Ethereum (ETH) mightiness beryllium gradually turning into a store of worth based connected the measurement of the integer plus being held by semipermanent investors, CryptoSlate’s investigation of Glassnode information revealed.

With Ethereum down by much than 70% from its all-time precocious during the existent marketplace cycle, 1 would deliberation that investors would massively dump the coin to recoup their funds.

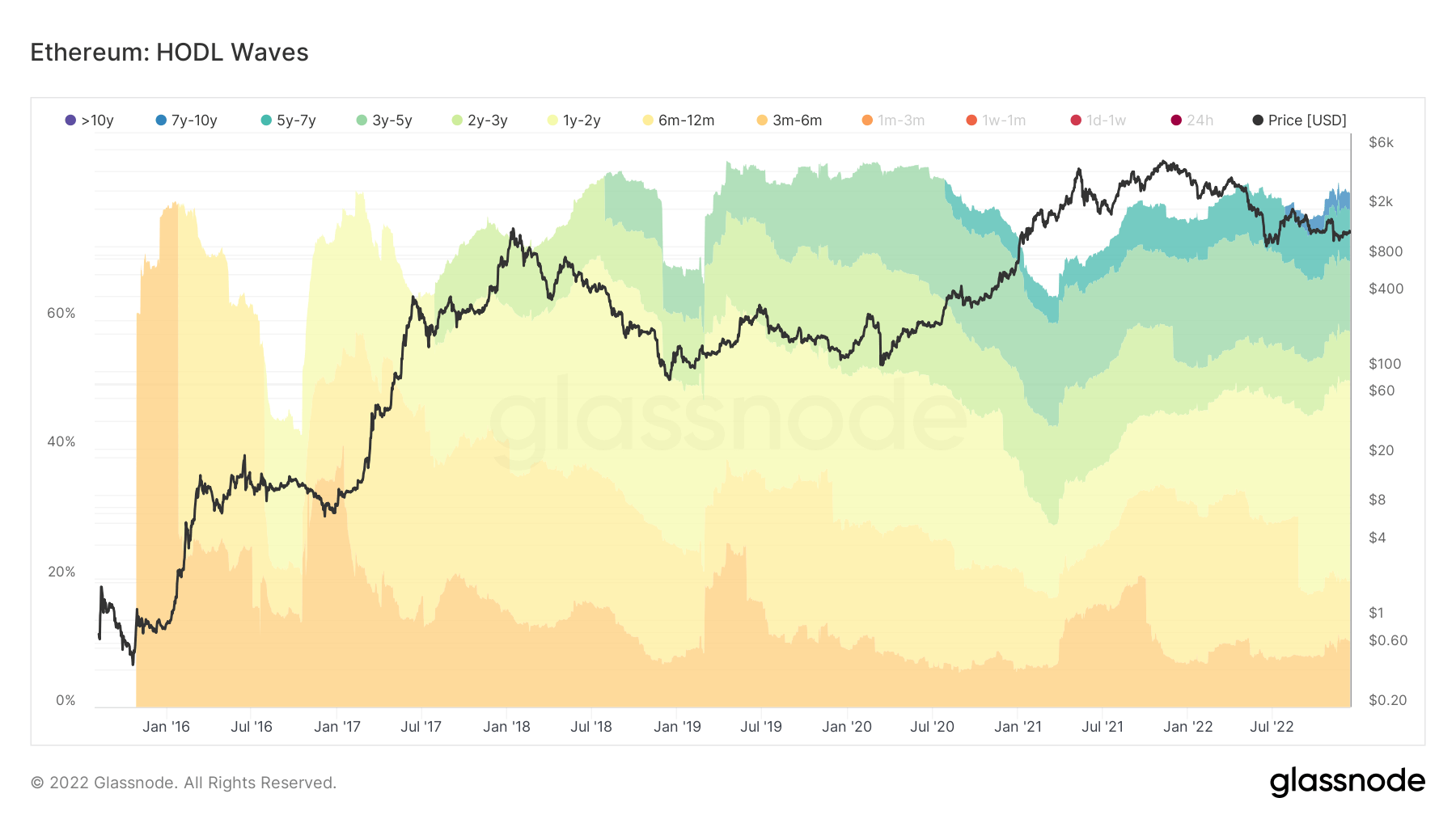

However, Glassnode HODL waves information showed that semipermanent investors presently clasp 80% of ETH supply, i.e., those holding the token for much than six months, which is precise akin to the 2018 carnivore marketplace level.

HODL question is simply a metric utilized to measurement the fig of investors holding a peculiar integer asset.

Ethereum: HODL Waves / Source: Glassnode

Ethereum: HODL Waves / Source: GlassnodeThe information that galore semipermanent holders were yet to merchantability their assets suggests their condemnation successful ETH’s semipermanent value. This is simply a motion communal to Bitcoin, wherever semipermanent holders usually clasp done the unsmooth patches due to the fact that they judge the asset is invaluable successful the agelong term.

