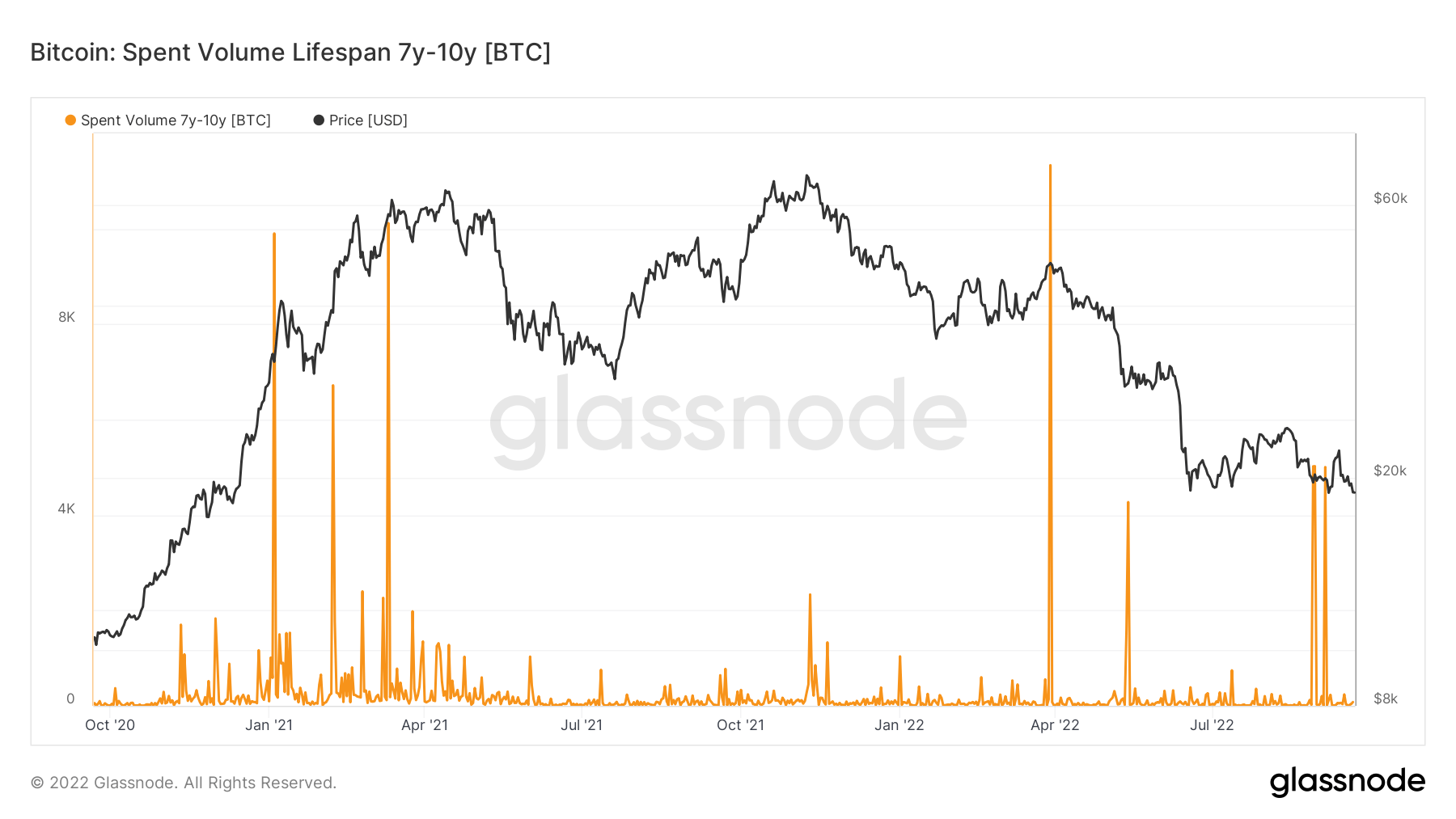

Long-term whales that person been holding their Bitcoins (BTC) for much than 7 to 10 years are selling them again for the archetypal clip since the Terra (LUNA) collapse successful May, arsenic Spent Volume Age Bands (SVAB) indicate.

Spent Volume Age Bands (SVAB) is simply a separation of the on-chain transportation measurement based connected the coins’ age. Each set represents the percent of the spent measurement that was antecedently moved wrong the clip play denoted successful the legend.

