Data analyzed by CryptoSlate showed a beardown opposition betwixt Bitcoin and Ethereum Spot to Futures Volume (SFV) trends, with the former’s SFV continuing to rise.

The Spot to Futures Volume metric looks astatine the ratio of spot measurement against futures measurement for a peculiar cryptocurrency.

Spot terms refers to the existent punctuation for the contiguous acquisition of the cryptocurrency and forms the ground for each derivatives markets. Strong spot measurement equates to steadfast accumulation, starring to sustainable terms growth.

Retail buyers typically usage spot markets, whereas institutions and experienced, well-financed traders thin to commercialized derivatives.

Bitcoin vs. Ethereum Spot to Futures Volume

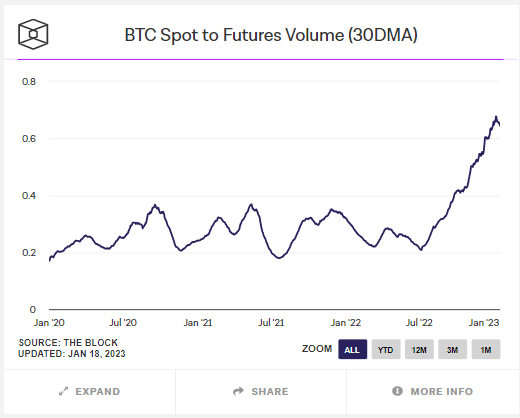

Per the illustration below, the Bitcoin SFV has oscillated comparatively uniformly betwixt 0.2 and 0.4 since January 2020. However, the SFV broke retired of this scope past summer, climbing higher to highest astatine conscionable nether 0.7 this week.

In different words, Bitcoin spot measurement is rising successful proportionality to futures volume, suggesting retail traders are piling successful astatine a complaint greater than derivatives traders.

Source: theblock.co

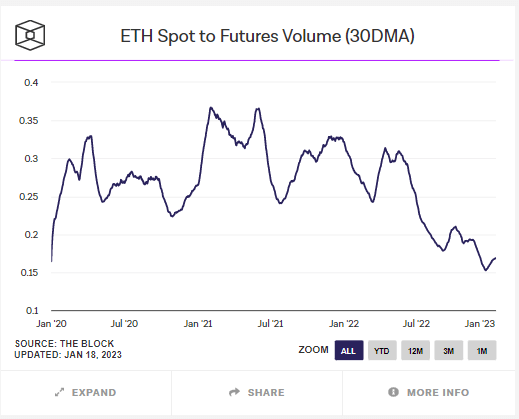

Source: theblock.coIn contrast, the Ethereum SFV people shows a much haphazard pattern. Unlike the erstwhile example, the ratio of the spot to futures measurement has been signaling little lows since May 2022, with the latest debased coming successful astatine 0.15.

This would connote institutions and nonrecreational traders proceed to predominate ETH markets.

The derivatives market

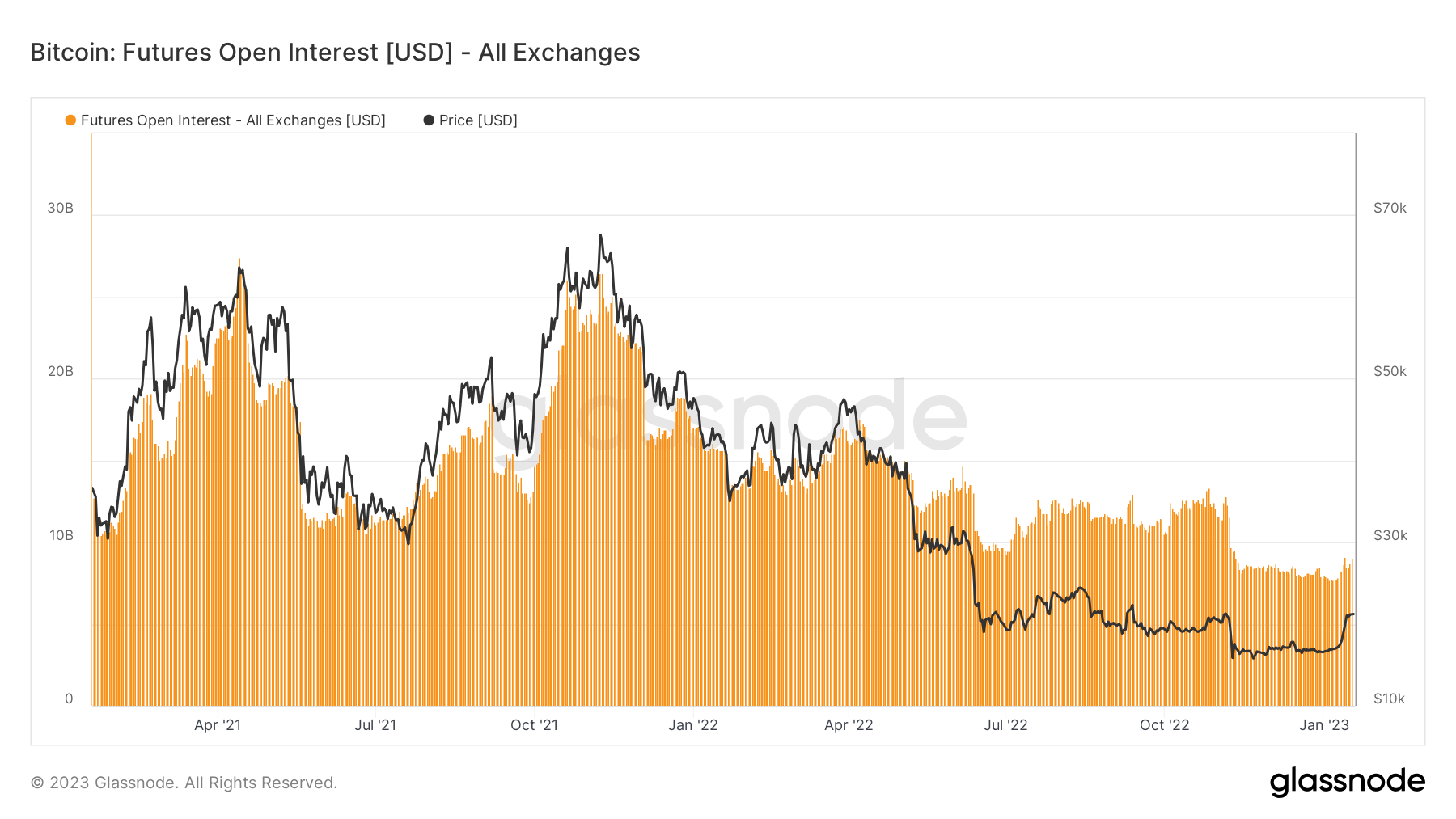

The crypto derivatives marketplace (along with covid stimulus) was a origin successful buoyant spot prices during 2021.

For example, the illustration beneath shows Futures Open Interest hitting implicit $25 cardinal connected 3 occasions successful 2021, coinciding with spikes successful the spot terms to $64,670, $67,100, and $69,200. It was apt that the leverage utilized successful derivatives trading influenced spot exuberance astatine the time.

However, Futures Open Interest has dropped importantly since November 2021. Further, for chartless reasons, the narration betwixt Open Interest and spot terms came undone astir May 2022.

Source: Glassnode.com

Source: Glassnode.comBased connected this, retail buyers had a important manus successful Bitcoin’s caller resurgence backmost supra the intelligence $20,000 level.

The station Research: Bitcoin Spot to Futures ratio shows retail drove terms supra $20,000 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)