The eagerly anticipated Ethereum Merge is expected to hap connected Sept. 15. This volition consolidate the existing Proof-of-Work (PoW) execution furniture to the concurrently moving Proof-of-Stake (PoS) Beacon chain. Proponents expect this to bring scaling and biology benefits.

Although the run-up to the Merge has seen a important leap successful price, increasing 90% since bottoming connected June 18, buying enactment appeared to person peaked implicit the weekend.

Analysis of ETH derivatives metrics showed traders expect a terms dip to hap post-Merge.

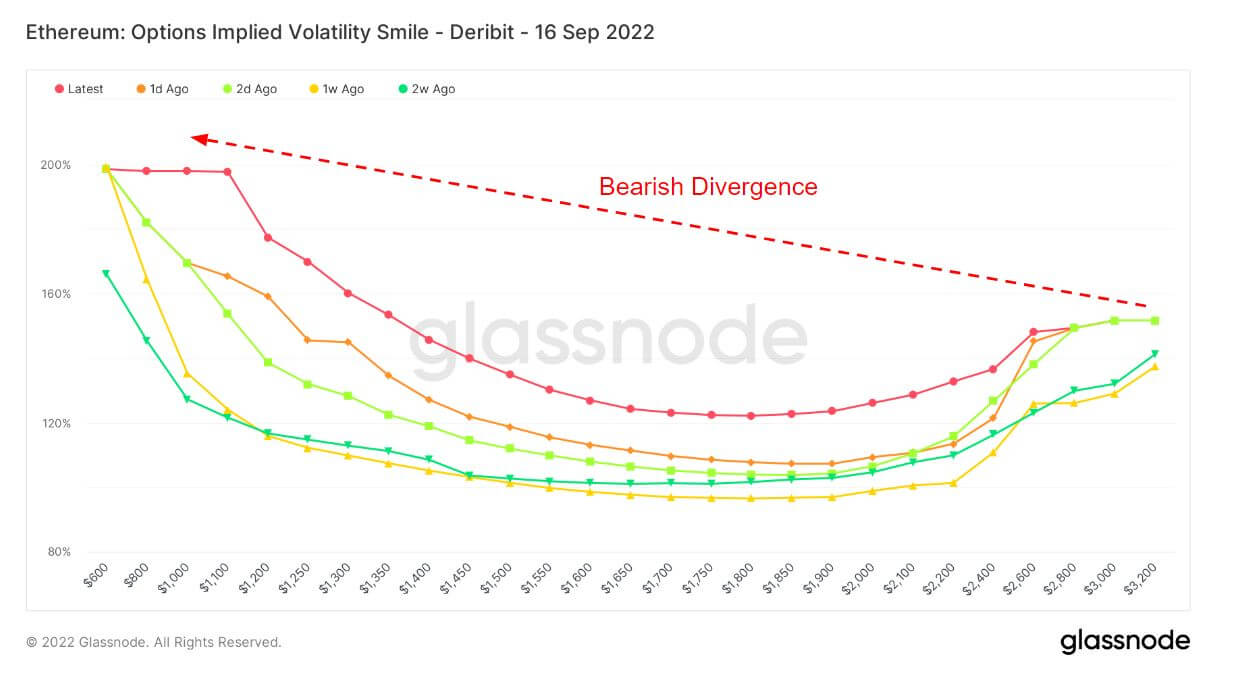

The Volatility Smile

The Volatility Smile illustration shows implied volatility by plotting options’ onslaught terms with the aforesaid underlying plus and expiration date. Implied volatility rises erstwhile the underlying plus of an enactment is further out-of-the-money (OTM), oregon in-the-money (ITM), compared to at-the-money (ATM).

Options further OTM usually person higher implied volatilities; hence Volatility Smile charts typically amusement a “smile” shape. The steepness and signifier of this grin tin beryllium utilized to measure the comparative expensiveness of options and gauge what benignant of process risks the marketplace is pricing in.

The accompanying fable refers to humanities overlays and shows the signifier of the grin 1 day, 2 days, 1 week, and 2 weeks ago, respectively. For example, erstwhile ATM implied volatility values for utmost strikes are little contiguous compared to humanities overlays, it could bespeak a reduced process hazard being priced successful by the market. In specified cases, the market’s presumption has a little probability for utmost moves compared to mean moves.

