Ahead of The Merge successful September, respective on-chain datasets bespeak a volatile extremity to proof-of-work connected Ethereum.

Will Ethereum rally into Merge Day, oregon volition determination beryllium a wide “sell the news” event?

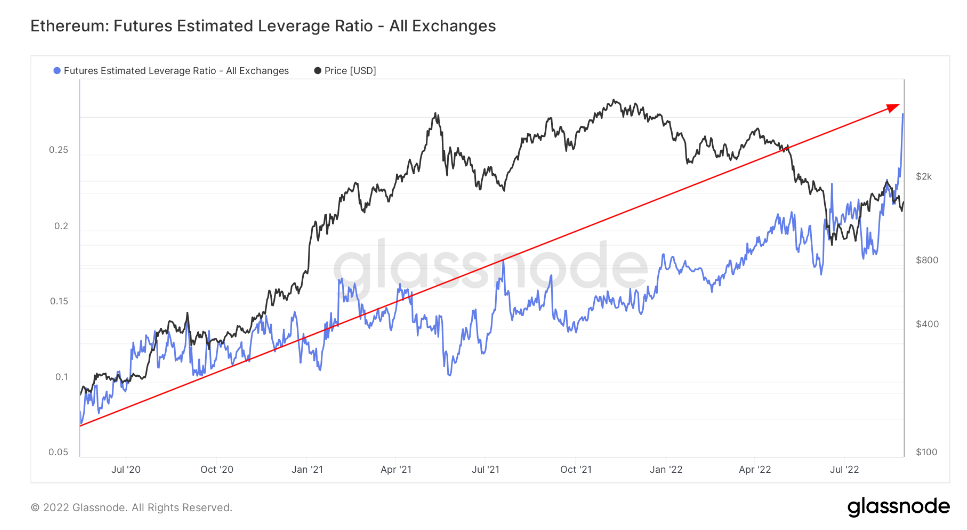

Estimated Leverage Ratios

The measurement of leverage wrong the Ethereum ecosystem has deed all-time highs going into The Merge. The interaction tin beryllium assessed by reviewing the Estimated Leverage Ratio below. An Estimated Leverage Ratio (ELR) is defined by the unfastened involvement ratio successful futures contracts against the equilibrium of the corresponding exchange.

As seen from the chat below, determination has been a important uptick successful ELR successful August. The ELR acts arsenic an Indicator that measures the ratio betwixt unfastened contracts awaiting execution and the reserve of currencies connected futures trading platforms. The graph shows the ELR has reached an all-time precocious of 0.28 — indicating the imaginable for precocious volatility should determination beryllium ample terms swings.

Ethereum: Futures Estimated Leverage Ratio — Source: Glassnode

Ethereum: Futures Estimated Leverage Ratio — Source: GlassnodeAs tin beryllium seen from the graph, determination is small correlation betwixt Ethereum and ELR successful presumption of terms prediction. New all-time highs successful ELR person not historically marked either tops oregon bottoms for Ethereum.

However, the much leverage, unfastened interest, and shorts participating successful the market, the higher the likelihood of volatility, arsenic liquidations tin origin a snowball effect successful either direction.

