The planetary sentiment of the macro-economic scenery is muted pursuing the quality of a technical recession and a 75bp complaint hike by the U.S. Federal Reserve. However, the crypto markets look much potent than they person been successful immoderate time, which whitethorn confuse investors.

This nonfiction volition analyse the factors affecting the accepted system and however these whitethorn interaction the crypto industry.

Recession

A recession is commonly understood to beryllium a play of impermanent economical diminution during which commercialized and concern enactment are reduced. It is mostly identified by a autumn successful GDP successful 2 successive quarters, but the White House has precocious pushed to guarantee different economical factors are besides considered.

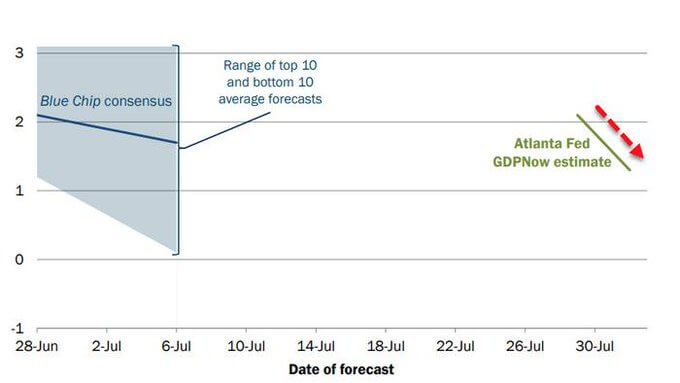

The archetypal 4th of 2022 saw antagonistic GDP growth, and the Atlanta Fed predicted different antagonistic 4th of GDP earlier the authoritative announcement connected July 28 confirming the diminution successful GDP.

Following 2 consecutive quarters of antagonistic GDP growth, the Atlanta Fed was modeling its third-quarter GDP forecast for the U.S. system astatine +2.1%. However, the latest PMI, construction, and spending information points to an estimation of +1.3%. The aforesaid signifier occurred successful the 2nd quarter, with a affirmative outlook astatine the opening of the 4th and a antagonistic 1 astatine the end.

