Determining the spot of the crypto marketplace requires looking astatine much than conscionable Bitcoin’s price. Addresses holding BTC arsenic a semipermanent concern correspond the instauration of the Bitcoin marketplace and clasp the fort successful times of precocious volatility.

The magnitude of BTC held arsenic a semipermanent concern tin beryllium determined by however often its circulating proviso moves. The longer a information of the circulating proviso stays dormant, the stronger the marketplace is, arsenic addresses holding these coins often signifier a beardown enactment for Bitcoin’s price.

Looking astatine Bitcoin’s proviso that hasn’t moved successful implicit a twelvemonth shows what the manufacture likes to telephone diamond hands — the astir determined hodlers.

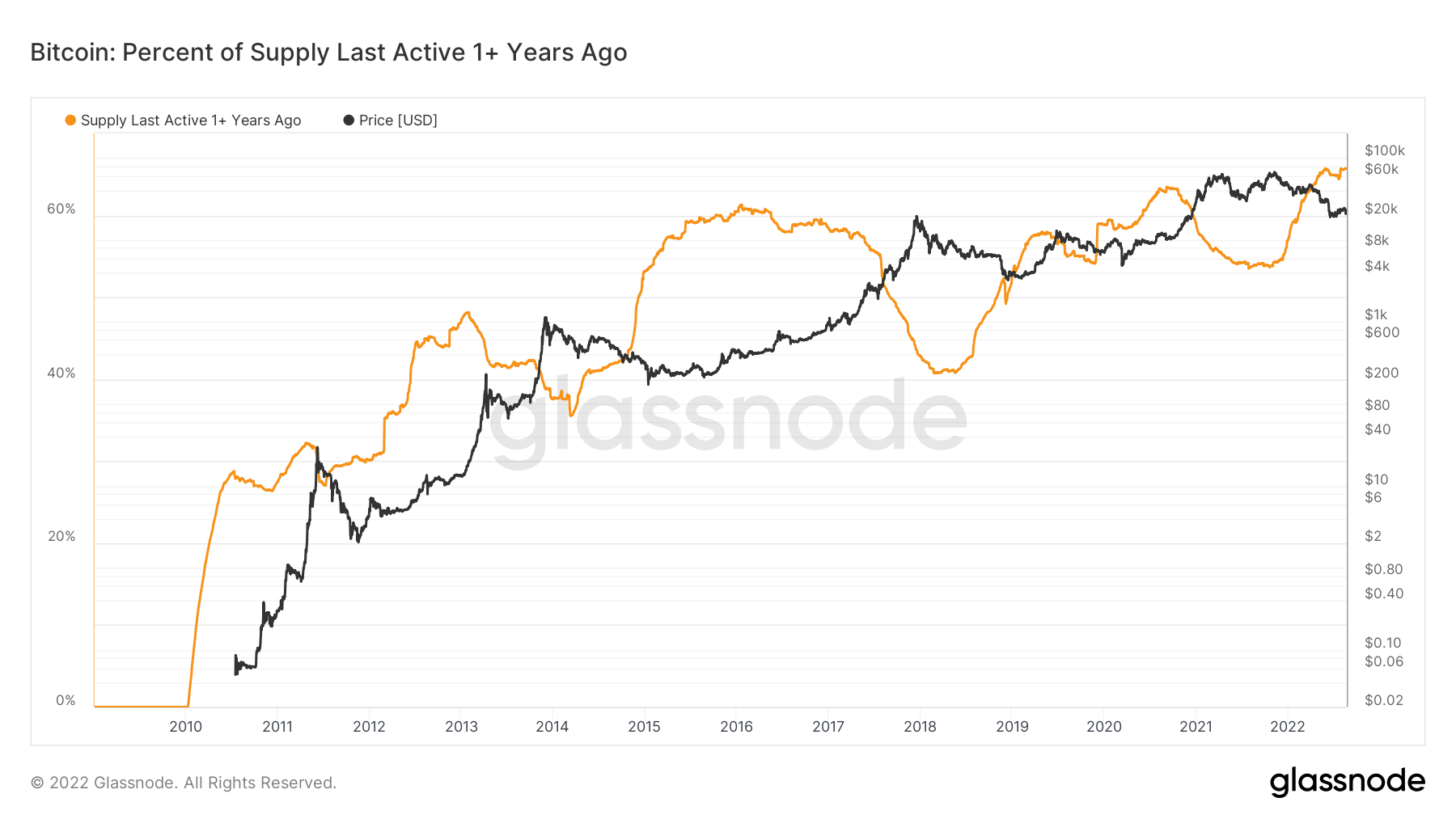

Graph showing Bitcoin’s circulating proviso past progressive implicit a twelvemonth agone (Source: Glassnode)

Graph showing Bitcoin’s circulating proviso past progressive implicit a twelvemonth agone (Source: Glassnode)According to information from Glassnode, Bitcoin’s proviso which was past progressive implicit a twelvemonth ago, reached its all-time precocious this period and presently stands astatine 65.7%. The existent percent is adjacent higher than the numbers recorded successful May 2022, erstwhile the crypto marketplace entered a play of unprecedented volatility.

The information that 65.7% of Bitcoin’s proviso remained dormant for implicit a twelvemonth shows that a grounds fig of addresses proceed to clasp their coins during the carnivore market.

