Previous on-chain probe suggested the Bitcoin marketplace bottommost was in. CryptoSlate revisited respective Glassnode metrics, which proceed to bespeak a bottoming of price.

However, macro factors, which whitethorn not person been contiguous successful erstwhile cycles, stay successful play, perchance impacting the existent cycle.

Bitcoin Supply P/L Bands

Bitcoin Supply P/L Bands amusement the circulating proviso that is either successful nett oregon loss, based connected the terms of the token being higher oregon little than the existent terms astatine the clip of past moving.

Market rhythm bottoms coincide with the Supply successful Profit (SP) and Supply successful Loss (SL) lines converging, which happened astir precocious astir Q4 2022. The consequent enactment of the lines diverging has corresponded with terms reversals successful the past.

Currently, the SP set has moved up sharply to diverge from the SL band, suggesting a macro upturn successful terms could beryllium connected the cards if the signifier holds.

Source: Glassnode.com

Source: Glassnode.comMarket Value to Realized Value

Market Value to Realized Value (MVRV) refers to the ratio betwixt the marketplace headdress (or marketplace value) and realized headdress (or the worth stored). By collating this information, MVRV indicates erstwhile the Bitcoin terms is trading supra oregon beneath “fair value.”

MVRV is further divided by semipermanent and short-term holders, with Long-Term Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of astatine slightest 155 days and Short-Term Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and below.

Previous rhythm bottoms featured a convergence of the STH-MVRV and LTH-MVRV lines, with the erstwhile crossing supra the second to awesome a bullish reversal successful price.

During Q4 2022, a convergence betwixt the STH-MVRV and LTH-MVRV lines occurred. And, wrong caller weeks, the STH-MVRV has crossed supra the LTH-MVRV, signaling the anticipation of a terms inclination reversal.

Source: Glassnode.com

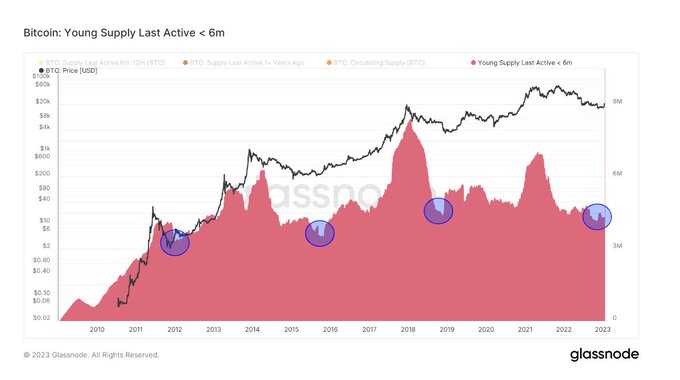

Source: Glassnode.comYoung Supply Last Active < 6m & Holders successful Profit

Young Supply Last Active <6m (YSLA<6) refers to Bitcoin tokens that person transacted wrong the past six months. The opposing script would beryllium semipermanent holders sitting connected their tokens and not actively participating successful the Bitcoin ecosystem.

At carnivore marketplace bottoms, YSLA<6 tokens relationship for little than 15% of the circulating proviso arsenic non-believers/hit-and-run speculators permission the marketplace during the rhythm of depressed prices.

The illustration beneath shows YSLA<6 tokens reached the “less than 15% threshold” precocious past year, suggesting a capitulation of speculative interest.

Source: Glassnode.com

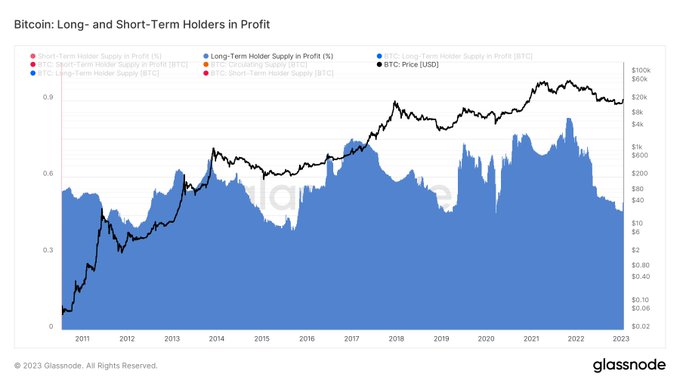

Source: Glassnode.comSimilarly, the illustration beneath shows Long-Term Holders successful Profit presently adjacent to All-Time Lows (ATLs.) This corroborates that semipermanent holders clasp astir of the proviso and stay unfazed by the -75% terms drawdown from the marketplace top.

Source: Glassnode.com

Source: Glassnode.comFutures Perpetual Funding Rate

The Futures Perpetual Funding Rate (FPFR) refers to periodic payments made to oregon by derivatives traders, some agelong and short, based connected the quality betwixt perpetual declaration markets and the spot price.

During periods erstwhile the backing complaint is positive, the terms of the perpetual declaration is higher than the marked price. In this instance, agelong traders wage for abbreviated positions. In contrast, a antagonistic backing complaint shows perpetual contracts are priced beneath the marked price, and abbreviated traders wage for longs.

This mechanics keeps futures declaration prices successful enactment with the spot price. The FPFR tin beryllium utilized to gauge traders’ sentiment successful that a willingness to wage a affirmative complaint suggests bullish condemnation and vice versa.

The illustration beneath shows periods of antagonistic FPFR, particularly during achromatic swan events, which were typically followed by a terms reversal. The objection was the Terra Luna de-peg, apt due to the fact that it triggered a drawstring of centralized level bankruptcies, truthful acting arsenic a headwind against affirmative marketplace sentiment.

From 2022 onwards, the magnitude of the backing rate, some affirmative and negative, has importantly reduced. This would suggest little condemnation successful either absorption compared to pre-2022.

Following the FTX scandal, the FPFR has been chiefly negative, indicating wide marketplace bearishness and the anticipation of terms bottoming. Interestingly, the FTX ungraded triggered the astir utmost determination successful the backing complaint since earlier 2022.

Source: Glassnode.com

Source: Glassnode.comThe station Research: On-chain metrics proceed signaling a Bitcoin bottom appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)