Glassnode information analyzed by CryptoSlate analysts suggests that rising Bitcoin (BTC) terms besides increases miner profitability and revenue, which person been humanities pointers for marketplace bottoms.

CryptoSlate looked into the Difficulty Regression Model and Miner Revenue vs. Yearly Average examination metrics to measure miners’ profitability. While some metrics hold that things are going swimmingly for BTC miners, the ASIC Rig profitability metric revealed that the hash complaint reached a caller all-time high.

Difficulty Regression Model

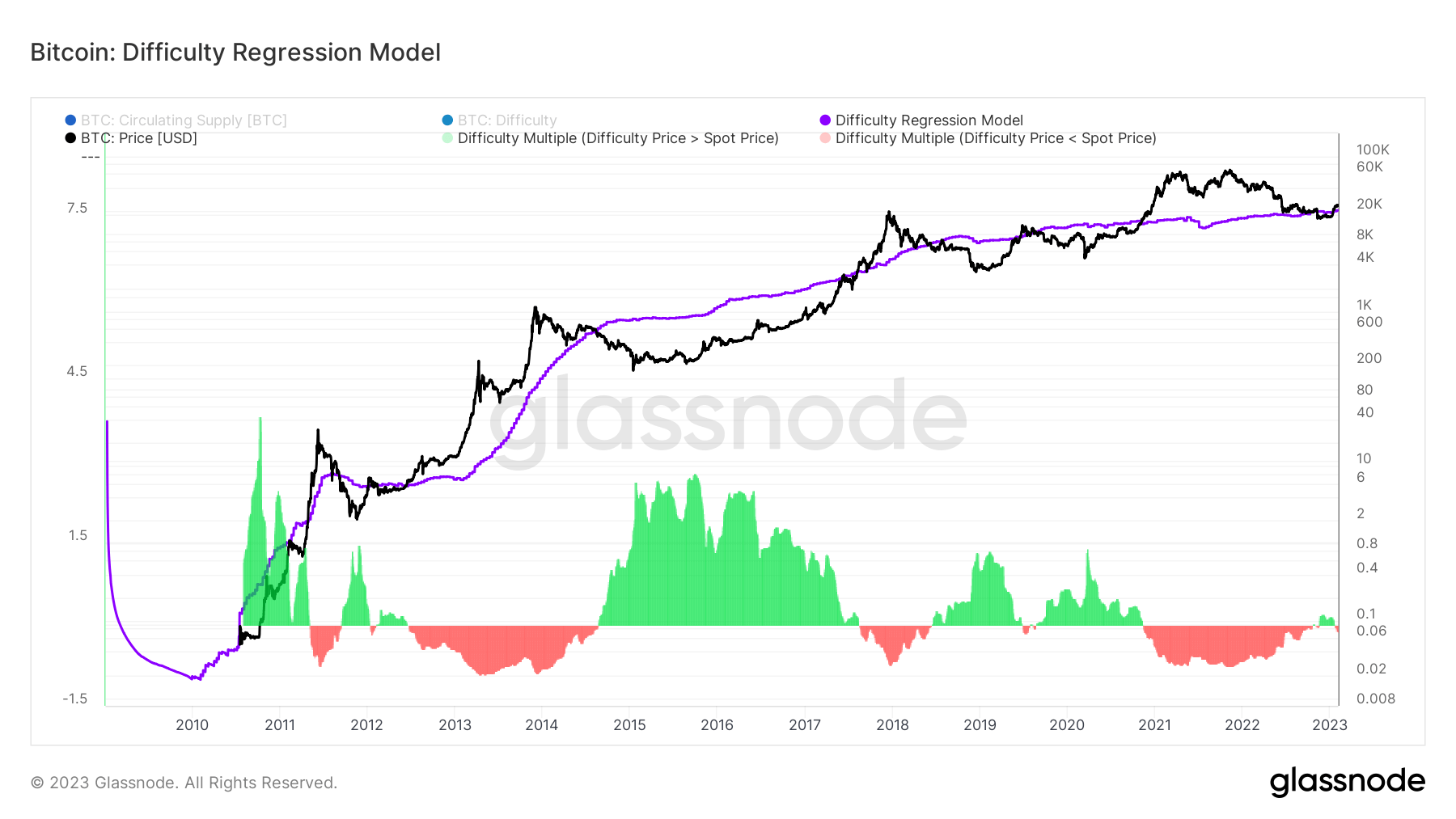

The Difficulty Regression Model is utilized to marque consciousness of the all-in-sustaining outgo of producing 1 BTC. It takes mining trouble arsenic the eventual distillation of the outgo of mining, accounting for each the mining variables successful 1 number. Therefore, the calculated worth reflects an estimated mean accumulation outgo for mining 1 BTC.

The illustration beneath shows the Difficulty Regression Model for BTC since 2010 with the purple enactment and the terms of BTC with the achromatic line. BTC mining becomes profitable erstwhile the purple enactment indicates a outgo little than the BTC price, which is illustrated successful the reddish areas below. Similarly, if the purple enactment exceeds the achromatic one, it means that BTC mining is not profitable, which creates the greenish zones connected the chart.

Difficulty Regression Model for BTC (Source: Glassnode)

Difficulty Regression Model for BTC (Source: Glassnode)Currently, the information shows that the all-in-sustaining outgo of producing 1 BTC is $20,000. This is simply a somewhat little worth than the existent BTC price, which lingers astir $23,554 astatine the clip of writing.

In summation to mining profitability, the illustration demonstrates the humanities narration betwixt the all-in-sustaining outgo of producing 1 BTC and the marketplace bottoms. Since 2010, the all-in-sustaining outgo of producing 1 BTC marked a little worth than the BTC terms connected 5 antithetic occasions successful 2011, 2012, 2018, 2019, and 2021, each of which were followed by an summation successful the BTC’s value. Historically, it tin beryllium said that this concern mightiness awesome a marketplace bottom.