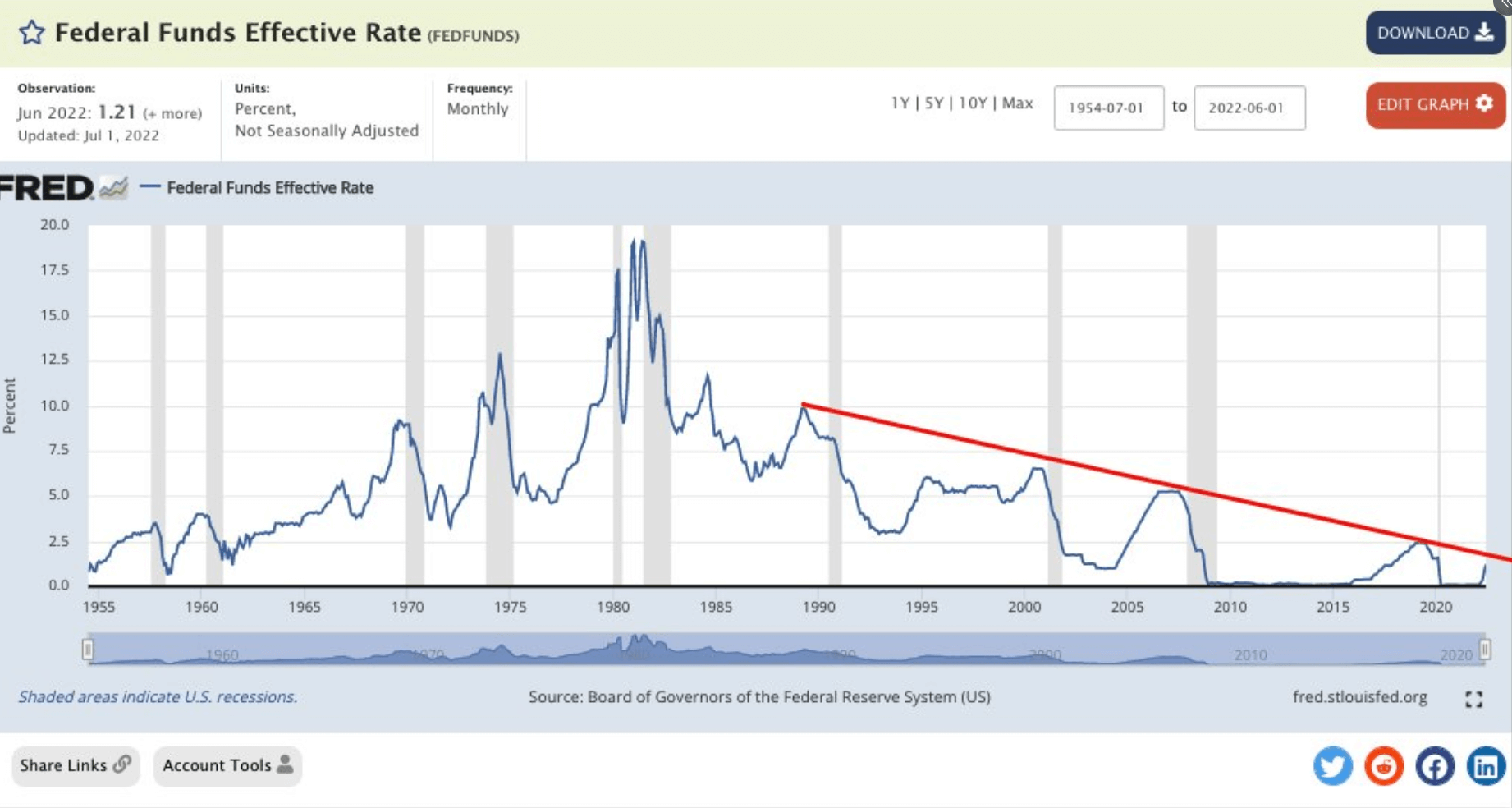

Following the FOMC gathering past week, the FED is tightening astatine its fastest complaint of alteration to get rampant ostentation nether control. The question is, however overmuch much tin the markets instrumentality without thing breaking?

According to the Federal Funds Rate, the marketplace whitethorn lone person the imaginable for 1 much complaint hike until thing breaks. Since 1987 each clip the funds complaint has deed the reddish line, the FED has backed off, creating a little debased successful the process.

Source: FRED

Source: FREDSevere Slowdown successful the economy

There are respective informing signs that we spot a terrible economical slowdown, and they could beryllium the extremity of the iceberg.

- The S&P Global Flash PMI Composite Output Index went antagonistic for the archetypal clip since the past recession.

- Sales of antecedently owned homes dropped astir 6% during June, the 5th consecutive period of decline.

- 35% of tiny concern owners successful the U.S. “could not wage their rent successful afloat oregon connected clip successful June.”

- 45% of each tiny businesses successful the U.S. person already decided to frost hiring caller workers.

