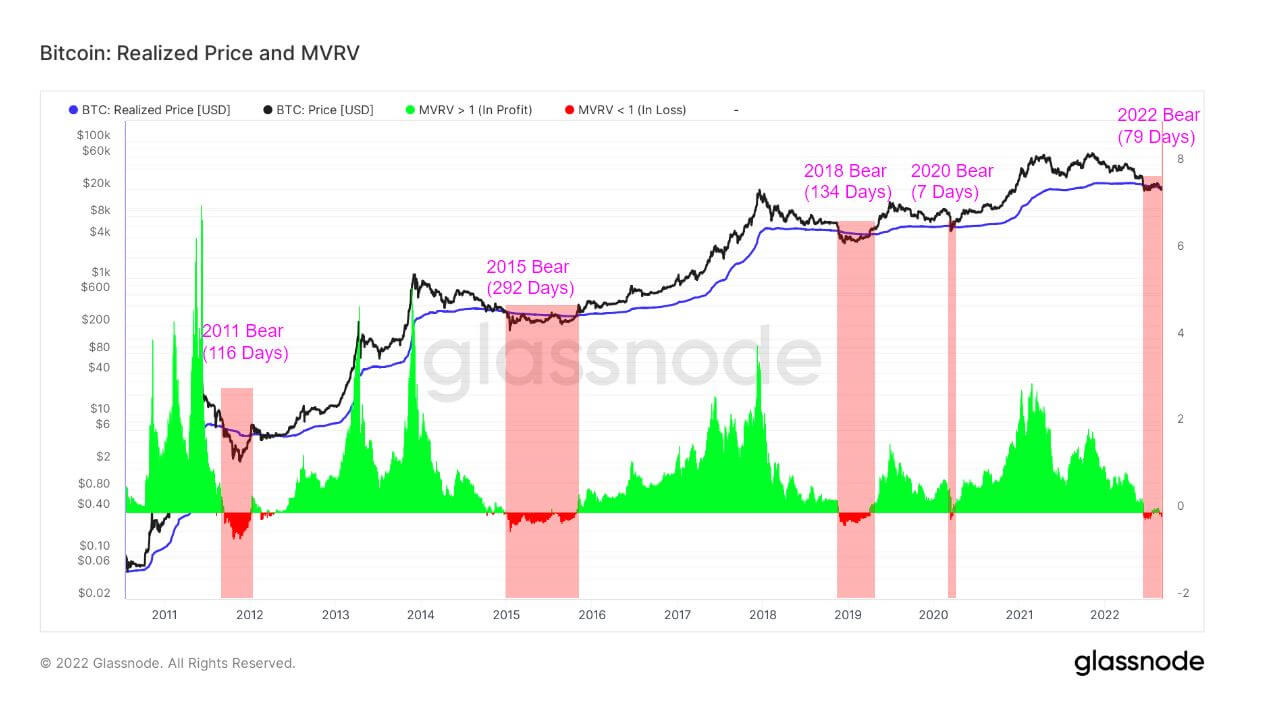

Determining a marketplace bottommost requires looking astatine assorted antithetic sets of data. However, erstwhile it comes to Bitcoin, determination are 2 often utilized on-chain metrics that person historically acted arsenic coagulated indicators of its price bottom — realized terms and the MVRV ratio.

Realized terms calculates the mean terms of the Bitcoin proviso valued astatine the time each coin past transacted on-chain. Realized terms is an indispensable metric and is considered to beryllium the cost-basis of the market. The MVRV ratio is the ratio betwixt the marketplace capitalization of Bitcoin’s proviso and its realized value. The ratio is simply a coagulated indicator of whether Bitcoin’s existent terms stands supra oregon beneath “fair value” and is utilized to measure marketplace profitability.

Each clip Bitcoin’s spot terms trades beneath the realized price, the MVRV ratio volition autumn beneath 1. This shows that investors are holding coins beneath their outgo ground and carrying an unrealized loss.

A accordant MVRV ratio shows wherever enactment is being formed and, erstwhile combined with further investigation of the realized price, tin awesome a marketplace bottom.

All of Bitcoin’s erstwhile carnivore marketplace cycles person seen prices autumn beneath the 200-week moving mean realized price. Since 2011, the mean stint beneath the realized terms lasted for 180 days, with the lone objection being March 2020, wherever the dip lasted lone 7 days.

Graph showing Bitcoin’s realized terms and MVRV ratio from 2011 to 2022 (Source: Glassnode)

Graph showing Bitcoin’s realized terms and MVRV ratio from 2011 to 2022 (Source: Glassnode)The ongoing carnivore marketplace that began successful May with Terra’s illness has seen Bitcoin’s terms enactment beneath the MVRV ratio for 79 days. While Bitcoin’s terms managed to ascent supra the MVRV ratio successful the past week of August, it’s inactive excessively aboriginal to accidental whether it signals the extremity of the carnivore market.

What it does awesome is beardown absorption forming astatine the $20,000 levels. This absorption is what yet determines the spot of the marketplace and the imaginable debased it could driblet to successful a aboriginal carnivore cycle.

