Glassnode information analyzed by CryptoSlate shows that caller code momentum metrics of Bitcoin (BTC) and Ethereum (ETH) bespeak that the BTC web is increasing portion the sentiment connected the ETH web is the opposite.

An uptick successful regular progressive users, much transaction throughput, and accrued request for backspace often qualify steadfast web adoption. Considering this, CryptoSlate analysts examined the caller code momentum, caller entity momentum, and progressive code momentum metrics for BTC and ETH.

New code momentum

The fig of caller addresses recorded on-chain tin beryllium an effectual instrumentality to measurement the magnitude, trend, and momentum of enactment crossed the network.

The implicit fig of caller addresses connected immoderate fixed time tin beryllium uninformative owed to intraday volatility successful on-chain enactment metrics. Instead, comparing the magnitude and inclination of caller addresses entering the marketplace connected a monthly oregon yearly ground tin beryllium overmuch much informative.

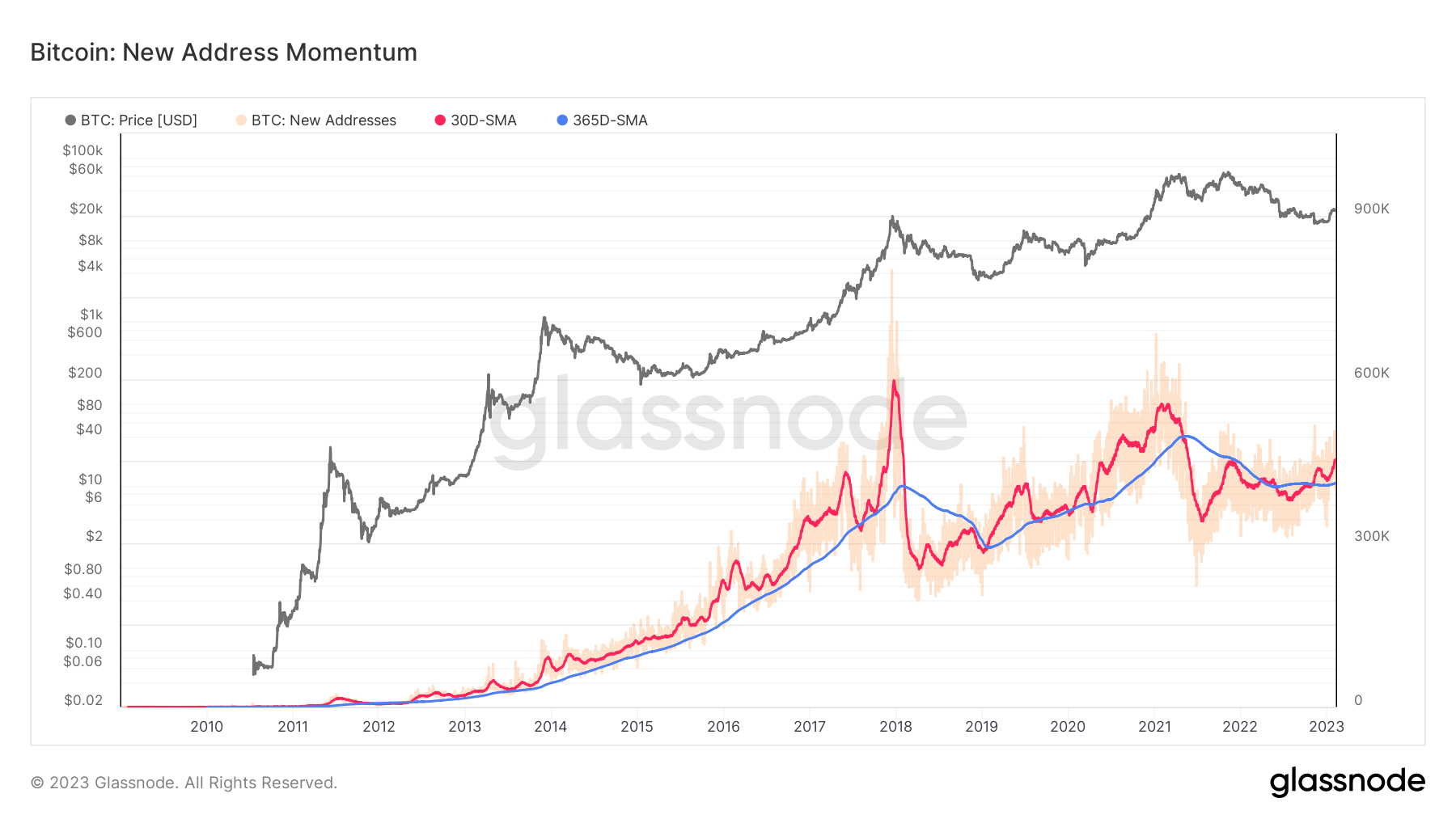

BTC New Address Momentum (Source: Glassnode)

BTC New Address Momentum (Source: Glassnode)The illustration supra reflects the fig of mean monthly and yearly caller addresses connected the BTC chain, which are represented with the reddish and bluish lines, respectively.

