Determining the marketplace bottommost requires a batch of guesswork. Bitcoin’s caller volatility has resulted from assorted factors ranging from geopolitical uncertainty and section regularisation to interior implosions of the crypto market.

Miners person historically been 1 of the astir reliable omens of Bitcoin’s performance.

Bitcoin miners marque up the instauration of the crypto marketplace and make beardown absorption levels that trim volatility. As 1 of the largest holders of BTC, miners tin plaything the marketplace by holding their coins and liquidating them.

Analyzing the authorities of the marketplace requires analyzing the authorities of Bitcoin miners.

As antecedently covered by CryptoSlate, immoderate of the astir coagulated indicators of miner wellness person been hash ribbons.

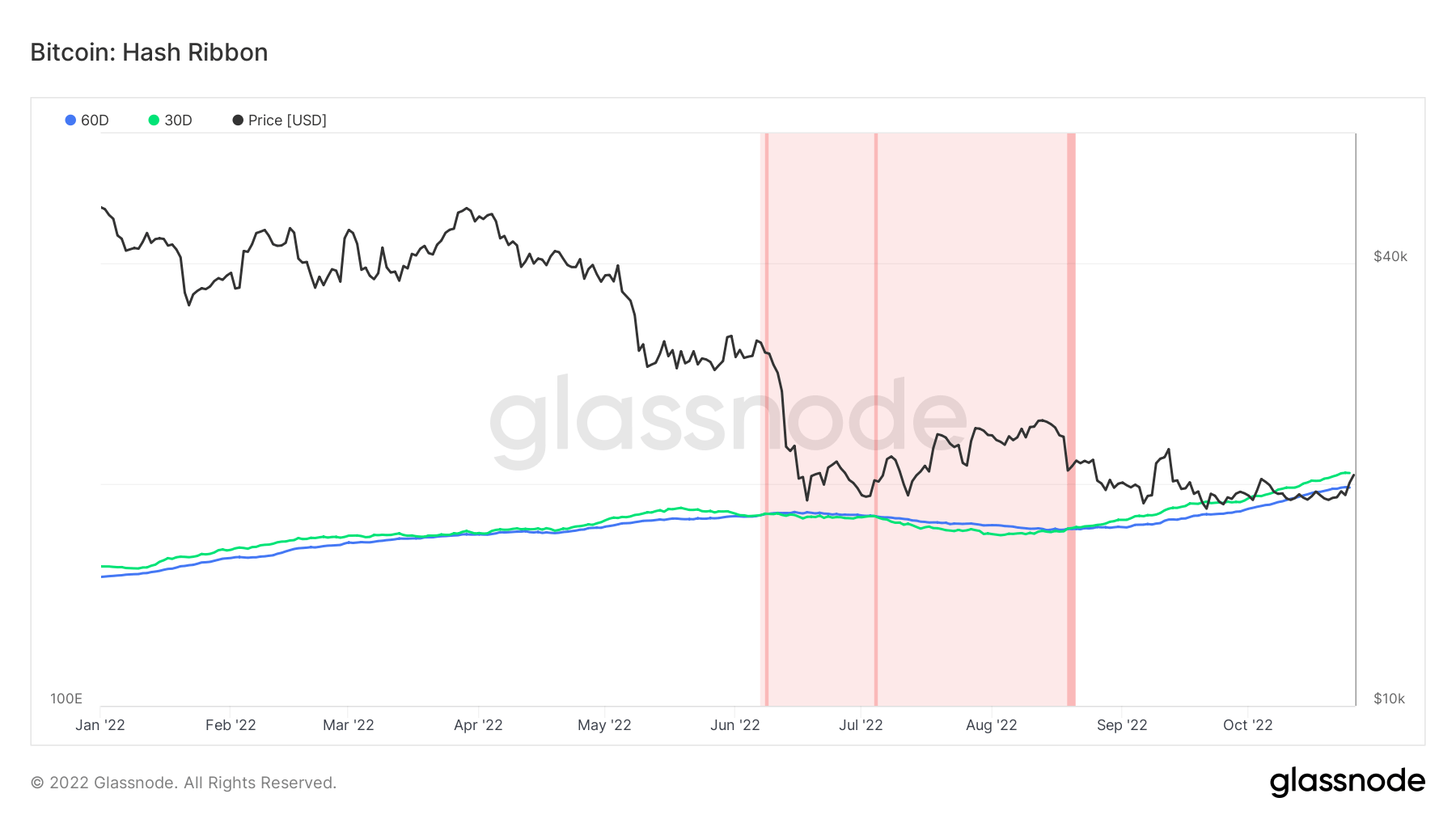

Hash ribbons bespeak erstwhile miners capitulate, showing the divergence betwixt the 30-day moving mean and the 60-day moving mean of the Bitcoin hash rate; having miners capitulate shows that Bitcoin has go excessively costly to excavation — i.e., Bitcoin’s marketplace terms is excessively debased to screen the outgo of energy required to nutrient it.

