With the 14th day of the Great Financial Crisis of 2008 approaching, we are astir to participate a caller indebtedness rhythm that could reset the market. Navigating upcoming crises requires a heavy knowing of however each erstwhile indebtedness crises worked and wherefore they happened.

Ray Dalio, the laminitis and president of Bridgewater Associates, was the archetypal to enactment retired the mentation of the archetypal large indebtedness cycles. Dalio separates these into short-term and semipermanent cycles, wherever short-term ones past 5 to 7 years and semipermanent ones past astir 75 years.

These archetypes signifier the instauration of Bridgewater’s concern strategy and person served arsenic a lifeboat that enabled the hedge money to navigate economical turmoil successful the past 30 years.

Looking astatine the existent marketplace done this lens shows that we are nearing the extremity of the rhythm that began successful 1944 with the signing of the Bretton Woods agreement. The Bretton Woods strategy brought connected what tin efficaciously beryllium called the U.S. dollar satellite bid — which continued adjacent aft the abandonment of the golden modular successful 1971.

Debt cycles

In a indebtedness cycle, the scarcity of recognition determines wherever the wealth ends up. When recognition is abundant, and wealth flows done the economy, radical put successful scarce assets similar golden oregon existent estate. When recognition is scarce and there’s a deficiency of wealth successful the economy, radical crook to cash, and scarce assets spot their worth drop.

Since 2008, involvement rates person either been incredibly debased oregon adjacent zero, drastically expanding the economy’s abundance of recognition and money. This diminution led to a notable summation successful the worth of scarce assets specified arsenic golden and existent property and speculative investments similar stocks.

The astir utmost illustration of this inclination is seen successful the U.S., arsenic it’s the largest market-driven system successful the world. However, this inclination led to the debt-to-GDP ratio successful the U.S. rising implicit 100%, making its system highly delicate to the movements of involvement rates.

Historically, each clip the marketplace has seen a notable question of involvement rates, a liquidity situation ensued. With the Federal Reserve expected to proceed aggressively hiking involvement rates good into adjacent spring, the marketplace could beryllium gearing up for an unprecedented liquidity crisis.

Bitcoin paints a picture

Understanding the scope of the situation requires taking a heavy look into Bitcoin. Although it’s inactive among the astir caller plus classes, Bitcoin is 1 of the astir liquid assets successful the world.

In the past year, Bitcoin’s show served arsenic a frontrunner to the show of each different markets.

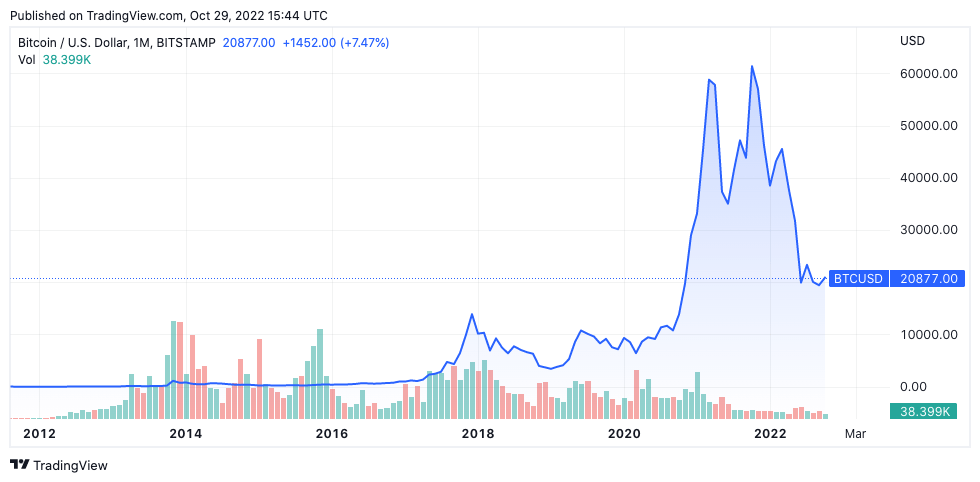

At the opening of November 2021, Bitcoin reached its all-time precocious of $69,000.

Graph showing Bitcoin’s terms from November 2011 to October 2022 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from November 2011 to October 2022 (Source: CryptoSlate BTC)Just nether 2 months later, astatine the extremity of December 2021, the S&P 500 saw its peak.

