Shanghai is the adjacent large Ethereum upgrade, scheduled to spell unrecorded connected April 12.

Once implemented, ETH staked connected the staking declaration volition beryllium unlocked and withdrawable – frankincense finalizing the process that began with the Beacon Chain motorboat successful December 2020.

The accusation of the Shanghai upgrade is taxable to overmuch speculation. Some expect the spot terms to vessel arsenic holders liquidate. Others judge moving into and retired of the staking declaration easy volition pull much stakers, starring to terms stability.

Glassnode information analyzed by CryptoSlate suggested Ethereum derivatives traders are cautious going into the Shanghai upgrade. However, post-Shanghai, sentiment relaxes.

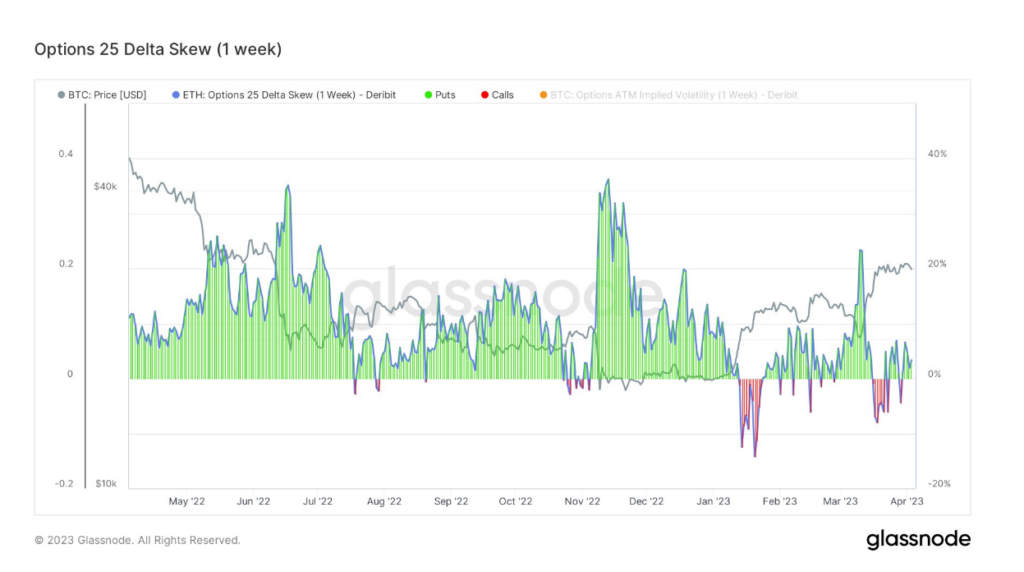

Ethereum – Options 25 Delta Skew

The Options 25 Delta Skew metric looks astatine the ratio of put-to-call options expressed successful presumption of Implied Volatility (IV).

A telephone enactment gives the holder the close to bargain an asset, and a enactment enactment gives the holder the close to merchantability an asset.

For options with a circumstantial expiration date, this metric looks astatine puts with a delta of -25% and calls with a delta of +25%, netted disconnected to get astatine a information constituent – giving a measurement of the option’s terms sensitivity taking into relationship the alteration successful Ethereum spot price.

Typically, this metric tin beryllium organized by periods astatine which the enactment declaration expires, specified arsenic 1 week, 1 month, 3 months, and six months.

The illustration beneath relates to options expiring successful a week (near term); it shows puts are present astatine a premium, suggesting the marketplace is cautious arsenic the Shanghai rollout nears.

Source: Glassnode.com

Source: Glassnode.comThe 1-month 25 Delta Skew is somewhat evenly poised betwixt puts and calls, pointing to a settling of sentiment post-Shanghai.