According to hash ribbons, the worst of the miner capitulation is usually implicit erstwhile the 30-day MA of the Bitcoin hash complaint crosses supra the 60-day MA. Since the opening of the year, we’ve seen 3 abstracted instances of this switch, shown successful acheronian reddish connected the graph below.

Graph showing the Bitcoin hash ribbon indicator from January 2022 to October 2022 (Source: Glassnode)

Graph showing the Bitcoin hash ribbon indicator from January 2022 to October 2022 (Source: Glassnode)Data analyzed by CryptoSlate showed that terrible miner capitulation began mid-June this twelvemonth and lasted until mid-August. The information is supported by crossing the hash ribbons illustrated successful the graph above.

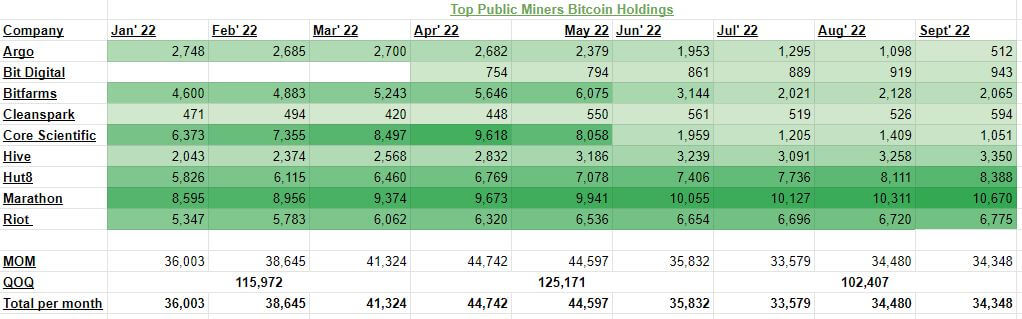

Looking astatine BTC holdings from the apical 9 largest publically listed Bitcoin mining companies further supports this trend. Several ample miners created dense selling unit betwixt May and June, liquidating astir 8,765 BTC.

And portion the selling unit seems to person steadied connected a month-to-month ground since June, quarterly information paints a overmuch antithetic picture.

The apical 9 nationalist Bitcoin miners saw their holdings alteration from 125,171 BTC successful the 2nd 4th to 102,407 successful the 3rd quarter.

Table showing the BTC holdings of the apical 9 largest publically listed Bitcoin mining companies from January 2022 to September 2022

Table showing the BTC holdings of the apical 9 largest publically listed Bitcoin mining companies from January 2022 to September 2022The numbers shown successful the array supra decreased adjacent further successful October. Earlier this month, Core Scientific liquidated implicit 1,000 BTC it held successful September and reported holding conscionable 24 BTC connected October 26.

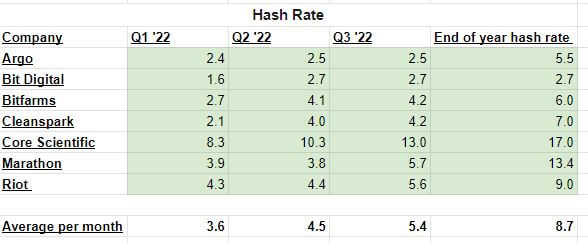

With mining trouble and the hash complaint astatine their all-time high, miners are getting squeezed successful presumption of their gross and resources. The mean hash complaint has been growing each 4th successful 2022 and is expected to summation astatine an adjacent higher complaint arsenic the 4th fourth ends.

