In an investigation released connected Monday, ASXN, an emerging crypto probe firm, outlines the dynamics of planetary Bitcoin adoption done the lens of crippled theory. The study titled “The Game Theory of Bitcoin Adoption Among Nations” provides an introspection of however nations tin leverage mathematical crippled mentation to strategically follow Bitcoin.

The study follows connected the heels of Donald Trump’s announcement astatine the Bitcoin 2024 league that he’ll person each BTC’s owned by the US authorities done enforcement actions into a “strategic Bitcoin stockpile”.

Bitcoin Game Theory Explained

The study begins by framing BTC adoption wrong the broader discourse of crippled theory, a subject that evaluates the strategical decisions made by individuals oregon entities nether conditions of uncertainty and competing interests. According to ASXN, “Game mentation provides a structured model to foretell the outcomes of nation-level strategies successful adopting integer currencies, taking into relationship not lone the economical benefits and technological advancements but besides the imaginable geopolitical shifts.”

According to the conception of ‘First Mover Advantage’, aboriginal adoption of BTC tin presumption nations advantageously connected respective fronts. The study states, “Nations acting arsenic archetypal movers successful the Bitcoin arena whitethorn acceptable precedents successful ineligible and regulatory frameworks, pull planetary crypto enterprises, and unafraid a important stock of the blockchain innovation landscape.”

However, it contrasts these advantages with the pitfalls of premature regulatory frameworks and the volatility of Bitcoin’s marketplace value, which could airs important risks to nationalist economies. The study adds, “Once a fewer influential nations follow Bitcoin, others volition travel suit to debar being near down – creating a bandwagon effect. This effect is driven by some the returns to adoption arsenic good arsenic the risks of non adoption. This is erstwhile the Bitcoin adoption rhythm enters the steepest portion of the s-curve.”

