One of the astir heated debates surrounding Ethereum’s modulation to a Proof-of-Stake network focused connected the issuance of ETH. The starring communicative down the Merge was that it was expected to marque ETH a deflationary currency.

Since the Merge was completed connected September 15, ETH issuance has been drastically reduced. The estimated yearly issuance successful the PoS web is astir 600,000 ETH. The nonstop yearly issuance volition alteration passim the years, arsenic it’s determined based connected the fig of validators participating successful the statement mechanism.

However, portion the issuance was reduced successful theory, the existent proviso of ETH has accrued since the web abandoned Proof-of-Work. The proviso maturation is presently affirmative and has grown by implicit 4,000 ETH since the Merge. At the existent pace, the proviso is acceptable to summation by 0.21% per year.

Dataset showing the yearly pain rate, the proviso growth, and the issuance of ETH (Source: SoundMoney)

Dataset showing the yearly pain rate, the proviso growth, and the issuance of ETH (Source: SoundMoney)The Merge has truthful acold failed to present connected making Ethereum a deflationary currency. The minted proviso from the PoS web has outpaced the pain complaint implemented with EIP-1559.

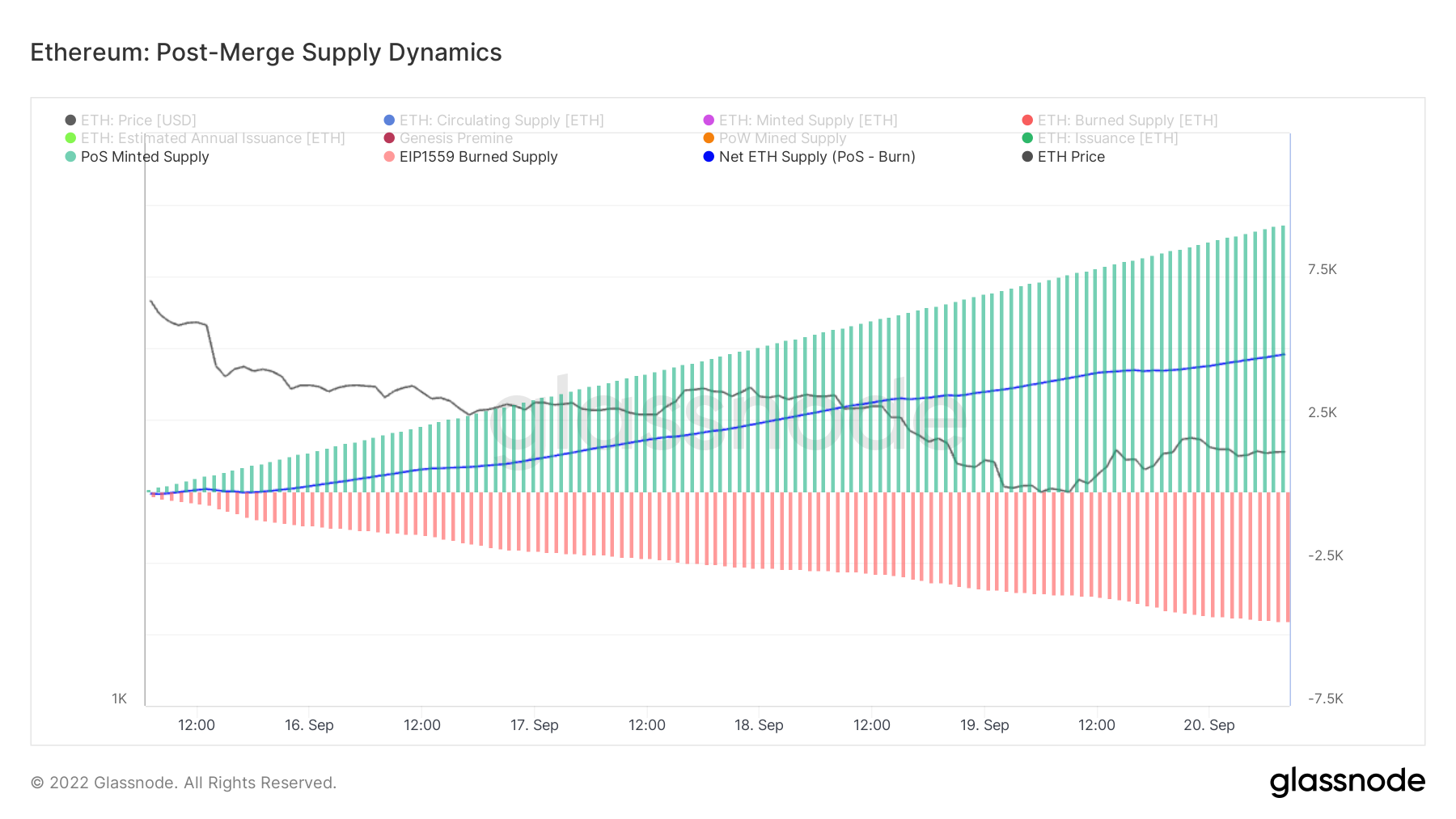

According to information from Glassnode, since Proof-of-Work issuance ceased permanently, Ethereum’s proviso has been expanding connected an hourly basis. The illustration beneath shows that the proviso mined by PoS is outpacing the proviso burned by EIP-1559. This caused the nett proviso of ETH to summation pursuing the Merge.

Chart showing the proviso minted by PoS (green), the proviso burned by EIP-1559 (red), and the nett proviso alteration pursuing the Merge (blue) (Source: Glassnode)

Chart showing the proviso minted by PoS (green), the proviso burned by EIP-1559 (red), and the nett proviso alteration pursuing the Merge (blue) (Source: Glassnode)Analyzing Ethereum’s proviso and issuance earlier the Merge shows the web has been nether inflationary unit for astir 2 years.

