Ethereum is the instauration of the decentralized concern ecosystem and is automatically categorized arsenic a decentralized network. On paper, Ethereum is simply a decentralized and antiauthoritarian web based connected a deflationary currency.

In reality, it’s neither decentralized nor deflationary.

Defying deflation

In September 2021, Ethereum’s London hard fork introduced EIP-1559, an upgrade acceptable to drastically alteration however the web worked. The upgrade would alteration the web to pain a information of the state fees paid by users, permanently reducing the proviso of ETH. The perpetually reducing proviso of ETH was expected to transcend the regular rewards paid to miners, turning ETH into a deflationary currency.

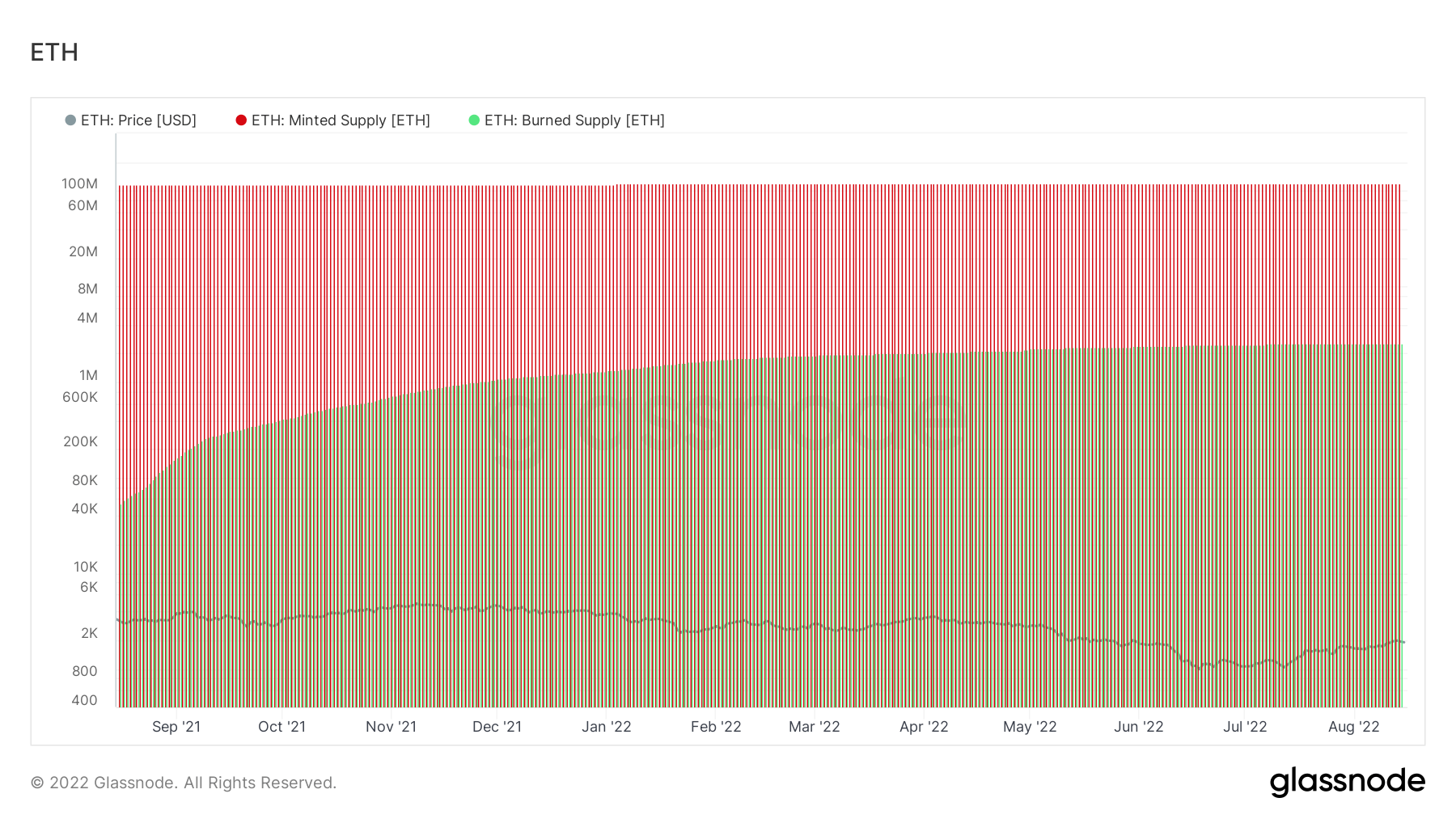

However, the complaint of burning ETH ne'er outpaced the complaint of minting ETH, arsenic indicated successful the graph below.

