Catching the coveted Bitcoin bottommost requires analyzing much than conscionable its price. One of the astir reliable indicators of marketplace bottoms has historically been miner data. Often considered to beryllium 1 of the astir resilient players successful the crypto ecosystem, miners capitulate lone erstwhile Bitcoin becomes excessively costly to mine.

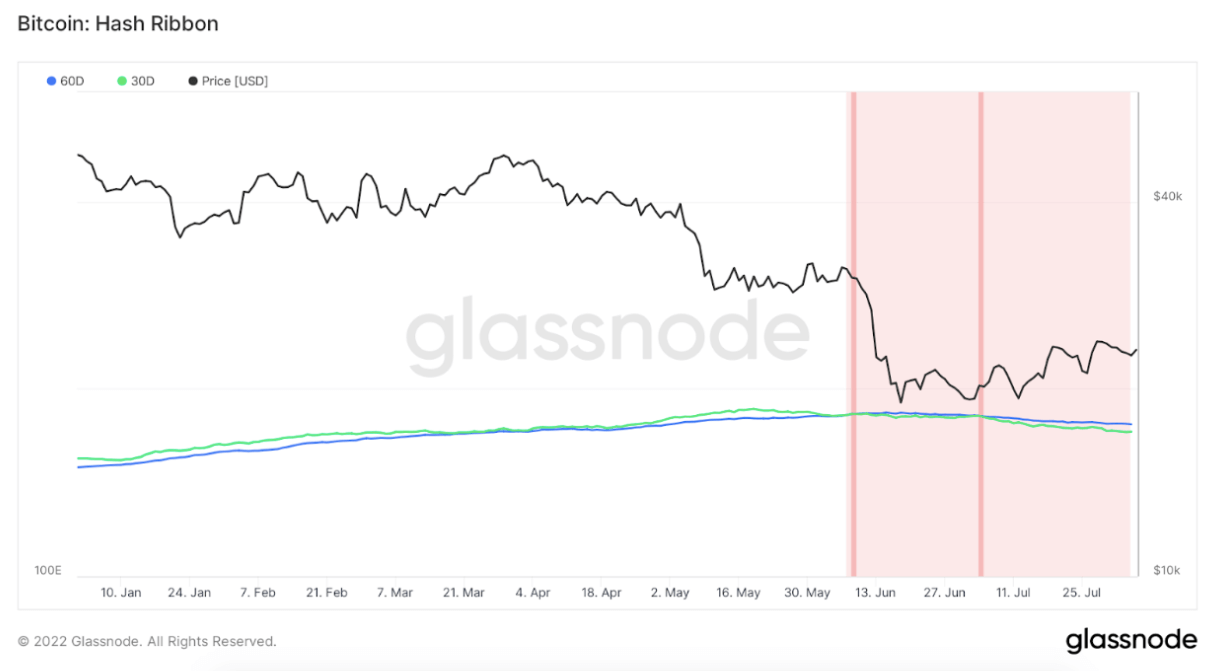

Hash ribbons are a unsocial metric utilized to find whether the marketplace is presently successful its carnivore oregon bull phase. The indicator contains the 30-day and the 60-day elemental moving mean (SMA) of Bitcoin’s hash rate. The 30-day SMA dropping beneath the 60-day 1 shows the opening of a carnivore marketplace and shows miners person begun to capitulate.

Data shows that the marketplace has been successful a miner capitulation mode for astir 60 days straight. The worse of miner capitulation volition beryllium implicit erstwhile the 30-day SMA crosses supra the 60-day SMA. However, the quality betwixt moving averages lasting inactive for days connected extremity makes it hard to find erstwhile we could spot a inclination reversal.

Graph showing Bitcoin’s hash ribbon indicator successful 2022 (Source: Glassnode)