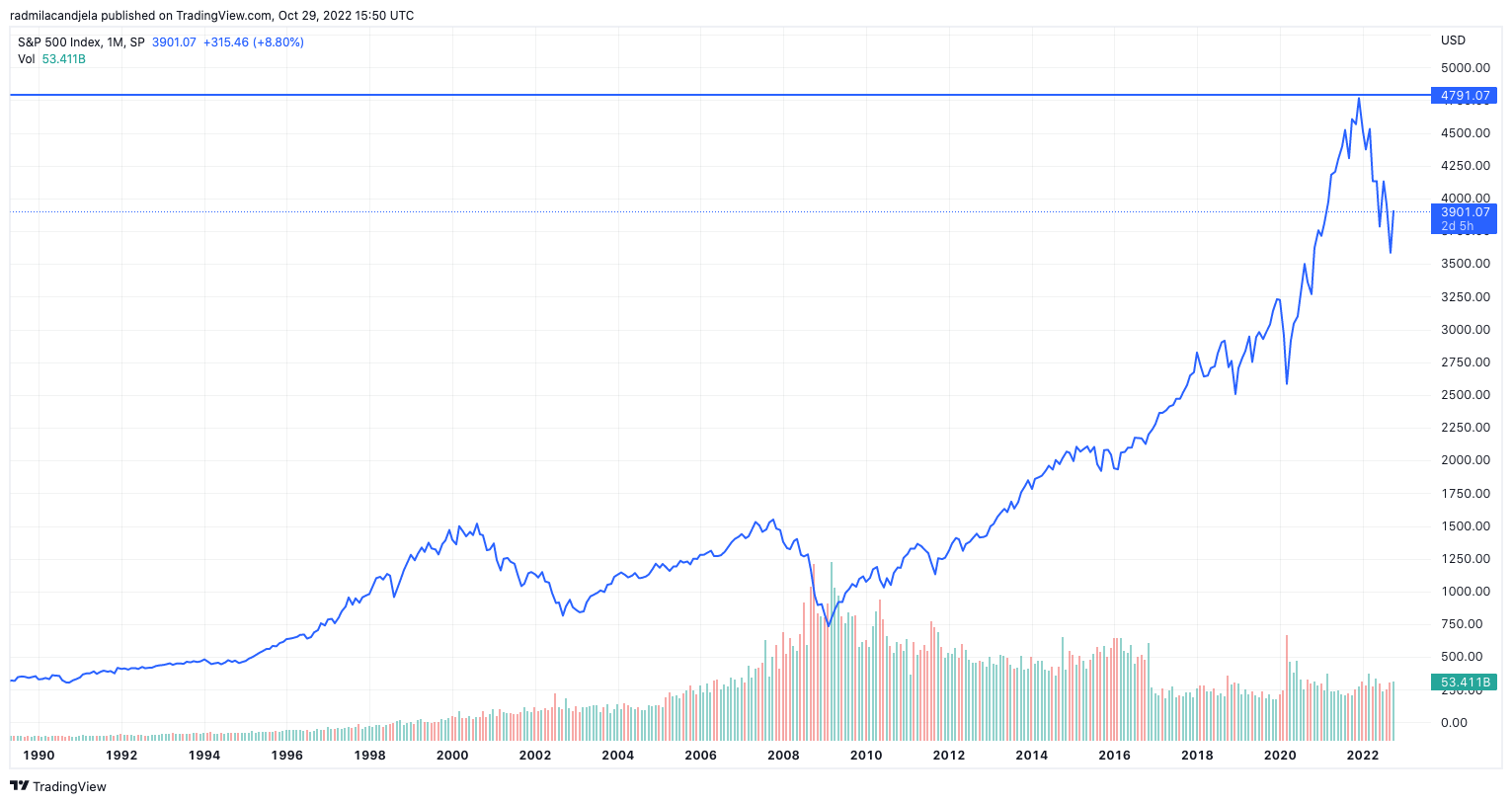

Graph showing the S&P 500 scale from 1990 to 2022 (Source: TradingView)

Graph showing the S&P 500 scale from 1990 to 2022 (Source: TradingView)In March 2022, gold followed suit and reached its all-time high.

