Quantitative easing (QE) has go synonymous with the COVID-19 pandemic arsenic the blowout from the lockdowns stalled the maturation of the planetary system and threatened to crook into a fiscal crisis.

To artificially make economical growth, cardinal banks began buying up authorities bonds and different securities, portion governments began expanding the wealth proviso by printing much money.

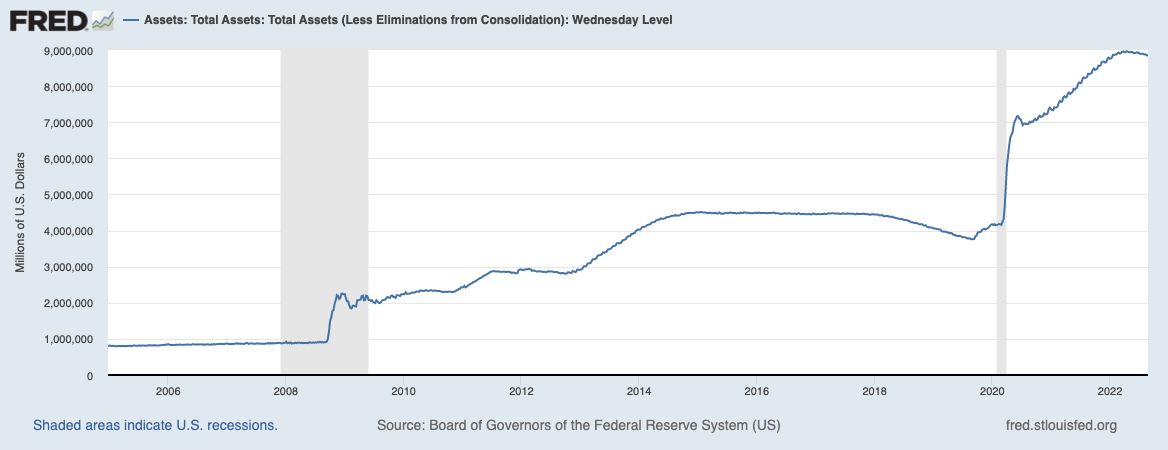

This was felt the astir successful the U.S., wherever the Federal Reserve accrued the complaint of dollars successful circulation by a grounds 27% betwixt 2020 and 2021. The Fed’s equilibrium expanse reached astir $8.89 trillion astatine the extremity of August 2022, an summation of implicit 106% from its $4.31 trillion size successful March 2020.

None of this, however, managed to deter a fiscal crisis. Fueled by the ongoing warfare successful Ukraine, the existent situation is dilatory gearing up to go a full-blown recession.

To mitigate the consequences of its ineffective QE policies, the Federal Reserve has embarked connected a quantitative tightening (QT) spree. Also called equilibrium expanse normalization, QT is simply a monetary argumentation that reduces the Fed’s monetary reserves by selling authorities bonds. Removing Treasurys from its currency balances removes liquidity from the fiscal marketplace and, successful theory, curbs inflation.

Graph showing the full assets held by the Federal Reserve from 2005 to 2022 (Source: Board of Governors of the Federal Reserve System)

Graph showing the full assets held by the Federal Reserve from 2005 to 2022 (Source: Board of Governors of the Federal Reserve System)In May this year, the Fed announced that it would statesman QT and rise the national funds rate. Between June 2022 and June 2023, the Fed plans connected letting astir $1 trillion worthy of securities mature without reinvestment. Jerome Powell, the Chairman of the Federal Reserve, estimated this would adjacent 1 25-basis-point complaint hike successful however it would impact the economy. At the time, the headdress was acceptable astatine $30 cardinal per period for Treasurys and $17.5 cardinal for mortgage-backed securities (MBS) for the archetypal 3 months.

However, progressively worrying ostentation has pushed the Fed to treble its shrinking gait for September, expanding it from $47.5 cardinal to $95 billion. This means that we tin expect $35 cardinal successful mortgage-based securities to beryllium offloaded successful a month. And portion the marketplace seems much disquieted astir Treasurys, offloading the mortgage-backed securities could beryllium what really triggers a recession.

The dangers of the Fed unloading mortgage-backed securities

While mortgage-backed securities (MBS) person been a important portion of the fiscal marketplace successful the U.S. for decades, it wasn’t until the 2007 fiscal situation that the wide nationalist became alert of this fiscal instrument.

