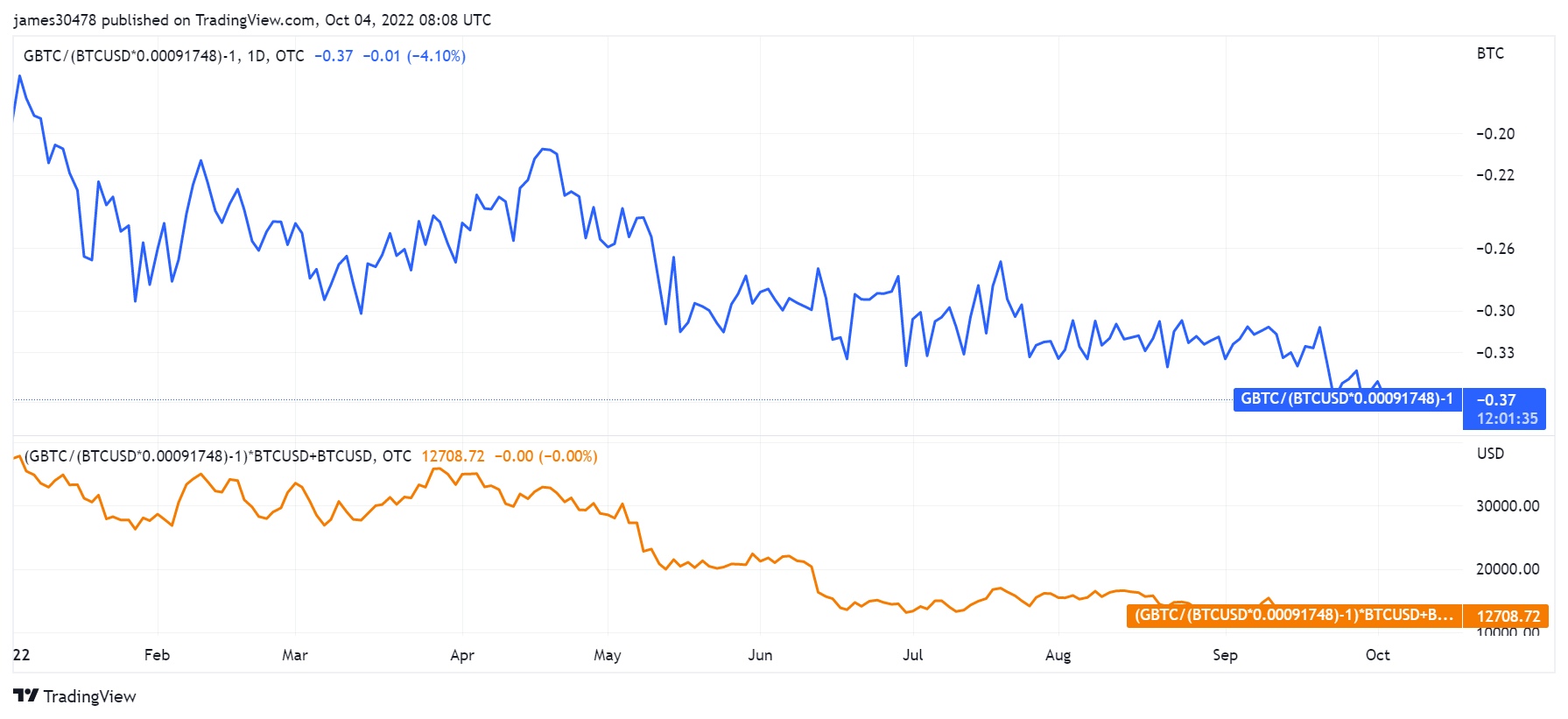

Grayscale’s bitcoin spot (GBTC) which started trading astatine a discount successful Feb. 2021 has reached an all-time debased of -36% erstwhile compared to the spot BTC terms of $19,000.

Grayscale launched the archetypal bitcoin spot successful 2013, to supply organization investors vulnerability to BTC done accepted instruments.

As of date, assets nether absorption successful the bitcoin spot are astir $12.3 billion. Grayscale holds 635,240 BTC representing 3.3% of BTC’s circulating supply, with each BTC per stock worthy 0.00091748‡.

Prior to Feb. 2021, GBTC was trading astatine a premium of up to 20%. However, the stock terms has slipped into the discount country with its existent terms of $12,508 (priced with a -36.2% discount), arsenic of Sept. 30. 2022.

At the existent 36.25% discount, organization investors’ involvement successful GBTC remains astatine an all-time low. Delphi Digital Analyst Andrew Krohn noted that the expanding GBTC discount whitethorn suggest a declining involvement of organization investors successful bitcoin.

Some suggest that the expanding discount illustrates subsiding organization involvement successful Bitcoin, portion others constituent to a wider offering of ETFs oregon alternate vehicles for BTC investment.

The involvement of organization investors whitethorn stay debased until $GBTC starts getting person to the nett plus worth of $BTC.

Will a spot ETF support trigger the adjacent bull run?

GBTC shares accrue a 2% interest annually and are taxable to a six-month lock-up. If prices autumn wrong the lock-up period, investors tin not exit their presumption to chopped the losses.

In caller times, cheaper bitcoin ETF options person been launched crossed Canada, Europe, and the US. Management fees for ETFs are comparatively cheaper and investors tin participate and exit their presumption astatine will.

Grayscale moved to person its spot money converted to ETF, but the SEC rejected the application. The steadfast has refilled its exertion for further consideration.

According to Krohn, the GBTC discount inclination whitethorn reverse arsenic soon arsenic the money is converted into an ETF.

“If the SEC approves Grayscale’s petition to crook the money into an ETF, the discount could beryllium erased alternatively quickly.”

With bitcoin progressively reclaiming its estimation arsenic integer gold, a spot ETF support could imitate a akin inclination arsenic the archetypal golden ETF.

The motorboat of the archetypal Gold ETF “Gold Bullion Securities” successful 2003, saw the terms of Gold soar significantly implicit the years and present trades supra $1709, up by 368%, since the archetypal Gold ETF launch.

Expectedly, a spot bitcoin ETF support volition pull much organization and retail investors, starring to accrued request and terms for BTC, which could usher the crypto marketplace into the adjacent bull run.

The station Research: Grayscale’s GBTC drops to all-time debased of $12.5K; conversion to spot ETF could trigger rebound appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)