Ethereum has seen its terms emergence by 40% successful the past period portion the remainder of the marketplace has been licking its wounds from the June terms crash. Despite its sheer size and web effect, Ethereum’s terms has historically had a pugnacious clip decoupling from Bitcoin and has ever followed Bitcoin’s rallies and drops.

However, this rally has small to bash with Bitcoin, which has posted lone a 20% betterment from the lows it reached successful mid-June.

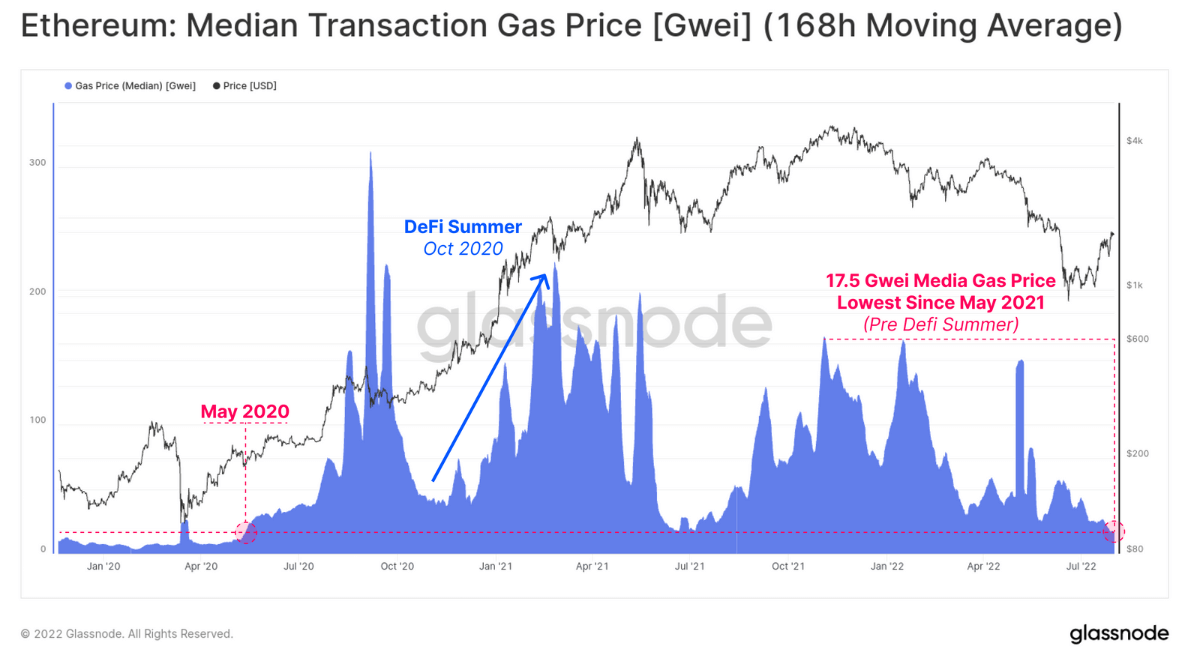

It besides has small bash with an summation successful web usage. Ethereum state fees person declined importantly this twelvemonth and presently basal astatine 17.5 GWEI, the lowest they’ve been since May 2021. The debased web congestion shows that idiosyncratic enactment connected Ethereum has been decreasing, with the wide fig of users estimated to scope levels seen successful May 2020 — earlier we’ve seen the web roar successful the DeFi Summer of 2020.

Declining idiosyncratic enactment stands successful opposition to the rapidly rising terms of ETH. This indicates that a ample chunk of Ethereum’s existent rally could beryllium attributed to speculation arsenic traders contention to station profits up of the upcoming Merge.

