Since bottoming astatine $17,700 connected June 18, Bitcoin has been trading wrong a comparatively choky band, with $25,100 marking the precocious bounds of this channel.

Although the past week oregon truthful saw BTC people six consecutive regular greenish closes, higher-than-expected CPI inflation data, released connected September 13, ended the upward momentum. On that day, BTC swung 13% to the downside to bottommost astatine $19,800.

Price uncertainty is the ascendant communicative arsenic macro pressures proceed to measurement dense connected the marketplace leader. According to the Options 25 Delta Skew and Options Volume Put/Call Ratio, this has played retired arsenic a willingness to spell long, adjacent connected insignificant signs of terms recovery. However, the wide sentiment is bearish.

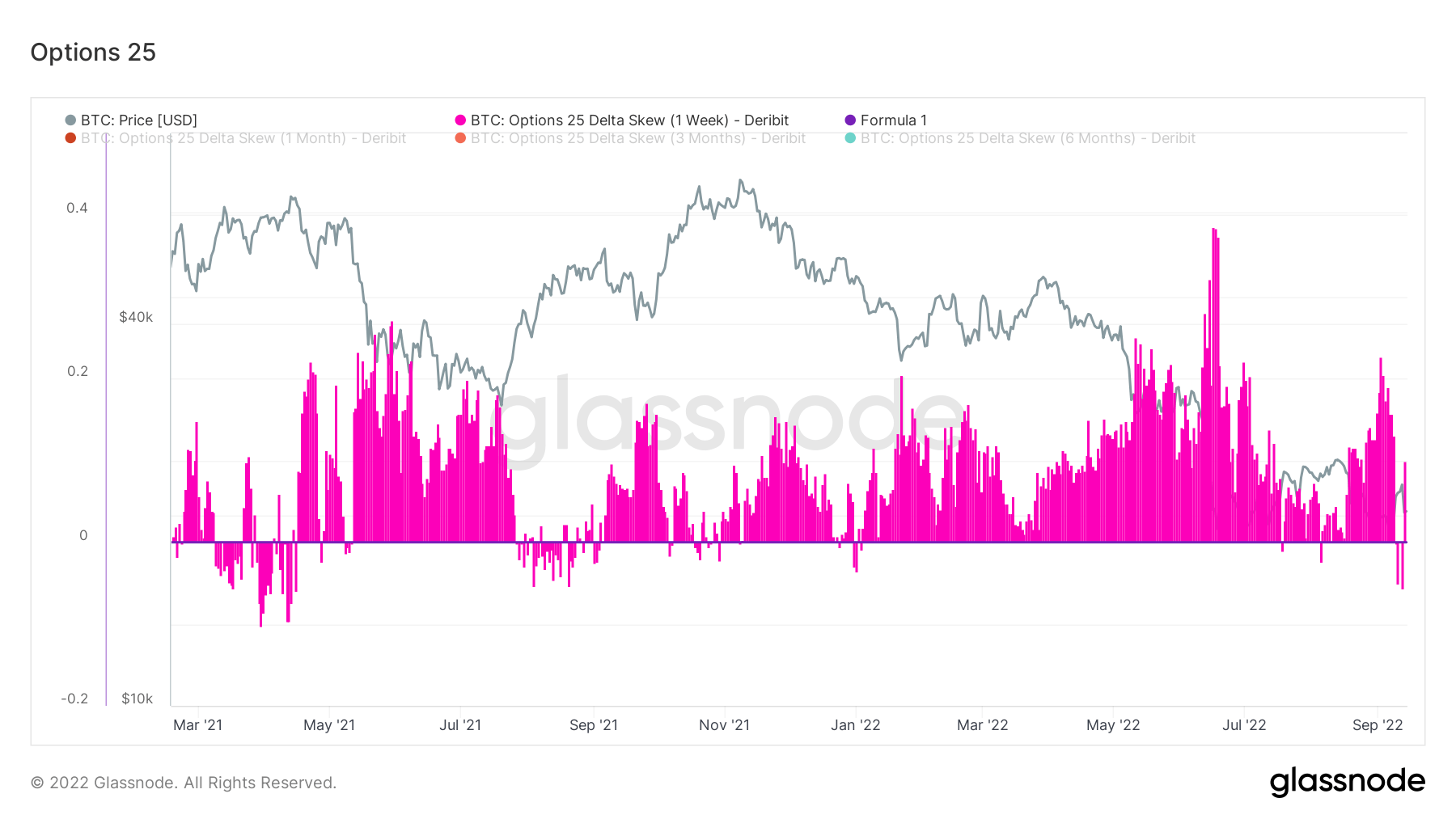

Options 25 Delta Skew

The Options 25 Delta Skew metric looks astatine the ratio of enactment vs. telephone options expressed successful presumption of Implied Volatility (IV). Puts being the close to merchantability a declaration astatine a circumstantial terms and calls being the close to buy.

For options with a circumstantial expiration date, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of +25%, netted disconnected to get astatine a information point. In different words, this is simply a measurement of the option’s terms sensitivity fixed a alteration successful the spot Bitcoin price.

The idiosyncratic periods notation to enactment contracts expiring 1 week, 1 month, 3 months, and 6 months from now, respectively.

