Glassnode information analyzed by CryptoSlate showed a divergence betwixt ace whales and retail, with the erstwhile remaining successful assertive accumulation mode going into the caller year.

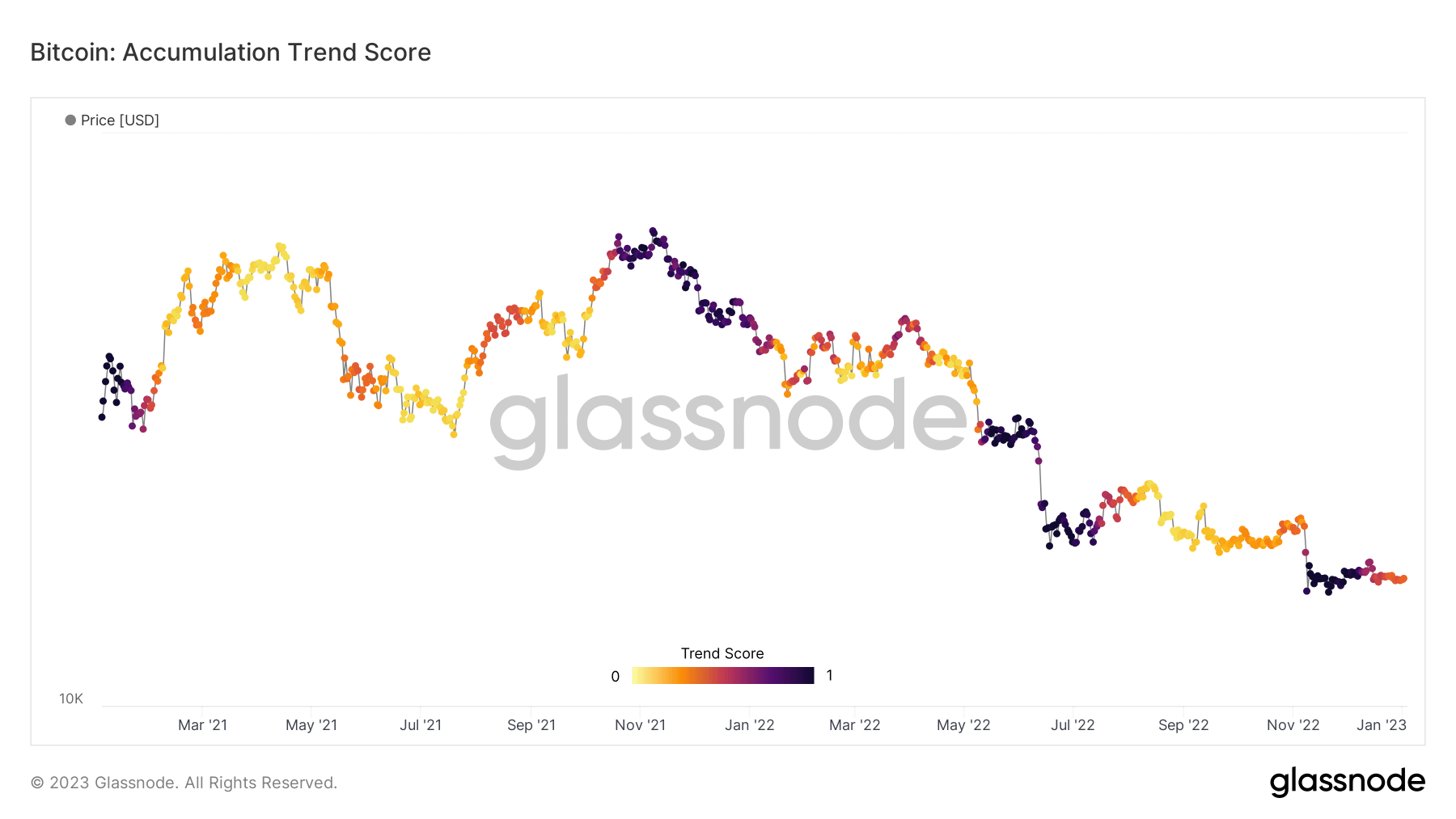

Bitcoin Accumulation Trend Score

The Accumulation Trend Score (ATS) looks astatine the comparative size of entities that are actively accumulating oregon distributing their Bitcoin holdings.