Graph showing the complaint of burning ETH and the complaint of minting ETH (Source: Glassnode)

Graph showing the complaint of burning ETH and the complaint of minting ETH (Source: Glassnode)A decreasing magnitude of enactment connected Ethereum is the biggest origin that has prevented the pain complaint from overtaking the mint rate. For Ethereum to go a deflationary currency, the magnitude of ETH burned successful state fees would request to overtake the magnitude of ETH minted to beryllium distributed arsenic artifact rewards.

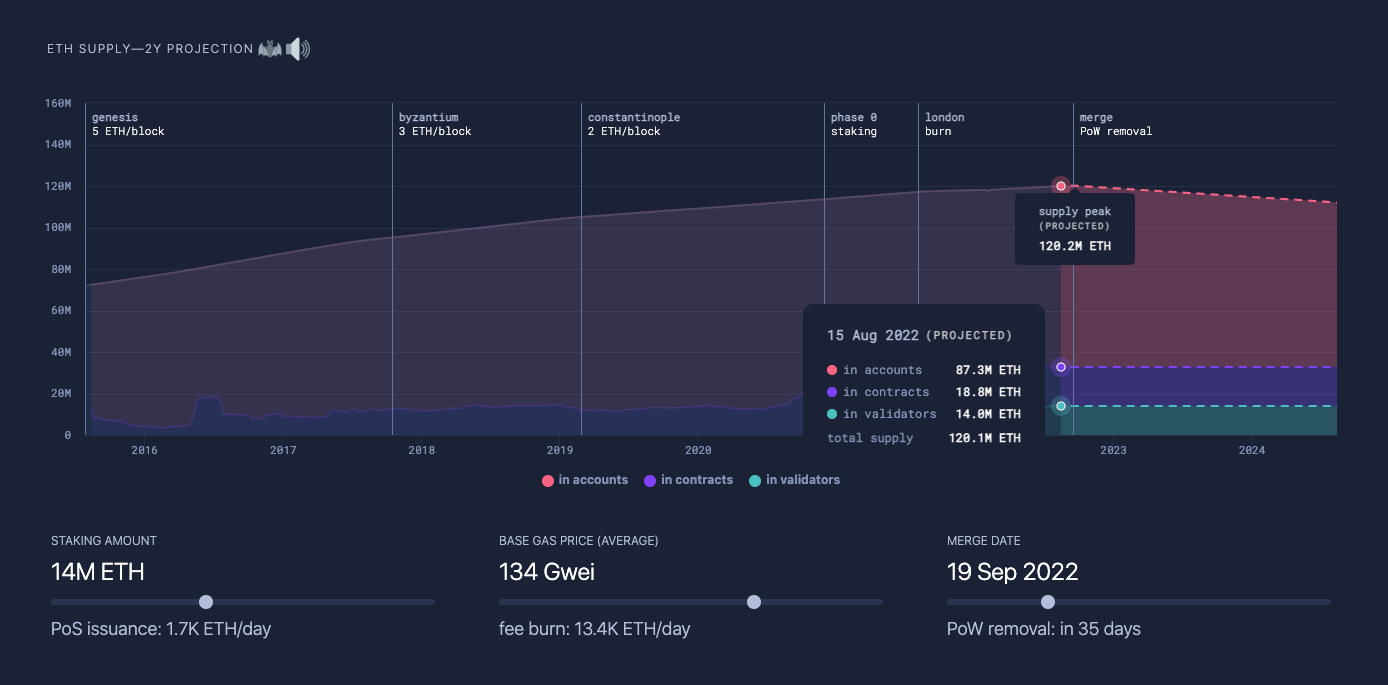

In the past year, an average of 13,000 ETH was distributed arsenic artifact rewards daily. In bid to pain implicit 13,000 ETH successful state fees, the Ethereum web would need to spot an mean basal state terms of astir 130 gwei.