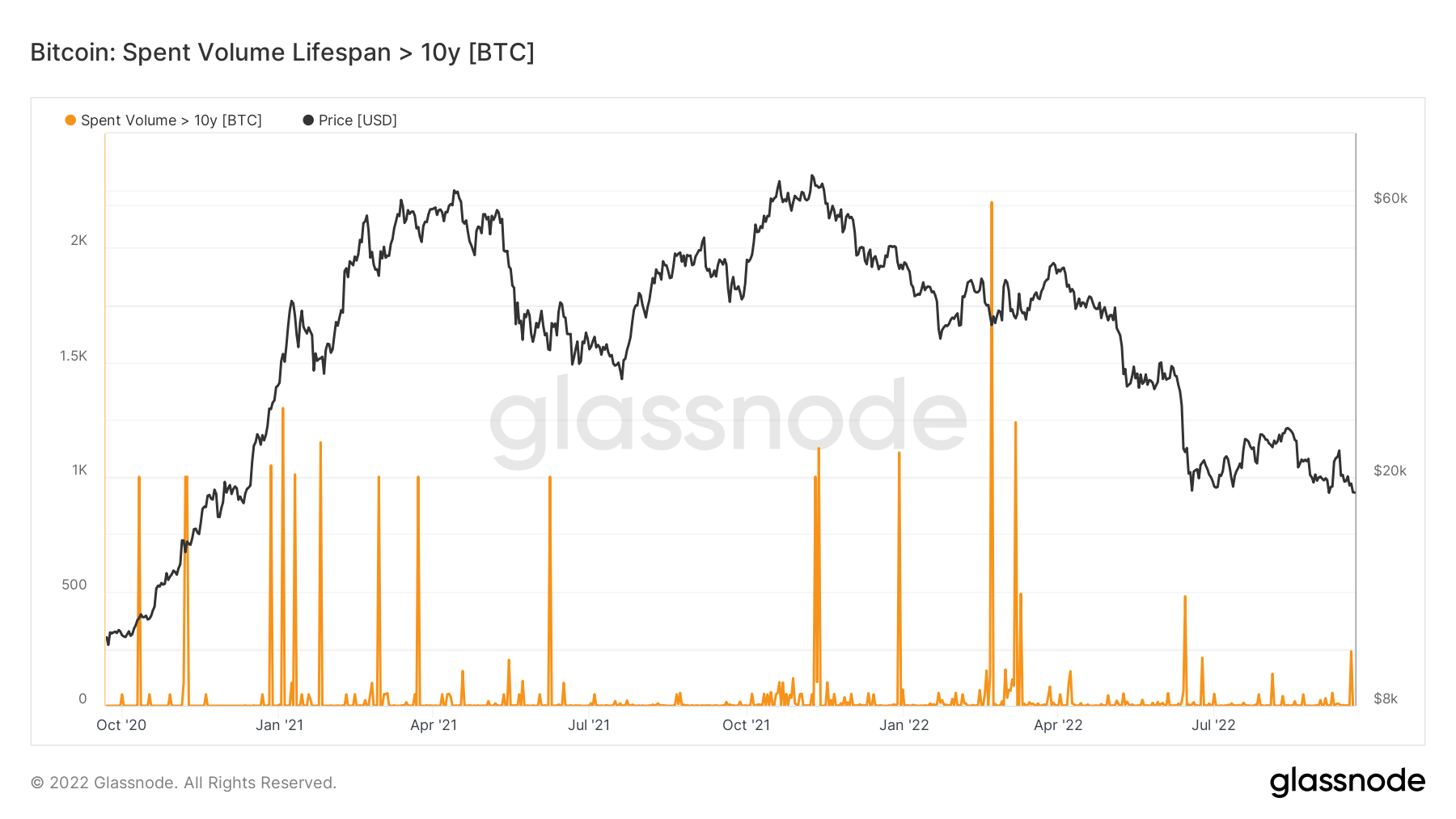

The illustration supra demonstrates the full transportation measurement of coins that were past progressive betwixt 7 and 10 years. The illustration below, connected the different hand, shows the aforesaid information for coins that person been stagnant for implicit 10 years.

Both charts commencement from October 2020 and show the sell-offs connected a monthly basis. The effects of the Terra situation tin beryllium seen connected some charts, with the spike successful spent volumes during May. The aforesaid spike tin besides beryllium seen successful September 2022, particularly for Bitcoin, which was past moved betwixt 7 and 10 years ago.

Are whales quitting?

Whales are considered astute wealth wrong the Bitcoin ecosystem since they person managed to clasp done astir each carnivore marketplace cycle. In addition, these holders person survived countless blocksize wars and FUD attacks.

Whales that are 7 to 10 years aged recorded their 5th and sixth-highest transaction of the twelvemonth during September.

Even though whales older than 10 years didn’t grounds yearly highs, the illustration shows a noticeable summation successful the sell-offs. Since whales older than a decennary tin recognize the marketplace cycles amended than immoderate cohort, their sell-offs bespeak bearish sentiment.