The ATS metric uses a spectrum betwixt 0 to 1. A speechmaking person to 0 indicates organisation oregon selling. While a people person to 1 shows accumulation oregon buying.

Analysis of the illustration beneath showed that important accumulation happened during the FTX illness astir aboriginal November 2022, adjacent arsenic the Bitcoin terms reacted negatively to the news.

This suggests that investors, arsenic a whole, saw worth successful buying astatine discounted prices.

The ATS has since turned much neutral, with organisation bias, reflecting lingering macro uncertainties going into 2023.

Source: Glassnode.com

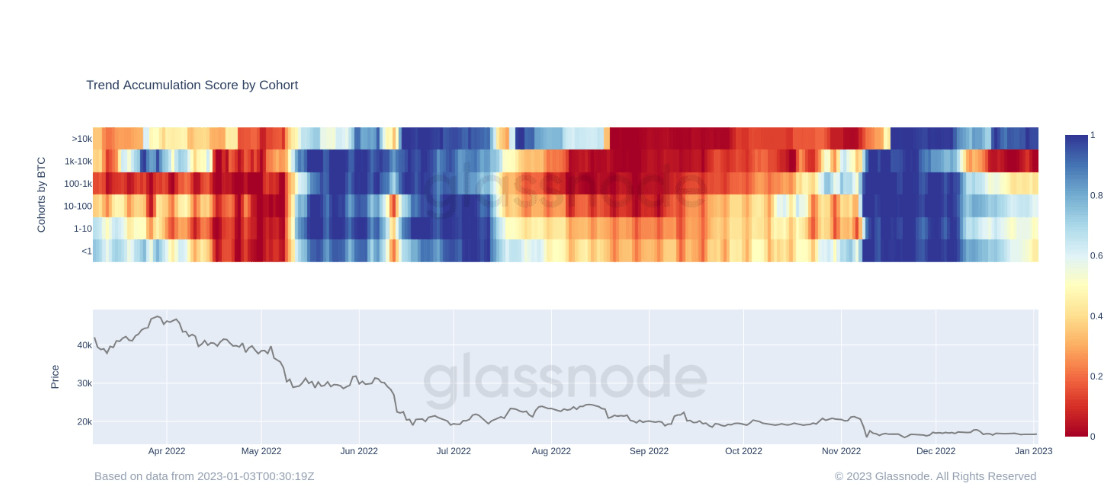

Source: Glassnode.comCohort analysis

Cohort investigation gives a graphical practice of accumulation and organisation crossed six cohorts, ranging from minnows with little than 1 BTC to ace whales holding much than 10,000 BTC.

As the FTX saga was blowing up, each cohorts were accumulating aggressively. This accordant inclination ended astir mid-December 2022 erstwhile whales (entities holding betwixt 1,000 and 9,999 BTC) began heavy distributing.

The alteration successful whale sentiment dispersed crossed different cohort groups, which besides began distributing, but not to the aforesaid grade arsenic the whales. Conversely, passim this play to the present, ace whales remained nett accumulators to a beardown degree.