New entity momentum

This metric represents the caller entities that travel to a blockchain and tin supply meaningful insights erstwhile utilized unneurotic with the caller code momentum metric.

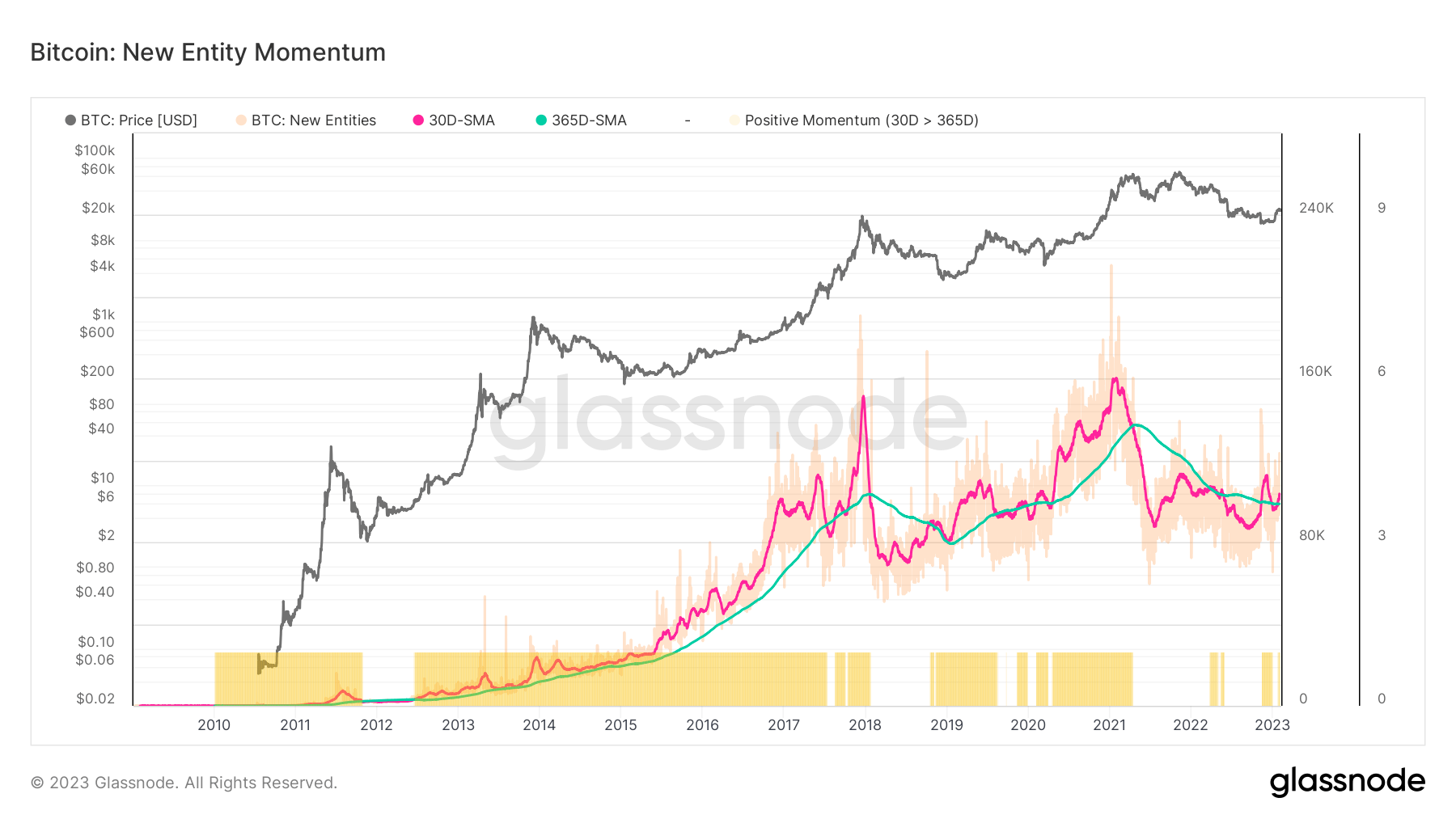

Similar to the caller code momentum chart, the illustration beneath represents the mean monthly and yearly BTC caller entity momentums since 2010. The pinkish enactment represents the monthly average, portion the greenish 1 reflects the yearly average.