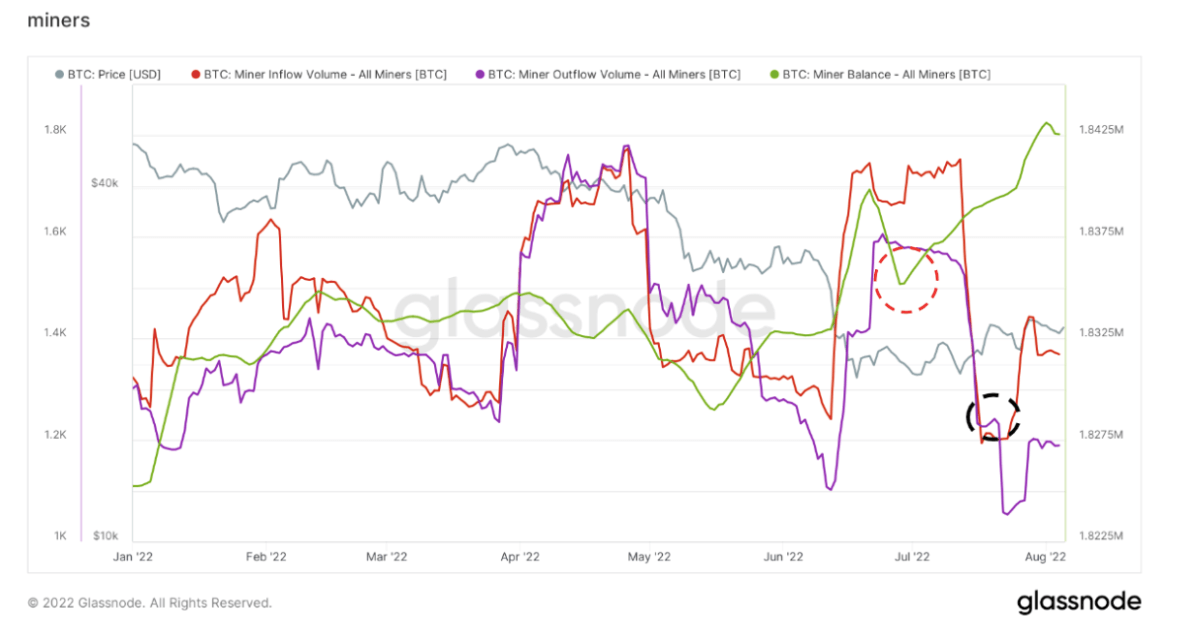

Graph showing Bitcoin’s hash ribbon indicator successful 2022 (Source: Glassnode)However, analyzing miner balances shows that the worst has passed, and miners person begun to recover. Miner balances look astatine the full proviso held successful addresses that beryllium to miners to find whether they’ve been selling disconnected their assets. According to information from Glassnode, miner balances recovered from the lows they reached successful June and are the highest they’ve been since October 2017 (highlighted successful red).

Alongside balances recovering, we’ve besides seen miner outflows from exchanges concisely surpass inflows to speech addresses (highlighted successful black). This shows that much miners person been withdrawing their BTC from exchanges than they’ve been depositing it to merchantability connected the market.

Graph comparing miner balances to miner inflows and outflows from exchanges successful 2022 (Source: Gassnode)

