The crypto derivatives marketplace has grown truthful large successful the past fewer years that it tin beryllium utilized arsenic an indicator of aboriginal terms movements. Bitcoin options person captured the crypto manufacture and person rapidly turned into mature products whose movements person the powerfulness to sway the remainder of the market.

Just similar successful the accepted fiscal market, Bitcoin options assistance their holders the right, but not the obligation, to bargain BTC astatine a preset terms astatine the contract’s expiration date. Options are usually priced utilizing a metric called implied volatility (IV), which shows the market’s presumption of the likelihood of changes successful a fixed security’s price.

Implied volatility (IV) is often utilized by investors to estimation aboriginal volatility successful a security’s price. However, portion IV tin foretell terms swings, it can’t foretell the absorption successful which the terms volition go. High implied volatility means there’s a precocious accidental of a ample terms swing, portion debased IV means that the terms of the underlying plus astir apt won’t change.

As such, IV is considered a bully proxy of marketplace risk.

Looking astatine the implied volatility for Bitcoin shows that the marketplace sees small hazard successful BTC.

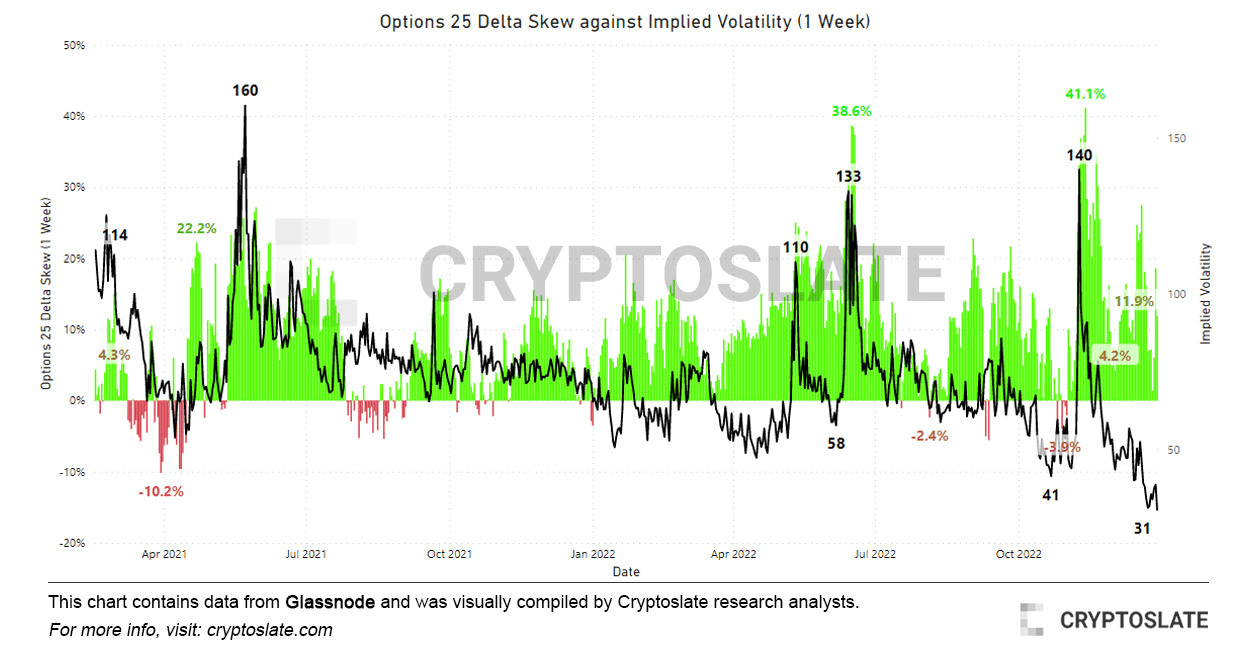

Bitcoin’s implied volatility presently stands astatine a two-year low. The crisp driblet successful IV has historically followed assertive spikes caused by achromatic swan events — spikes were seen during the 2021 Defi Summer, the Terra illness successful June 2022, and the FTX downfall successful November 2022.

However, the driblet successful implied volatility seen astatine the extremity of 2022 shows that the derivatives marketplace sees nary large terms movements successful the adjacent future.

Graph showing the options 25 delta skew against implied volatility (IV) (Source: CryptoSlate)

Graph showing the options 25 delta skew against implied volatility (IV) (Source: CryptoSlate)Comparing Bitcoin’s implied volatility with the options 25 delta skew further confirms this.

When applied to options contracts, skew measures the implied volatility betwixt antithetic onslaught prices with the aforesaid expiration. Put simply, it presents the ratio betwixt enactment and telephone options. Delta is simply a measurement of alteration successful an option’s terms resulting from a alteration successful the underlying security.

The 25 delta skew looks astatine puts with a delta of -25% and calls with a delta of 25%, netted disconnected to get astatine a information point. A 25-delta enactment skew of -25% means that the enactment enactment costs 25% little than the spot terms of the underlying asset, and vice versa.

The metric fundamentally measures however delicate an option’s terms is to changes successful Bitcoin’s spot price. Data analyzed by CryptoSlate shows that the premium for enactment options has travel down from utmost levels recorded successful November and June. Spikes successful the 25 delta skew are usually a coagulated gauge for carnivore markets arsenic they correlate with utmost bouts of terms volatility.

December brought connected a crisp driblet successful the 25-delta skew, which saw a flimsy summation successful the archetypal fewer days of 2023. Just similar the driblet successful implied volatility, this indicates a overmuch calmer marketplace successful the days and weeks to come.

The station Research: Implied volatility shows lone sideways movements for Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)