Miner Revenue vs. Yearly Average

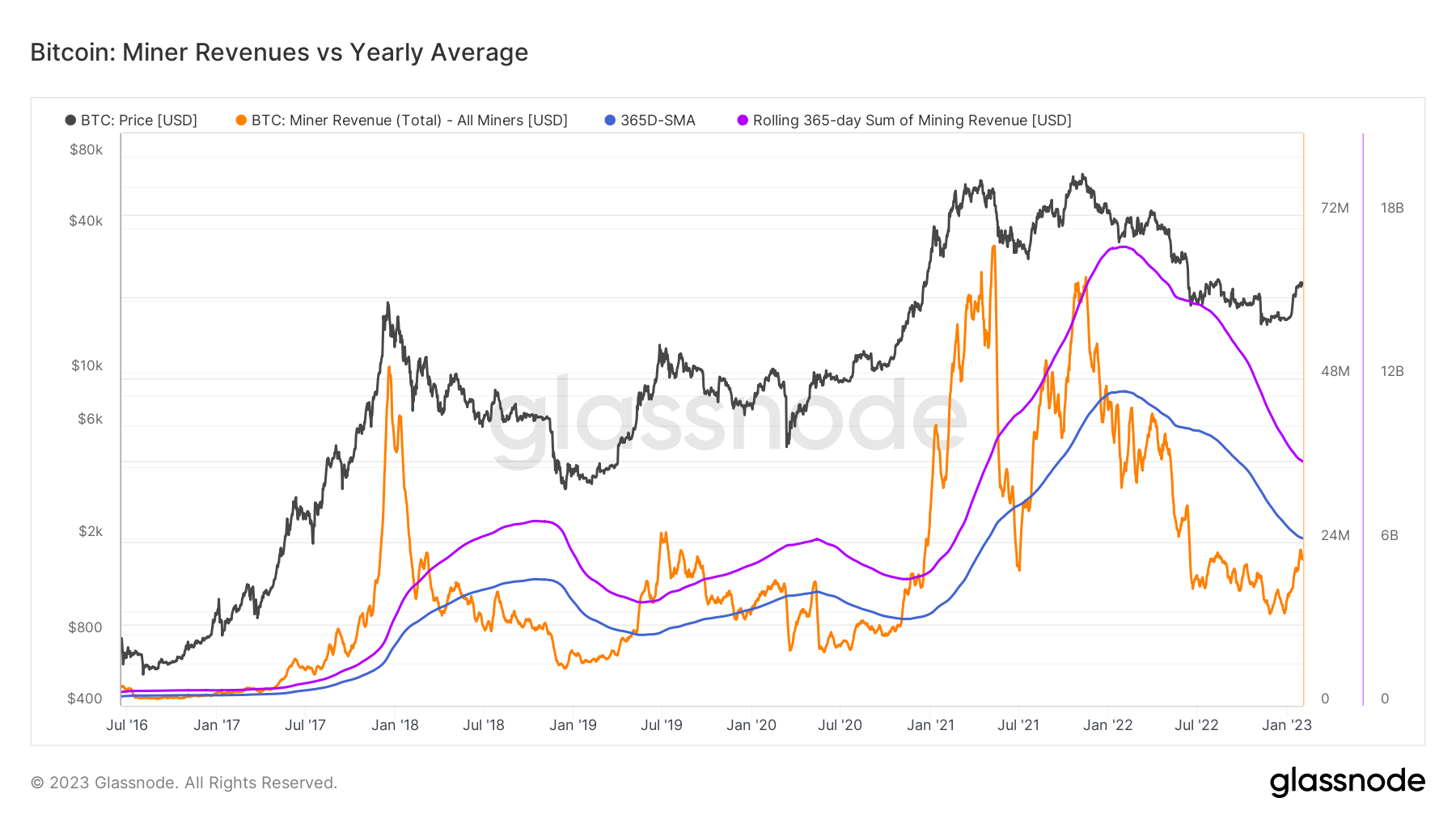

The Miner Revenue vs. Yearly Average examination is utilized by analysts who privation to measurement regular volatility against a longer-term trend. This metric takes the full regular gross generated by BTC miners successful U.S. dollars and compares it to the 365-day elemental moving average.

The illustration beneath starts from mid-2016 and represents the full gross paid to miners and the 365-day elemental moving mean with the orangish and bluish lines, respectively.

Miner Revenue vs. Yearly Average for BTC (source: Glassnode)

Miner Revenue vs. Yearly Average for BTC (source: Glassnode)The aggregated gross generated by miners has been beneath the 365-day elemental moving mean level since the opening of 2022. According to the chart, the full gross generated by miners is presently astir $22.5 million, portion the 365-day elemental moving mean is astir $24.6 million.

This narration besides indicates marketplace bottoms. A BTC terms surge was recorded whenever the aggregate gross created by miners exceeded the 365-day elemental moving average. The information besides shows that the miners’ income has been expanding since the opening of 2023. If the summation continues, the aggregate gross mightiness interruption done the 365-day elemental moving mean resistance, greenlighting a marketplace surge.