Previous research from a period agone examined the behaviour of options traders utilizing the Smile Volatility chart. The wide decision was that options traders expect a terms run-up, starring into a dump post-Merge. But has thing changed betwixt past and now?

The Volatility Smile illustration beneath shows a bearish divergence for each of the humanities overlays and the existent smile. Typically, astatine little onslaught prices, the implied volatility is lower. But the near process successful each lawsuit is astatine astir 100% oregon more, signaling the imaginable for swings successful implied volatility post-Merge.

Source: Glassnode.com

Source: Glassnode.comOptions Open Interest

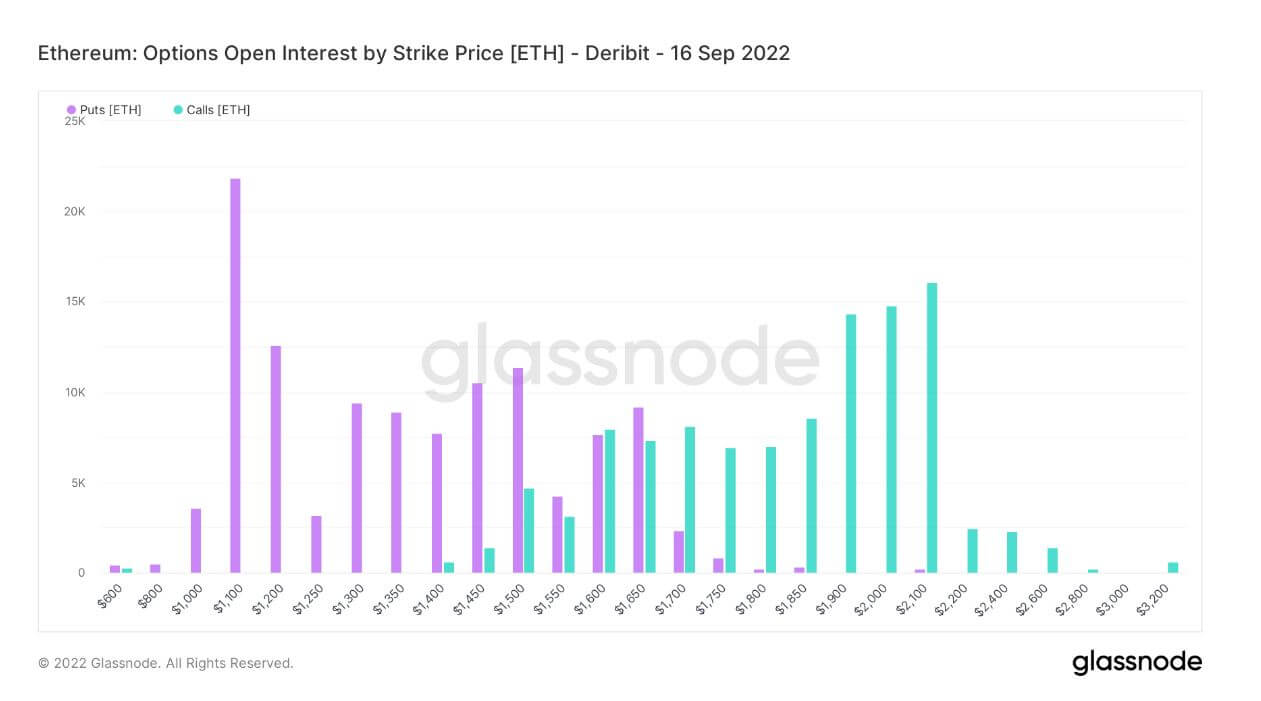

Options Open Interest refers to the fig of progressive options contracts. These are contracts that person been traded but not yet liquidated by an offsetting commercialized oregon assignment.

There is nary accusation connected erstwhile the options were bought oregon sold. However, this metric tin beryllium utilized to gauge measurement astatine assorted onslaught prices and find liquidity.

