CryptoSlate analysts examined the state usage shares of antithetic transaction categories connected the Ethereum (ETH) web and recovered that the NFTs class accounted for 28% successful the archetypal period of the year.

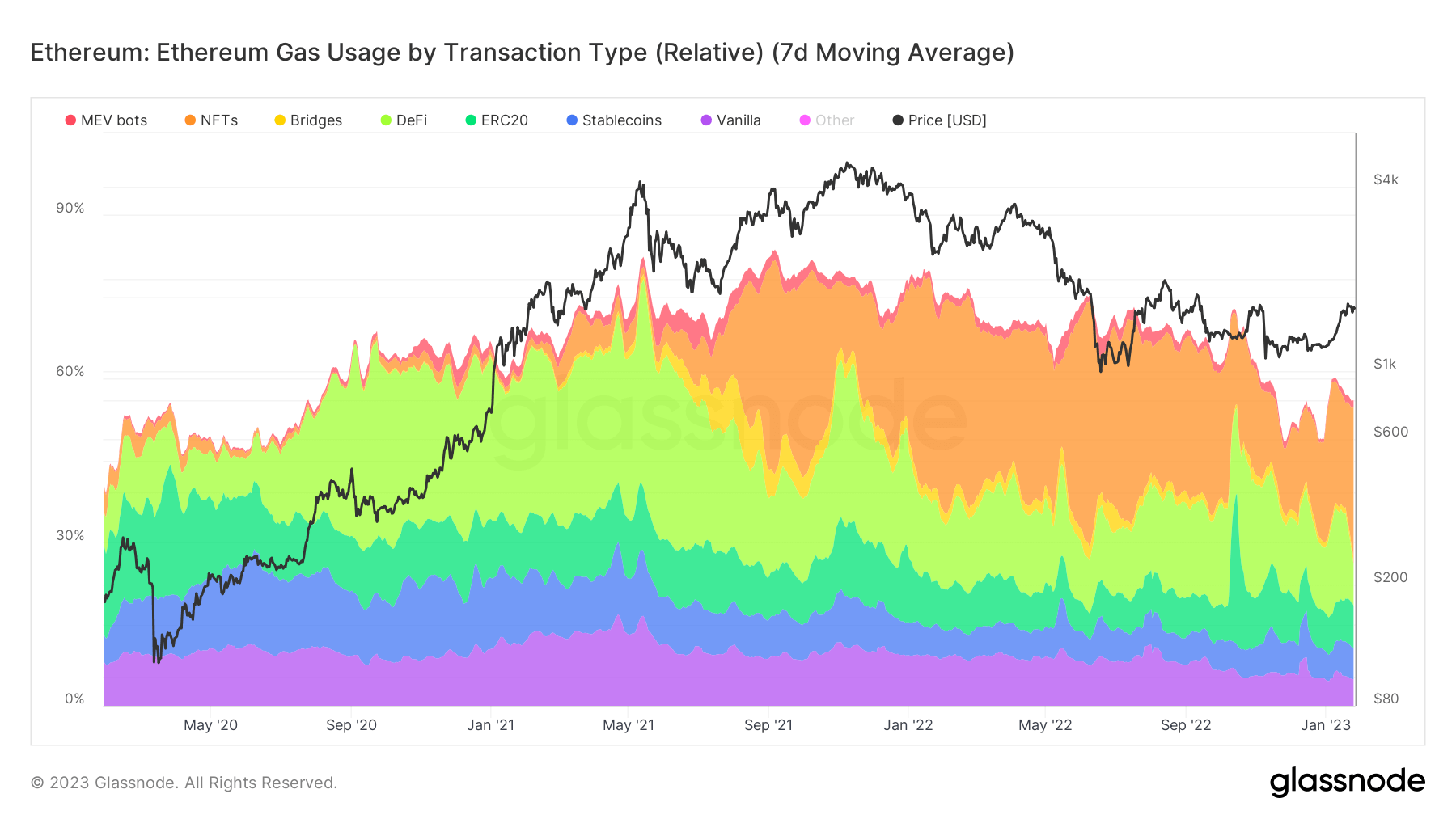

The investigation divides each transactions connected the ETH web into 8 categories arsenic Vanilla, ERC20, Stablecoins, DeFi, Bridges, NFTs, MEV Bots, and others.

