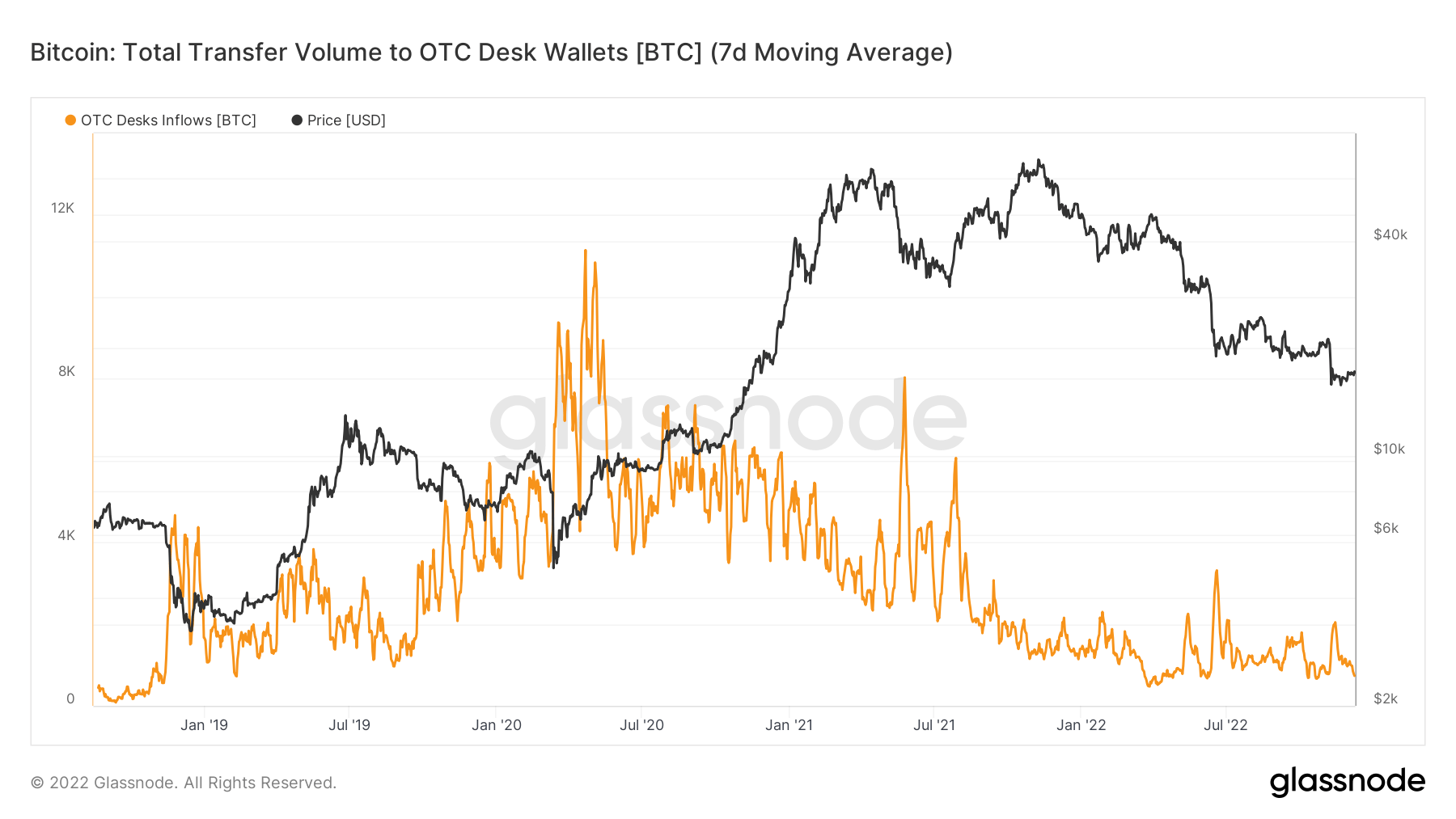

Institutional appetite for Bitcoin (BTC) has dilatory evaporated owed to the existent carnivore marketplace concern and is reflected successful the important driblet successful over-the-counter (OTC) trades, according to an investigation of Glassnode information by CryptoSlate.

A bull tally successful 2021 saw respective organization players heap into the flagship integer asset, but that involvement faded arsenic the terms plunged to caller lows successful 2022. Data from 3 antithetic OTC desks showed that the travel of funds from this radical has dilatory evaporated.

According to River Financial, an OTC table acts arsenic a trader for traders looking to commercialized a fixed plus which could beryllium securities, currencies, etc. They are usually utilized erstwhile a fixed commercialized is intolerable connected centralized exchanges.

CryptoSlate’s investigation showed that the seven-day moving mean for full transfers to OTC table wallets is present adjacent to 2018 lows. OTC trades peaked during covid 19 pandemic erstwhile BTC was trading astatine astir $3000.