The illustration beneath shows the full Open Interest of puts and calls by onslaught price. A flimsy bias towards puts (or the close to merchantability a contract) indicates a bearish sentiment. At the aforesaid time, the astir important information constituent shows implicit 22,000 puts astatine a terms of $1,100.

Source: Glassnode.com

Source: Glassnode.comAnnualized perpetual funding

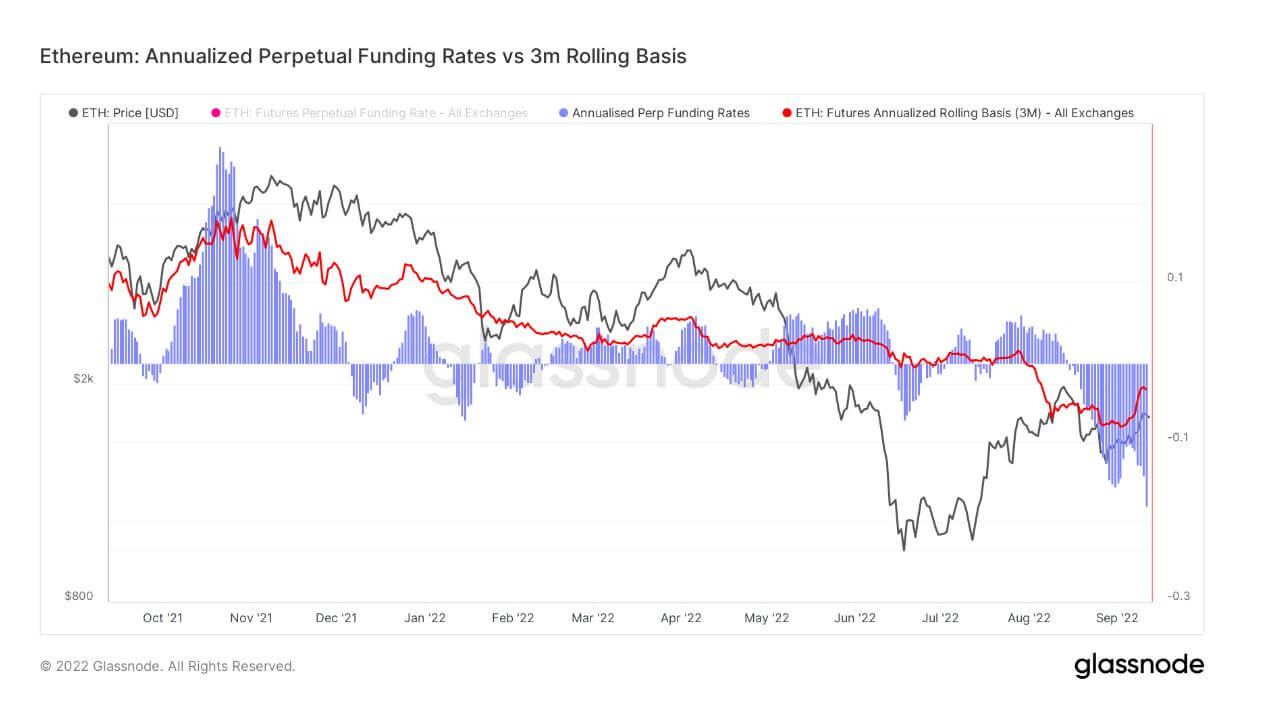

This metric compares the annualized rates of instrumentality disposable successful a cash-and-carry commercialized betwixt 3-month expiring futures (3-mth rolling basis) and perpetual backing rates.

Given that integer assets person debased storage, handling, and transportation outgo overheads (unlike carnal commodities), perpetual futures person go a preferred instrumentality for marketplace speculation, hazard hedging, and capturing backing complaint premiums.