Source: Glassnode.com

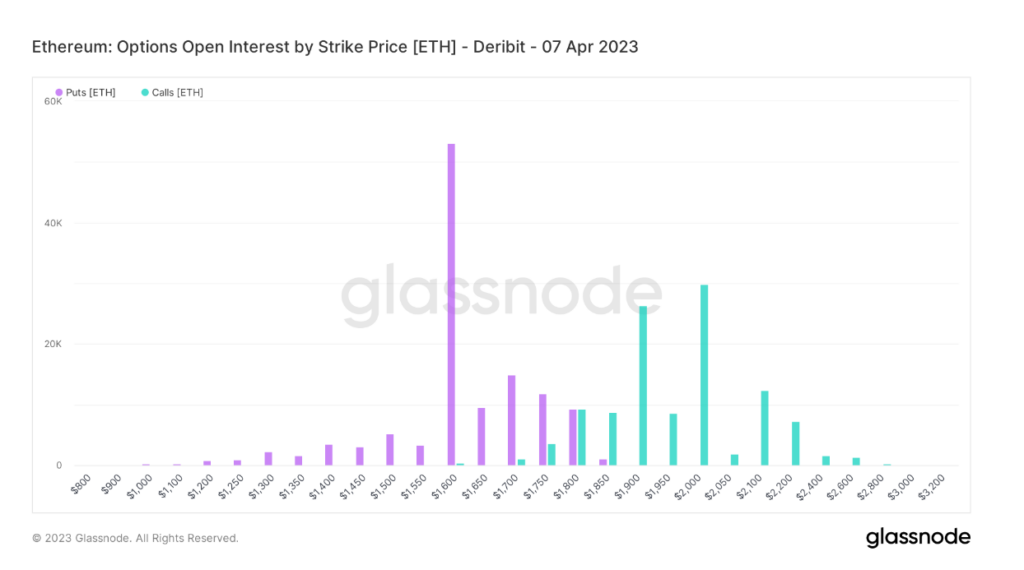

Source: Glassnode.comOpen Interest

Open Interest by Strike Price refers to the full fig of outstanding derivatives contracts yet to settle, organized by the exercised enactment oregon telephone price.

This metric is utilized to gauge the wide marketplace sentiment, peculiarly the spot down enactment oregon telephone terms trends.

The illustration beneath for April 7 shows puts dominating, with the $1,600 onslaught terms acold successful the pb at implicit 50,000 contracts.

Source: Glassnode.com

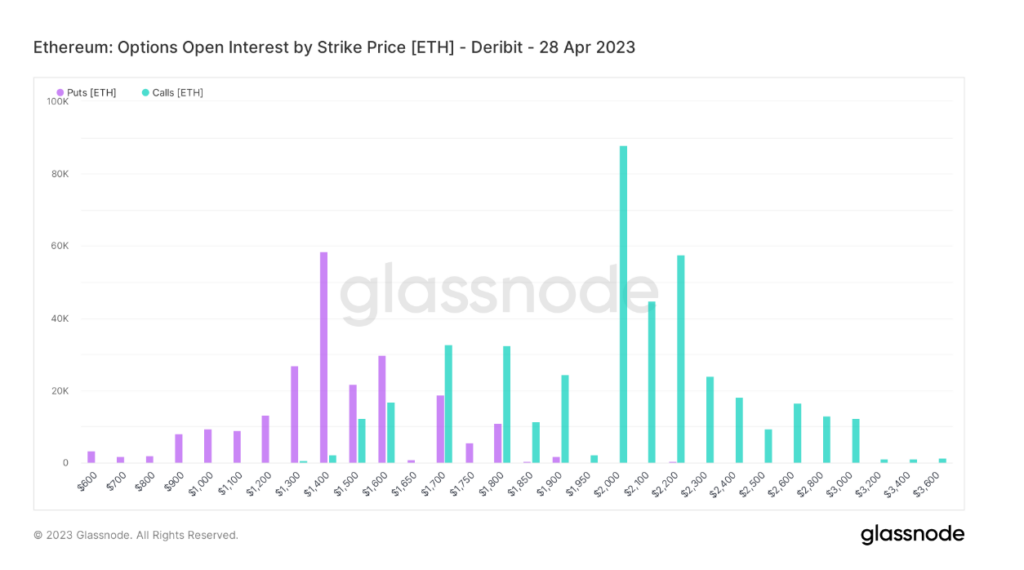

Source: Glassnode.comLooking beyond Shanghai’s go-live date, towards the extremity of April, the frequence of puts versus calls has evened up compared to April 7. However, sentiment swings the different way, with calls astatine $2,000 being the astir predominant prime astatine astir 90,000 contracts.

As such, moving into adjacent month, traders are signaling a much optimistic outlook.