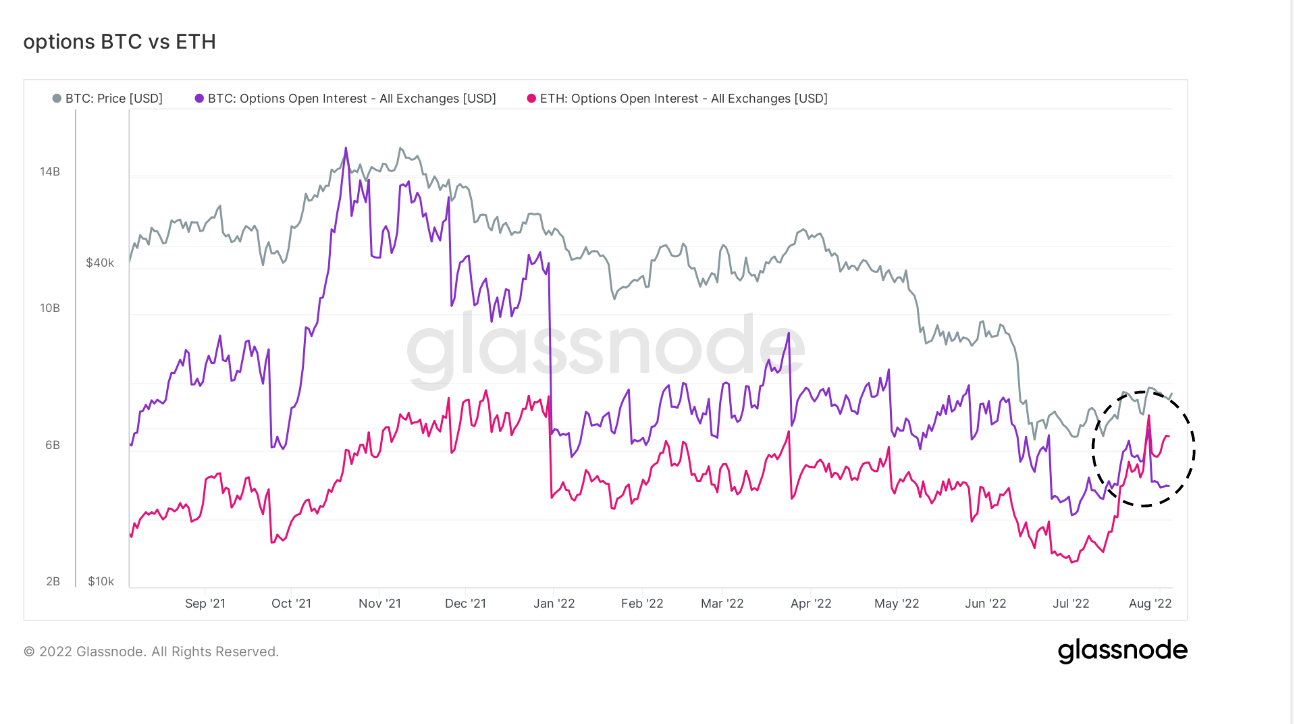

Derivatives besides uncover an expanding fig of traders are speculating connected Ethereum’s further rise. This is the archetypal clip that unfastened involvement connected Ethereum is greater than connected Bitcoin — there’s presently $6.4 cardinal successful Ethereum unfastened involvement for the Merge scheduled for September 19th, compared to $5 cardinal successful Bitcoin unfastened interest.

Graph comparing the unfastened involvement connected Ethereum and Bitcoin from 2021 to 2022 (Source: Glassnode)