The second, third, and 4th categories that occupied the astir important state usage by stock appeared arsenic Defi, ERC20, and stablecoins, with 8% for Defi and ERC20 and 6% for stablecoins.

The categories

The vanilla class includes axenic ETH transfers betwixt Externally Owned Accounts (EOAs) issued without calling immoderate contracts. The ERC20 people counts each transactions that telephone ERC20 contracts, excluding stablecoin transactions.

The stablecoins class represents each fungible tokens that person their worth pegged to an off-chain plus either by the issuer oregon by an algorithm. This class includes implicit 150 stablecoins, with Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI) being the astir salient ones.

The Defi class covers each on-chain fiscal instruments and protocols implemented arsenic astute contracts. Decentralized exchanges (DEXs) besides autumn nether this category. More than 90 Defi protocols are represented nether this section, including Uniswap (UNI), Etherdelta, 1 inch (1INCH), Sushiswap (SUSHI), and Aave (AAVE).

Bridges correspond each contracts that let the transportation of tokens betwixt antithetic blockchains and includes implicit 50 bridges specified arsenic Ronin, Polygon (MATIC), Optimism (OP), and Arbitrum (ARBI).

All transactions interacting with non-fungible tokens autumn nether the NFTs category. This conception includes some ERC721 and ERC1155 token declaration standards and NFT marketplaces for trading them.

MEV bots, oregon Miner Extractable Value bots, correspond bots that automatically execute transactions for nett by reordering, inserting, and censoring transactions wrong blocks.

All remaining ETH transactions are gathered nether the Other category.

Gas usage by category

The illustration beneath represents the comparative magnitude of state consumed by each class successful the ETH network. The chat starts from January 2020 and represents the state usage stock of each class with a antithetic color.

At archetypal glance, the NFTs, Defi, ERC20, Stablecoins, and Vanilla categories basal retired arsenic they person the astir disposable shares successful full state fees.

At archetypal glance, the NFTs, Defi, ERC20, Stablecoins, and Vanilla categories basal retired arsenic they person the astir disposable shares successful full state fees.

According to the data, the NFTs class presently accounts for 28% of the full state fees connected the ETH network, which is represented with the orangish zone. This category’s stock was lone astir 4% successful aboriginal May earlier the pandemic started.

The Defi takes up the 2nd largest stock with 8%, represented by the airy greenish area. Both the NFTs and the Defi class recorded an summation successful state interest shares since the pandemic started. The ERC20 class accounts for 8% of the full state share. Represented by the acheronian greenish area, the category’s stock halved from 16% successful October 2022.

In the meantime, stablecoins’ percent remained flat, astir 5-6%, arsenic tin beryllium seen from the acheronian bluish portion arsenic well. Finally, the vanilla class continued to relationship for astir 5% of full state fees.