Source: Glassnode.com

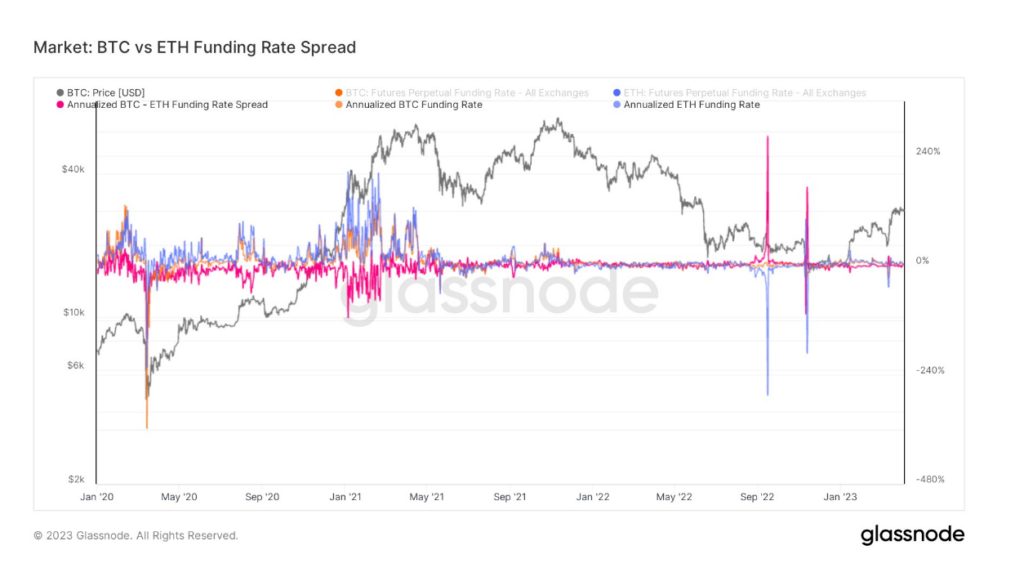

Source: Glassnode.comFunding Rate Spread

The Funding Rate refers to periodic payments made to oregon by derivatives traders, some agelong and short, based connected the quality betwixt perpetual declaration markets and the spot price.

When the backing complaint is positive, the terms of the perpetual declaration is higher than the marked price. In specified cases, agelong traders wage for abbreviated positions. By contrast, a antagonistic backing complaint shows perpetual contracts are priced beneath the marked price, and abbreviated traders wage for longs.

This mechanics ensures futures declaration prices autumn successful enactment with the underlying spot price.

In this case, the dispersed refers to the quality successful the annualized BTC and ETH Funding Rates.

During the Merge successful September 2022, the annualized ETH Funding Rate sunk arsenic debased arsenic -282% – indicating abbreviated traders were overwhelmingly bearish and consenting to wage for longs.

Fast guardant to now, the magnitude of moves has lessened to a important grade compared to past September. Yesterday, ETH traders posted a somewhat affirmative Funding Rate astatine 0.14% – suggesting mildly bullish sentiment. Compared to the BTC Funding Rate of 2.8%, this indicates a somewhat much pessimistic presumption than Bitcoin traders.

Source: Glassnode.com

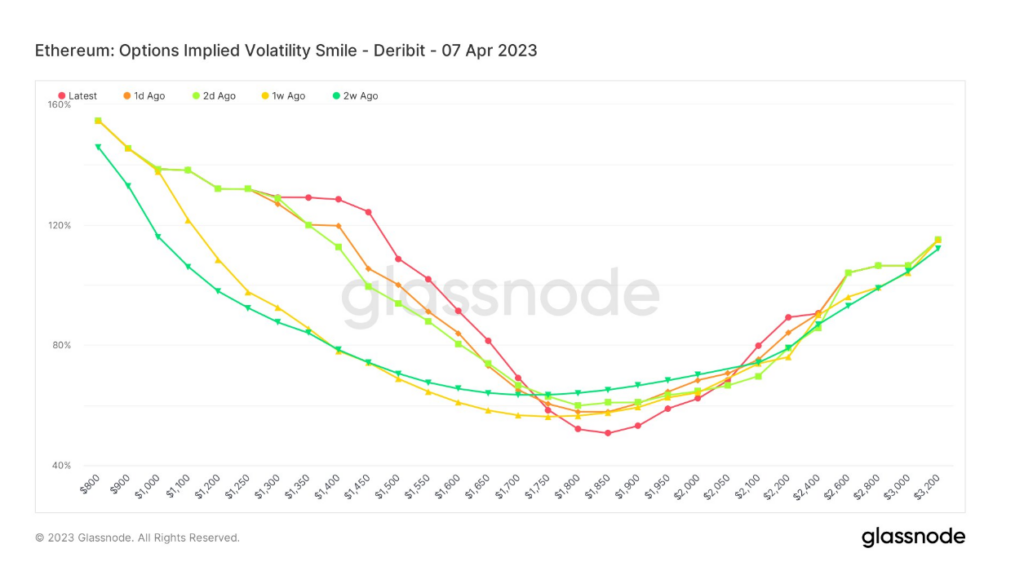

Source: Glassnode.comImplied Volatility Smile

The Volatility Smile results from plotting the Strike Price and Implied Volatility (IV) of options with the aforesaid underlying plus and expiration date.

IV rises erstwhile the underlying plus of an enactment is further out-of-the-money (OTM), oregon in-the-money (ITM), compared to at-the-money (ATM).

Options further OTM mostly bespeak higher IVs, giving Volatility Smile charts their distinctive “smile” shape. The steepness and signifier of the grin tin beryllium utilized to measure the comparative expensiveness of options and gauge what benignant of process risks the marketplace has priced in.

Comparing the “Latest” grin to humanities overlays from 1 day, 2 days, 1 week, and 2 weeks ago, it is imaginable to find the grade of implied volatility connected either broadside of ATM.

The illustration beneath shows markets are paying a premium for downside extortion earlier the Shanghai upgrade. IV is good supra 100%.

