Quantitative tightening (QT) reduces the Federal Reserve’s equilibrium sheet. It transfers a important magnitude of Treasury and bureau mortgage-backed securities to investors.

The existent Fed argumentation is to usage QT arsenic a instrumentality to combat ostentation arsenic good arsenic expanding involvement rates.

It is the other of what has been much prevalent implicit the past respective years successful Quantitative Easing, whereby cardinal banks people wealth to acquisition securities from the unfastened market.

QT has not been the argumentation successful the US since 2017, and according to macro data, this QT volition beryllium much important erstwhile fiscal markets are strained. The extremity is to combat surging ostentation by reducing the $9 trillion Fed equilibrium sheet.

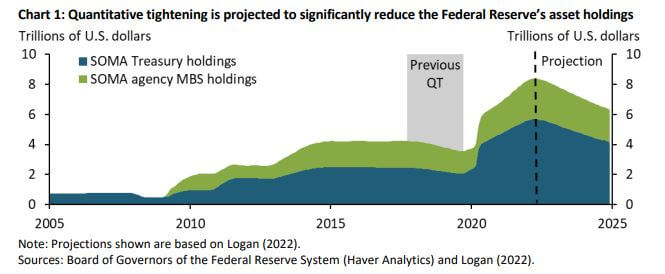

In 2019 determination was $4.2 trillion connected the Fed equilibrium sheet, and by the extremity of May 2022, it had risen to a staggering $8.9 trillion owed to assertive plus purchases passim the Covid-19 pandemic.

Between 2017 and 2019, the Fed reduced its enslaved holding by $650B. We volition commencement to spot the interaction of QT this September, and information suggests that it volition beryllium much extended and assertive than successful 2017. The Fed volition apt beryllium offloading $95B of Treasuries and Mortgage-backed securities, based connected projections of much than $2 trillion.

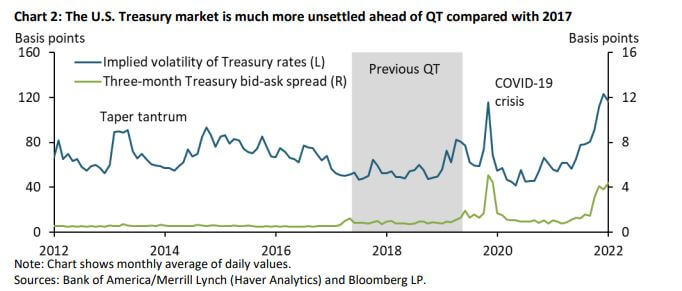

Further, the US Treasury marketplace is besides much volatile than successful 2017. The bluish enactment successful the illustration beneath shows the MOVE index, which measures aboriginal volatility successful treasury rates. The volatility is good supra the levels during the tallness of Covid-19 and the erstwhile play of QT successful 2017.

The greenish enactment represents liquidity measures specified arsenic the bid-ask dispersed for Treasury bills. This dispersed is besides elevated, akin to pandemic levels.

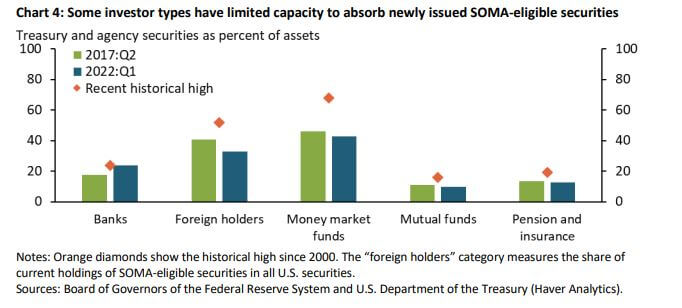

The pursuing illustration illustrates the maximum stock of SOMA-eligible securities held by each capitalist benignant since 2000. This information acts arsenic a realized benchmark for the maximum equilibrium expanse absorption capacity. Foreign holders and wealth marketplace funds (MMFs) whitethorn beryllium capable to sorb immoderate further SOMA-eligible securities, though the scope is apt limited. However, pensions and banks are adjacent capacity.

The stock of Foreign Holders has been declining since the planetary fiscal situation arsenic they pivoted to purchasing golden instead. The Fed volition request overmuch higher yields for short-term maturities, indicating that this QT occurrence has the imaginable to beryllium much disruptive than ever before, chiefly owed to rising rates.

Bitcoin has nary specified monetary policy. There is nary mode to summation proviso without forking the full network, removing immoderate party’s quality to summation the Bitcoin wealth supply. Bitcoin is automated successful presumption of monetary policy, with proviso tied straight to hashrate and web difficulty. These mechanics signifier portion of the statement favoring Bitcoin arsenic a store of worth and a semipermanent ostentation hedge.

The crypto manufacture has followed accepted securities markets passim 2022. However, Bitcoin has ne'er experienced a recession, assertive QT, oregon inflation beyond 2.3%, each of which are prevalent successful today’s market. The pursuing 12 months volition beryllium unprecedented territory for Bitcoin, and it volition beryllium a existent trial of its economical design.

The station Research: Quantitative Tightening has imaginable to beryllium the astir disruptive ever appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)