Amid arguably the coldest wintertime successful Bitcoin’s history, its price has fallen by much than 70% from its Nov. 10, 2021, all-time precocious of $69,044.77, portion its marketplace headdress is down to $318.943 cardinal from the yearly precocious of $902.04 billion — a 64.64% decline.

Let’s instrumentality a look astatine immoderate metrics that tin supply much penetration into the existent Bitcoin carnivore market:

Transfer Volume Momentum

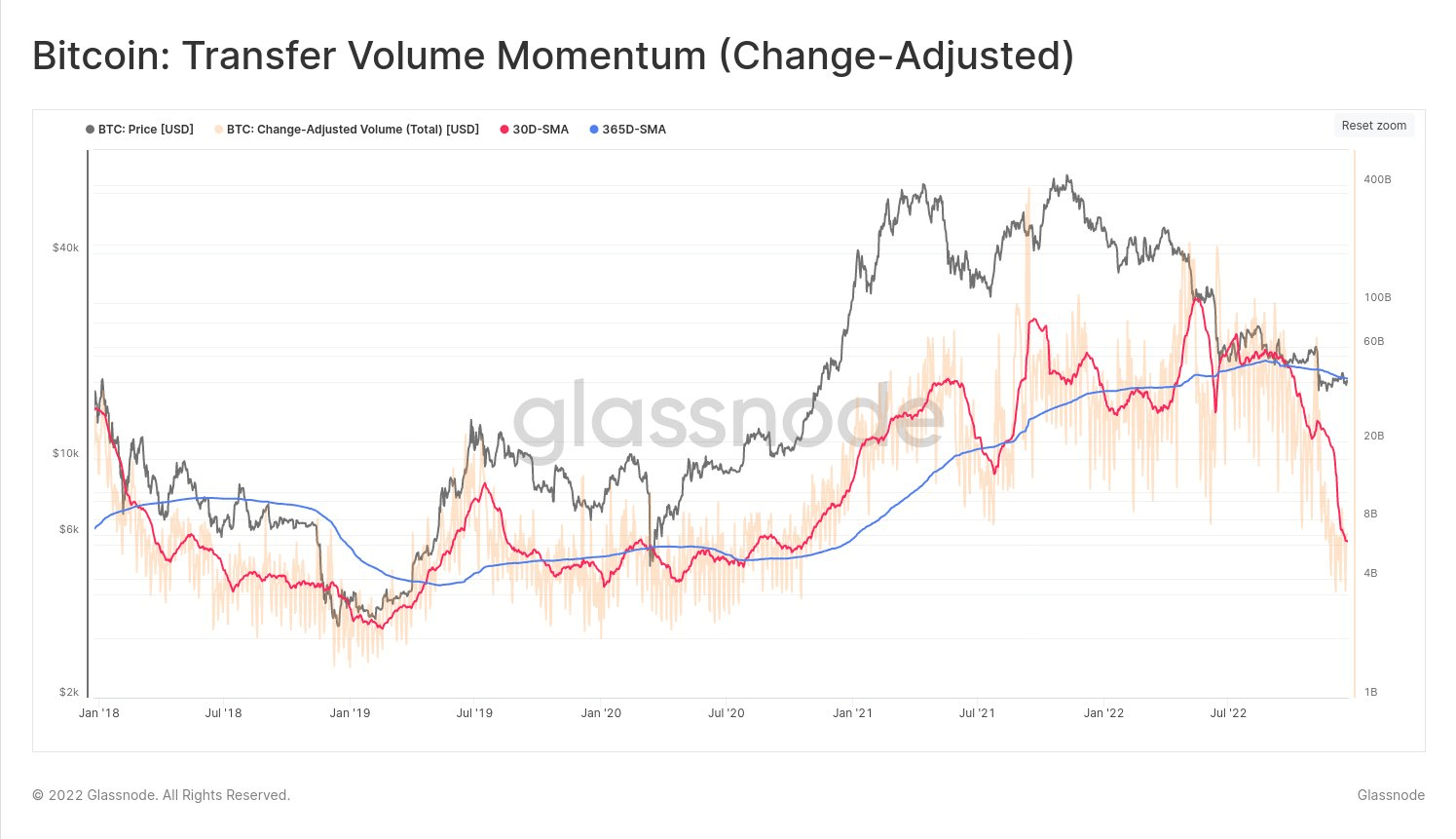

Before June, the 30-day Moving mean (DMA) (red line) transportation measurement successful BTC reached caller highs, but aft the Luna-Terra crash, it rapidly declined and present stands astatine caller lows.