Below 0 indicates calls are pricer than puts. This concern has occurred lone six times this year. During Bitcoin’s caller bottoming, traders scrambled for puts and past reverted to calls astatine the section top.

BTC Price vs. Options Skews (Source: Glassnode.com)

BTC Price vs. Options Skews (Source: Glassnode.com)This changeable behaviour tin beryllium explained by a long, drawn-out carnivore marketplace prompting traders to respond quickly, adjacent connected insignificant indications of terms recovery.

In caller weeks, arsenic Bitcoin flitted supra and beneath $20,000, traders person struck for calls, to spell long, connected 4 occasions, lone for the marketplace to determination against them. Consecutive back-to-back calls person not happened since the extremity of past year.

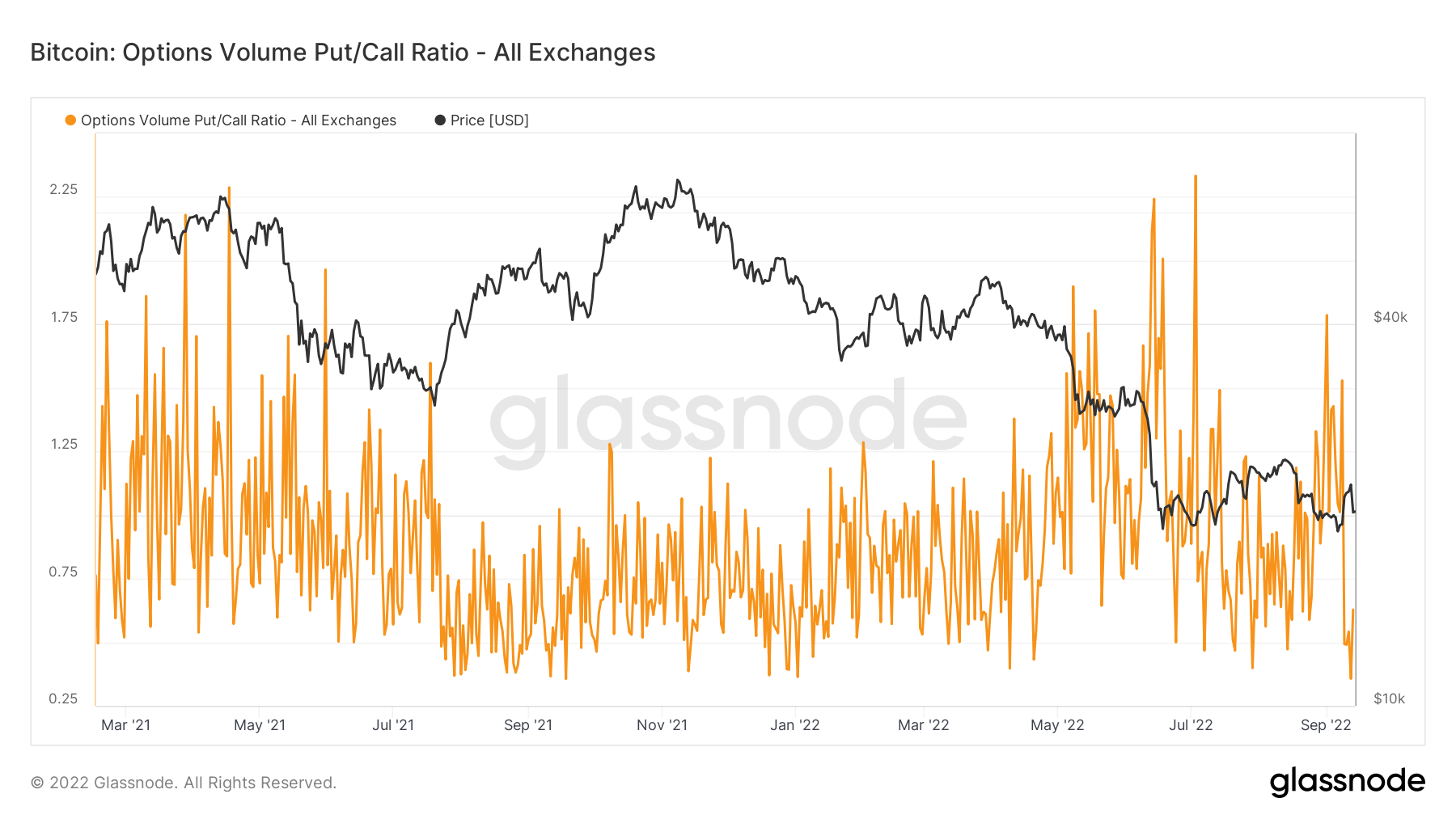

Options Volume Put/Call ratio

The Options Volume Put/Call Ratio shows the enactment measurement divided by the telephone measurement traded successful options contracts successful the past 24 hours. It is utilized to gauge the wide temper of the market.

The illustration beneath shows a dense skew towards puts, arsenic evidenced by crisp increases successful the ratio during instances of terms bottoming.

This suggests bearish sentiment is firmly embedded. But akin to the Options 25 Delta Skew data, traders volition spell agelong connected signs of terms recovery.

Bitcoin: Options Volume Put/Call Ration (Source: Glassnode.com)

Bitcoin: Options Volume Put/Call Ration (Source: Glassnode.com)The station Research: Bitcoin traders consenting to spell agelong but sentiment remains firmly bearish appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)