Source: Glassnode.com

Source: Glassnode.comBitcoin vs. Ethereum Options Open Interest

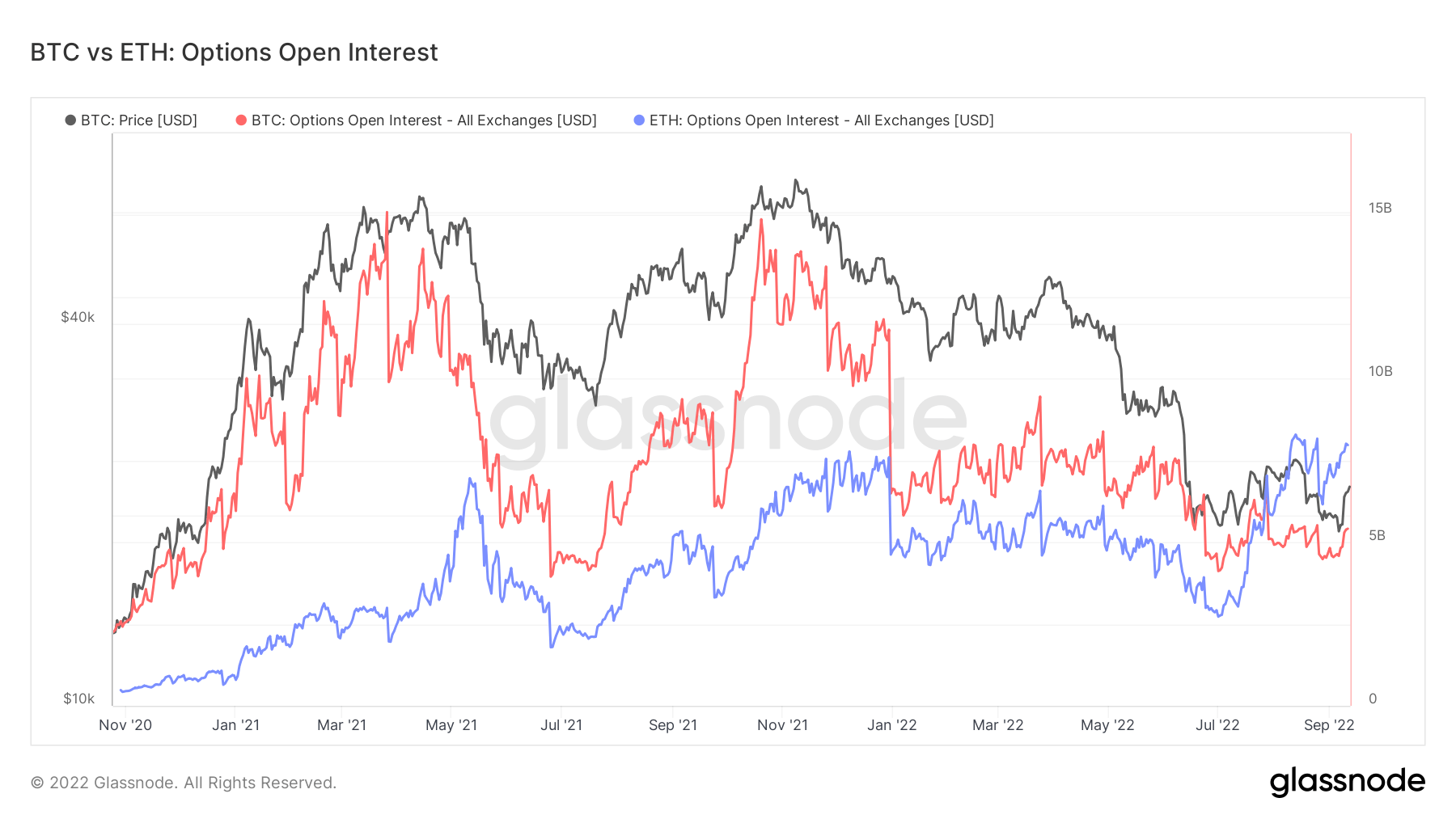

Comparing the Bitcoin and Ethereum Options Open Interest shows ETH is $8 cardinal – a caller all-time high. Meanwhile, BTC’s existent unfastened involvement is astir $5 billion, which is good beneath its $15 cardinal peak.

In July, ETH unfastened involvement moved BTC for the archetypal time, indicating speculative involvement is beardown and that derivatives traders are gearing up for the Merge.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Ethereum terms volatility expected post-Merge arsenic unfastened involvement options soar with bearish divergence appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)