Decrease successful whales

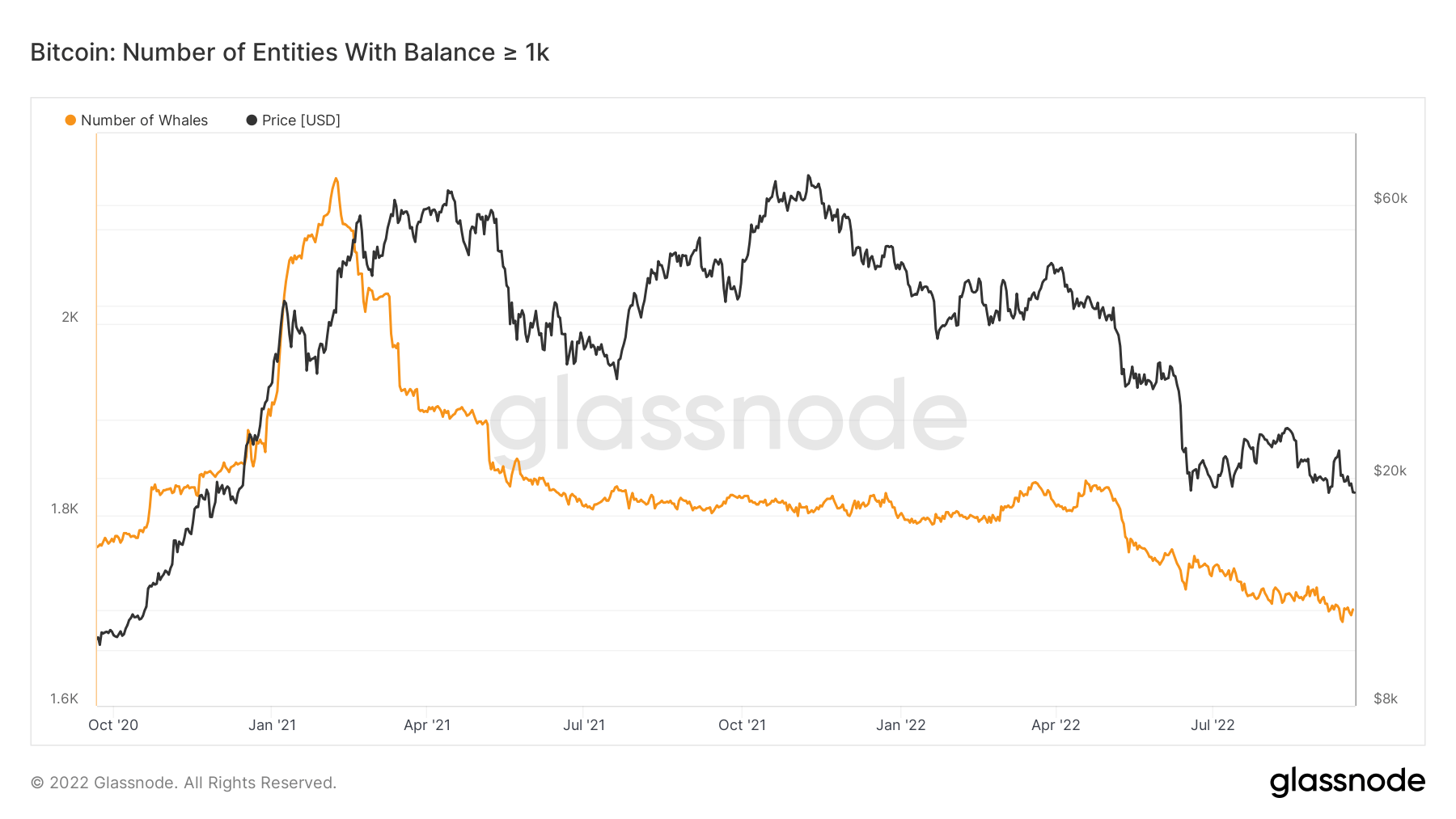

In summation to sell-offs, the numbers besides amusement a alteration successful the fig of whales.

Individuals who clasp astatine slightest 1,000 Bitcoins are referred to arsenic whales, and their fig has decreased since the highest of the 2021 bull cycle, which took spot connected January 2021. Even though it was the peak, January was conscionable the opening of the bull run. Nevertheless, astir whales cashed retired during January.

The alteration recorded successful the fig of whales from January 2021 to July 2021 is understandable owed to the 2021 bull run. Between July 2021 and April 2022, the fig of whales accrued arsenic Bitcoin terms besides became somewhat unchangeable betwixt $60,000 and $40,000.

The alteration recorded successful the fig of whales from January 2021 to July 2021 is understandable owed to the 2021 bull run. Between July 2021 and April 2022, the fig of whales accrued arsenic Bitcoin terms besides became somewhat unchangeable betwixt $60,000 and $40,000.

However, Bitcoin kept falling aft April 2022. Even with decreasing prices, the fig of whales dropped from 2,150 to 1,695. The past portion is peculiarly absorbing arsenic whales thin to hold retired the wintertime prices.

On the agleam side

The alteration successful whales and the precocious fig of sell-offs, contempt debased prices, bespeak bearish sentiment, but determination is simply a metallic lining. The sell-offs and disappearing whales mean that their Bitcoin is distributed to much than 1 person.

This means that Bitcoin is concentrated among less and less individuals. In the agelong term, having a much distributed Bitcoin benefits the retailer and increases the information of the network.

The station Research: Decade aged whales selling Bitcoin hoard again; past clip was during LUNA collapse appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)