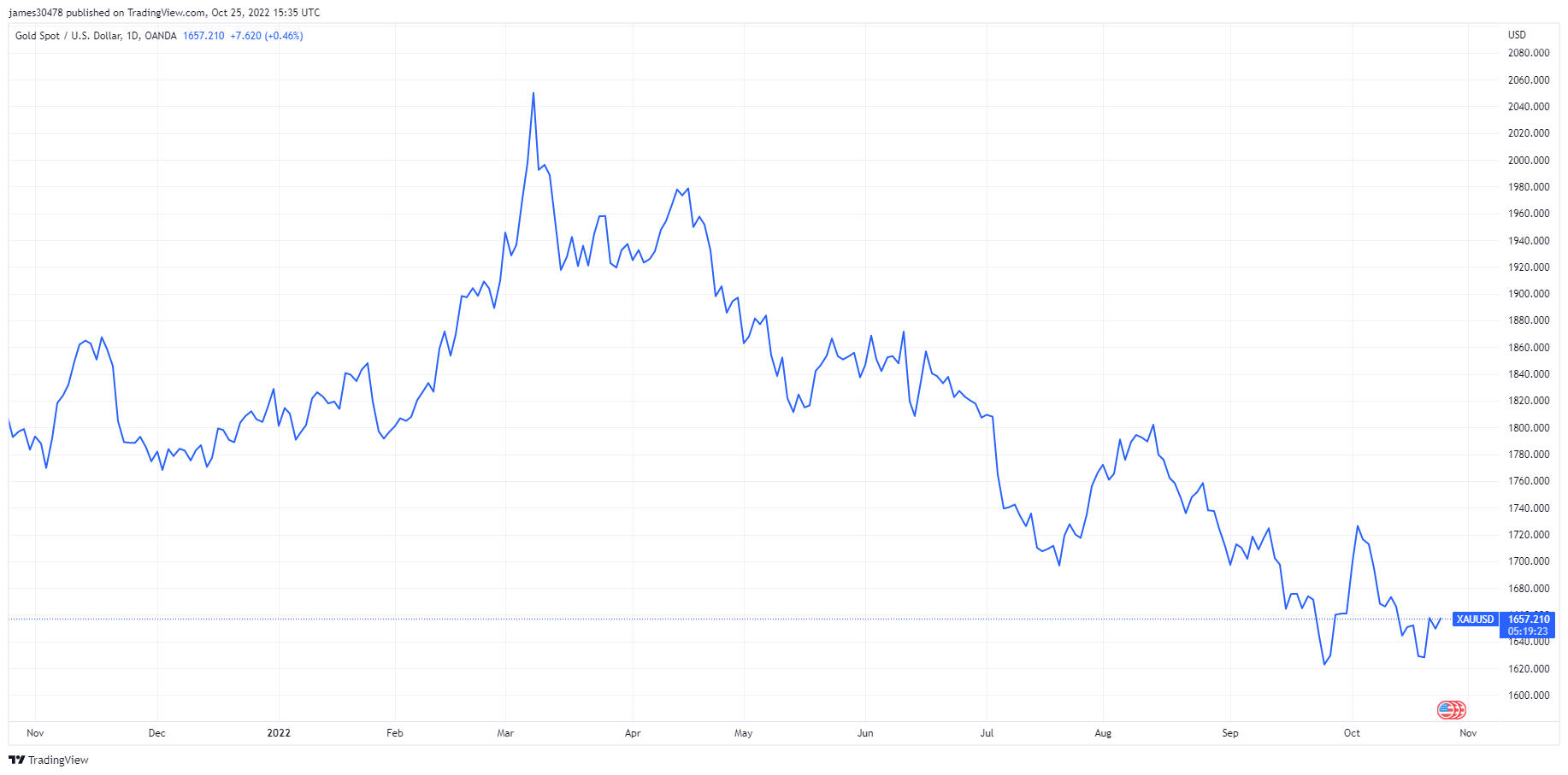

Graph showing the terms of golden from October 2021 to October 2022 (Source: TradingView)

Graph showing the terms of golden from October 2021 to October 2022 (Source: TradingView)Alternative assets

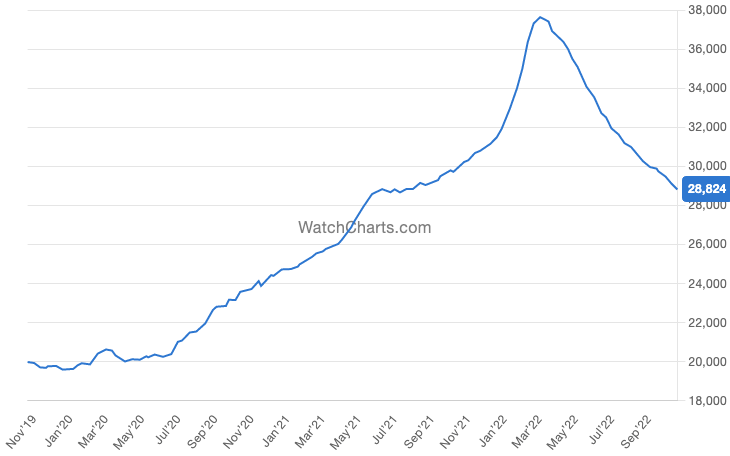

Watches, cars, and jewelry person besides seen their highest alongside golden arsenic an abundance of wealth successful the system pushed radical to put successful luxury and scarce assets. This inclination is evident successful the Rolex Market Index, which shows the fiscal show of the apical 30 Rolex watches connected the secondhand market.