Graph showing the projected proviso highest for Ethereum and the required basal state terms to execute a interest pain of implicit 13,000 ETH (Source: Ultrasound Money)

Graph showing the projected proviso highest for Ethereum and the required basal state terms to execute a interest pain of implicit 13,000 ETH (Source: Ultrasound Money)However, since the opening of the year, the mean state terms connected Ethereum seldom surpassed 130 gwei. According to information from YCharts, extracurricular of the 2 peaks recorded successful May, state prices remained beneath 60 gwei since April. Since the opening of July, the mean terms remained beneath 20 gwei.

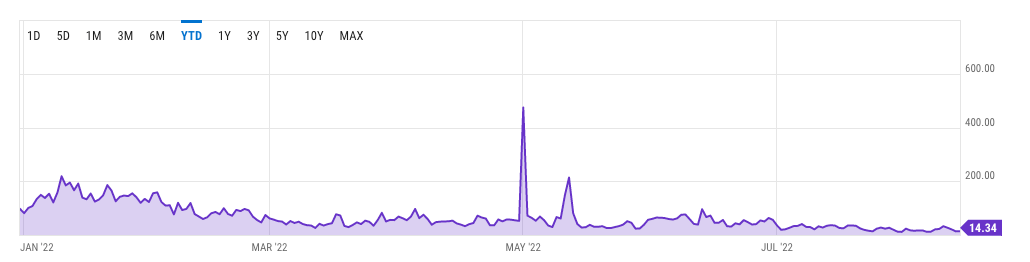

Graph showing the mean state terms connected Ethereum successful 2022 (Source: Glassnode)

Graph showing the mean state terms connected Ethereum successful 2022 (Source: Glassnode)The rising terms of Ethereum, which keeps defying the wide marketplace trend, could beryllium 1 of the factors decreasing enactment connected the network. Rising prices are, successful turn, a nonstop effect of accrued speculation surrounding Ethereum’s upcoming merge. As antecedently covered by CryptoSlate, the accrued magnitude of speculation is evident successful the derivatives market, wherever the unfastened involvement connected ETH options contracts surpassed the unfastened involvement connected BTC for the archetypal clip ever.

Resisting decentralization

When it comes to decentralization, Ethereum is successful adjacent much trouble.