Source: Glassnode

Source: GlassnodeSince then, the marketplace witnessed sizeable spikes passim 2021 but slowed arsenic the twelvemonth ended. OTC trades successful 2022 saw a important spike successful July erstwhile investors were inactive reeling from the Terra ecosystem collapse.

Since then, the 7-Day moving mean for OTC table inflows has fallen and is present approaching a year-to-date (YTD) low.

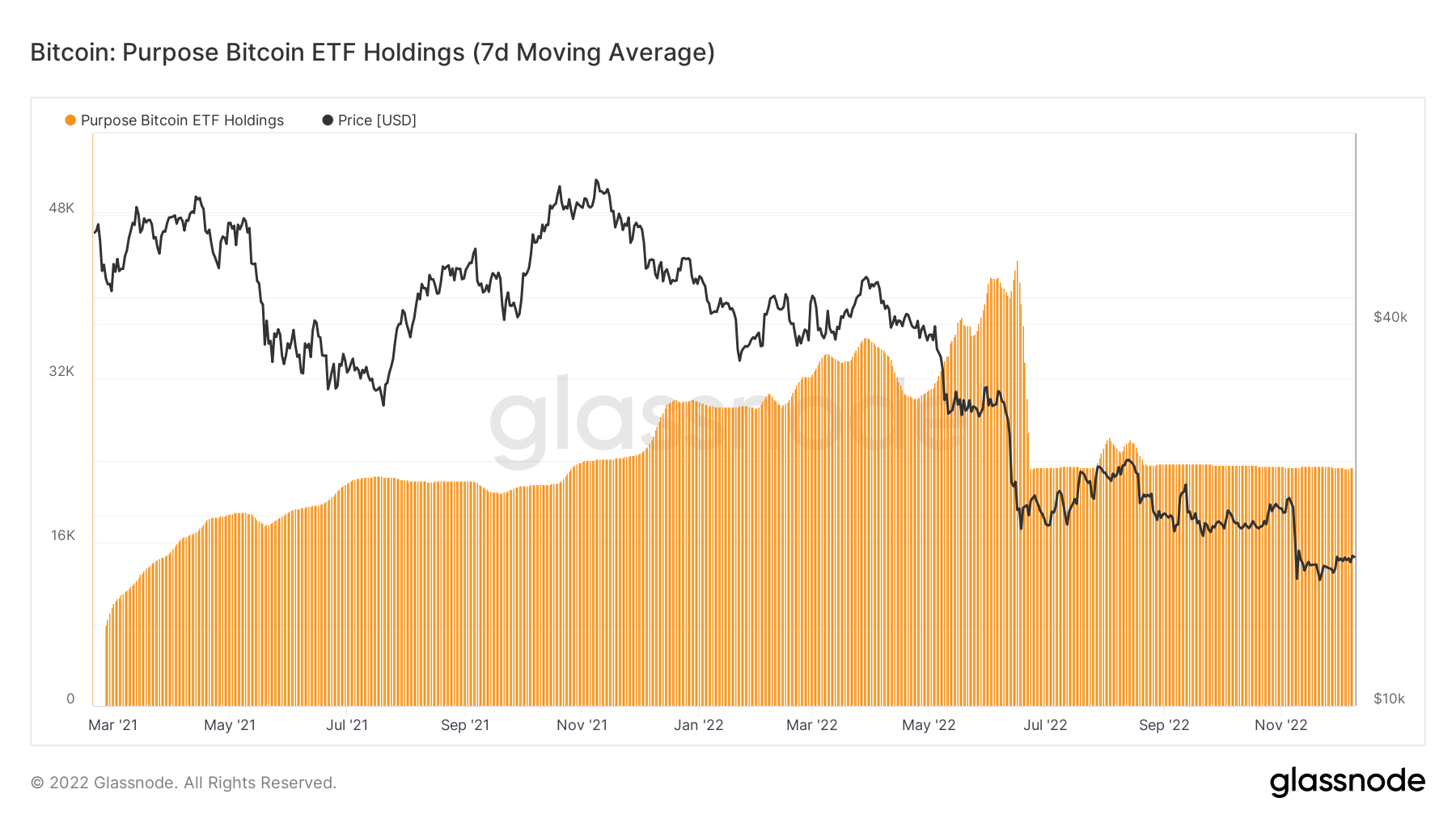

Purpose ETF has seen nary enactment since aboriginal August

The world’s archetypal Bitcoin ETF, Purpose Spot Bitcoin ETF, has had a beauteous quiescent year.

CryptoSlate investigation revealed that the ETF had not seen immoderate large enactment since precocious July and aboriginal August. According to Glassnode information connected its 7-Day moving average, Purpose ETF BTC holdings peaked betwixt June and July 2022.