BTC caller entity momentum (Source: Glassnode)

BTC caller entity momentum (Source: Glassnode)Both metrics underline comparative shifts successful ascendant sentiment and assistance place erstwhile the tides are turning for web activity. When the monthly mean surpasses the yearly one, it indicates an enlargement successful on-chain activity, usually reflecting cardinal web improvements and increasing web utilization.

If the yearly mean exceeds the monthly average, it indicates a contraction successful on-chain activity, a emblematic motion of deteriorating web fundamentals and declining web utilization.

The charts bespeak that currently, some BTC’s caller code momentum and caller entity momentum metrics are supra the yearly averages. Historical information suggests that a bull marketplace sentiment emerged each clip these metrics exceeded the yearly average. The latest illustration of this tin beryllium observed during the archetypal period of 2023, which saw BTC summation from astir $15,000 to $24,000.

This besides supports the arguments claiming that the bull tally successful 2021 ended successful mid-2021, and the November bull tally wasn’t integrated and was pushed by derivatives.

Currently, we spot caller entities travel into the BTC web successful an effectual mode for the archetypal clip successful 2021. However, the travel stopped for a little play during aboriginal 2022, but it tin beryllium said that this play was during the extremity of the bull run.

Ethereum

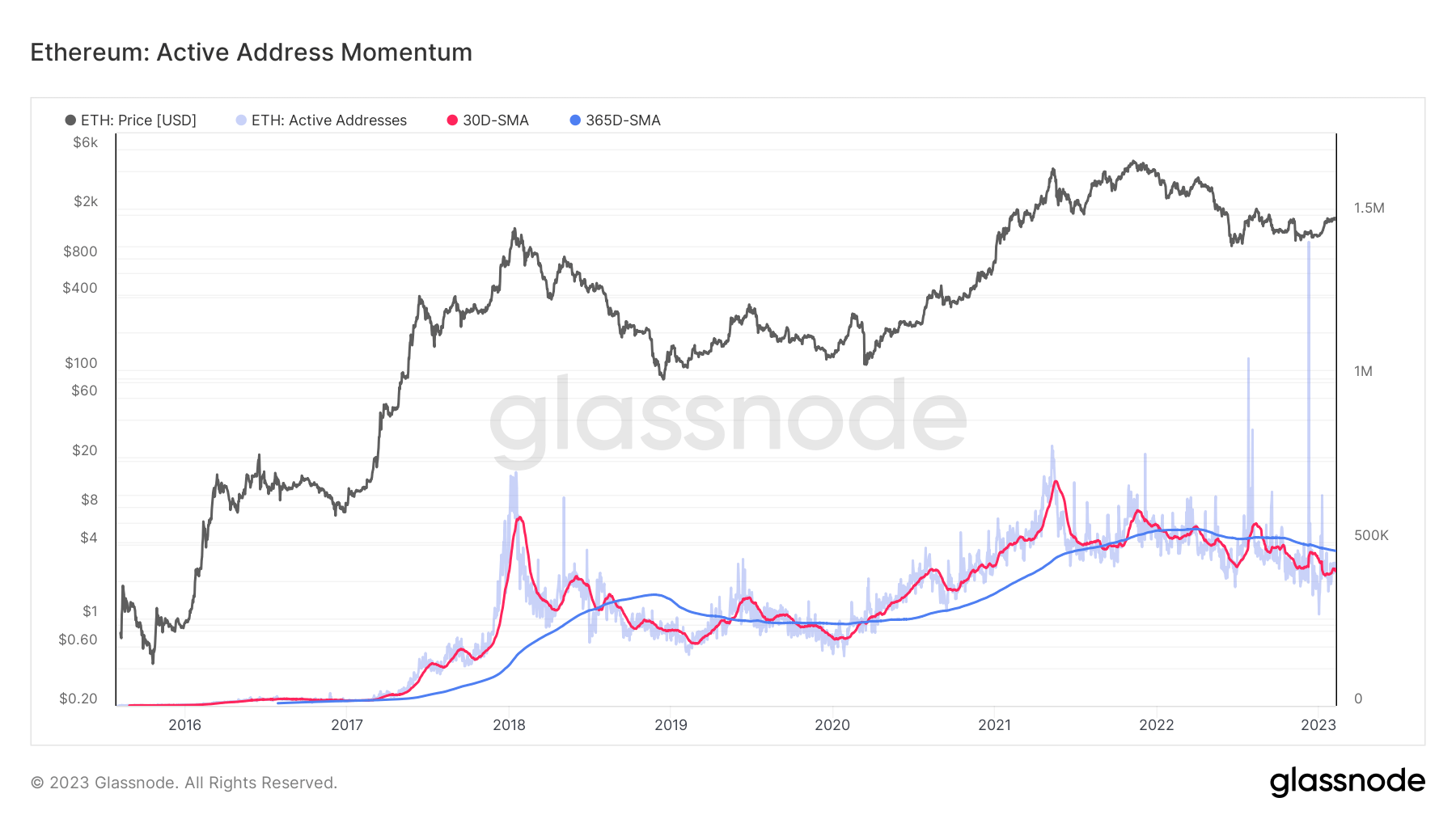

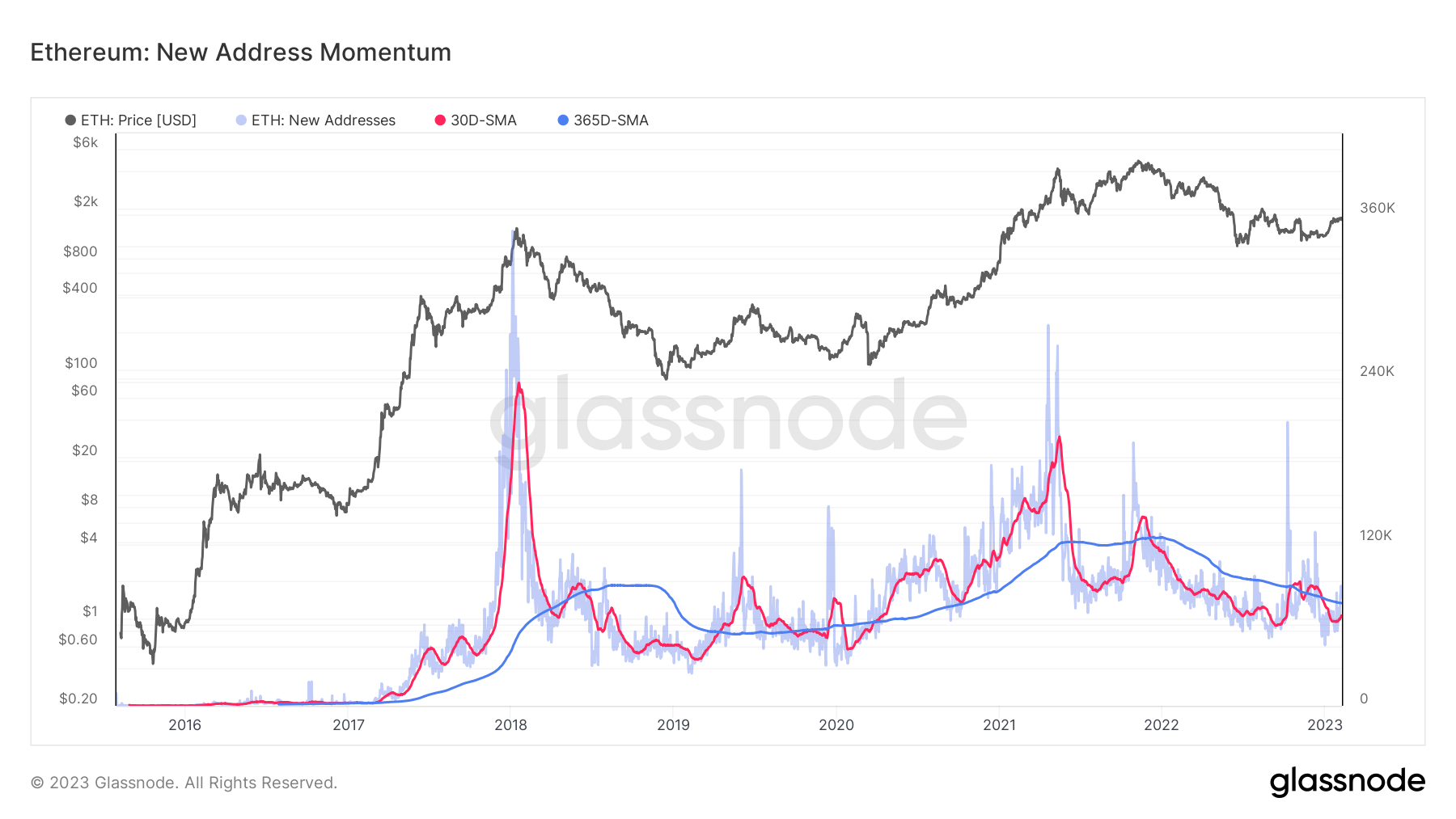

The metrics for ETH bespeak a antithetic sentiment. The charts beneath correspond the mean monthly and yearly progressive code momentum and caller code momentum metrics for ETH.

ETH Active Address Momentum (Source: Glassnode)

ETH Active Address Momentum (Source: Glassnode) ETH New Address Momentum (Source: Glassnode)

ETH New Address Momentum (Source: Glassnode)Both metrics are firmly beneath the yearly average, suggesting a deficiency of caller participants entering the network. These metrics person been beneath the yearly averages since the opening of 2021.

The station Research: BTC, ETH code momentum shows important divergence appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)