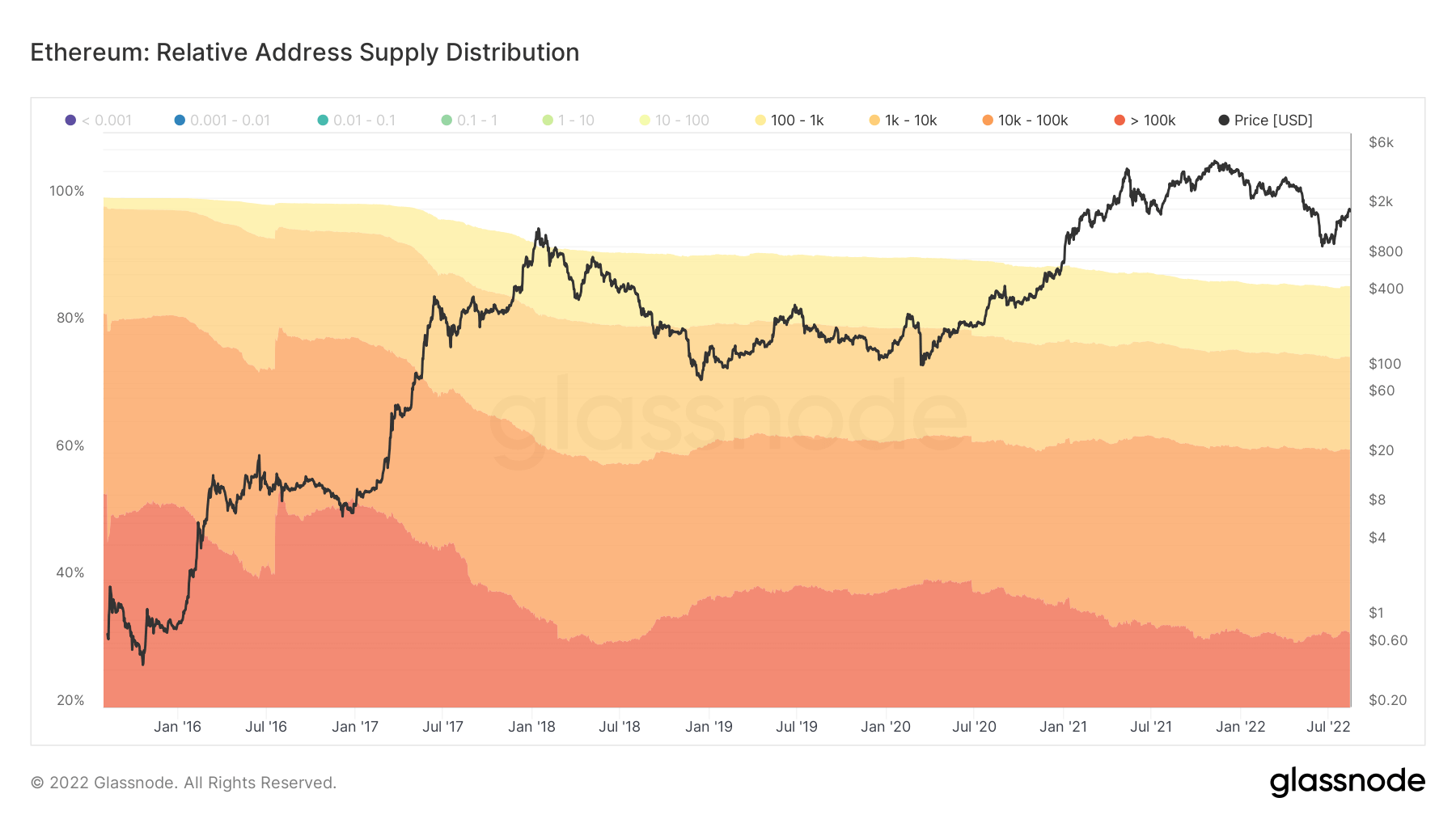

According to information from Glassnode, implicit 85% of Ethereum’s proviso is held by entities with 100 ETH oregon more. Around 30% of its proviso lies successful the hands of entities with implicit 100,000 ETH.

Graph showing ETH’s proviso organisation (Source: Glassnode)

Graph showing ETH’s proviso organisation (Source: Glassnode)Ethereum’s upcoming power to a proof-of-stake (PoS) web raises adjacent further questions. As the aboriginal PoS web volition necessitate validators to involvement a minimum of 32 ETH, it efficaciously removed tiny players from securing the network. Ethereum’s Beacon Chain already has a acceptable of validators that exemplify however the web volition look pursuing the merge.

The bulk of validators connected the Beacon Chain are ample entities, ranging from established exchanges to recently founded staking providers with ample ETH holdings. A ample information of Ethereum’s validators are ineligible entities registered successful the U.S. and the E.U. and, arsenic such, are taxable to each region’s regulations.

