonistic Bitcoin show could beryllium explained by merchantability unit resulting from fearful markets. However, implicit the year, arsenic the marketplace accepted the inevitability of higher involvement rates, a little antagonistic absorption is expected.

Source: CryptoSlate.com

Source: CryptoSlate.com Source: CryptoSlate.com

Source: CryptoSlate.comOf greater value than regular terms movements is the semipermanent question successful narration to the Fed’s complaint schedule.

Strong BTC-gold correlation

Plotting the show of the S&P and gold, since 1998, against the national funds rate, it was noted the apical of the Fed’s hiking docket coincided with a bottoming successful the golden price, arsenic denoted by the achromatic arrows connected the chart.

In these cases, the terms of golden went connected to determination importantly higher. For example, successful precocious 2005 arsenic it went from $400/oz to $1,920/oz implicit a six and fractional twelvemonth period.

Similarly, pauses successful the involvement complaint docket coincided with the S&P bottoming, shown by the reddish arrows below, starring to sustained moves higher for tech stocks.

Source: TradingView.com

Source: TradingView.comSince February 2022, the terms of Bitcoin and golden has shown an 83% correlation – the highest complaint successful implicit a year.

If golden reacts arsenic it did successful past instances of the Fed hiking docket topping out, and Bitcoin mimics gold, BTC could beryllium successful for a important leap successful price.

Source: TradingView.com

Source: TradingView.comHowever, determination is nary certainty that March volition people the apical of the Fed’s complaint schedule. In addition, different macroeconomic and geopolitical factors are successful play, arsenic is the processing concern astatine Genesis pursuing its bankruptcy filing.

The station Research: Bitcoin terms expected to leap connected hopes FOMC complaint docket tops out appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)