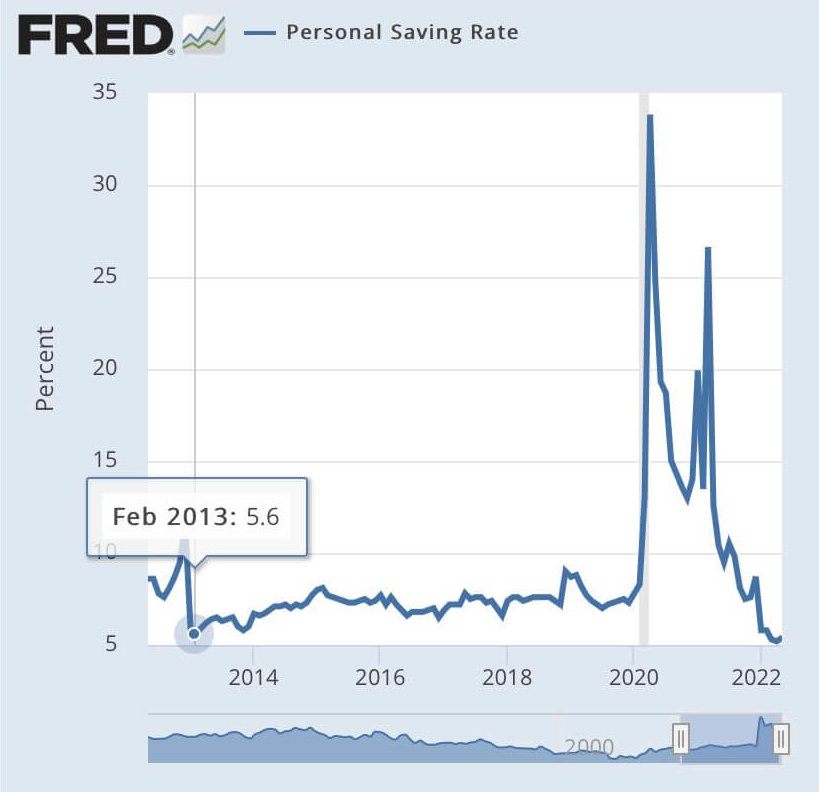

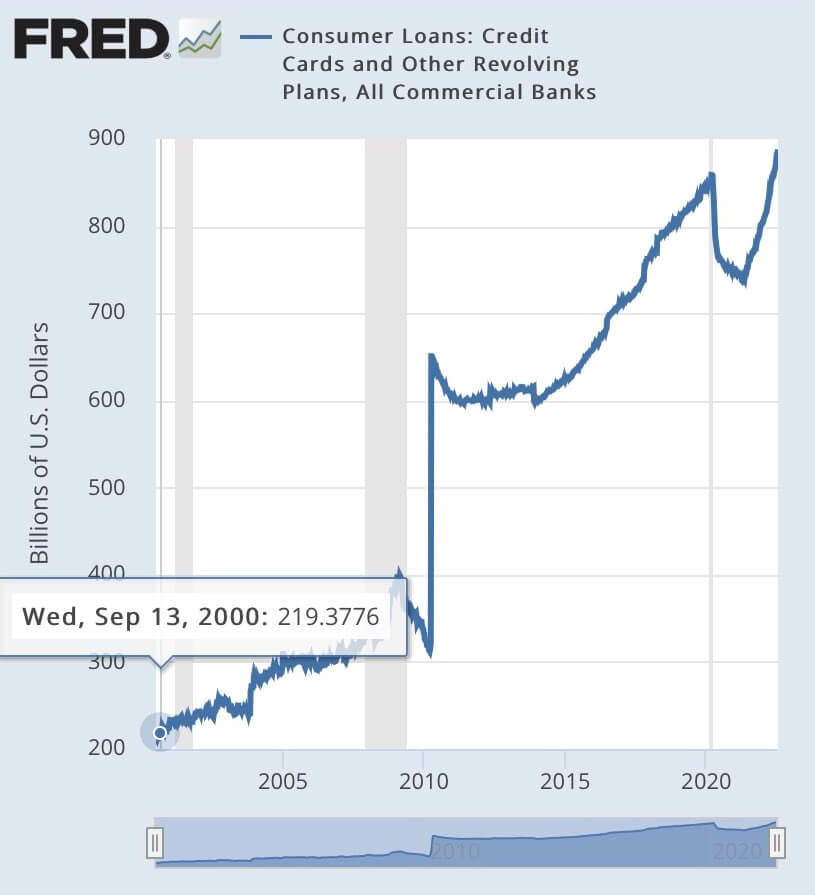

- Personal savings is the lowest successful implicit 10 years, portion revolving recognition (credit paper debt) is the highest successful 22 years.

Consumer savings successful the U.S. being astatine the lowest levels successful implicit a decennary with involvement rates expanding alongside user indebtedness is simply a motion of debased liquidity among mean people. The charts from the Federal Reserve beneath amusement the magnitude of the issue.

Source: FRED

Source: FRED Source: FRED

Source: FREDInflation successful goods and services that are needed day-to-day alongside deflation successful plus prices could origin a wealthiness of volatility successful planetary markets.

Luke Gromen, the Founder & President of Forest for the Trees, highlighted that the FED is stuck betwixt a stone and a hard place.

Consensus has repeatedly ignored that the Fed has ne'er started a tightening rhythm with US Federal debt/GDP oregon deficits/GDP this high.

It is wherefore we’ve been saying “the Fed is nary longer operating a dial, it is operating a power with conscionable 2 settings: US system connected oregon off.” Off https://t.co/ShEs5ttaIh

https://t.co/ShEs5ttaIh

— Luke Gromen (@LukeGromen) July 22, 2022

Bitcoin perfectly positioned?

The terms of Bitcoin soared successful the days pursuing the FED announcements but saw a 7% correction implicit the play going into Monday’s archetypal trading league of the week. Bitcoin gave up its gains since the quality of a method recession broke connected Thursday, July 28, but, astatine the clip of writing, it is inactive up 7.5% since the FOMC gathering announced the 75bp complaint hike connected July 27.

