With the Merge yet completed, Ethereum is present moving arsenic a Proof-of-Stake (PoS) network.

However, its modulation from a Proof-of-Work (PoW) strategy has been highly controversial. Supporters of PoW mining feared that staking would centralize the web and endanger its independence. Those warring for a PoS web touted the scalability and precision that would originate from the caller system.

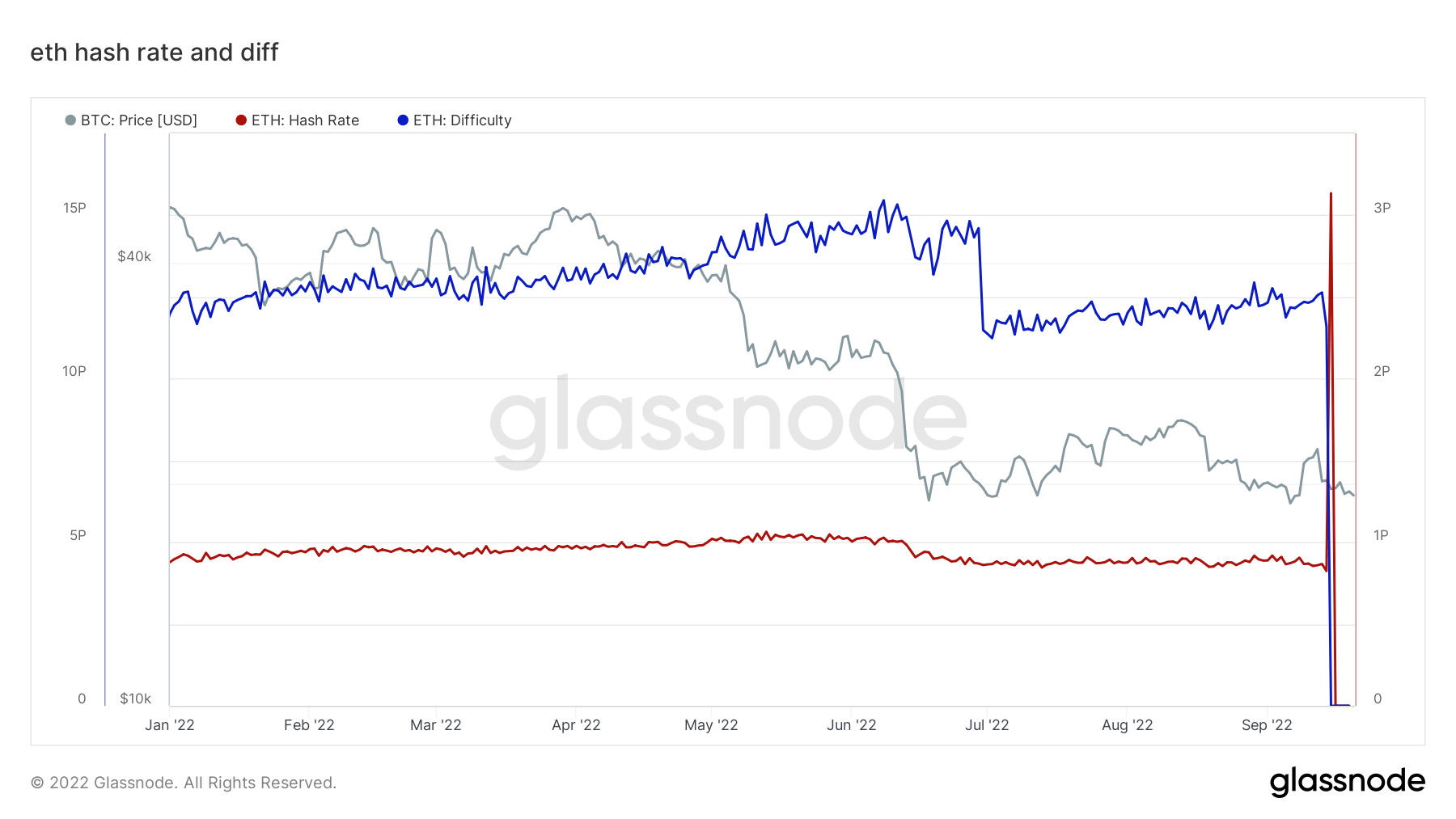

On-chain investigation provides america with a wide presumption of each the pros and cons of the Merge. Looking astatine the Ethereum blockchain shows erstwhile the modulation from PoW to PoS occurred, with ETH mining trouble and hash complaint dropping to zero.

Graph showing the Ethereum hash complaint and mining trouble successful 2022 (Source: Glassnode)

Graph showing the Ethereum hash complaint and mining trouble successful 2022 (Source: Glassnode)The centralization issues PoS opponents warned astir are evident on-chain.