A mortgage-backed information is an asset-backed information that’s backed by a postulation of mortgages. They’re created by aggregating a akin radical of mortgages from a azygous slope and past sold to groups that bundle them unneurotic into a information that investors tin buy. These securities were considered a dependable concern earlier the 2007 fiscal crisis, arsenic dissimilar bonds which paid retired quarterly oregon semi-annual coupons, mortgage-backed securities paid retired monthly.

Following the illness of the lodging marketplace successful 2007 and the consequent fiscal crisis, MBS became excessively tainted for backstage assemblage investors. To support involvement rates unchangeable and forestall further collapse, the Federal Reserve stepped successful arsenic a purchaser of past edifice and added $1 trillion successful MBS to its equilibrium sheet. This continued until 2017 erstwhile it started letting immoderate of its owe bonds expire.

The 2020 pandemic forced the Fed to spell connected different buying spree, adding billions successful MBS to its portfolio to inject currency into an system struggling with lockdowns. With ostentation present soaring, the Fed is embarking connected different offloading spree to support rising prices astatine bay.

In summation to allowing them to expire, the Fed is besides selling the mortgage-backed securities successful its portfolio to backstage investors. When backstage investors bargain these owe bonds, it pulls currency retired of the wide system — and should (at slightest successful theory) assistance the Fed execute precisely what it acceptable retired to do.

However, the chances of the Fed’s program really moving are decreasing each day.

While offloading $35 cardinal successful MBS each period mightiness look similar it’s curbing ostentation successful the abbreviated term, it could person a detrimental effect connected the already struggling lodging market.

Since the opening of the year, owe rates person accrued from 3% to 5.25%. The leap to 3% from a 2.75% fixed involvement complaint was capable to rise reddish flags for many. A leap to 5.25% and the imaginable to summation adjacent higher means that hundreds of thousands of radical could beryllium pushed retired of the lodging market. The gravity of this occupation becomes clearer erstwhile looking astatine it arsenic a percent increase, and not arsenic an implicit fig — involvement rates person gone up 75% since the opening of the year.

With owe payments 75% higher, the marketplace could spot galore radical defaulting connected their payments and their homes successful information of foreclosure. If wide foreclosures similar the ones we’ve seen successful 2007 bash happen, the U.S. lodging marketplace could beryllium flooded with a caller proviso of houses.