The information besides indicates that the bulk of the proviso present lying dormant was accumulated betwixt May and July 2021. At the time, Bitcoin’s terms took a dense stroke arsenic astir each ample miners were forced to unopen down their operations and move out of China. Accumulating BTC successful stressful and uncertain times shows steadfast condemnation successful the marketplace that seems unshaken by downward terms movements.

The lone clip the marketplace sees these diamond hands exiting their positions is during bull runs. The accumulation and organisation cycles that instrumentality spot during carnivore and bull markets further corroborate this.

The latest marketplace downturn wiped retired astir 75% of Bitcoin’s price, destroying immoderate imaginable profits these older coins could person made. However, during carnivore marketplace cycles, addresses holding coins for implicit a twelvemonth astir ever garbage to merchantability astatine a nonaccomplishment and take to upwind the tempest until the adjacent bull run.

When the bull marketplace does arrive, these addresses are the ones distributing their tokens to recognize a profit.

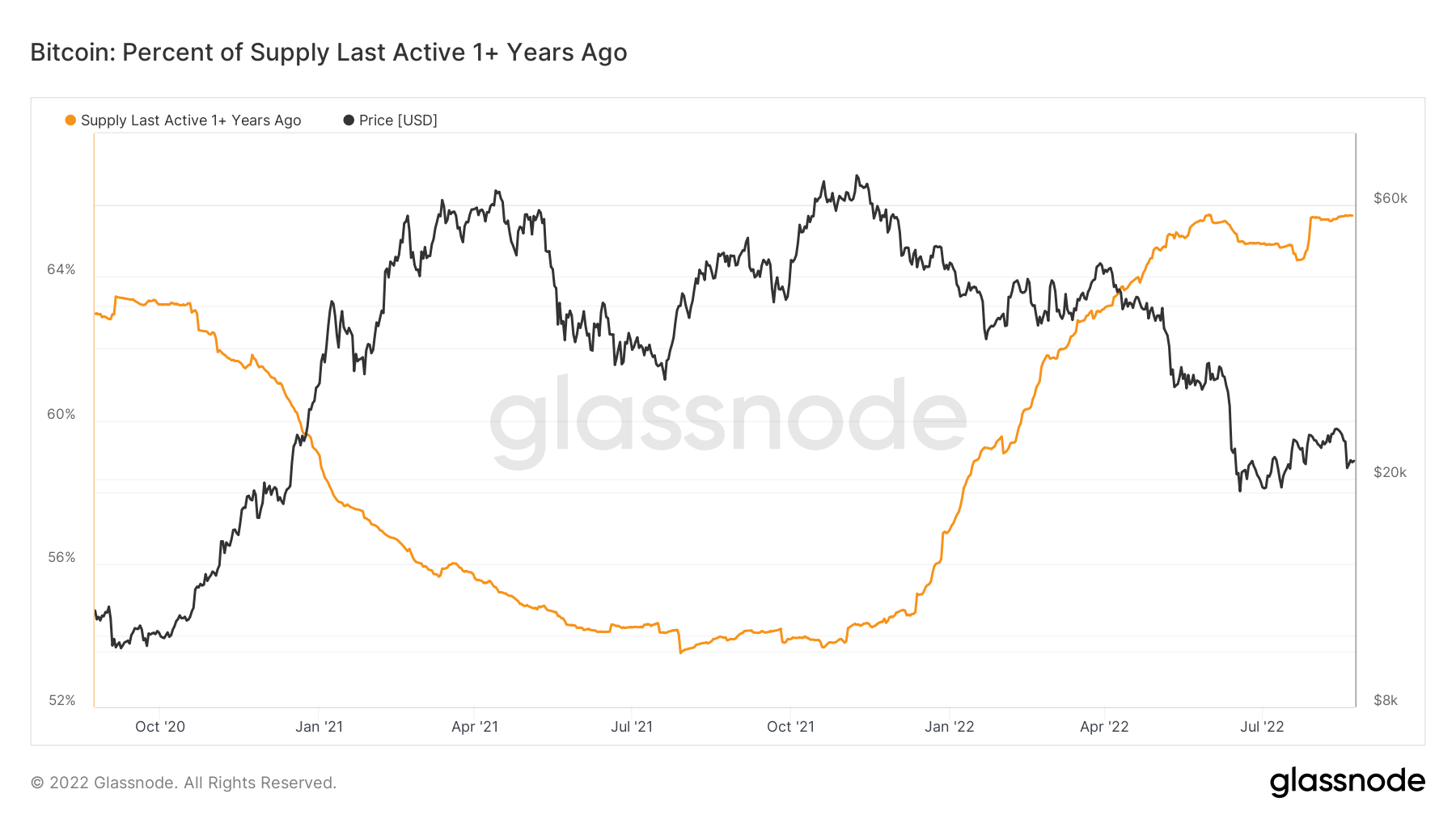

Graph illustrating however Bitcoin’s proviso past progressive implicit a twelvemonth agone increases erstwhile Bitcoin’s terms decreases (Source: Glassnode)

Graph illustrating however Bitcoin’s proviso past progressive implicit a twelvemonth agone increases erstwhile Bitcoin’s terms decreases (Source: Glassnode)The station Research: Diamond hands are astatine an all-time high appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)