It has been 9 months since the marketplace apical and successful that time, astir $2 trillion successful superior has near the abstraction hitting token prices hard.

However, the question of whether the marketplace bottommost is successful yet remains.

An investigation by CryptoSlate of on-chain information from Glassnode reveals mostly affirmative sentiment from semipermanent holders. However, a examination of full proviso successful nonaccomplishment to erstwhile years indicates the bottommost is not yet in.

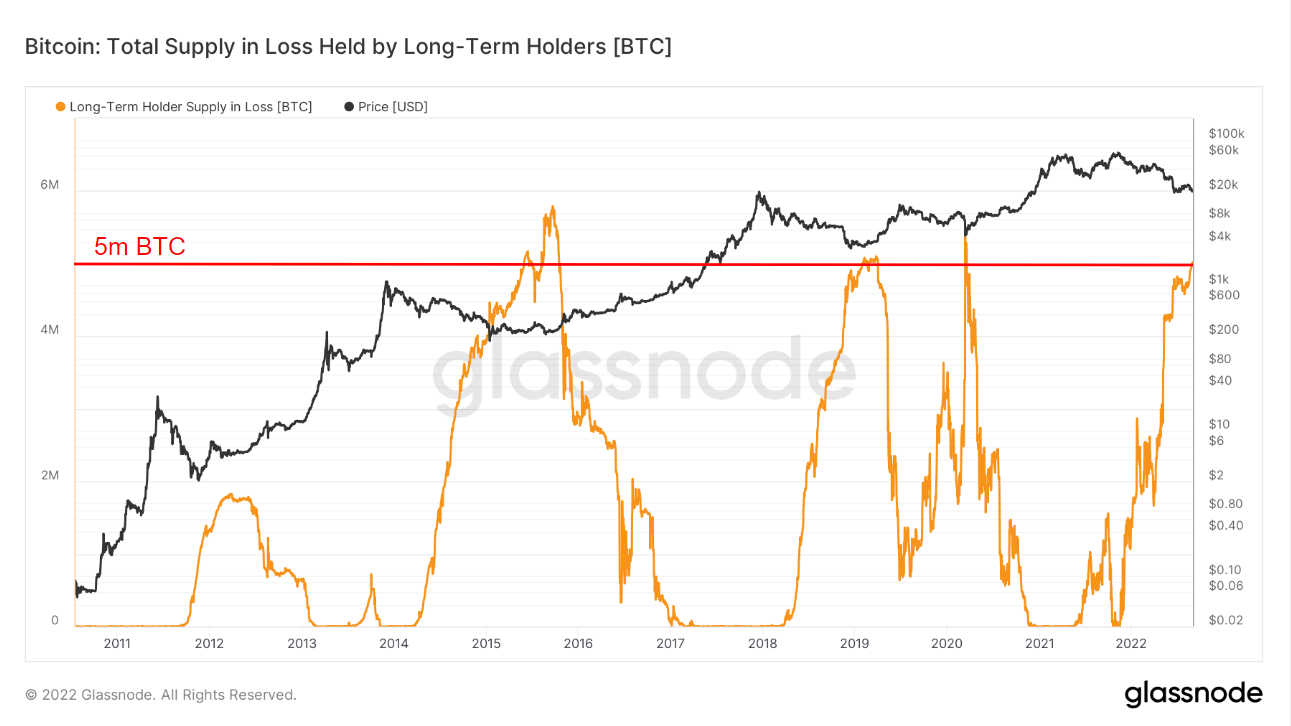

Total Bitcoin Supply successful Loss

Long-term Bitcoin holders are defined arsenic those who person held BTC for much than 155 days. Based connected past data, the capitulation of semipermanent Bitcoin holders usually accompanies marketplace rhythm bottoms.

The illustration beneath shows the full proviso of semipermanent holders (LTH) successful nonaccomplishment for the past 11 years. In 2015, 2019, and 2020, erstwhile this metric exceeded 5 cardinal tokens successful loss, the BTC terms soon reverted to an uptrend.

The existent proviso successful nonaccomplishment is approaching this threshold. However, it has yet to transverse beyond it, suggesting the marketplace has yet to bottommost and further symptom lies up for Bitcoin holders.