ASIC Rig Profitability

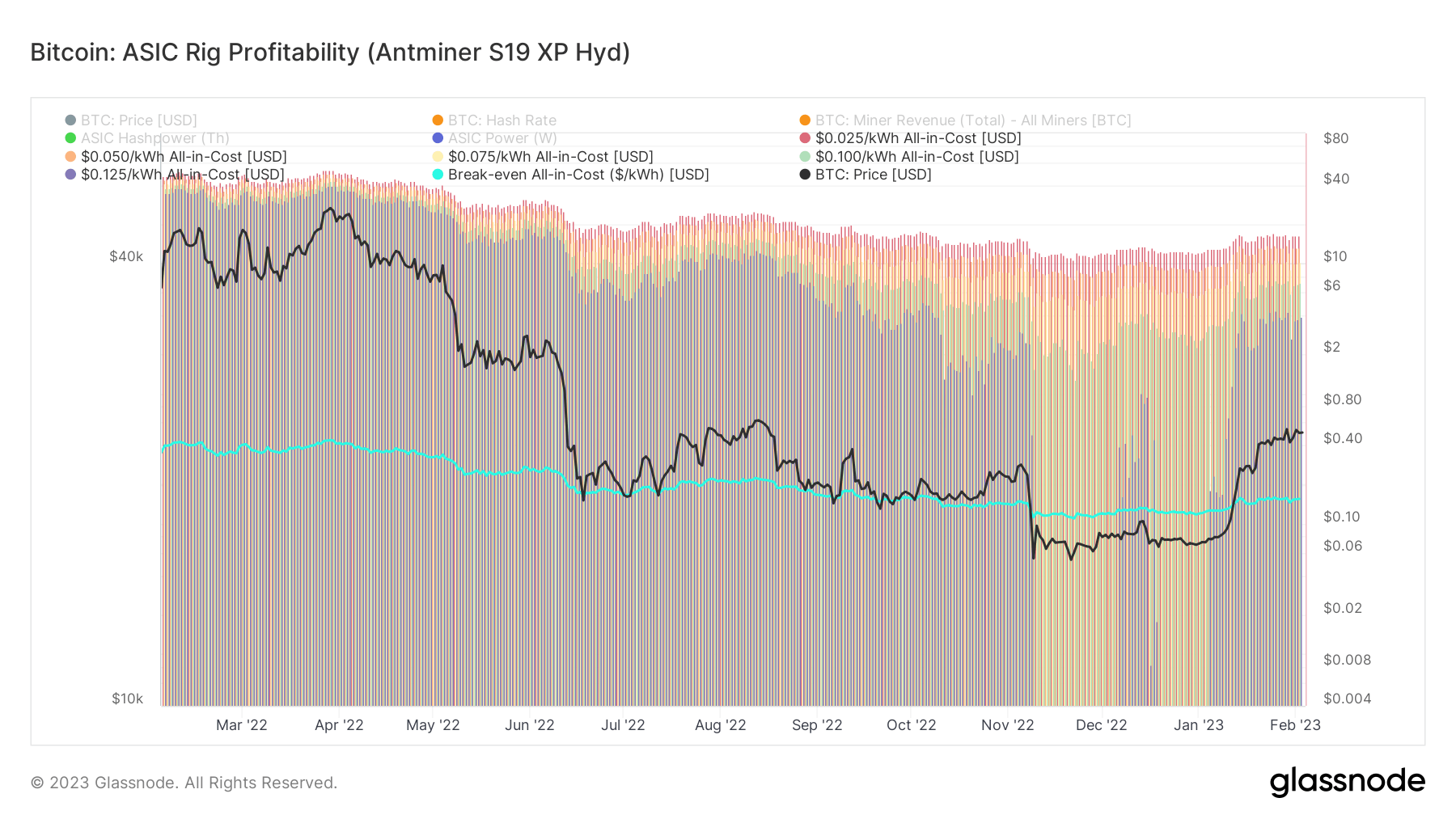

This metric estimates a U.S. Dollar worth for the denominated regular nett earned by an Antminer S19 XP Hyd ASIC rig nether assorted all-in-sustaining-cost AISC assumptions.

The Antminer S19 XP Hyd ASIC rig was released successful October 2022 and tin scope 255 Th/h hash rate, consuming 5304 watts.

The illustration beneath shows the ASIC Rig Profitability for BTC since the opening of 2022 with the turquoise line. The enactment indicates profitability if it marks a constituent little than the BTC price.

ASIC Rig Profitability for BTC (Source: Glassnode)

ASIC Rig Profitability for BTC (Source: Glassnode)According to the chart, the Antminer S19s person go profitable astatine the opening of 2023. The all-in-sustaining outgo sits astatine astir $0.15. This caused miners to crook backmost connected the Antminer S19s rigs, which accrued the hash complaint to the constituent of a caller all-time high.