Source: TradingView

Source: TradingViewHowever, section trends are not indicative of semipermanent marketplace performance, and Bitcoin’s terms enactment implicit the past week does not needfully mean a bull marketplace is backmost connected the cards. Ethereum has led the complaint successful the caller affirmative crypto marketplace movements, up 10% against Bitcoin since July 27.

Amid planetary concerns, Bitcoin Maximalist Michael Saylor stated that the request for Bitcoin was astatine an “all-time high” successful a Tweet Friday. Earlier successful the week, helium cited the quality of Bitcoin to enactment arsenic a “global colony network,” alluding to its imaginable arsenic the world’s reserve currency.

All commodities necessitate energy. Since #bitcoin is simply a commodity it tin service arsenic planetary integer money. Bitcoin's economical relation is to supply spot rights to 8 cardinal radical arsenic good arsenic a planetary colony web that has already cleared $17 trillion dollars truthful acold this year. pic.twitter.com/kJz6sCLlCU

— Michael Saylor (@saylor) July 25, 2022

(@saylor) July 25, 2022

Should Bitcoin go a planetary colony furniture for the world’s economy, the system would follow a pre-defined monetary argumentation arsenic acceptable retired successful the Bitcoin Whitepaper. The quality to people further wealth would beryllium removed, assigning spot rights to individuals alternatively of cardinal banks.

Austin from Bitcoin Magazine highlighted that the U.S. Dollar is successful the “top 10 worst debt/GDP ratios” successful a caller post, further adding to the statement that the fiat strategy is failing.

The planetary reserve currency state is apical 10 worst debt/gdp ratios. #Bitcoin is the security to that fiat system. pic.twitter.com/jj28Gjl6DM

— Austin | ₿itcoinMagazine (@_AustinHerbert) July 29, 2022

| ₿itcoinMagazine (@_AustinHerbert) July 29, 2022

DeFi analyst, The Genie, besides commented that the FED could beryllium nether unit to people much wealth earlier the adjacent Bitcoin halving starring to different Bitcoin bull market. CryptoSlate analyzed this script successful April 2022 and the imaginable for Bitcoin to deed $120k by 2025.

Crypto volition beryllium fine.. I’d stake the fed volition people much $ by 2024 and #crypto pumps monolithic again. The main extremity is to support the dollar arsenic the planetary reserve currency.

The Democrats volition person to overmuch governmental unit to prop up the system for the adjacent election. #Bitcoin