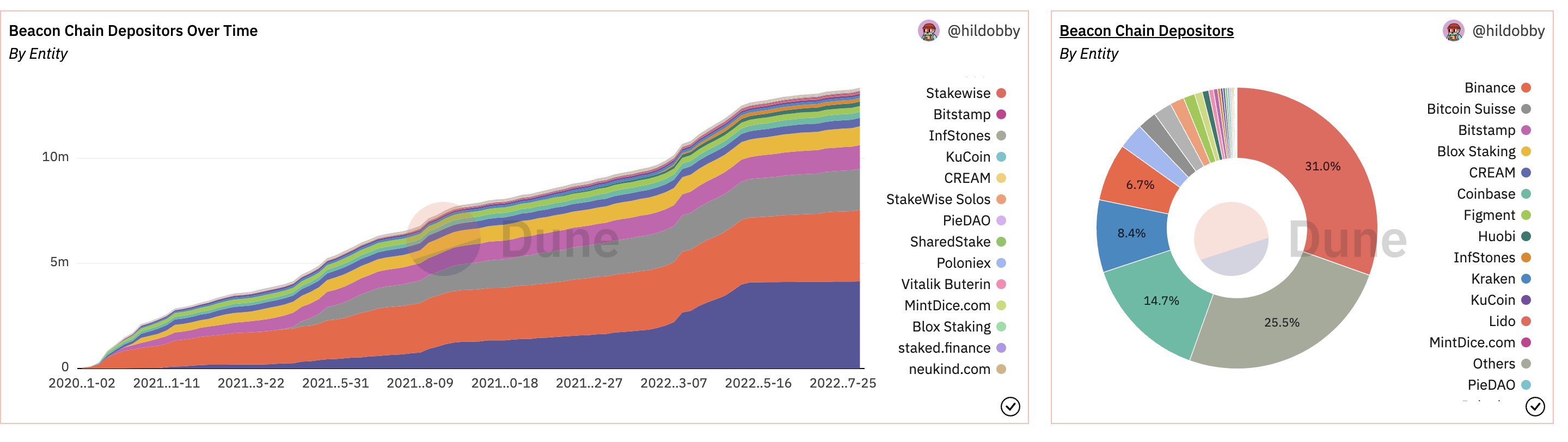

Chart showing the Beacon Chain depositors and the size of their involvement (Source: @TheEylon)

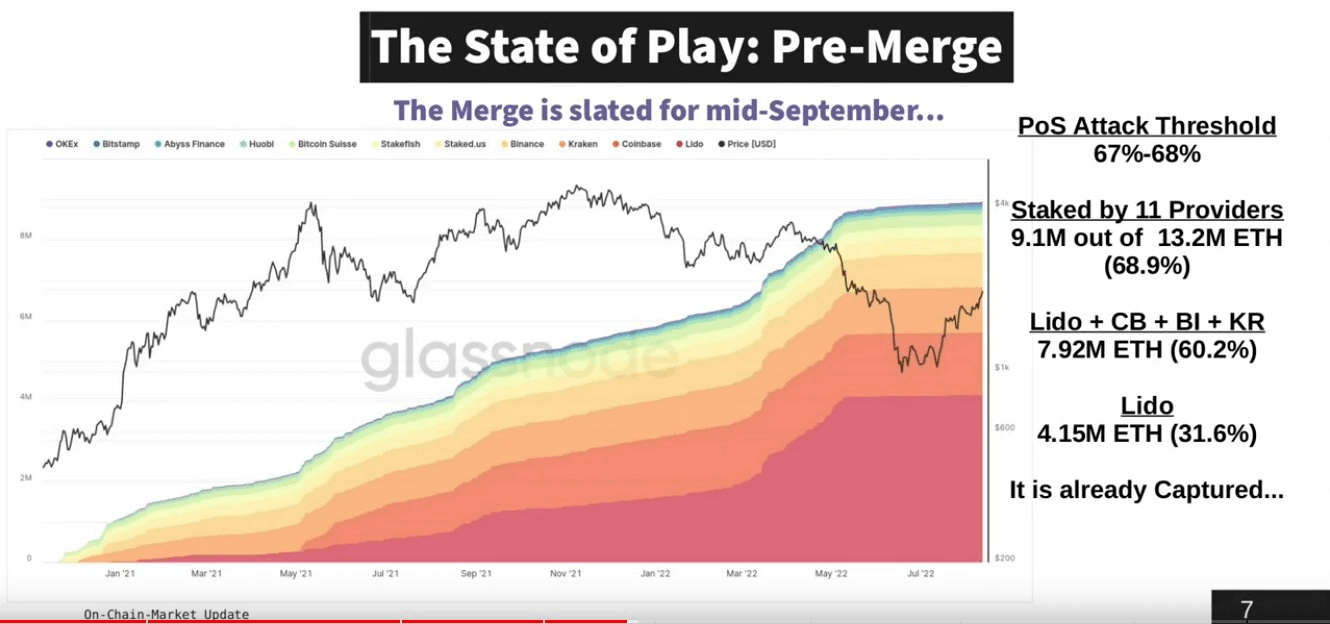

Chart showing the Beacon Chain depositors and the size of their involvement (Source: @TheEylon) The State of Play: Pre-Merge

The State of Play: Pre-MergeJust nether 69% of the full magnitude staked connected the Beacon Chain is staked by conscionable 11 providers. A full of 60% of the staked proviso is staked by 4 providers, portion a azygous supplier — Lido — accounts for 31% of the staked supply.

In an unburdened bull market, this magnitude of centralization tends to spell unnoticed. However, a turbulent marketplace further shaken by macro uncertainties reveals each of these flaws.

The contention surrounding the sanctioning of Tornado Cash and different decentralized privateness services has caused galore to judge that governments could unit Ethereum’s validators to go sanctioners themselves.

The station Research: Ethereum is neither decentralized nor deflationary appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)