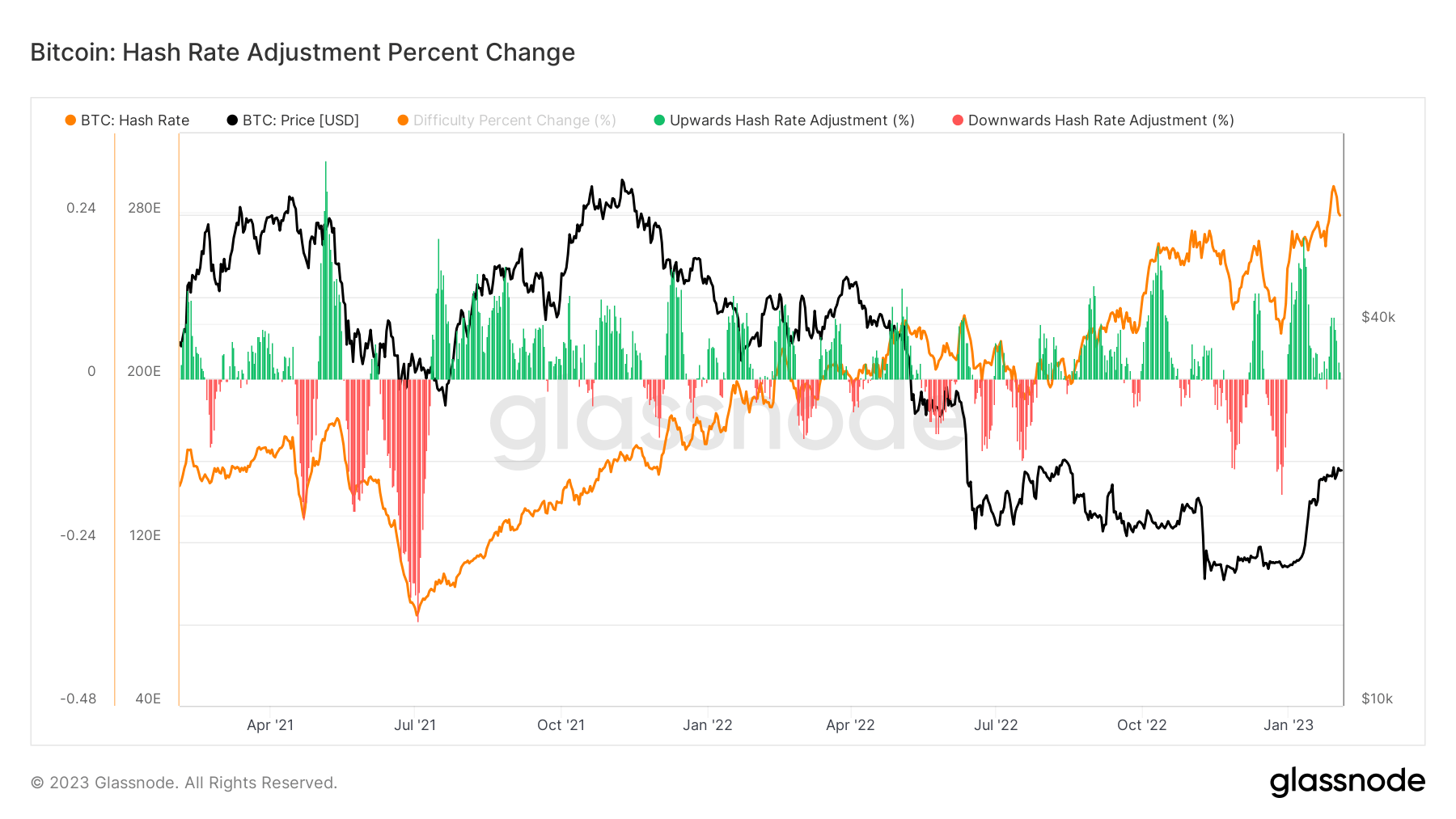

BTC Hash Rate Adjustment Percent Change (Source: Glassnode)

BTC Hash Rate Adjustment Percent Change (Source: Glassnode)The illustration supra represents the BTC hash complaint with the orangish enactment since the opening of 2021. The hash complaint has been increasing exponentially since the opening of 2023, which has besides been strengthening web security.

The station Research: BTC terms surge increases miner profitability, indicating marketplace bottom appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)