The PoS issuance of ETH began agelong earlier the Merge — close aft the beacon concatenation genesis lawsuit connected December 1, 2020. The PoW issuance, however, wasn’t halted until September 15, 2022. EIP-1559, the transaction pricing mechanics that implemented a fixed transaction interest burned with each block, was enactment into effect connected August 5, 2021.

This discrepancy successful implementation times has further exacerbated the unit connected the network.

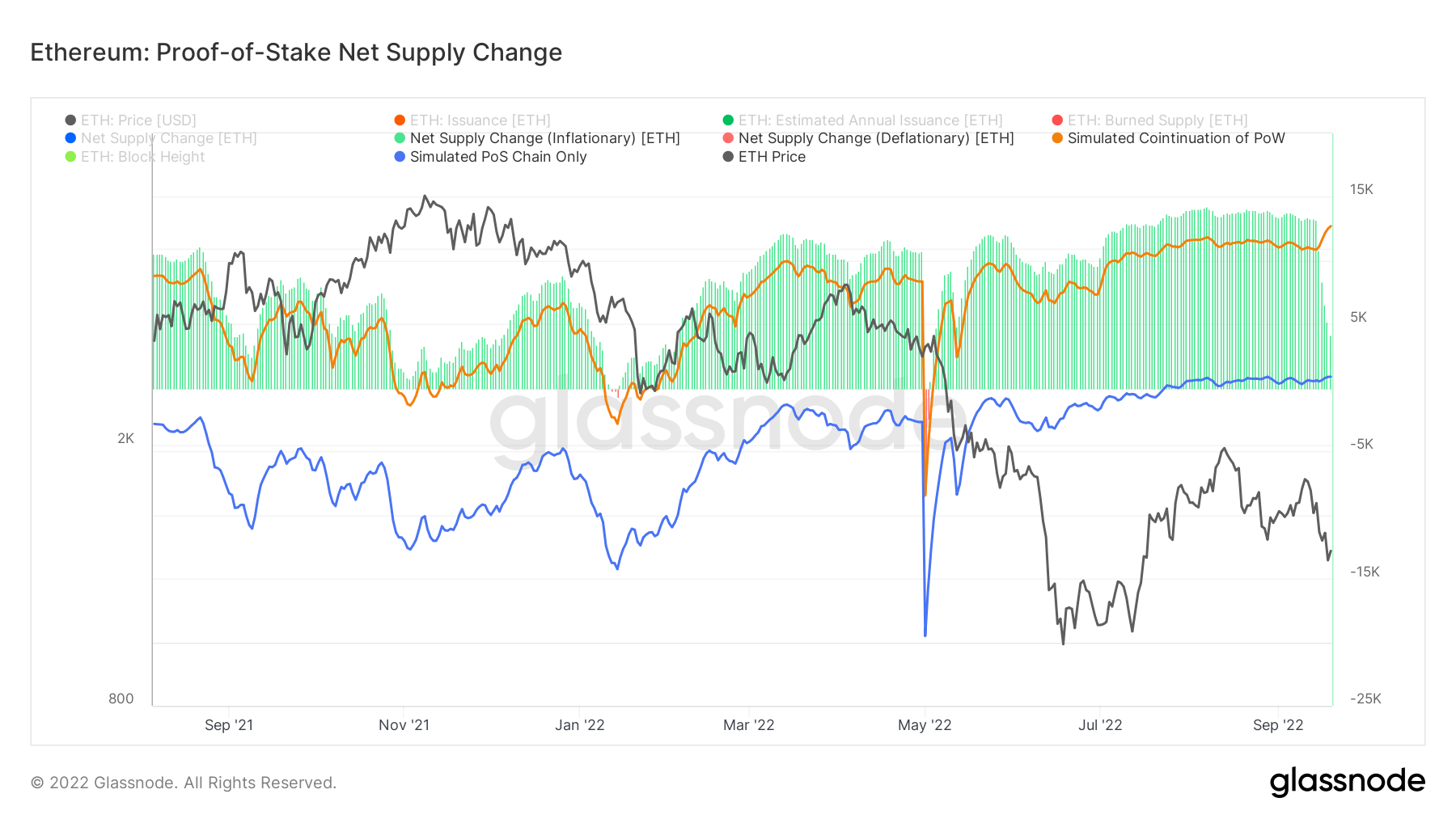

Since EIP-1559 was implemented, ETH has been deflationary for lone precise abbreviated periods — successful January and May 2022. The graph beneath shows the disparity betwixt inflationary and deflationary periods — the erstwhile are marked green, portion the second are marked red.

Chart showing the nett proviso alteration of ETH from September 2021 to September 2022 (Source: Glassnode)

Chart showing the nett proviso alteration of ETH from September 2021 to September 2022 (Source: Glassnode)Nonetheless, PoS managed to trim the proviso of ETH drastically. In the graph above, the orangish enactment represents the simulated proviso if Ethereum continued to beryllium arsenic a PoW system. The bluish enactment represents the simulated proviso if Ethereum existed arsenic a PoS strategy for the past year. The information intelligibly shows that a PoS strategy drastically reduces the proviso of ETH.

The graph besides illustrates that the inflationary unit connected Ethereum has been steadily dropping since the Merge. However, we’re yet to spot whether the reduced unit yet leads to a deflationary supply.

The station Research: Is ETH inflationary oregon deflationary aft the Merge? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)