Source: Glassnode.com

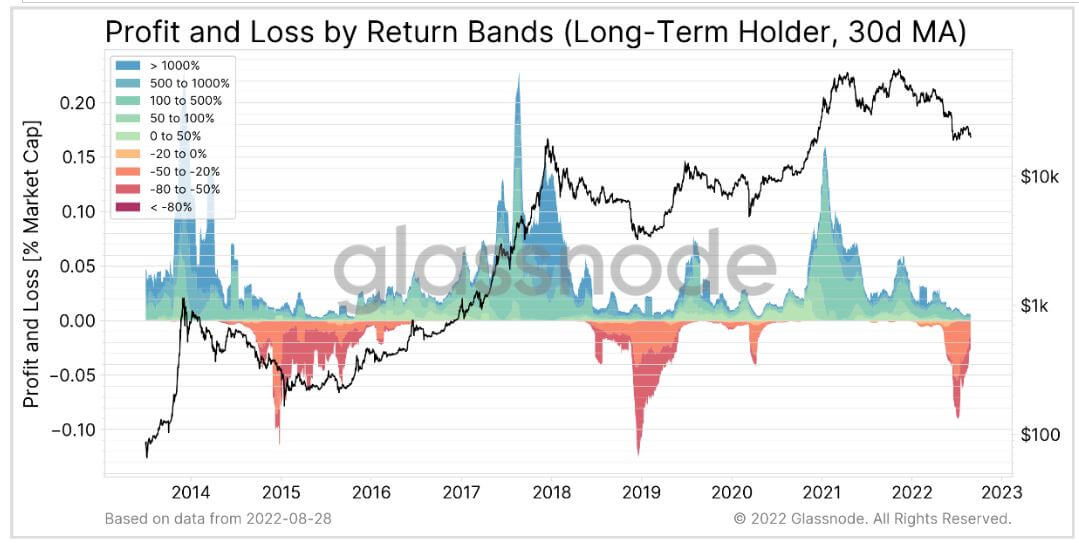

Source: Glassnode.comProfit and Loss by Return Bands

The Profit and Loss by Return Band metric illustrates the symptom presently being felt by LTHs. This metric shows the spending behaviour of assorted marketplace cohorts segmented into bands related to the magnitude of realized profit/loss.

The information is presented arsenic a percent of the marketplace cap. For example, a Y worth of +0.5 indicates the full nett realized was adjacent to 0.5% multiplied by the full marketplace headdress astatine that constituent successful clip (X coordinate).

Meanwhile, nett oregon nonaccomplishment is calculated successful USD by taking the coin worth and multiplying it by the terms sold minus the terms erstwhile bought. This calculation is past aggregated for each spent coins and apportioned to the applicable instrumentality band.

The illustration beneath shows LTHs heavy wrong the capitulation zone. However, the existent little set is speechmaking astir -0.07, which is importantly little than 2015’s lowest set of -0.12, and 2019’s lowest speechmaking of -0.14.

Source: Glassnode.com

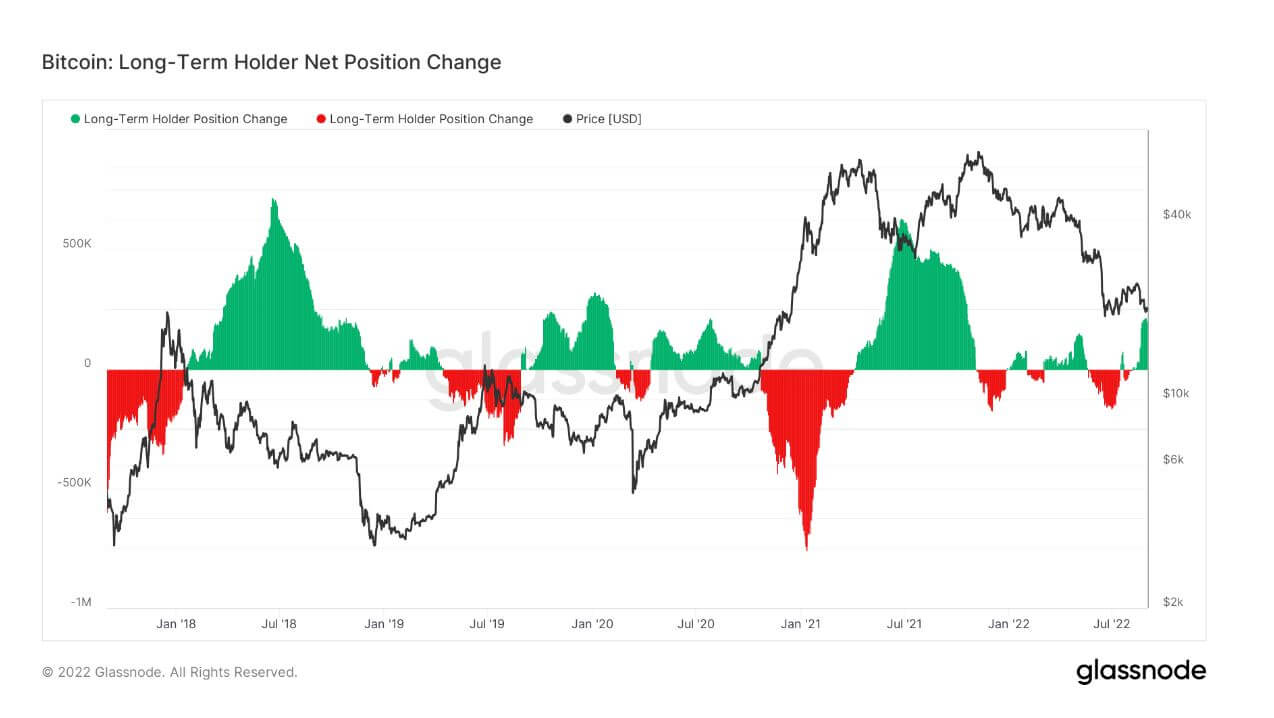

Source: Glassnode.comLong-Term Holder Net Position Change

LTH Net Position Change refers to either the organisation of tokens arsenic LTHs currency retired oregon accumulation arsenic holders instrumentality connected caller positions.

The illustration beneath shows 2022’s Net Position Change flipping betwixt organisation and accumulation, and astatine little magnitudes compared to erstwhile years. This suggests precocious uncertainty amid deteriorating macro conditions.

Since August, LTHs person been accumulating astatine their highest levels this year. This is an encouraging motion successful presumption of semipermanent sentiment toward Bitcoin.

Source: Glassnode.com

Source: Glassnode.comThe station Research: On-chain metrics suggest much symptom up for semipermanent Bitcoin holders appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)