The 2nd largest cryptocurrency by marketplace cap, Ethereum (ETH), implemented a token pain mechanics connected Aug. 5, 2021, done the Ethereum Improvement Proposal (EIP) 1559 upgrade. Since then, astir $9 cardinal worthy of tokens person been burned cumulatively, information from Glassnode indicates.

A full of astir 2.8 cardinal ETH tokens person been removed from the proviso since the pain mechanics was instituted, according to information from ultrasound.money.

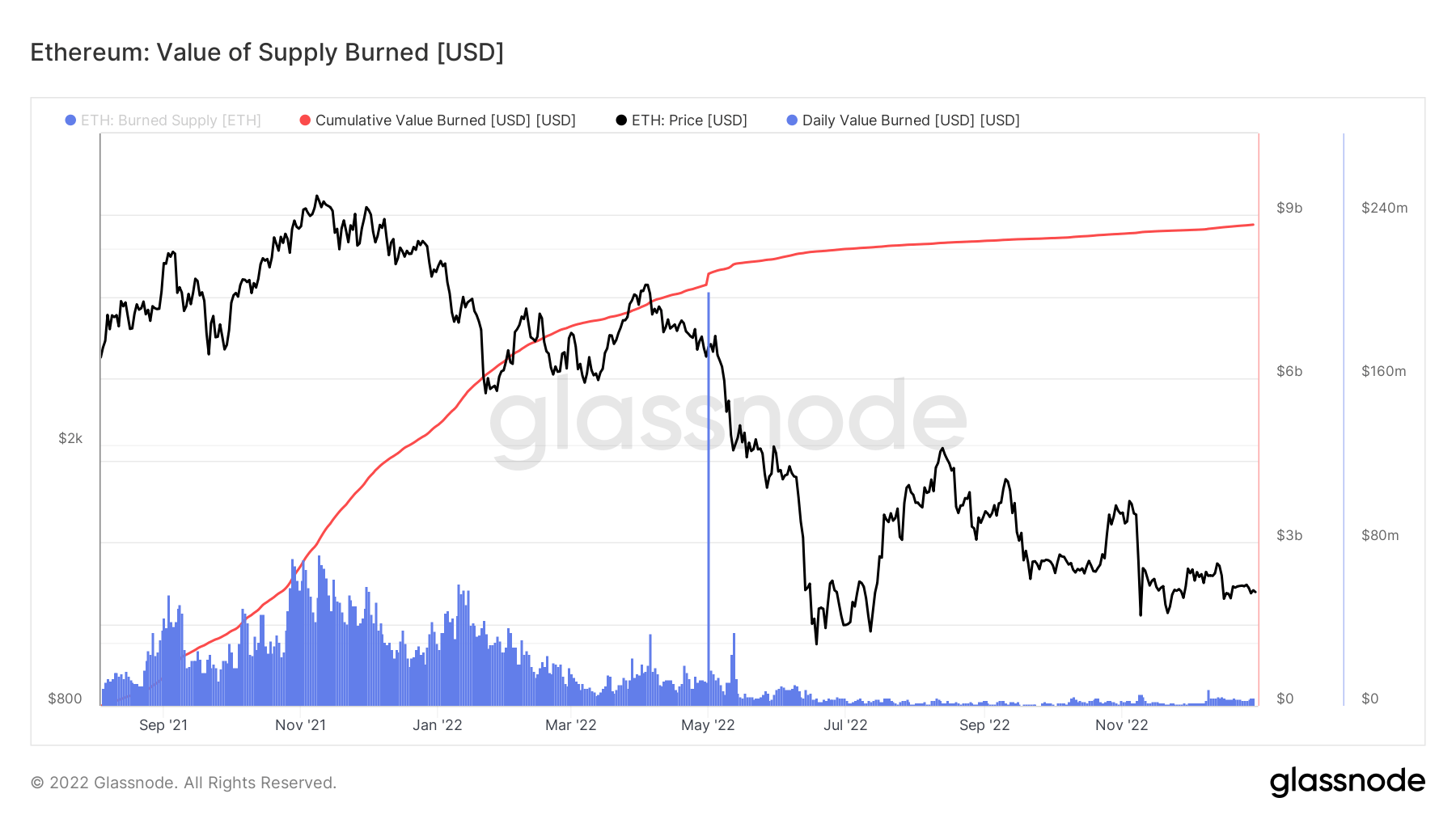

Cumulative worth of ETH proviso burned. Source: Glassnode

Cumulative worth of ETH proviso burned. Source: GlassnodeIn the supra illustration from Glassnode, bluish reflects the regular ETH proviso burned astatine the spot price, portion reddish stands for the cumulative worth of ETH burned implicit time. An investigation of the Glassnode information by CryptoSlate suggests that Ethereum’s regular pain complaint has decreased importantly and astir stagnated since the illness of Terra-Luna successful May 2022.

During the bull tally of 2021, $20 cardinal to $75 cardinal worthy of ETH was being destroyed daily. This has fallen to lone astir $2 cardinal to $4 cardinal worthy of ETH burned each time successful December 2022. According to ultrasound.money, 1,896.30 ETH, worthy astir $2.2 cardinal was burned implicit the past day.

It is to beryllium noted that the autumn successful the regular pain complaint of Ethereum is simply a nonstop reflection of the autumn successful Ethereum enactment amid the existent carnivore market.

Understanding the value of ETH burn

Buring of tokens refers to sending tokens to an code from which the tokens go irretrievable. Also referred to arsenic destroying tokens, burning tokens reduces the asset’s circulating proviso and contracts wide proviso implicit time. The burning mechanics aimed to modulate Ethereum’s state fees — the fees paid for carrying retired transactions connected Ethereum.

Prior to the pain mechanism, Ethereum users had to conjecture the fees they had to wage to person their transactions included successful the blockchain. This caused precocious volatility successful Ethereum state fees, particularly during times of precocious web congestion.

With millions of users complaining astir steep state fees, the Ethereum web incorporated the token pain mechanism. As per the EIP 1559 upgrade, users are required to wage a basal interest and a tip. This is equivalent to users paying a basal interest for transportation and a extremity to transportation executives for delivering connected oregon earlier time. While the web burns each basal fees, the extremity is rewarded to miners.