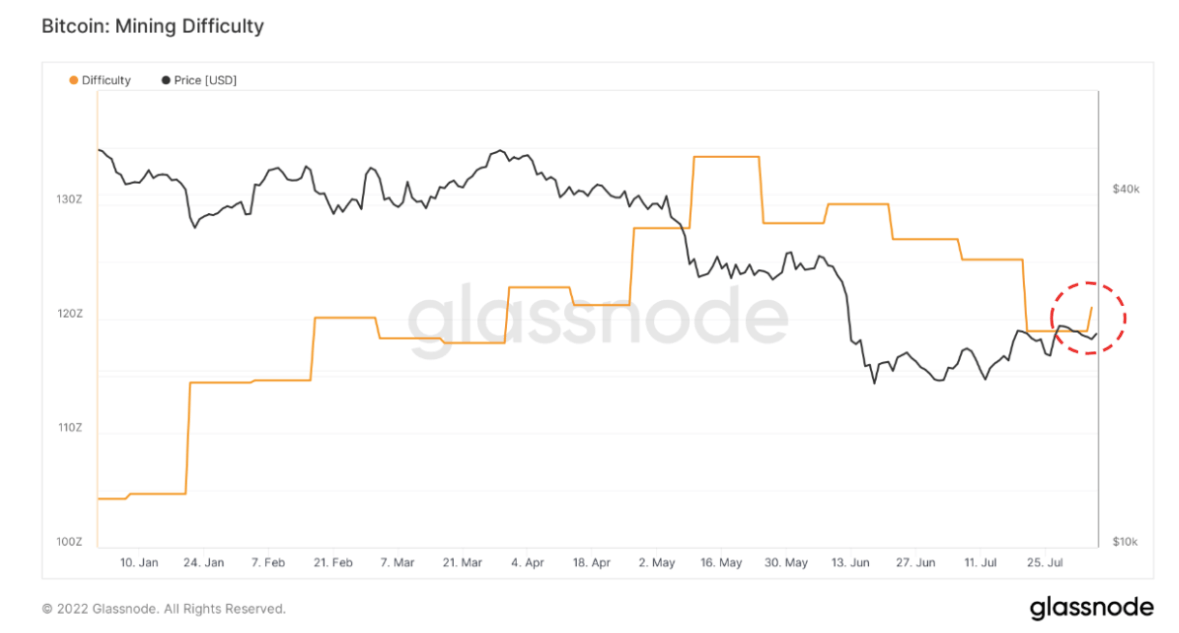

Graph comparing miner balances to miner inflows and outflows from exchanges successful 2022 (Source: Gassnode)The trouble accommodation besides shows that Bitcoin could person reached its bottom. Defined arsenic the existent estimated fig of hashes required to excavation a block, the trouble accommodation accrued for the archetypal clip since June, rising by 1.7%. The summation shows that the Bitcoin mining trouble could person bottomed astatine the opening of August. If Bitcoin tin proceed holding its terms alongside the $23,000 resistance, we mightiness not revisit these mining trouble lows immoderate clip soon.

Graph showing Bitcoin’s mining trouble successful 2022 (Source: Glassnode)

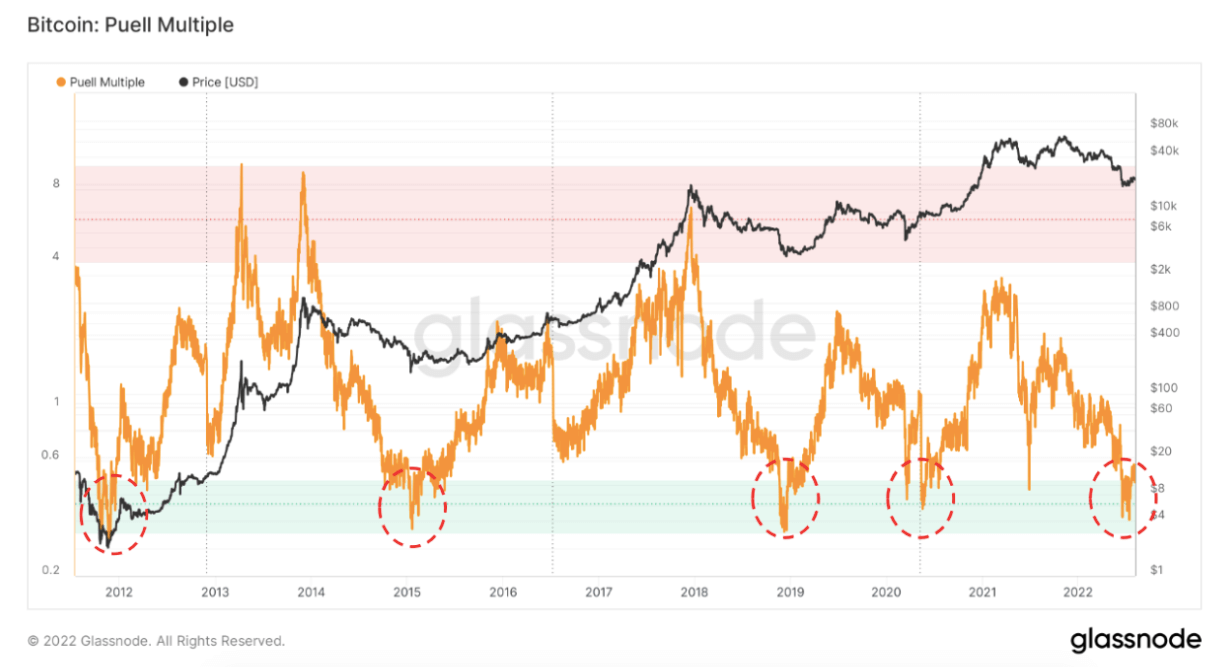

Graph showing Bitcoin’s mining trouble successful 2022 (Source: Glassnode)Lastly, different reliable indicator of marketplace bottoms besides seems to beryllium flashing red. The Puell Multiple is an indicator utilized to find mining probability by calculating the ratio of regular coin issuance successful USD and the 365-day moving mean of regular coin issuance value. When the Puell Multiple is low, it shows that miner profitability is debased compared to the yearly average. When the indicator is high, miner profitability is high, and it incentivizes miners to liquidate their treasuries.

The Puell Multiple has marked erstwhile rhythm bottoms with a bully grade of accuracy — it flashed bottommost signals successful November 2011, January 2015, November 2018, and May 2020. Data has shown that the Puell Multiple has near the greenish portion for the archetypal clip since June and is climbing dilatory and steadily. And portion the indicator has gone successful and retired of the greenish portion successful erstwhile marketplace cycles, the outlook remains positive.

Graph showing the Puell Multiple indicators for Bitcoin (Source: Glassnode)

Graph showing the Puell Multiple indicators for Bitcoin (Source: Glassnode)The station Research: Miner information shows Bitcoin could person bottomed appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)