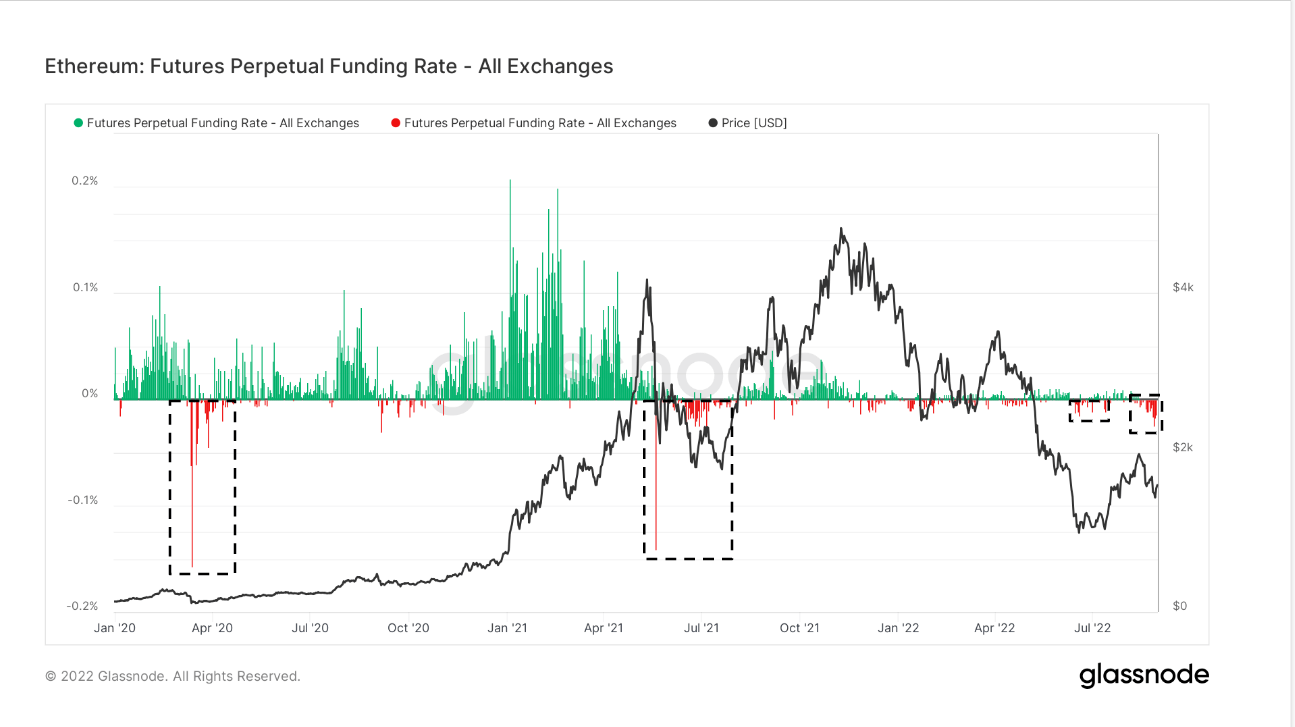

Funding Rates

Funding rates person been highly antagonistic and correlate with different important events wrong the ecosystem, specified arsenic Covid-19, Chinese miner bans, and the Terra Luna collapse.

The Merge is apt the catalyst for the antagonistic backing rates since the commencement of August. Anticipation of The Merge is precocious for those looking to speculate connected terms with plaything trades astir the event.

The illustration beneath highlights the mean backing complaint percent acceptable by exchanges for perpetual futures contracts. When the complaint is positive, agelong positions periodically wage abbreviated positions. Conversely, erstwhile the complaint is negative, abbreviated positions periodically wage agelong positions.

Ethereum: Futures Perpetual Funding complaint — Source: Glassnode

Ethereum: Futures Perpetual Funding complaint — Source: GlassnodeIn caller weeks, determination was neutrality successful backing arsenic rates continuously flipped betwixt affirmative and antagonistic funding, suggesting stability. However, antagonistic backing has been persistent and assertive successful the past week.

The existent levels lucifer the miner sell-off the erstwhile summer, which marked the rhythm bottom, akin to Covid. When shorts are bold, this has historically marked a rhythm bottom.