S curve adoption | Source: X @asxn_r

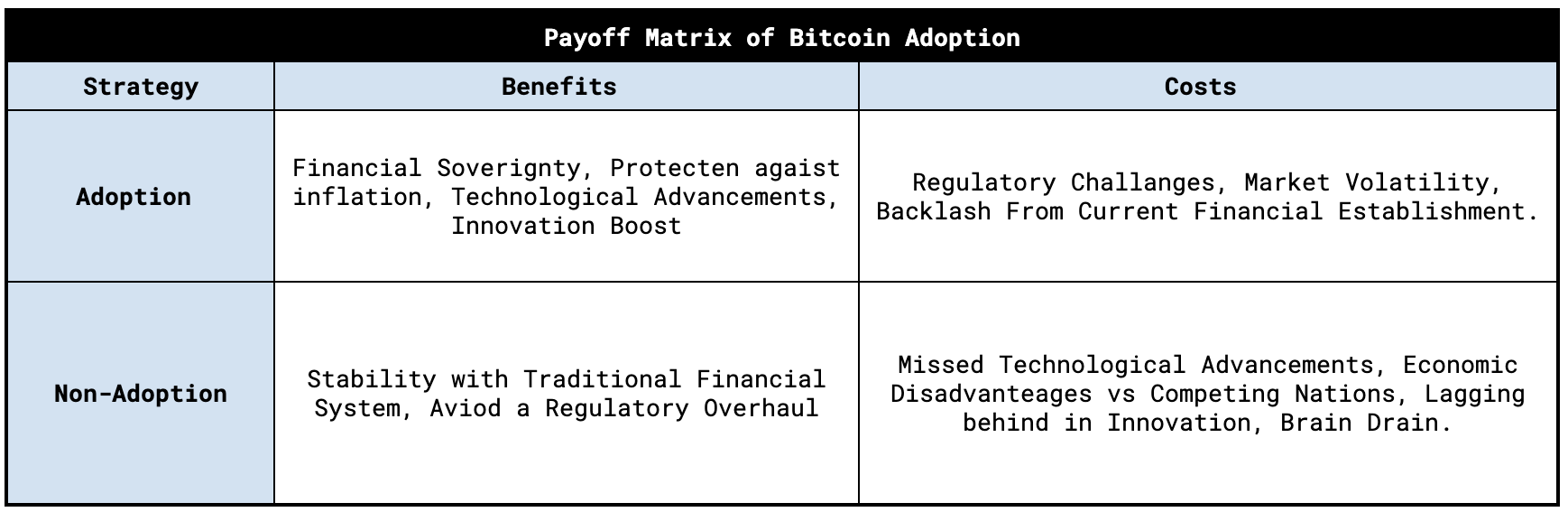

S curve adoption | Source: X @asxn_rThe ‘Payoff Matrix’—a cardinal instrumentality successful crippled theory—is applied by ASXN to dissect the decision-making process of countries considering Bitcoin adoption for nations. ASXN elaborates connected however this matrix helps countries measure the imaginable returns and risks associated with assorted strategical choices. “Each federation faces a unsocial matrix based connected its economical structure, governmental climate, and marketplace dynamics. The optimal strategy, portion mostly skewing towards adoption owed to the projected planetary ascendancy of cryptocurrencies, indispensable inactive beryllium tailored to idiosyncratic nationalist circumstances,” the study elaborates.

Payoff matrix of Bitcoin adoption | Source: X @asxn_r

Payoff matrix of Bitcoin adoption | Source: X @asxn_rFurthermore, the study besides introduces the conception of the ‘Best Reaction Function’ successful the discourse of Bitcoin adoption, explaining however nations make strategies by anticipating the decisions of others. “A nation’s strategy is influenced not lone by its nonstop gains from adopting Bitcoin but besides by the expected actions of different nations, which mightiness change the planetary economical and technological landscape,” the study states.

The researchers adhd however the bandwagon effect could play out; “The logic plays retired thing similar – Nation 1 assesses the outgo payment commercialized disconnected and decides connected adoption. Nation 1 realizes that each different nations are besides going to take adoption, Nation 1 concluded that, fixed that each nations volition take adoption, they should summation adoption velocity truthful arsenic not to suffer competitory edge. Slowly, past each astatine once.”

ASXN uses respective real-world applications to exemplify the theoretical concepts discussed. The lawsuit of El Salvador is examined successful depth, showcasing however its aboriginal adoption has influenced different nations’ perceptions and strategies towards Bitcoin. The investigation extends to however Wisconsin’s pension money investment successful Bitcoin ETFs reflects a broader inclination of sub-national entities assessing cryptocurrency arsenic a viable constituent of their fiscal strategies, and the important committedness by MicroStrategy is highlighted arsenic a firm parallel to nationalist strategies.

