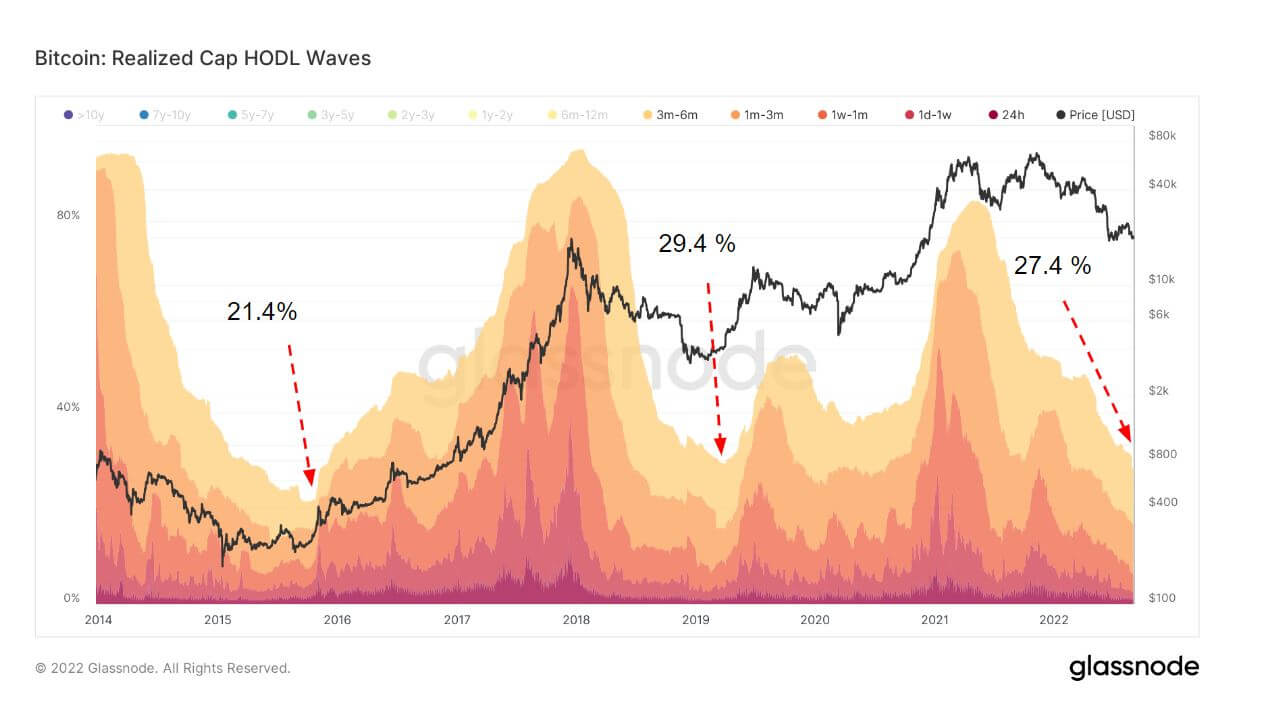

HODL Waves are an indicator that bundles each progressive proviso addresses by property bands. Each colored set shows the percent of Bitcoin successful beingness that was past moved wrong the clip play denoted successful the legend.

A reappraisal of the existent authorities of the HODL Waves illustration by CryptoSlate indicates that short-term holders are astatine a little level than the bottommost of the 2016 – 2020 halving cycle.

HODL Waves weighted by Realized Price | Source: Glassnode

HODL Waves weighted by Realized Price | Source: GlassnodeShort-term holders are defined arsenic a cohort holding bitcoin for little than 155 days. Short-term holders typically bargain successful spot during bull runs and administer erstwhile prices commencement to driblet owed to accrued terms sensitivity.

The realized headdress HODL Waves illustration supra showcases that short-term holders clasp a important magnitude of coins and historically lend to the level of carnivore markets. In 2015 short-term holders made up 21.4% and successful 2019, it was implicit 29%. Presently, it is 27.4% marking a traditionally important infinitesimal wrong the halving cycle.