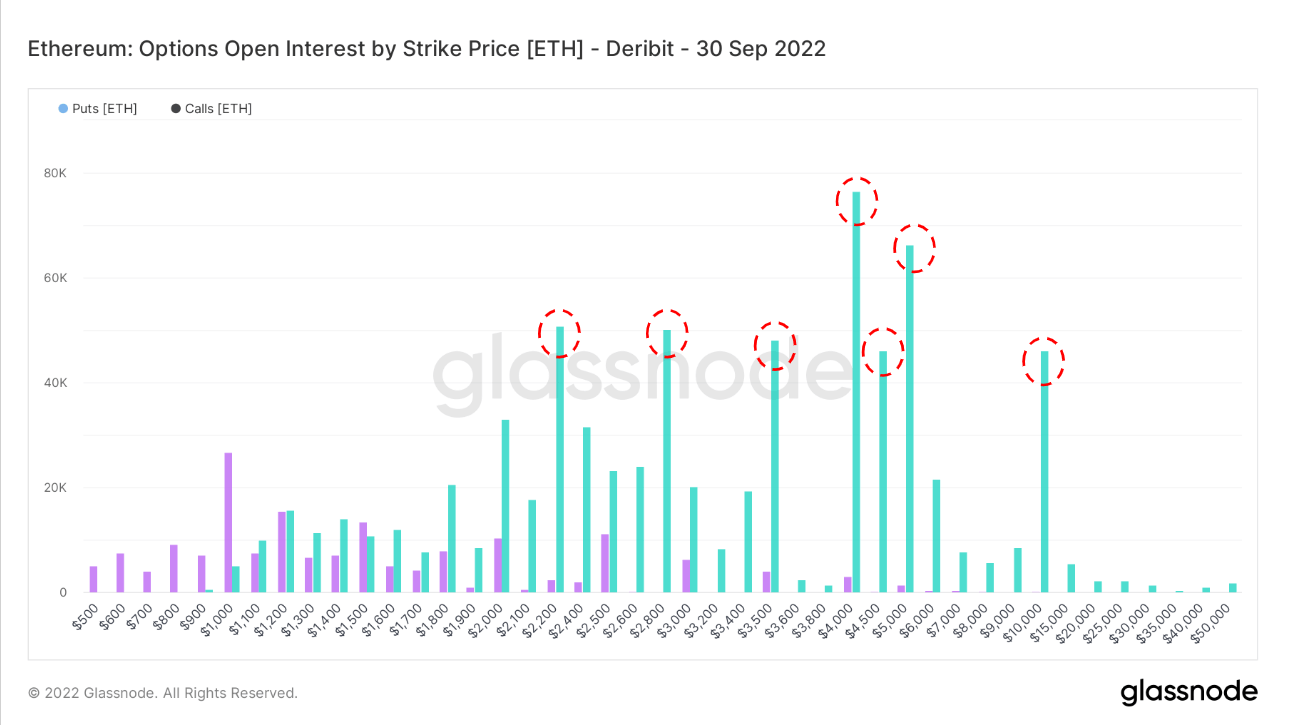

Graph comparing the unfastened involvement connected Ethereum and Bitcoin from 2021 to 2022 (Source: Glassnode)The full unfastened involvement of telephone and enactment options by onslaught terms favour telephone options contracts. The bulk of Ethereum’s options are telephone options concentrated connected September 30th, with the astir calling for $4,000.

Chart showing the Ethereum options unfastened involvement by onslaught terms (Source: Glassnode)

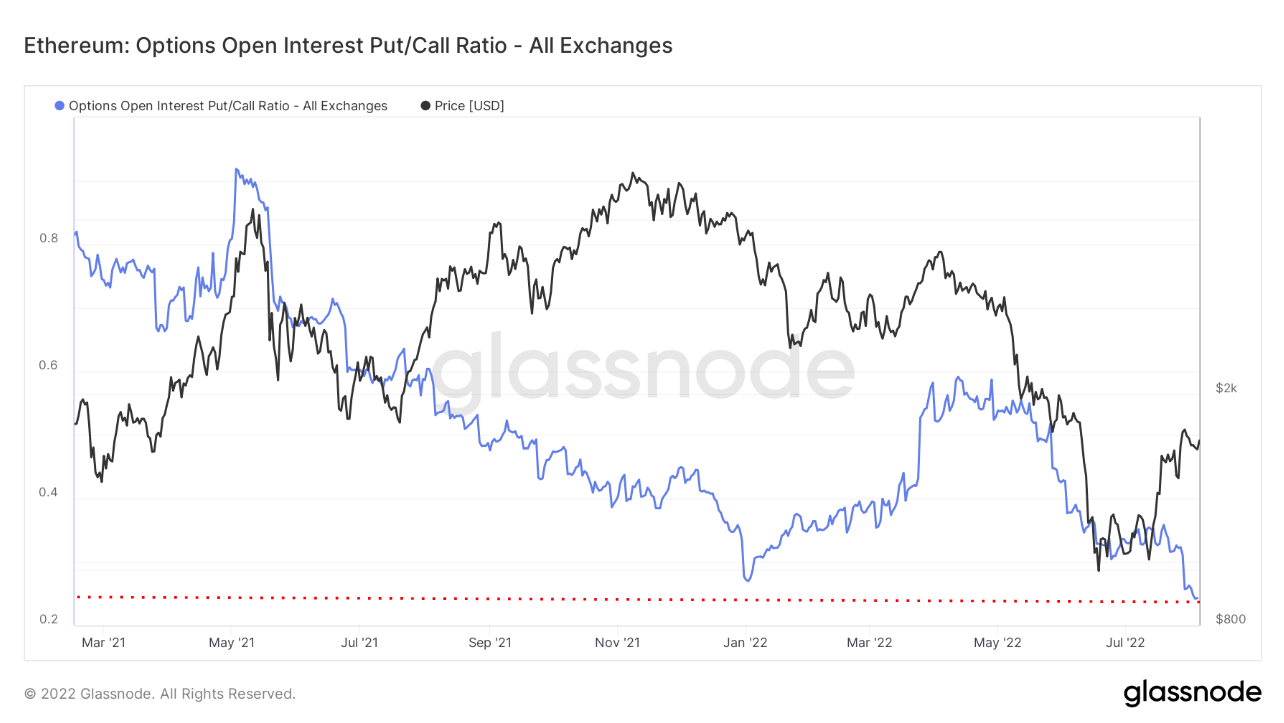

Chart showing the Ethereum options unfastened involvement by onslaught terms (Source: Glassnode)The options unfastened involvement put/call ratio besides shows a speculator’s market. The indicator shows the enactment measurement divided by the telephone measurement of each funds presently allocated successful options contracts to find the wide temper of the market. A rising put/call ratio shows traders are speculating that the marketplace volition determination little and are buying much enactment options than telephone options. On the different hand, a falling put/call ratio shows a bullish sentiment arsenic much traders are buying calls than puts.

Ethereum’s put/call ratio is presently the lowest it has ever been, and astatine 0.24 shows a immense fig of traders are anticipating a bull run.

Graph showing Ethereum’s options involvement put/call ratio (Source: Glassnode)

Graph showing Ethereum’s options involvement put/call ratio (Source: Glassnode)The station Research: Ethereum’s rally fueled by speculation connected the upcoming Merge appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)