Change successful Bitcoin transportation measurement since January 2018 (Source: Glassnode)

Change successful Bitcoin transportation measurement since January 2018 (Source: Glassnode)Transfer measurement connected the Bitcoin web provides an denotation of the existent level of web enactment and the worth that is being transferred successful BTC and USD. This metric compares the monthly mean (red line) transportation measurement against the yearly mean (blue line) to underline comparative shifts successful ascendant sentiment and assistance place erstwhile the tides are turning for web activity.

It is emblematic for the 30DMA to beryllium beneath the 365 DMA during carnivore markets and vice versa during bull markets. Currently, the 30 DMA has fallen beneath the 365 DMA, indicative of declining web fundamentals and declining web utilization, according to information analyzed by CryptoSlate.

This indicates that momentum has evaporated successful presumption of concatenation transfer, which is concerning. It is besides the largest discrepancy betwixt the 30 DMA and the 365 DMA successful implicit the past 5 years.

Bitcoin Reserve Risk

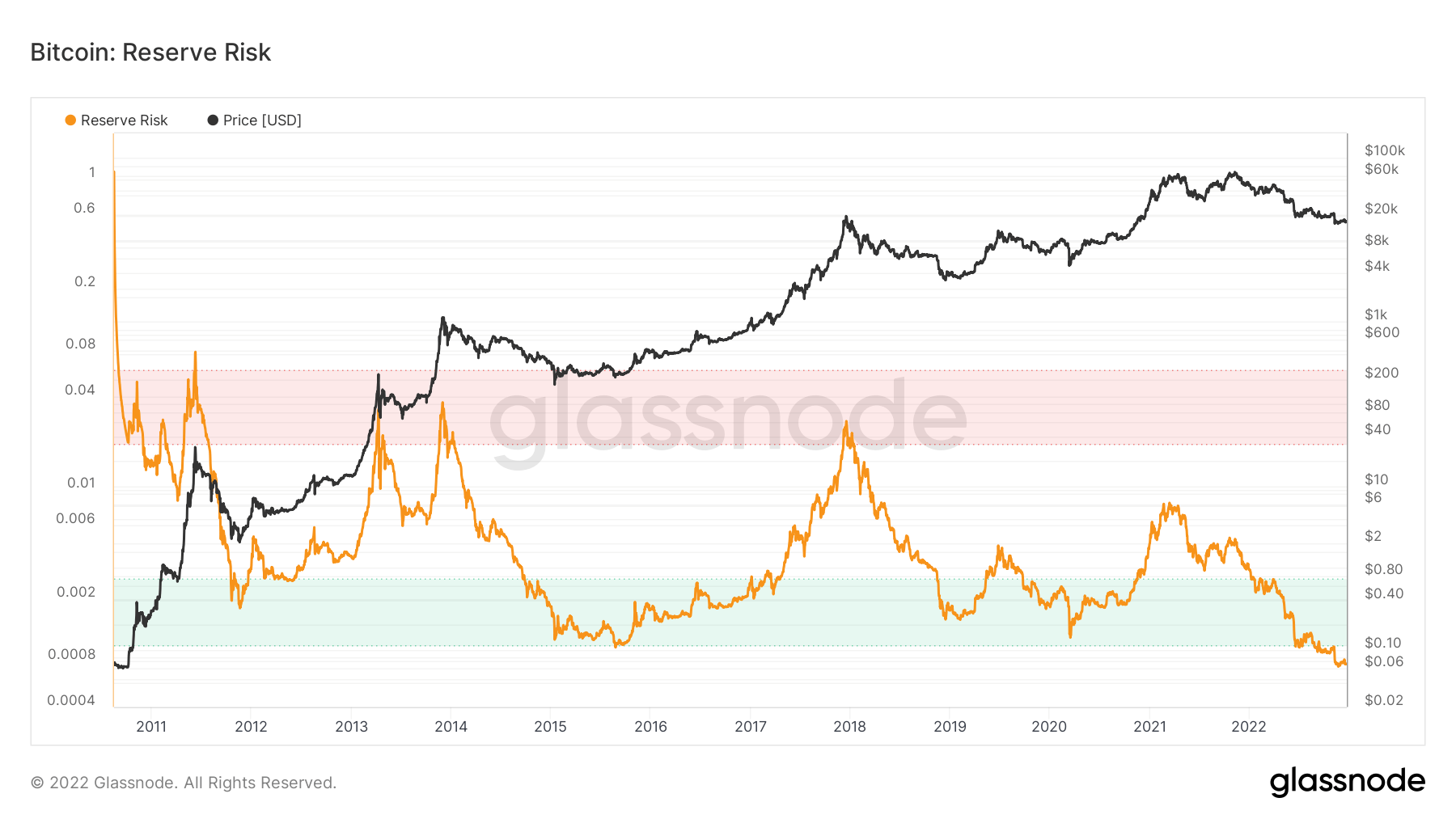

CryptoSlate’s on-chain investigation shows the Bitcoin Reserve Risk indicator has declined to an all-time low.