Graph showing the Rolex Market Index worth successful USD from November 2019 to October 2022 (Source: WatchCharts.com)

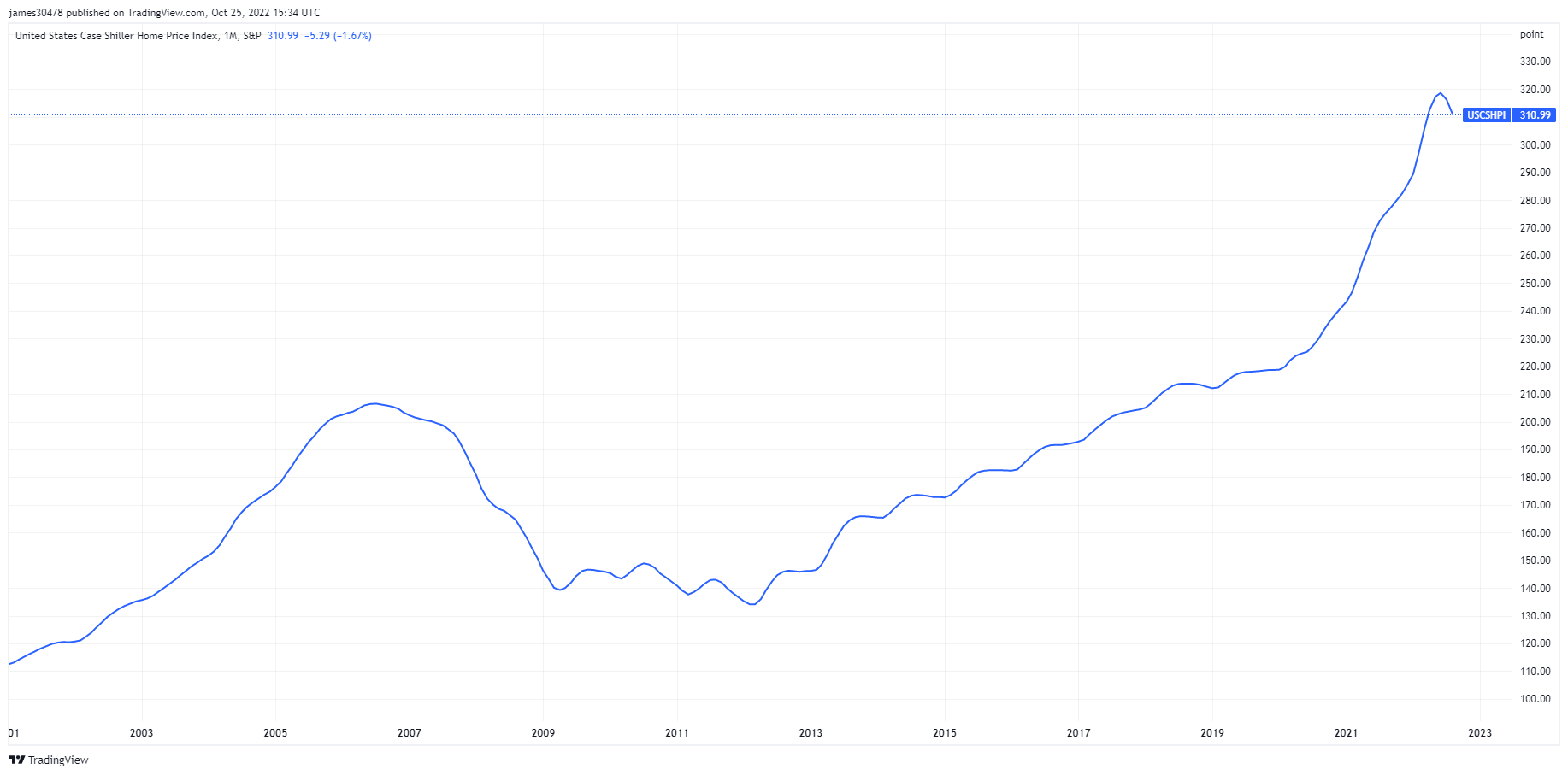

Graph showing the Rolex Market Index worth successful USD from November 2019 to October 2022 (Source: WatchCharts.com)And now, arsenic their astir illiquid asset, existent property is astir to spot a crisp fall. The lodging marketplace successful the U.S. reached its highest successful September 2022, with the Case Shiller Home Price Index reaching its all-time precocious of 320. The Federal Reserve’s assertive complaint hike has caused owe rates successful the state to treble successful little than six months. When combined with soaring ostentation and a struggling market, rising owe rates are acceptable to propulsion lodging prices downwards and hitch retired billions from the existent property market.

Graph showing the U.S. Case Shiller Housing Price Index from 2003 to 2022 (Source: TradingView)

Graph showing the U.S. Case Shiller Housing Price Index from 2003 to 2022 (Source: TradingView)The station Research: Measuring liquidity with Bitcoin: Why this situation spells occupation for Rolexes and existent estate appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)