The full magnitude of ETH transferred to the ETH2 deposit contract via staking providers presently stands astatine astir 13.8 cardinal ETH. Around 70% of that amount, oregon astir 10 cardinal ETH, is concentrated with conscionable 4 staking work providers—Lido, Coinbase, Kraken, and Binance.

Graph showing the full worth of staked ETH by supplier (Source: Glassnode)

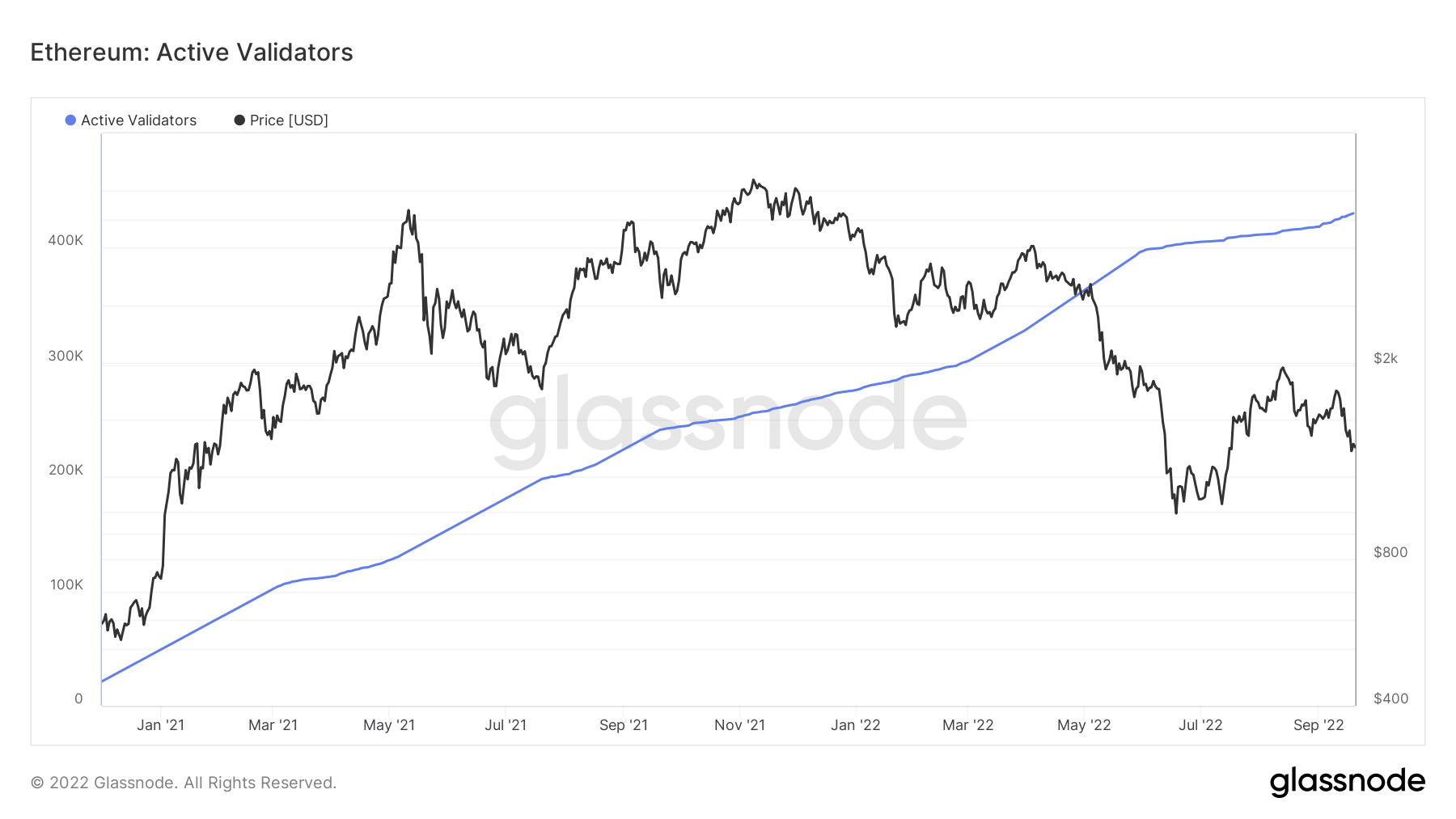

Graph showing the full worth of staked ETH by supplier (Source: Glassnode)However, the fig of progressive validators connected the web has reached its all-time high. A higher fig of autarkic validators drastically increases the decentralization of the web and offers a much affirmative alternate to the centralization seen among staking providers.

Active validators are defined arsenic validators that person completed activation, aren’t lined successful an exit queue, and person effectual balances greater than 32 ETH. There are presently implicit 430,000 progressive validators, with the fig expanding importantly since the Merge was announced successful January 2021.