Table showing the mean hash complaint for the apical 7 nationalist Bitcoin miners successful 2022

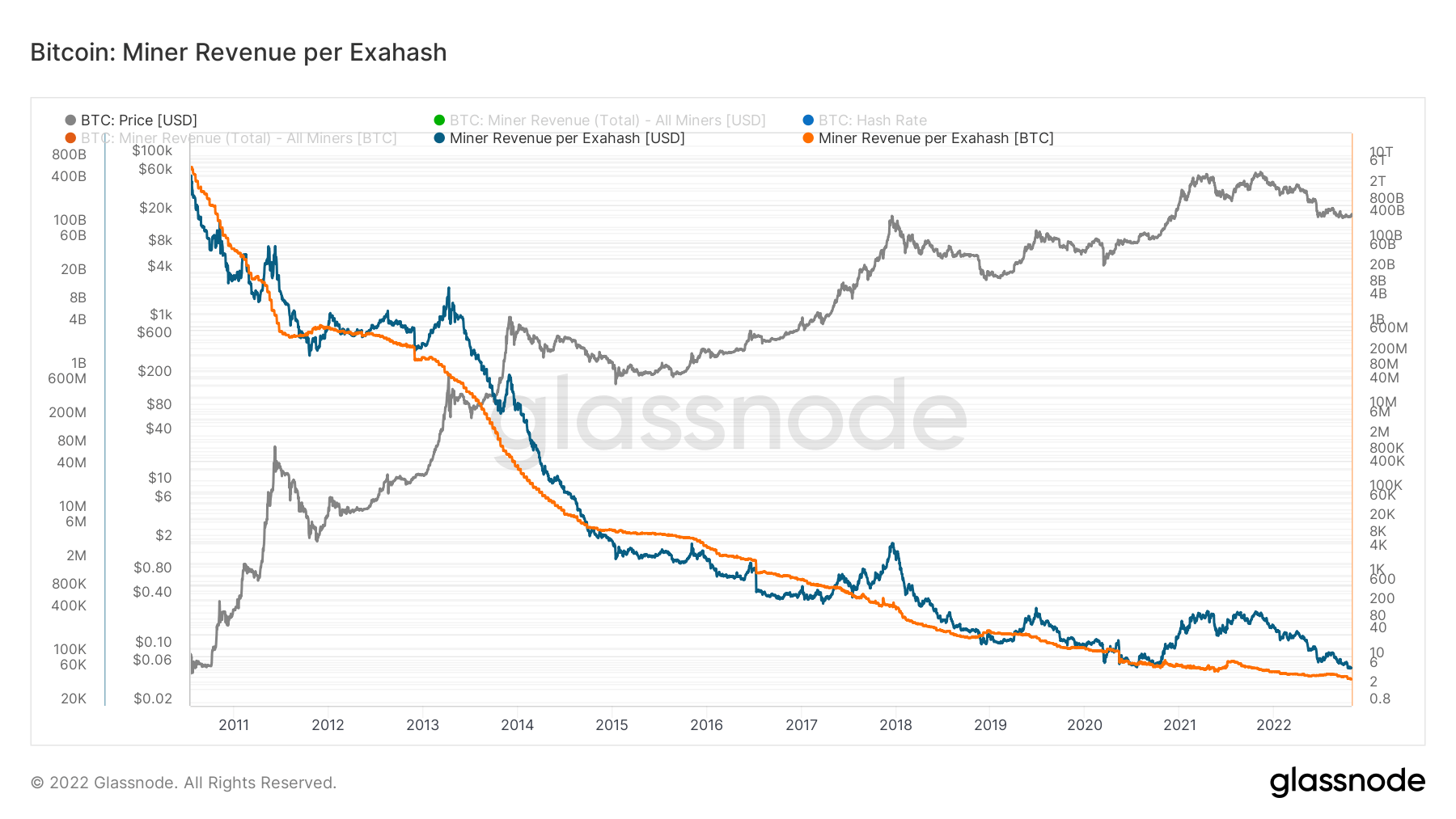

Table showing the mean hash complaint for the apical 7 nationalist Bitcoin miners successful 2022Data analyzed by CryptoSlate showed that Bitcoin’s driblet successful the year’s 2nd fractional caused a notable simplification successful miner revenue.

Graph showing Bitcoin miner gross per exahash from 2011 to 2022 (Source: Glassnode)