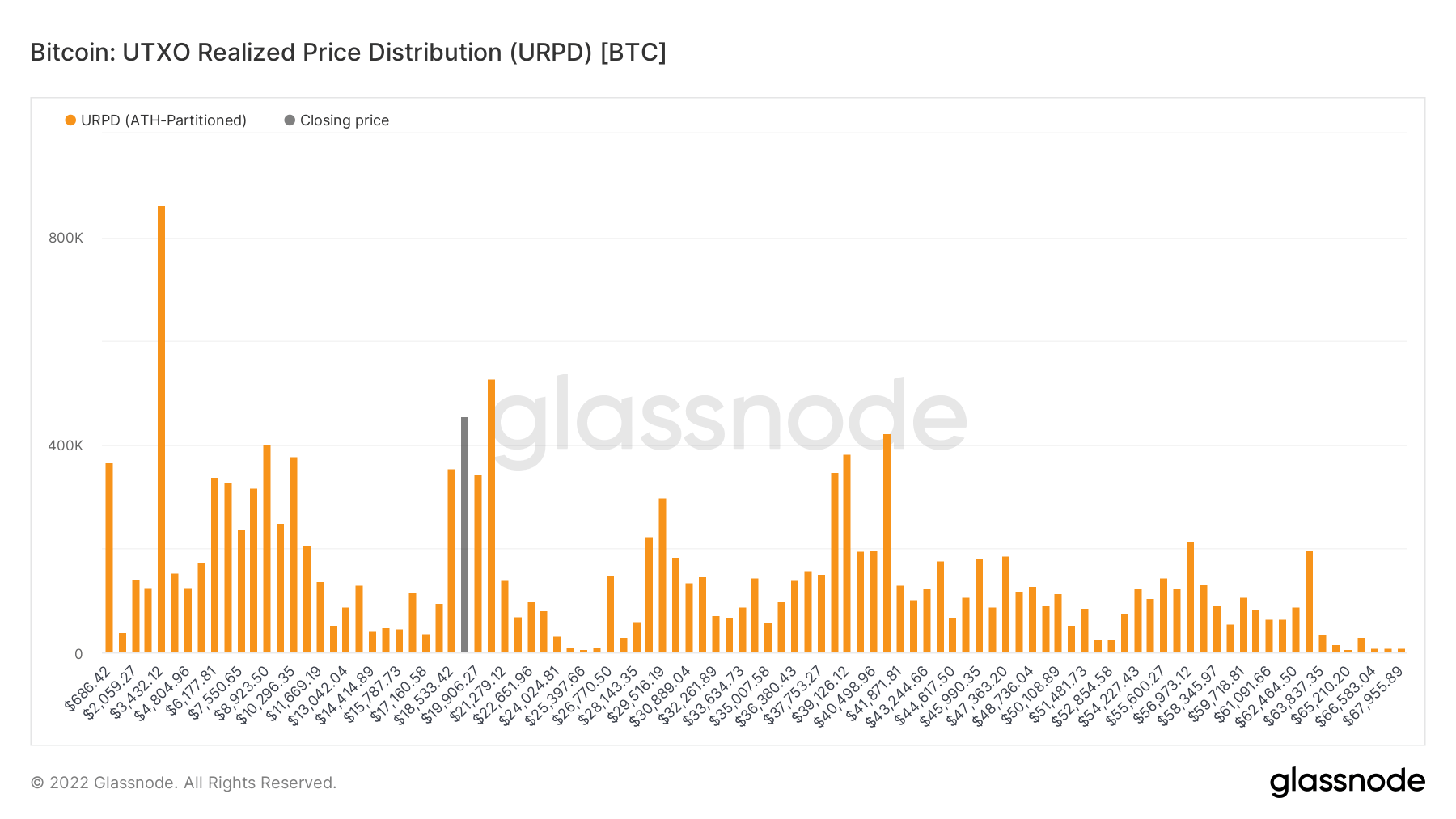

Short-term holders bought erstwhile BTC dropped beneath the intelligence enactment astatine $20,000. The Unrealized Price Distribution (URPD) metric supports this thesis arsenic a important magnitude of concentrated coins person been bought astir $17.5k to $22k. The overwhelming bulk of holders, however, are semipermanent holders which signifier the base.

The important origin to retrieve is that Bitcoin has ne'er had to navigate a planetary recession oregon Quantitative Tightening. Since 2009, Bitcoin has had the payment of riding a question of rising plus prices crossed myriad markets. While short-term holders driblet to levels emblematic of a marketplace bottom, on-chain metrics volition person to contend with different macro factors amid soaring ostentation and continued wealth printing.

However, 1 perchance affirmative indicator is the information that the M1 wealth proviso successful the US has yet ticked down aft reaching a precocious of $20.69 trillion. Updated numbers for August volition beryllium released aboriginal successful September, yet, the astir caller figures from July amusement the wealth proviso dropping to $20.51 trillion.

Strong on-chain information tin beryllium seen arsenic a awesome of erstwhile Bitcoin is acceptable to caput backmost towards a bull tally erstwhile the planetary macro situation allows for it.

The station Research: HODL waves amusement short-term holders astatine level little than 2019 carnivore marketplace bottom appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)