Gas usage by NFTs

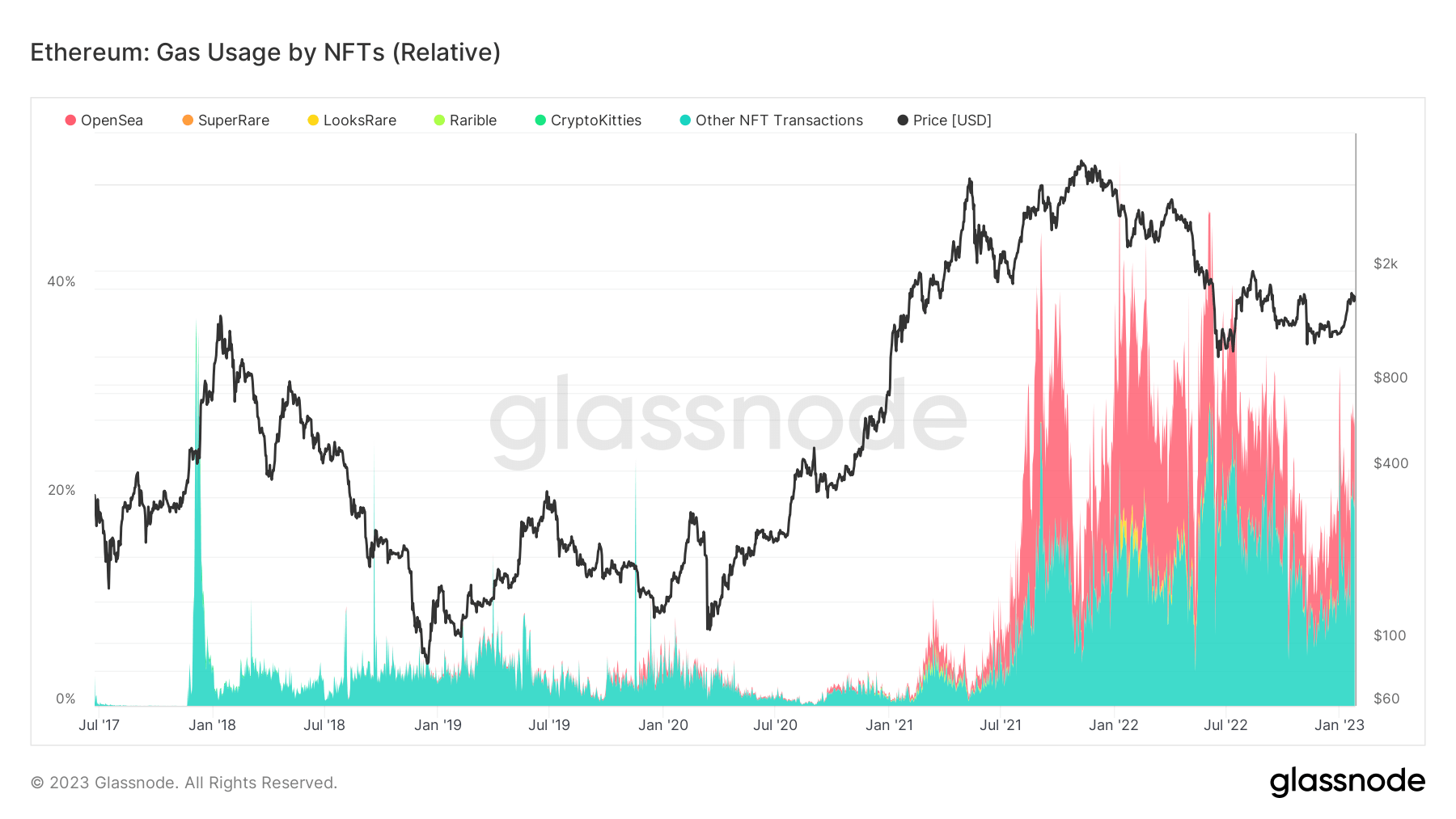

Looking astatine the state usage of the NFTs class successful detail, OpenSea appears arsenic dominant. The illustration beneath represents the NFT marketplaces’ stock successful state usage since the opening of 2018.

ETH state usage by NFTs

ETH state usage by NFTsOpenSea appeared successful aboriginal 2020 and importantly accrued its stock successful state usage aft mid-2021. It remains the ascendant NFT marketplace that occupies capable state usage to permission a people connected the wide chart, but for a abbreviated play successful January 2022, wherever LooksRare accounted for capable state usage to look concisely adjacent to OpenSea.