Graph showing the fig of progressive validators connected Ethereum from January 2021 to September 2022 (Source: Glassnode)

Graph showing the fig of progressive validators connected Ethereum from January 2021 to September 2022 (Source: Glassnode)Another tangible payment PoS brought to Ethereum is scalability.

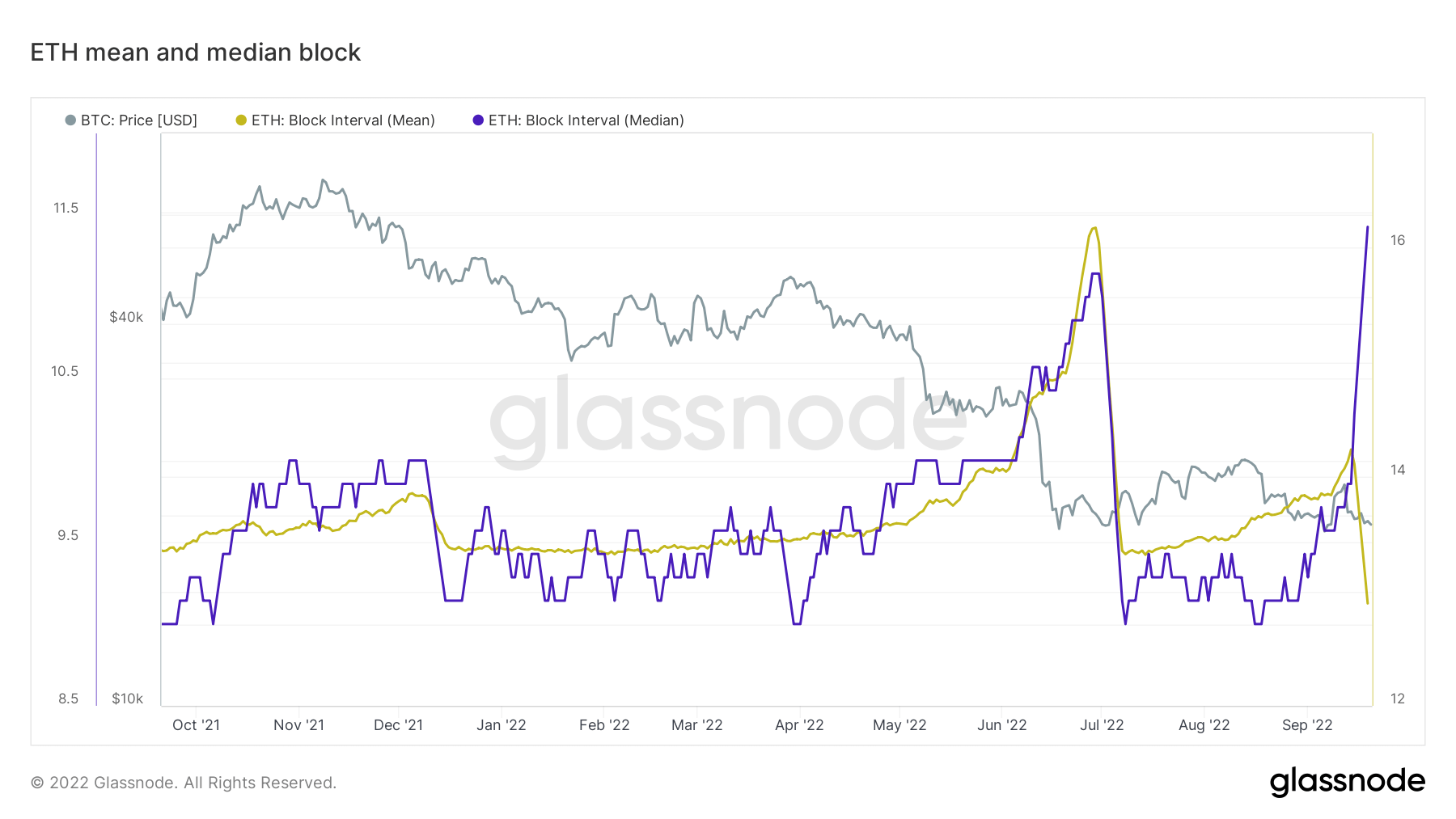

The recently implemented deterministic artifact times brought a 15% summation successful artifact abstraction per day. The modulation from PoW to PoS reduced artifact times from 13.5 seconds to 12 seconds, creating a precision staking consensus. Immediately pursuing the Merge, the artifact interval median clip and the mean programmed clip dropped to 12 seconds.

Graph showing the mean and median artifact times connected Ethereum from October 2021 to September 2022 (Source: Glassnode)

Graph showing the mean and median artifact times connected Ethereum from October 2021 to September 2022 (Source: Glassnode)The station Research: Ethereum’s determination to PoS is trading disconnected decentralization for scalability appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)