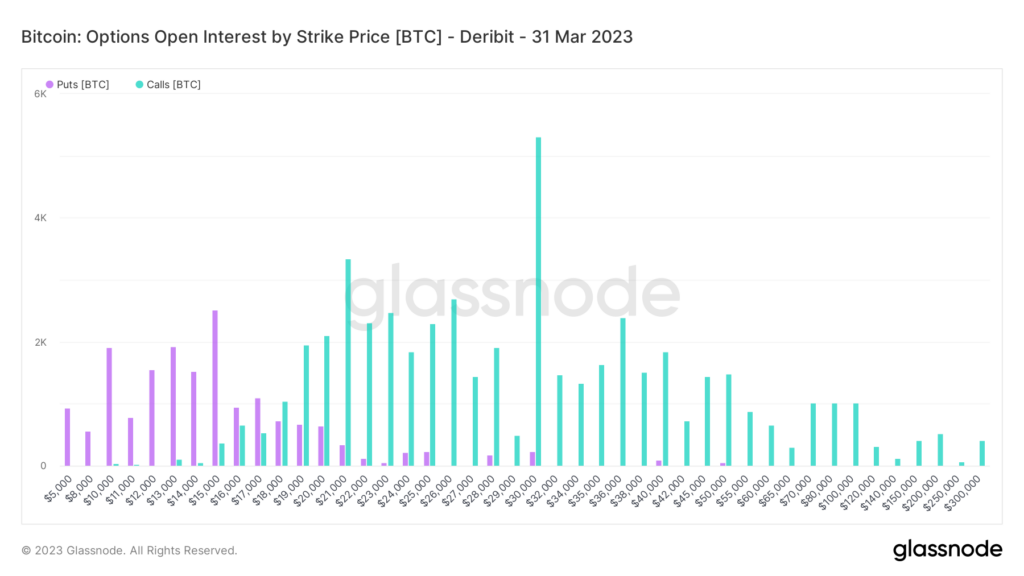

Bitcoin options traders person overwhelmingly re-revised their expectations to $30,000 by the extremity of March, according to Glassnode information analyzed by CryptoSlate.

Recent terms enactment took a decidedly bullish code during the second week of the caller year.

Since Jan. 8, BTC recorded 7 consecutive greenish regular closes, which took it 25% higher and recaptured $20,000 for the archetypal clip since the FTX illness astir 9 weeks ago.

With that, sentiment among options traders has go much bullish.

Bitcoin sentiment flips further bullish among options traders

Previous research highlighted bullishness among Bitcoin and Ethereum options traders, arsenic denoted by the prevalence of Open Interest calls, implicit puts, successful some instances.

Calls and puts notation to the buying and selling, respectively, of options. These derivative products springiness holders the right, but not the obligation, to bargain oregon merchantability the underlying plus astatine immoderate aboriginal constituent for a predetermined price.

The dispersed of calls and puts astatine varying predetermined (or strike) prices bespeak wide marketplace sentiment.

At that time, for Bitcoin, the scope betwixt $15,000 and $20,000 was favored owed to the comparatively adjacent dispersed of calls and puts wrong this spread.

However, owed to caller buoyant terms action, Bitcoin options traders person flipped adjacent much bullish.

Strike terms calls astatine $30,000

The illustration beneath provides updated Bitcoin Open Interest information pursuing caller terms moves. Again, calls acold transcend puts, with the $16,000 to $18,000 scope favored this time.

Nonetheless, revised Open Interest information showed the astir enactment for calls astatine $30,000 and by a important margin, followed by calls for $21,000 by the quarter’s end. The astir important puts involvement was astatine the $15,000 onslaught price.

Source: Glassnode.com

Source: Glassnode.comWhile macro uncertainty remains, the dominance of calls successful Bitcoin Options Open Interest suggests a grade of detachment from broader uncertainties, astatine slightest successful the abbreviated term.

The station Research: Buoyant terms enactment has Bitcoin options traders eyeing $30,000 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)