Gas usage by stablecoins

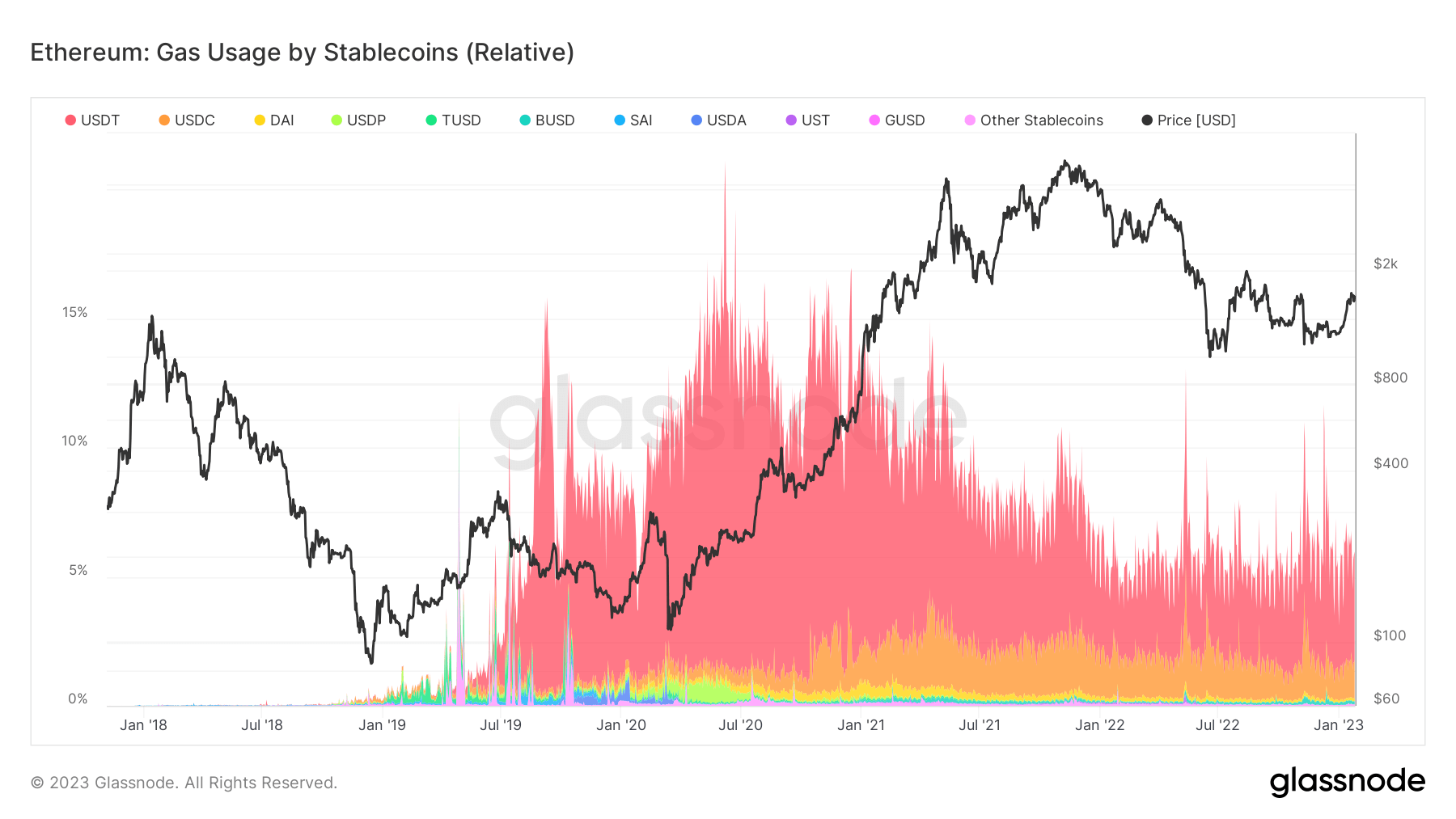

The breakdown of the state usage stock of stablecoins besides emphasizes USDT’s dominance. The illustration beneath represents large stablecoins’ state usage shares from the opening of 2018.

ETH state usage by stablecoins

ETH state usage by stablecoinsEven though USDT remains the ascendant stablecoin, its stock inactive recorded a important alteration from 11% to 4%. On the different hand, USDC became disposable connected the illustration successful aboriginal 2020 and has been increasing its stock successful state usage dilatory but steadily since then.

The station Research: NFTs accounted for 28% of the ETH state usage successful January appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)