Flagship integer plus Bitcoin (BTC) has had a unsmooth year, falling 72% from its all-time precocious and losing much than 50% of its worth this twelvemonth alone.

On respective occasions, the plus has seen its worth plunge beneath the $20,000 mark. During the heavy of the carnivore run, BTC fell beneath a erstwhile cycle’s all-time-high terms — $19,750 — for the archetypal clip successful its history.

These scenarios person led to the emergence of 1 of the astir prevalent questions successful the marketplace “how debased tin BTC go?”

For starters, determination is nary definite mode to find this arsenic the crypto market’s volatile quality tin beryllium precise unpredictable — 1 lone has to look astatine however Ethereum’s (ETH) price performed aft the highly anticipated merge to get an thought of however unpredictable the marketplace is.

However, definite metrics similar the MVRV Z-Score tin beryllium utilized to find the terms show of an asset.

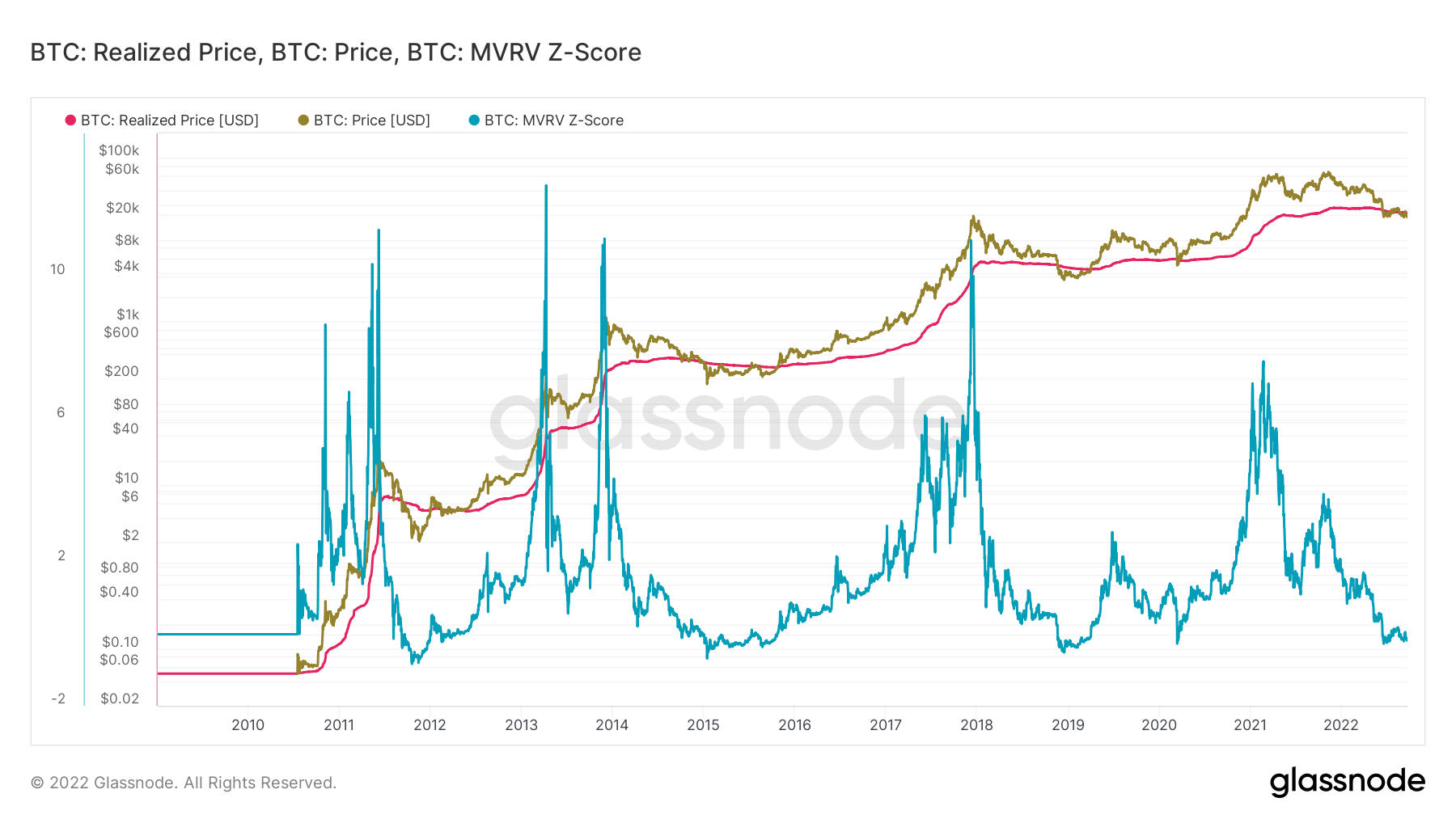

The MVRV Z-Score is based connected 3 metrics – Market worth (MV), Realized Value (RV), and Z-score. The realized people is the terms of each Bitcoin since it was transferred crossed wallets, portion Z-score is the deviation trial betwixt marketplace worth and realized value.

So, the MVRV Z-Score is defined arsenic the ratio betwixt the marketplace headdress and realized headdress and the modular deviation of each humanities marketplace headdress data, i.e. (market headdress – realized cap) / std(market cap).

Most times, MVRV Z-Score tin beryllium utilized to find whether Bitcoin is implicit oregon under-valued. Historically, erstwhile the marketplace worth is importantly higher than realized value, it indicates a marketplace apical (red zone), portion the other means a marketplace bottommost (green zone). The MVRV Z-Score shows that BTC is undervalued arsenic the realized terms is somewhat higher than the marketplace price.

Source: Glassnode

Source: GlassnodeThe people is presently successful the greenish zone, which suggests a marketplace bottom, and has been determination since the Terra LUNA collapsed.

As of September 21, the Z-score was -0.14, intelligibly showing that the marketplace worth is smaller than the realized value. The MVRV astatine that clip was 0.87.

Compared with erstwhile carnivore markets successful 2020, 2019, 2014, and 2011, the marketplace was successful this portion betwixt 20 days to 300 days, suggesting that BTC’s terms could stay successful this scope for six much months.

Meanwhile, the information that MV shows that we mightiness person reached the bottommost does not mean BTC tin not inactive dip lower. However, falling beneath $17,500 –the adjacent absorption level– would suggest that this is not a regular carnivore market.

Former BitMEX CEO Arthur Hayes pointed this retired successful 1 of his essays. According to him, traders successful agelong positions connected Bitcoin should beryllium wary of $17,500.

Hayes continued that overmuch of Bitcoin’s terms depends connected US Dollar liquidity, which has been tightened since November 2021. With the Fed readying to region liquidity further, the hawkish stance could trial Bitcoin’s resilience astatine that mark.

The station Research: How debased tin Bitcoin terms go? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)