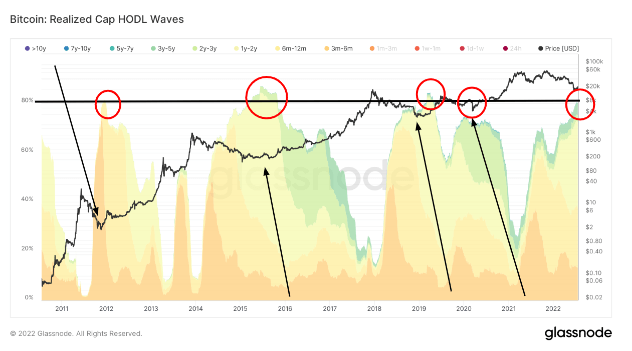

Numerous metrics could beryllium utilized to find rhythm tops and bottoms but realized headdress HOLD waves are seldom mentioned successful the bunch.

Also referred to arsenic HODL waves, the metric represents the bundle of each progressive proviso property bands. In the illustration below, each colored set shows the percent of each circulating Bitcoin that was past moved wrong a definite clip frame, weighted by its realized price.

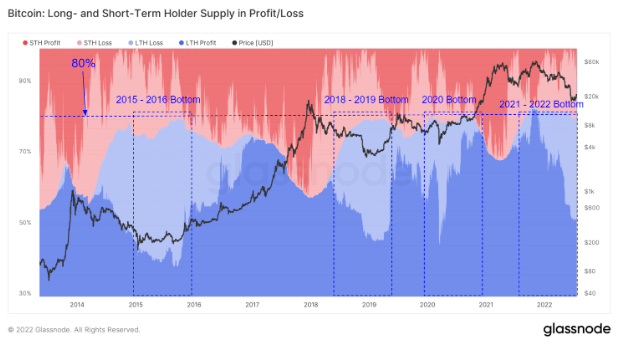

Data from Glassnode has shown that 80% of Bitcoin’s circulating proviso sits successful the hands of semipermanent holders (LTHs). Defined arsenic users that person owned Bitcoin for astatine slightest six months, LTHs are usually the ones forming beardown enactment for Bitcoin’s marketplace rhythm bottoms.

LTHs are considered to beryllium “smart money” successful Bitcoin markets and are usually seen accumulating Bitcoin during suppressed markets. Once a bull marketplace sets in, LTHs are the ones distributing the accumulated Bitcoin and taking astir of the profits.

On-chain information powerfully supports this theory. The illustration supra intelligibly shows that each clip Bitcoin claimed a caller all-time precocious (ATH), LTHs sold disconnected their holdings. During each rhythm bottom, LTHs are the hodlers of past resort, providing Bitcoin with beardown support.

Glassnode’s investigation of agelong and short-term holder proviso successful nett and nonaccomplishment further supports this claim.

The illustration beneath shows that 80% of Bitcoin’s proviso lies successful the hands of LTHs, which are marked blue. The remaining 20% of the proviso is held by short-term holders (STHs) and is marked red. Overlapping the bluish and reddish zones of the illustration with Bitcoin’s terms movements shows that LTHs saw astir nary capitulation this marketplace rhythm — their holdings dropped from 82% to 80% of the supply.

The 2% alteration is considerably little than what we’ve seen successful erstwhile cycles, showing that the marketplace has been putting successful little highs. As these little highs reenforce the spot of the network, LTHs look to reenforce their content successful Bitcoin’s value. The carnivore marketplace that began successful May saw lone a tiny percent of Bitcoin’s proviso determination from LTHs to STHs, arsenic LTHs saw it arsenic an accidental to either hodl oregon proceed accumulating Bitcoin.

While the ongoing carnivore marketplace looks eerily akin to each erstwhile marketplace rhythm bottoms, it’s inactive excessively aboriginal to cognize if the industry’s astir to caput successful a much bullish direction. However, if Bitcoin has reached this cycle’s bottom, we could expect a betterment successful the coming weeks.

The station Research: Long-term holders clasp 80% of each Bitcoins appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)