Source: Glassnode.com

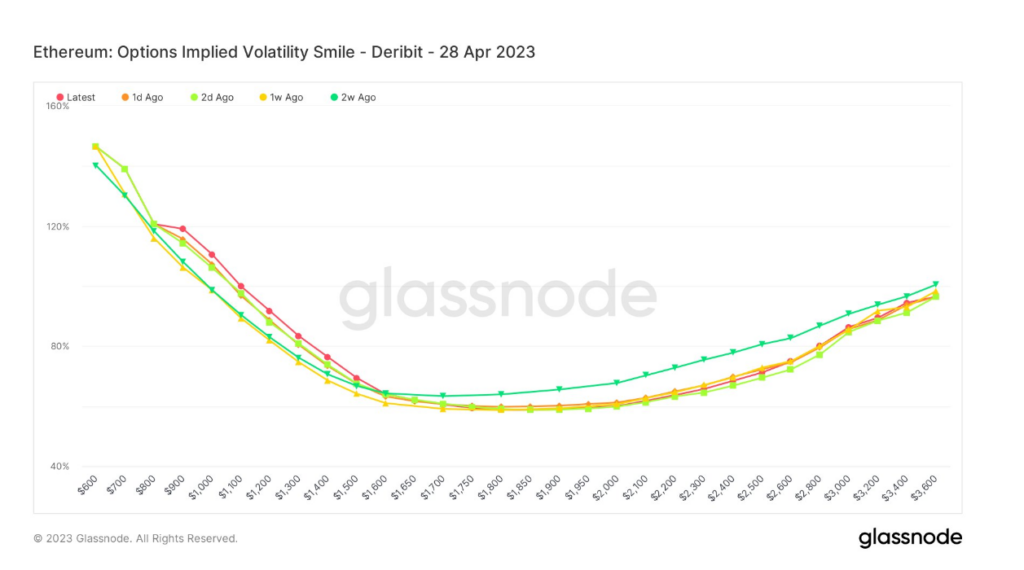

Source: Glassnode.comPost-upgrade, markets proceed paying a premium for downside protection. But the patterns person smoothed retired significantly, showing a flimsy diminution connected the close tail, with a comparatively level signifier and sub 100% IV crossed the close broadside curve.

Source: Glassnode.com

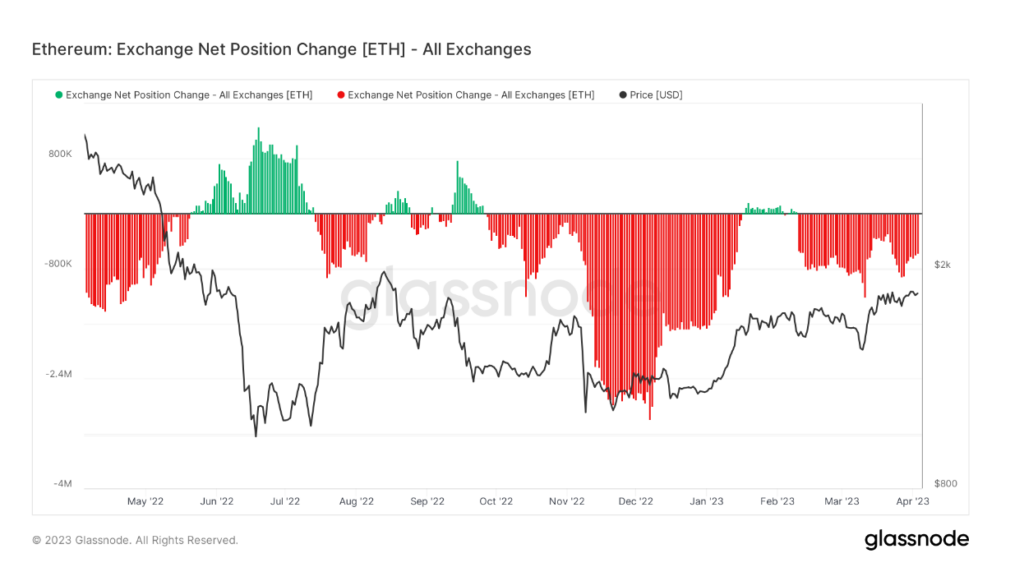

Source: Glassnode.comSpot demand

Exchange Net Position Change (ENPC) measures the coins deposited oregon withdrawn from speech wallets.

Inflows oregon affirmative alteration is mostly considered bearish, arsenic the superior crushed to transportation to an speech is to sell. Whereas outflows, oregon antagonistic change, is usually regarded arsenic bullish, the main crushed to retreat relates to wallet retention – frankincense hodling.

Since mid-February, ETH’s ENPC has flipped negative, suggesting beardown spot request successful the run-up to Shanghai.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Ethereum derivatives traders awesome caution up of Shanghai upgrade appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)