In fact, during the tallness of the Terra illness contagion successful July, a caller cohort of semipermanent holders who person held Ethereum for 7 to 10 years began to emerge. According to the supra chart, this radical of investors holds astir 3% of the full ETH supply.

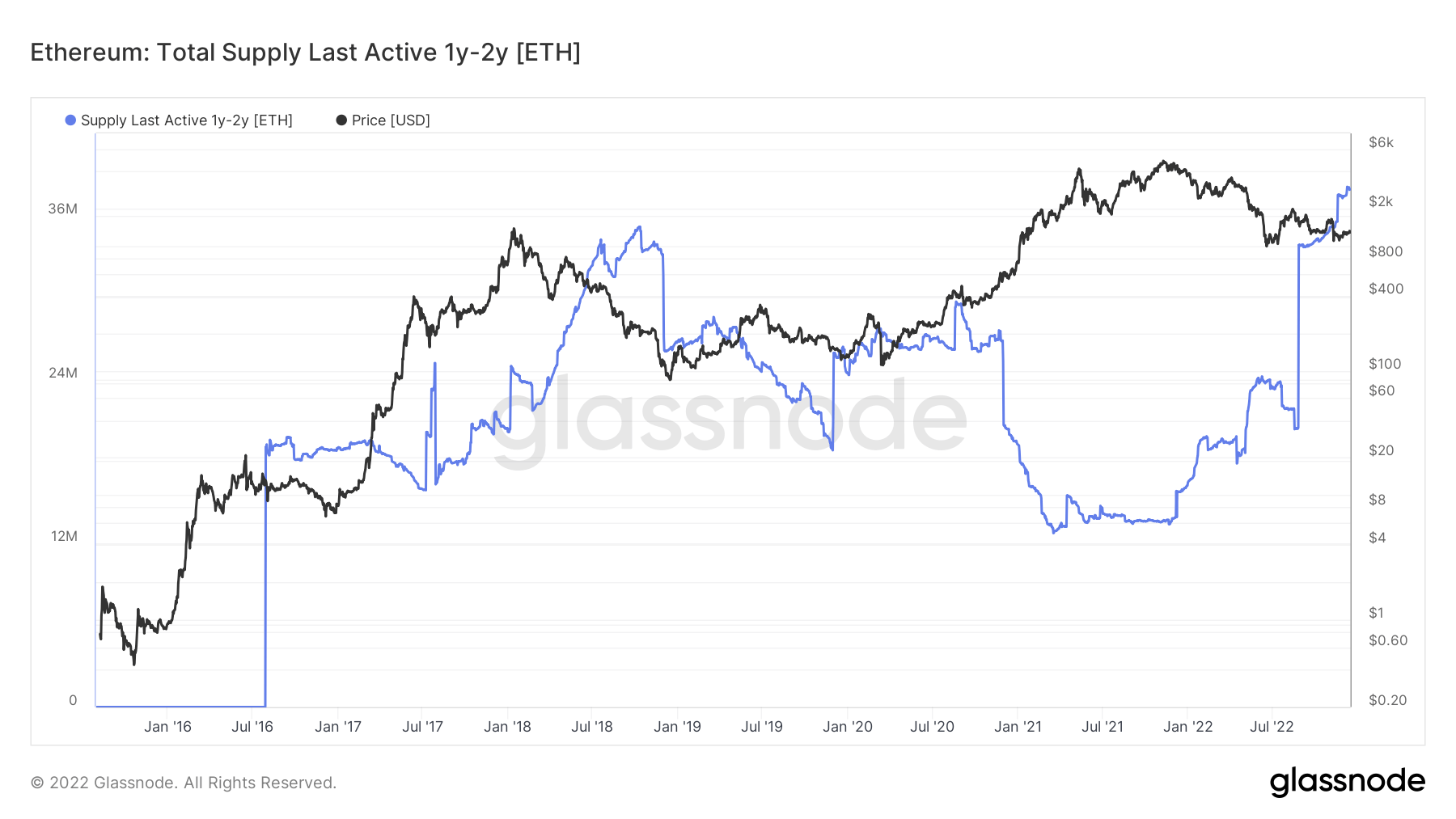

Investors successful the 1-2 years set are underwater

Meanwhile, ETH investors holding for 1-2 years are astir apt underwater fixed the apt bought during the 2021 bull tally and aboriginal 2022. The precocious unrealized losses mightiness person prevented this cohort from selling.

Ethereum: Total Supply Lat Active / Source: Glassnode

Ethereum: Total Supply Lat Active / Source: GlassnodeThe full proviso for this radical saw a important leap successful July 2022, erstwhile the plus mostly traded supra $1000. These investors present clasp 40 cardinal ETH, akin to the magnitude held by BTC investors who person held for astatine slightest a year.