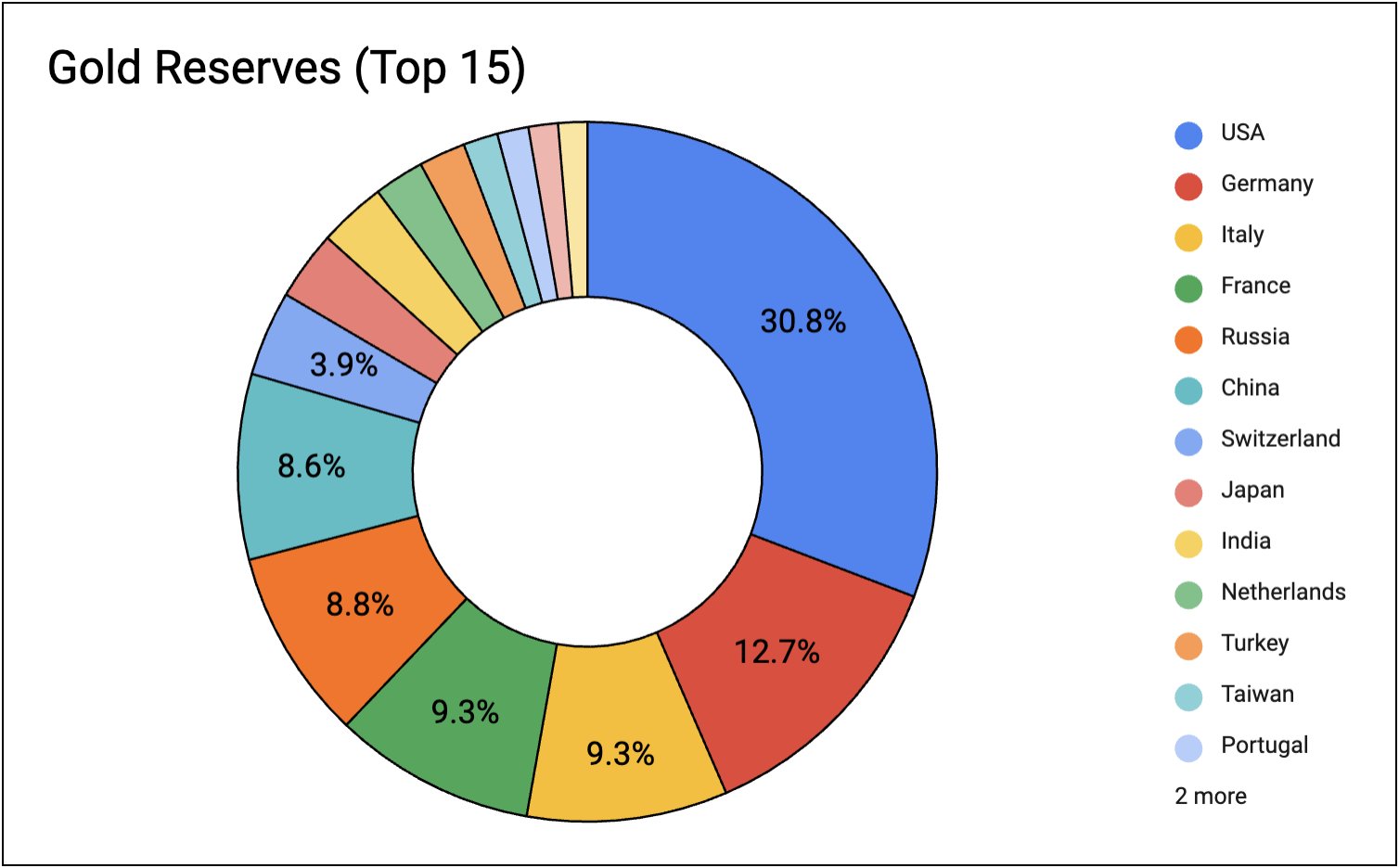

Looking forward, the study discusses the imaginable aboriginal trajectories of Bitcoin adoption, influenced by some technological advancements and evolving geopolitical dynamics. It specifically addresses Robert Kennedy Jr.’s proposal astatine Bitcoin Nashville 2024 to get 550 BTC regular until the US amasses 4 cardinal BTC, which represents 19% of the full disposable BTC supply. This attack aims to bespeak the proportionality of planetary golden reserves that the US presently maintains successful examination to different countries.

Gold reserves apical 15 | Source: X @asxn_r

Gold reserves apical 15 | Source: X @asxn_rAnd the Bitcoin crippled mentation is already playing out. “Whilst the ideas Trump presented astatine Bitcoin Nashville whitethorn oregon whitethorn not happen, the elemental information helium publically acknowledged Bitcoin & it’s properties is simply a triumph & we are already seeing aboriginal signs of the effects of this,” the researchers conclude.

They notation to Johnny Ng, a subordinate of Hong Kong’s Legislative Council, who has been advocating for the incorporation of Bitcoin into the city’s fiscal reserves pursuing Trump’s announcement.

At property time, BTC traded astatine $66,660.

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)