Retail investors owning little than 1 BTC are accumulating Bitcoin portion whales holding implicit 10,000 BTC are selling, according to information analyzed by CryptoSlate.

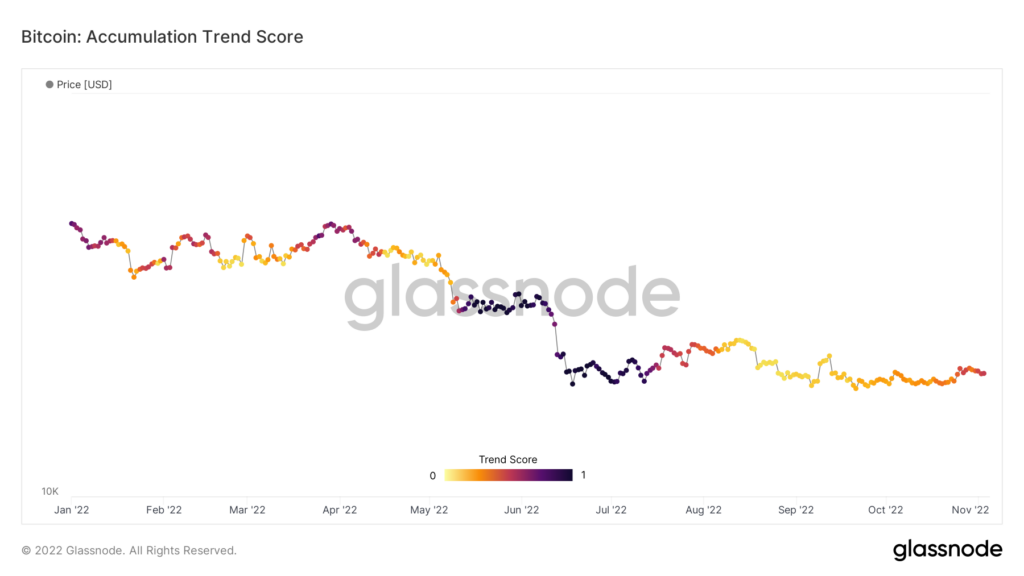

Since August, Bitcoin has been successful a organisation phase, arsenic shown by the lighter colors connected the graph below. The darker colors denote accumulation periods, arsenic seen passim May, June, and July. The archetypal illustration beneath showcases the Accumulation Trend Score for Bitcoin crossed each coin holders.

During the May downturn initiated by the illness of Terra Luna, investors continued to accumulate Bitcoin and bought the dip. However, this inclination ended successful August arsenic sentiment moved bearish, causing Bitcoin to commercialized level passim Q3. While determination were much sellers than buyers successful this period, it does not look to person been capable to unit Bitcoin beneath $18,000 for an extended period.

Bitcoin’s quality to clasp astir $20,000 passim Q3 amid persistent selling unit highlights the beardown enactment astatine this level. The apical cryptocurrency by marketplace headdress has been scope bound since mid-August, trading betwixt $18,000 and $22,000 throughout.

Source: Glassnode

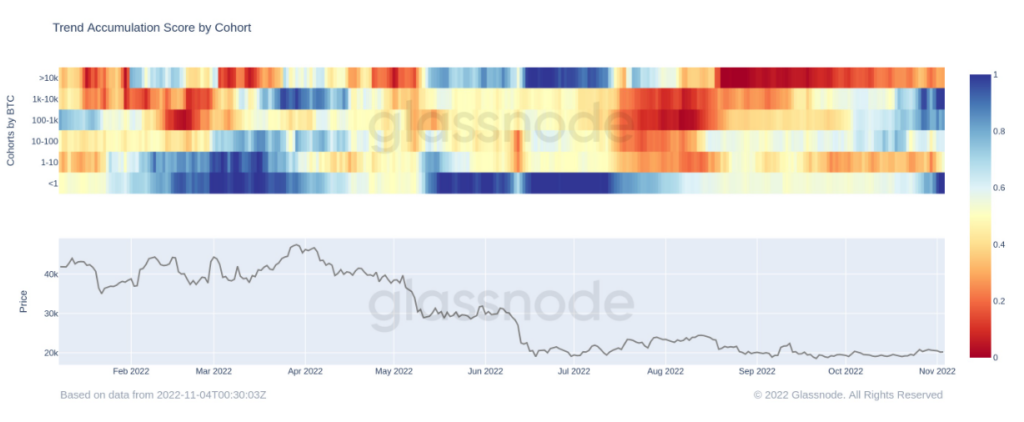

Source: GlassnodeHowever, analyzing Bitcoin holders divided into cohorts based connected the magnitude of BTC held successful their wallets reveals much elaborate insights into the trend. Bitcoin holders with little than 1 BTC re-entered an accumulation signifier successful precocious October, arsenic did holders with betwixt 1,000 BTC and 10,000 BTC. Those with much than 10,000 BTC person continued to merchantability arsenic they person done since mid-July.

The illustration beneath gives a wide representation of the antithetic trends among antithetic cohorts of Bitcoin holdings. Investors with little than 1 BTC person historically bought astatine abstracted times to larger whales.

In March, smaller retail investors bought Bitcoin heavily, whereas whales started selling astir the aforesaid period. The lone clip with evident similarities betwixt retail and whales was June and July this year.

Source: Glassnode

Source: GlassnodeWhile Bitcoin whales whitethorn inactive beryllium distributing coins done accordant selling, determination are signs of a reversal successful caller weeks. The whale cohort has moved from acheronian reddish into a airy orangish region, suggesting a much neutral position.

Given the deficiency of volatility successful Bitcoin’s terms since the summer, some whales and retail investors who purchased Bitcoin successful June and July are apt to either beryllium successful nett oregon adjacent to breaking even. Over the past week, Bitcoin has climbed 11% aft investigating the $18,500 enactment respective times.

Although larger whales stay successful a organisation phase, Bitcoiners with little than 10,000 BTC but much than 1,000 BTC person besides started to accumulate arsenic of the extremity of October.

The station Research: Retail begins accumulating Bitcoin portion whales proceed to sell appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)