Source: Glassnode

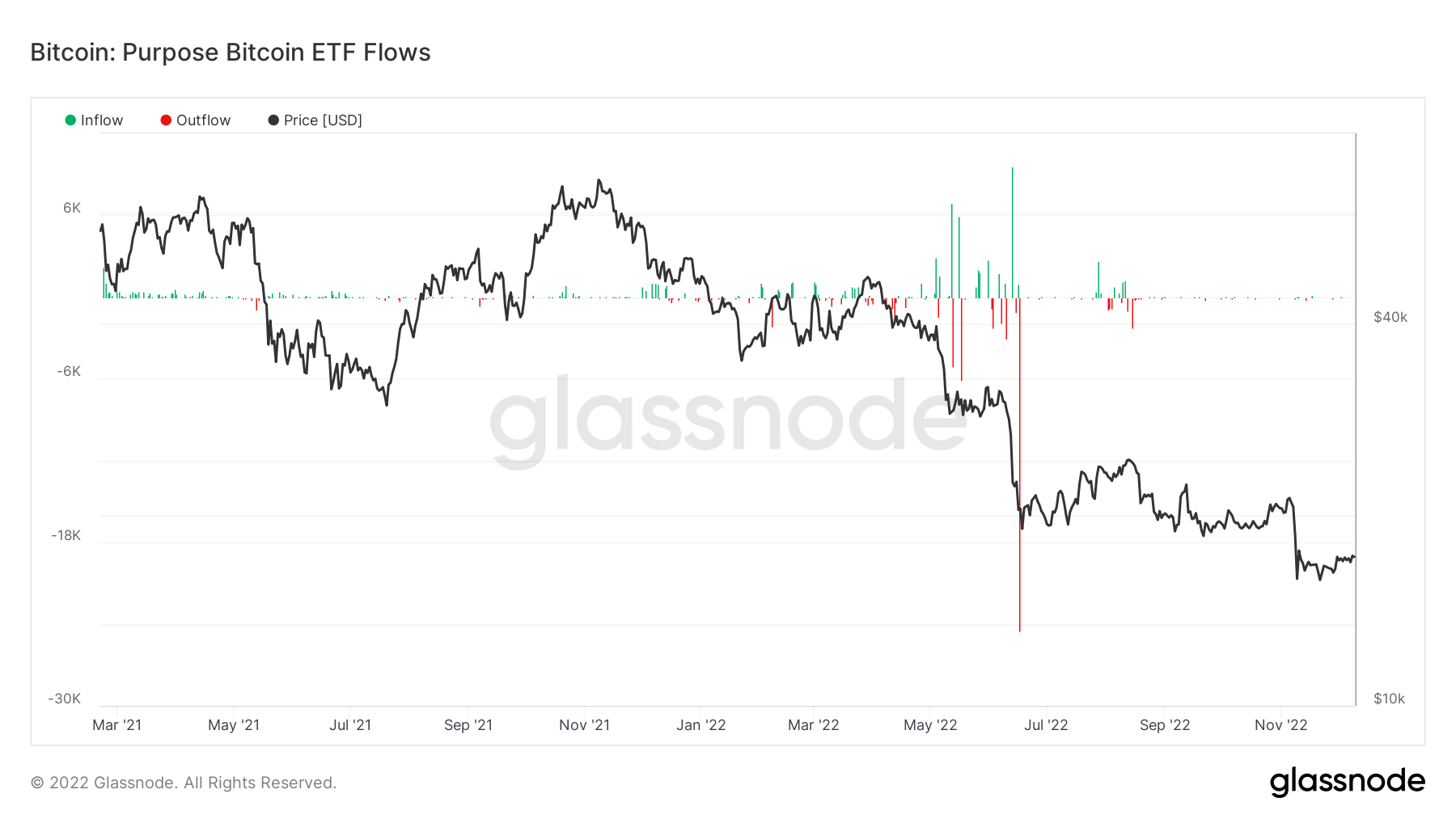

Source: GlassnodeThe Glassnode illustration connected its inflows and outflows showed that the ETF had experienced dense outflows betwixt May and July 2022, coinciding with erstwhile BTC’s worth dipped by 40%. In July mainly, Purpose ETF saw its largest wick of outflow.

Source: Glassnode

Source: GlassnodeIt experienced immoderate inflows and outflows successful aboriginal August and has seen small to nary enactment since then.

Despite the months of inactivity, the ETF holdings are inactive importantly supra the levels successful March 2021 erstwhile it launched. According to Purpose Invest, the ETF’s plus nether absorption sits astatine $396.7 cardinal (23,240 BTC).

The station Research: Institutional appetite for Bitcoin has evaporated arsenic OTC trades attack YTD low appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)