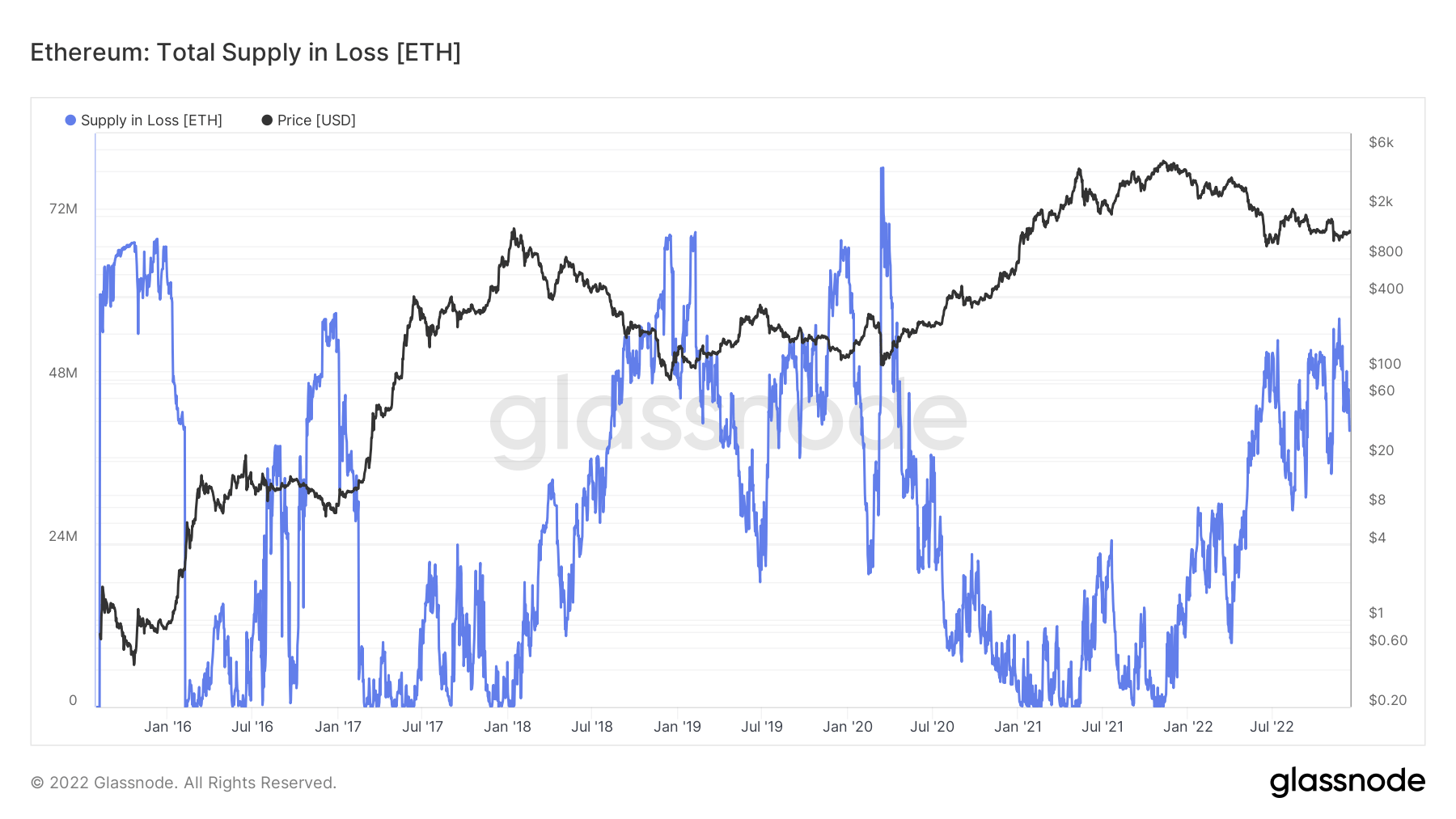

Glassnode information besides showed that ETH’s full proviso successful nonaccomplishment is presently astatine 44 cardinal ETH –a flimsy driblet from the rhythm highest of 50 cardinal successful June. This pales importantly to the fig recorded during the Covid -19 pandemic and the 2019 carnivore marketplace erstwhile losses successful proviso crossed 72 cardinal tokens.

Ethereum: Total Supply successful Loss / Source: Glassnode

Ethereum: Total Supply successful Loss / Source: GlassnodeWith less losses contempt the ETH’s steep driblet successful 2022, astir investors are bullish connected the plus and expect its worth to emergence importantly with time.

The bullishness is tied to the information that ETH proviso has been deflationary a fewer times since the Merge event. Analysts person predicted that accrued web enactment would effect successful a sustained deflationary supply.

The station Research: How Ethereum is gradually becoming a store of value appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)