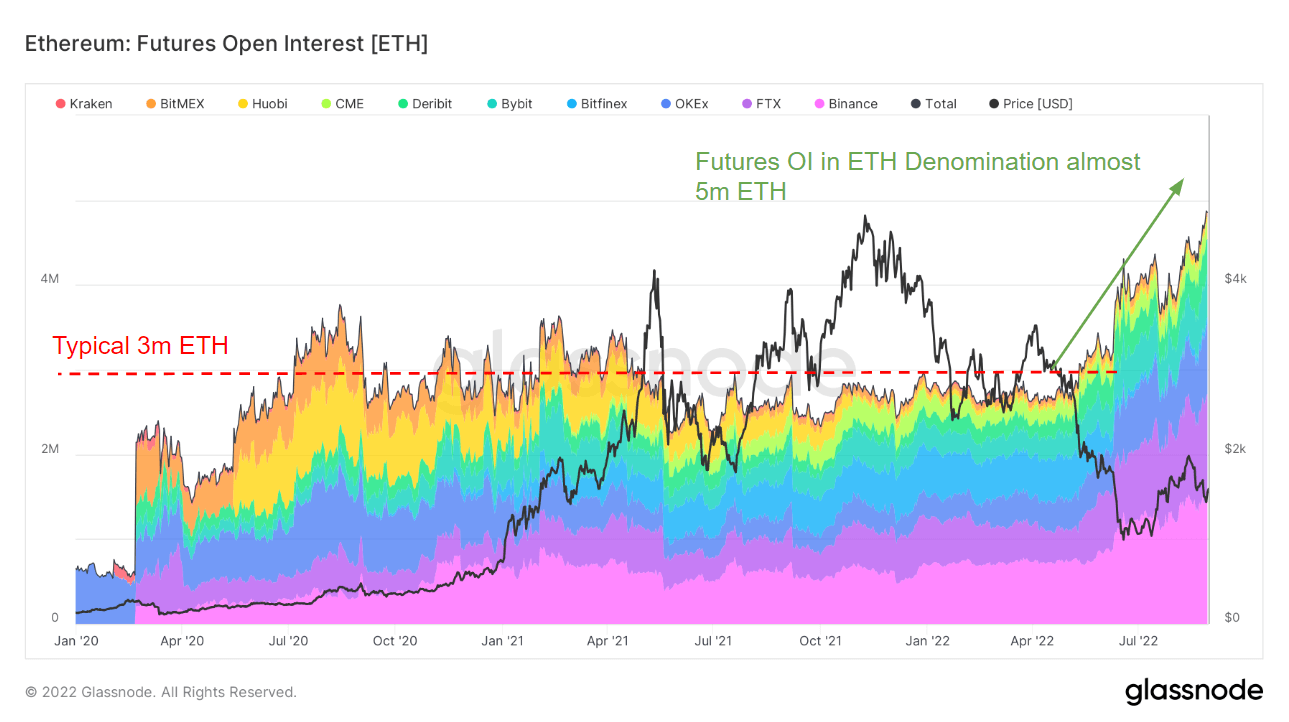

Open Interest

Since the commencement of May, Ethereum futures markets person seen a melodramatic summation successful unfastened interest. Open involvement lifted disconnected the baseline of astir 3 cardinal ETH and reached caller heights of 5 cardinal ETH successful August. The maturation was led by a fistful of exchanges — chiefly Binance, Deribit, OKEx, Bybit, FTX, and CME.

The illustration beneath shows the full magnitude of funds — successful autochthonal coin ETH — allocated successful unfastened futures contracts.

Source: Glassnode

Source: GlassnodeComparing unfastened involvement successful an ETH denomination helps isolate periods of maturation successful futures leverage from coin terms changes. On a USD basis, the existent unfastened involvement is $8 billion, which is comparatively debased and equivalent to the aboriginal bull marketplace successful January 2021.

The signifier is acceptable for 1 of the biggest days successful net past arsenic Merge Day comes ever closer. The information suggests that we’re successful for a rollercoaster of a ride, and you tin ticker each infinitesimal of it unrecorded with CryptoSlate during our Ethereum Merge Watch Party connected September 14.

Follow CryptoSlate connected Twitter oregon Subscribe connected YouTube to find the nonstop clip and day erstwhile it is confirmed.

We volition beryllium joined by MetaMask, PolkaStarter, Xborg, DefiYieldApp, Swissborg, Coin Bureau, Crypto busy, and many, galore much — truthful don’t miss retired connected the lone spot to beryllium connected Merge Day.

The station Research: Liquidations, volatility expected up of Ethereum’s Merge arsenic leverage, unfastened involvement and shorts deed all-time high appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)