Source: Glassnode.com

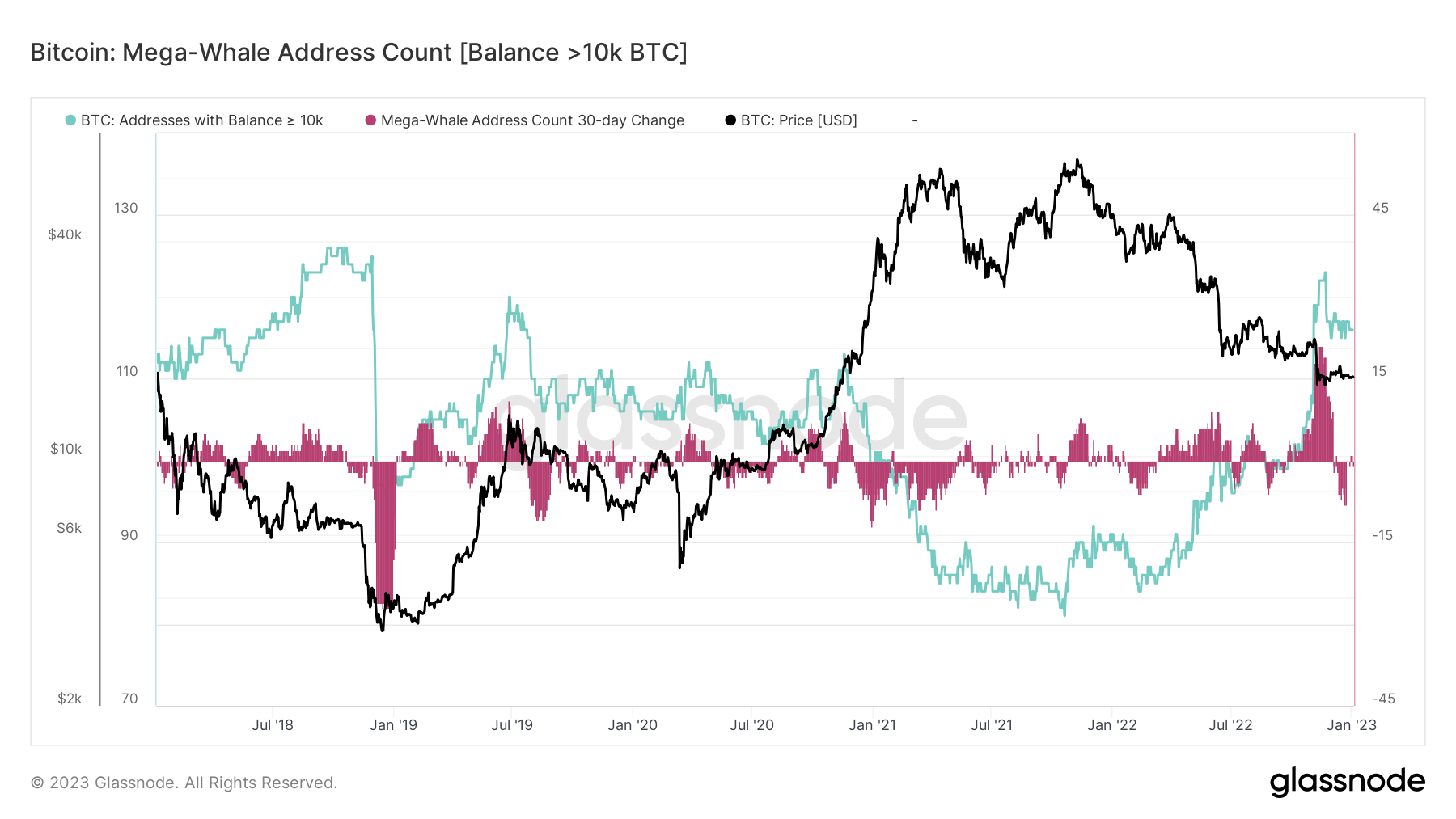

Source: Glassnode.comMega-Whale Address Count

Analysis of the Bitcoin Mega-Whale Address Count Balance showed entities with much than 10,000 BTC surpassed 120 addresses astatine the process extremity of past year. This encompassed a 30-day alteration of implicit 20 further addresses, marking the fastest maturation complaint since 2018.

Coupled with the supra charts detailing assertive ace whale accumulation, it’s just to reason astute wealth investors were buying the dip.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Bitcoin ace whales stay assertive accumulators, retail sells appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)