Change successful Bitcoin Reserve Risk Indicator (Source: Glassnode)

Change successful Bitcoin Reserve Risk Indicator (Source: Glassnode)The Bitcoin Reserve indicator gauges the assurance level of semipermanent holders comparative to the existent bitcoin price. Reserve Risk is the ratio betwixt the existent terms (incentive to sell) and HODL Bank. The HODL Bank metric represents the cumulative accidental outgo of holding the asset.

When Bitcoin prices scope grounds highs, Reserve Risk (the reddish zone) tends to beryllium higher, reflecting a alteration successful capitalist confidence.

Alternatively, a little Bitcoin terms and higher assurance mean little Reserve Risk (the greenish zone) oregon an improved risk/reward ratio.

However, astatine existent times, BTC reserve hazard has fallen retired of the greenish container for the archetypal clip successful its history, showing a deficiency of assurance among investors.

Nevertheless, debased Reserve Risk tin signal comparative undervaluation, which tin beryllium a lengthy and prolonged process.

Bitcoin Miner’s Revenue

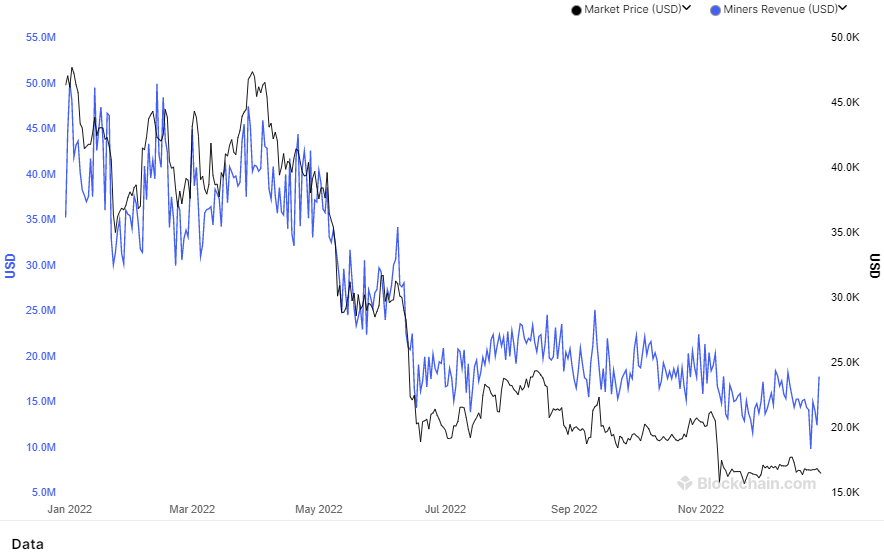

Bitcoin miners’ gross per time declined implicit 1 twelvemonth and fell to caller lows owed to a anemic marketplace and expanding computational demands.

Miner’s gross connected a one-day mean successful 2022 (Source: Blockchain.com)

Miner’s gross connected a one-day mean successful 2022 (Source: Blockchain.com)As a result, mining firms specified arsenic Core Scientific person filed for bankruptcy, and multiple miners are besides suffering. In addition, according to a erstwhile report by CryptoSlate, miners are selling their coins astatine the highest complaint successful the past 2 years, resulting successful trouble being adjusted negatively moving forward.

Meanwhile, BTC miner wallet balances person dropped to levels seen successful January 2022, according to information analyzed by CryptoSlate.

Mark Mobius, the co-founder of Mobius Capital Partners, who correctly predicted the driblet to $20,000 this year, believes bitcoin is not acold from $10,000 having breached the method enactment levels of $17,000 and $18,000.

If Mobius’ $10,000 telephone comes true, it volition adhd much misery to the cryptocurrency market.

However, Bitcoin sentiment is not wholly bearish successful 2022. For instance, the fig of semipermanent Bitcoin holders hit an all-time high this year.

The station Research: The Bearish lawsuit for Bitcoin arsenic 2022 ends appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)