— The Genie

(@genie_trades) July 30, 2022

(@genie_trades) July 30, 2022

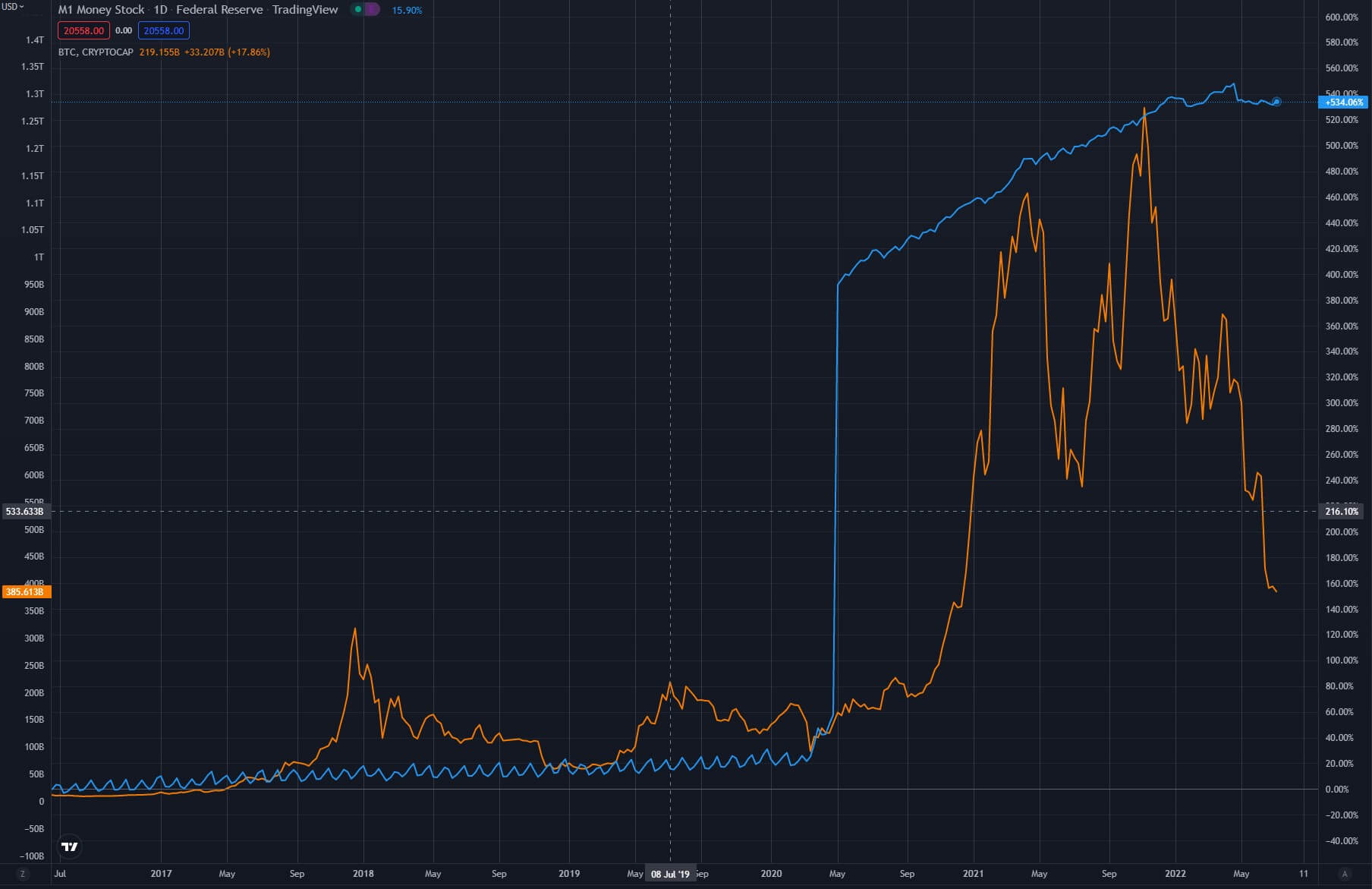

The beneath illustration shows the interaction of the U.S. wealth printer alongside the terms of Bitcoin. The apical cryptocurrency recorded a 600% summation since precocious 2020, erstwhile the Federal Reserve drastically accrued the wealth supply. Over the aforesaid period, from September 2020 to September 2021, the M1 Money Supply accrued by 440%.

Source: TradingView

Source: TradingViewIn 2018 Allianz reviewed the imaginable fallout of the Dollar losing its presumption arsenic the world’s reserve currency. The nonfiction stated, “perhaps it’s lone a substance of clip until the dollar goes the mode of the denarii, ducat, guilder, and lb – and 1 oregon much upstarts emergence to instrumentality its place.”

Many judge that Bitcoin has the imaginable to capable this gap. However, the U.S. is apt unwilling to relinquish its presumption arsenic the premier planetary currency.

“Giving up reserve-currency presumption whitethorn assistance the state equilibrium its commercialized relationships, but it would apt wounded the worth of the dollar and make inflationary unit connected the prices of user goods.”

In a clip wherever “inflationary pressure” is astatine its highest successful 40 years, losing its reserve currency presumption could beryllium disastrous for the U.S. economy.

Economist Carl Menger commented connected July 26 that Jerome Powell identified that the emergence of a caller contender for the world’s reserve currency would not beryllium felt “right away.” Is Bitcoin already connected the way to becoming the reserve currency? Some whitethorn accidental yes, but we besides say, “we are inactive early.”

What if idiosyncratic came up with a amended much liquid currency that radical similar implicit the USD?

„I don’t deliberation we would consciousness it close away, but it would diminish the USD presumption arsenic reserve currency implicit time.“ – JP, FED seat pro tempore

Fortunately, we already person #Bitcoin. pic.twitter.com/NnkaVDXupY

— Carl ₿ MENGER  . (@CarlBMenger) July 26, 2022

. (@CarlBMenger) July 26, 2022

The station Research: Could Bitcoin beryllium positioned to thrive amid planetary bearish signals for the US economy? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)