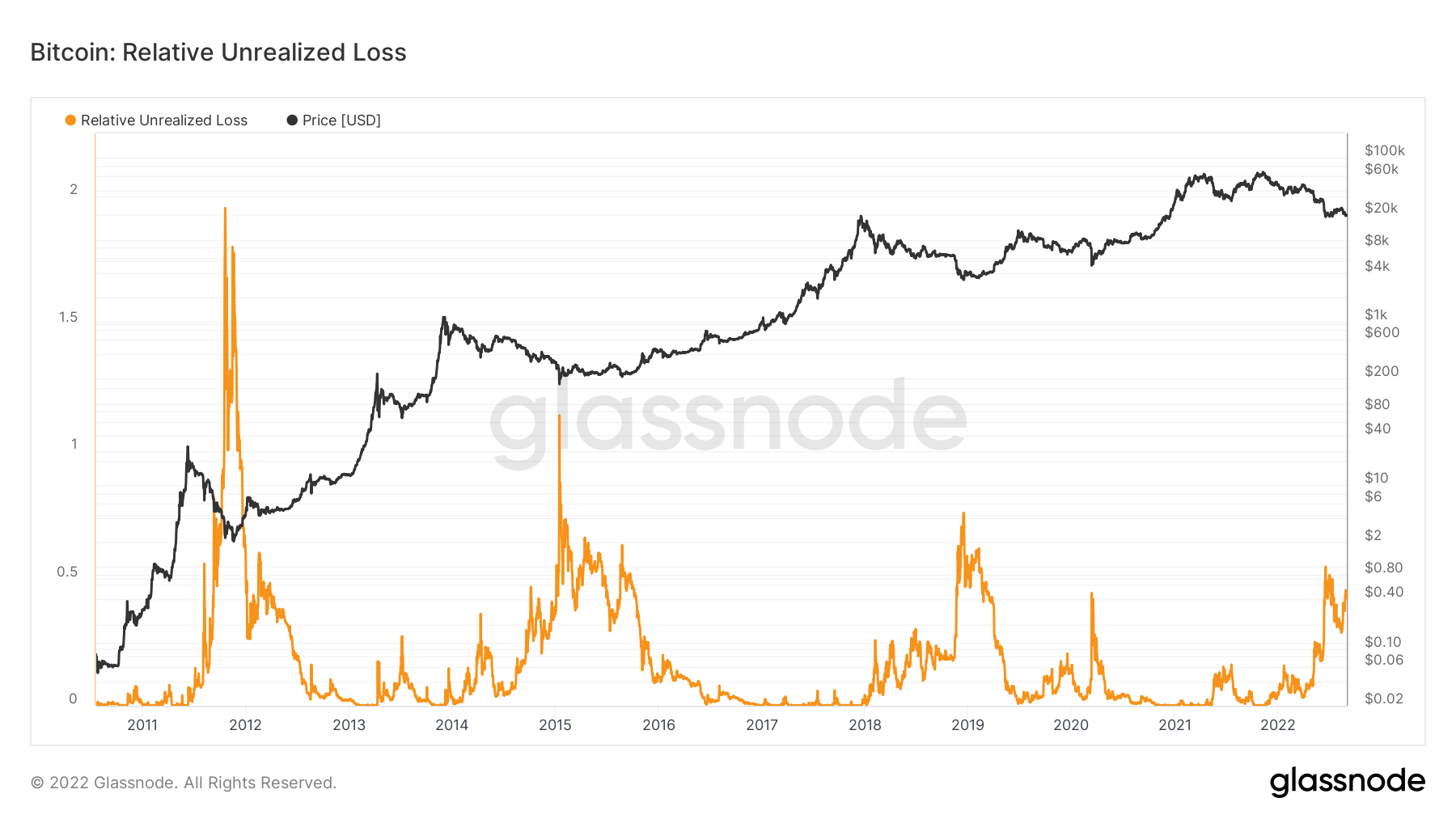

According to information from Glassnode, Bitcoin has seen its comparative unrealized nonaccomplishment leap importantly successful August, pursuing a likewise crisp spike astatine the opening of the summer. Relative unrealized nonaccomplishment shows however overmuch worth coins whose terms astatine realization was higher than the existent terms lost. A rising unrealized nonaccomplishment people shows that addresses proceed to clasp their coins contempt their comparative devaluation and aren’t selling them astatine a loss.

Graph showing the comparative unrealized nonaccomplishment of Bitcoin from 2022 to 2022 (Source: Glassnode)

Graph showing the comparative unrealized nonaccomplishment of Bitcoin from 2022 to 2022 (Source: Glassnode)Looking astatine humanities information shows that each clip the unrealized comparative nonaccomplishment spiked, Bitcoin posted a higher low. In each pursuing marketplace cycle, Bitcoin attempted to retest the precocious it reached earlier the carnivore marketplace but astir ever failed to bushed it. It took astatine slightest 2 years earlier Bitcoin’s terms reached the precocious of the erstwhile marketplace cycle.

Looking astatine the information shows that there’s a precocious accidental a bottommost could beryllium forming. And portion this indicates an upward terms question successful the coming months, it could inactive beryllium different 2 years earlier the marketplace recovers successful afloat and enters into a full-blown bull run.

The station Research: Bitcoin’s realized terms shows a bottommost could beryllium forming appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)