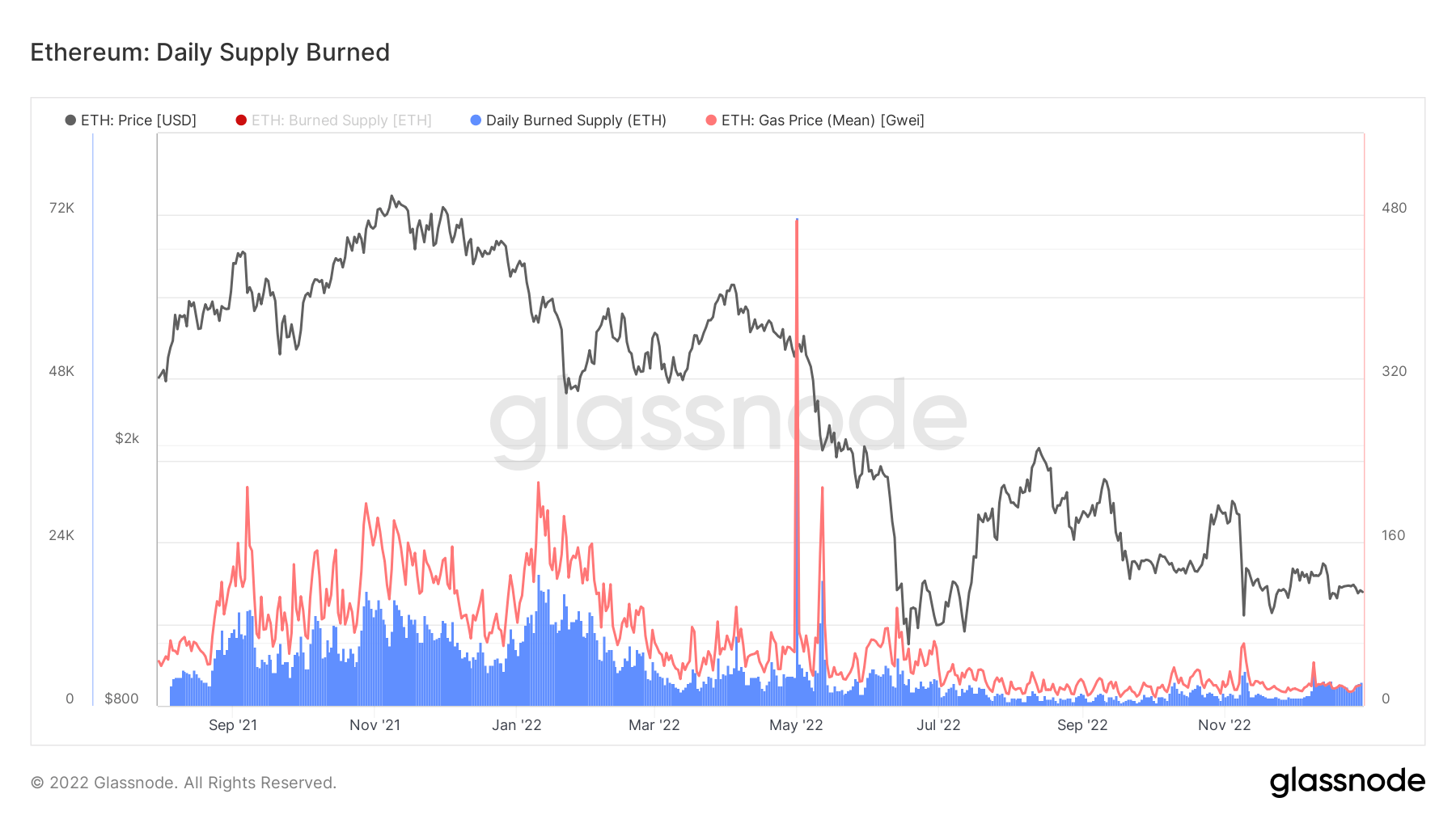

A heavy dive into the regular ETH proviso burned and state fees information from Glassnode indicates that the mean state interest has fallen importantly to astir 15-20 Gwei from astir 100 Gwei anterior to the implementation of EIP 1559. For instance, the mean state interest ranged from 100 to 200 Gwei betwixt January and April 2021, portion it changeable up beyond 200 Gwei during web congestion.

In different words, Ethereum’s mean state fees decreased by astir 80% since the implementation of the burning mechanism.

Daily proviso burn

Daily proviso burnThe mean Ethereum state interest was 20.55 Gwei connected Dec. 30, according to Etherscan data. Moreover, information from ultrasound.money indicates that the mean Ethereum state fees stood astatine 16.2 Gwei implicit the past 30 days.

In summation to regulating state prices, the ETH burning mechanics was introduced to enactment deflationary unit connected the token. In different words, the pain mechanics reduces the proviso of ETH which tin origin the terms of ETH to summation implicit time. This is due to the fact that the terms of immoderate plus is affected by the request and proviso law, which states that a alteration successful proviso causes the terms to increase.

At the clip of writing, Ethereum’s ostentation complaint oregon its nett issuance complaint stood astatine 0.013% per year, arsenic per ultrasound.money data. If Ethereum had not switched to a proof-of-stake (POS) statement mechanism, its issuance complaint would person stood astatine 3.588% per year. With the power to POS, Ethereum’s ostentation complaint has fallen acold beneath that of Bitcoin (BTC), which issues caller coins astatine the complaint of 1.716% per year.

As per ultrasound.money estimates, astir 1.9 cardinal ETH tokens are expected to beryllium burned per year, portion lone 622,000 ETH tokens are expected to beryllium issued each year.

Ethereum’s terms is presently struggling amid the crypto wintertime — ETH was trading astatine $1,196.52 astatine the clip of writing, down 67.88% for the year. However, with the token pain mechanism, ETH is expected to go deflationary, which could pb to an summation successful its worth successful the agelong term.

The station Research: Nearly $9B worthy of ETH was burned successful 1.4 years appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)