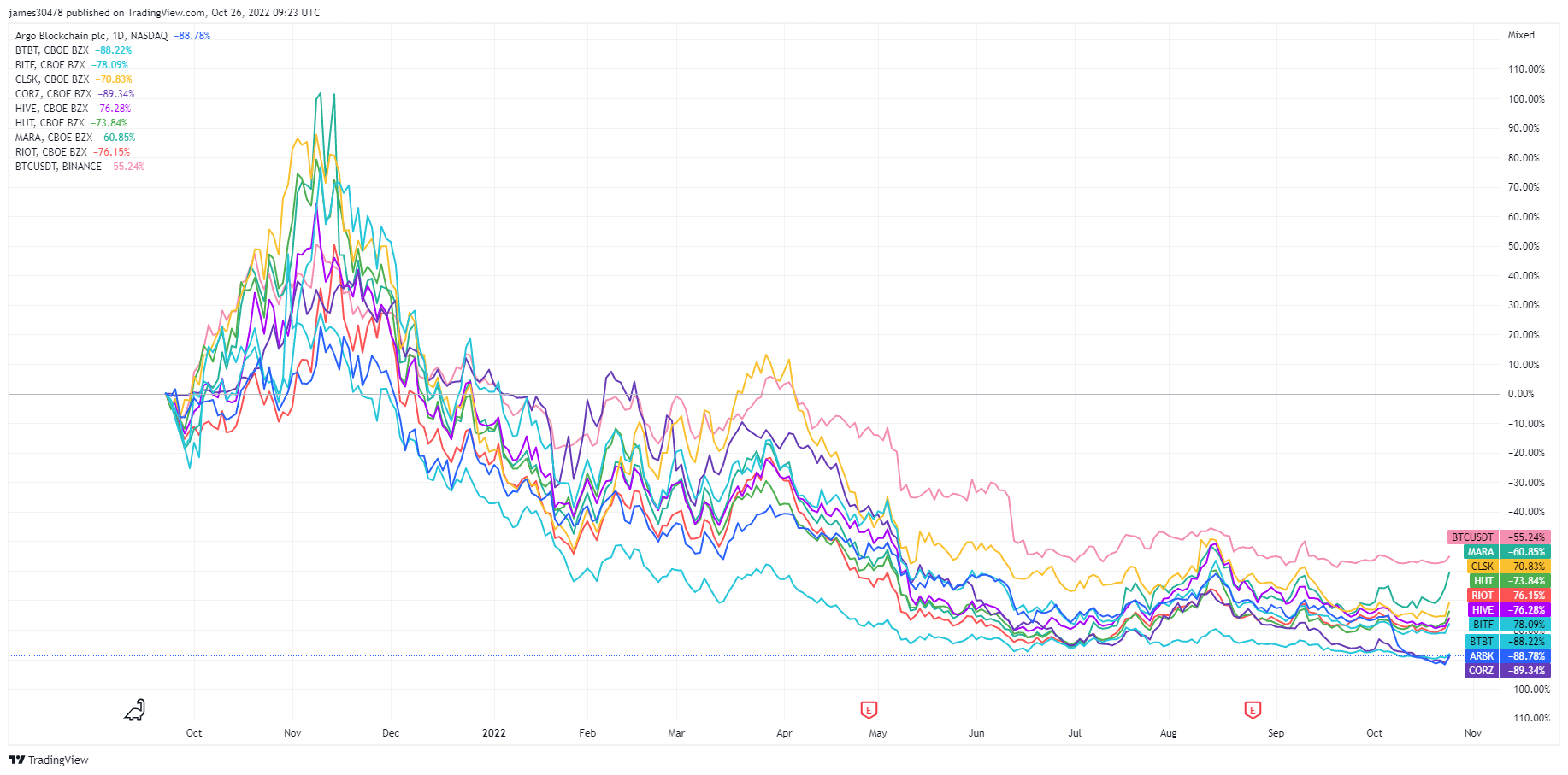

Graph showing Bitcoin miner gross per exahash from 2011 to 2022 (Source: Glassnode)Bitcoin’s terms volatility, dropping revenue, and decreasing BTC holdings person besides affected the banal market. The shares of each publically listed Bitcoin mining companies person been connected a crisp driblet since peaking successful October 2021. Core Scientific leads the way, with CORZ down astir 90% successful the past year, with Argo Blockchain and BitDigital adjacent down with an 88% drop.

Graph showing the banal terms of publicly-listed Bitcoin mining companies from October 2021 to October 2022 (Source: TradingView)

Graph showing the banal terms of publicly-listed Bitcoin mining companies from October 2021 to October 2022 (Source: TradingView)With the hash complaint expected to turn adjacent further and nary extremity successful show to the carnivore market, we could spot the ongoing miner capitulation proceed until the extremity of the year. And portion information shows that miners person exited the acheronian reddish portion and are either flatlining oregon consolidating, the worse isn’t over. If existent conditions continue, we could spot different miner capitulation earlier the extremity of the year, creating further selling unit that could further plaything the delicate market.

The station Research: Public Bitcoin miners amusement we tin expect a 2nd capitulation appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)