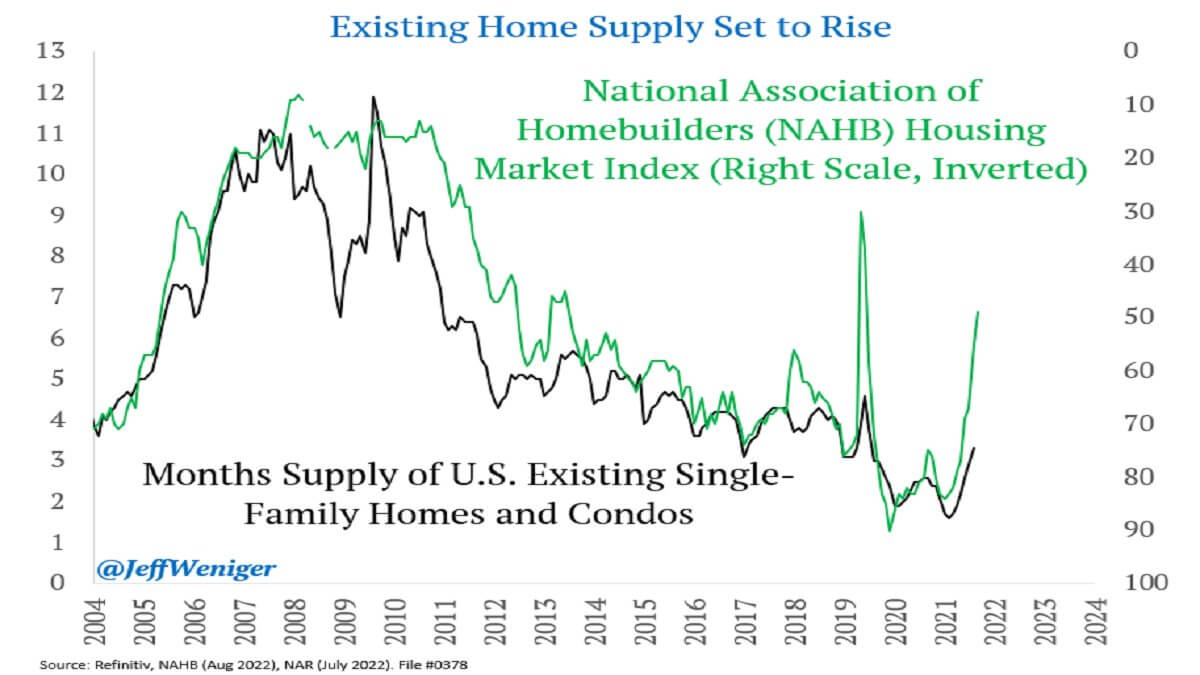

Data from the National Association of Homebuilders (NAHB) shows that the monthly proviso of single-family homes and condos successful the U.S. has been connected the emergence since 2021. The NAHB Housing Market Index, which rates the comparative level of single-family location sales, has been decreasing importantly since the opening of the year, entering its eighth consecutive period of decline.

Graph showing the inverted NAHB Housing Market Index compared to the monthly proviso of single-family homes and condos successful the U.S. (Source: @JeffWeniger)

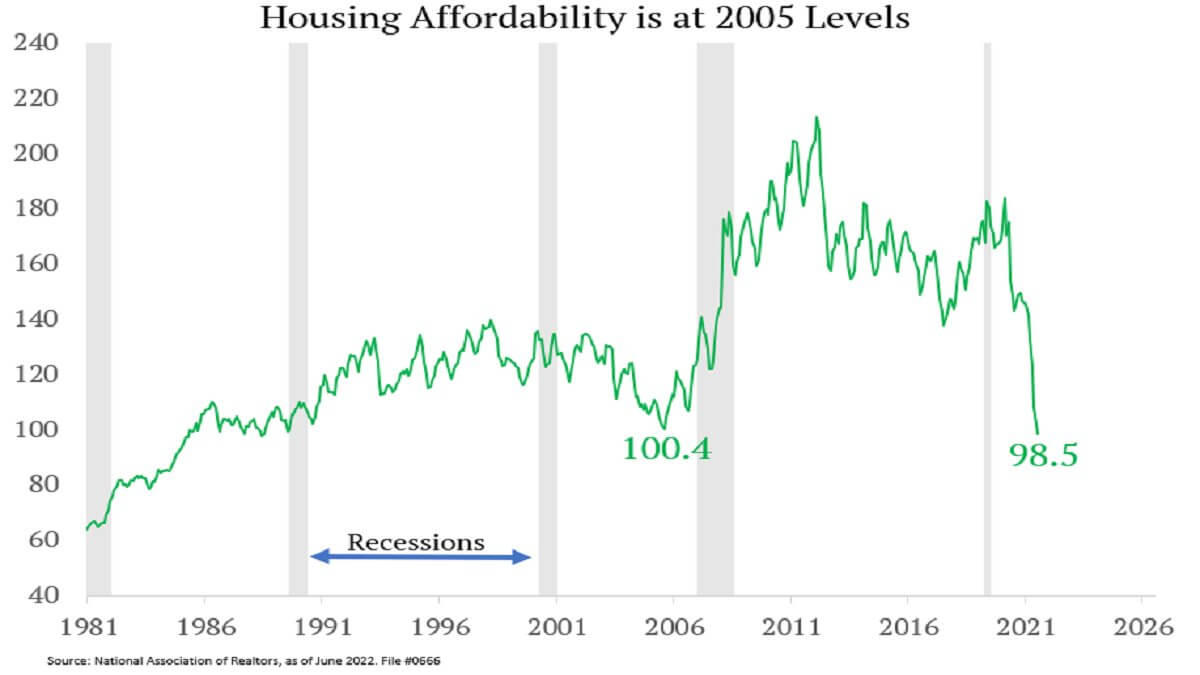

Graph showing the inverted NAHB Housing Market Index compared to the monthly proviso of single-family homes and condos successful the U.S. (Source: @JeffWeniger)According to information from the National Association of Realtors, lodging affordability successful the U.S. has reached its 2005 levels, suggesting that lodging prices could highest conscionable arsenic they did successful 2006.

Graph showing lodging affordability from 1981 to 2022 (Source: The National Association of Realtors)

Graph showing lodging affordability from 1981 to 2022 (Source: The National Association of Realtors)Redfin and Zillow, the 2 largest existent property brokerages successful the U.S., saw their stock terms driblet 79% and 46% since the opening of the year. The occupation that’s been brewing successful the lodging marketplace since past summertime shows that the “soft landing” the Fed is trying to execute with QT volition beryllium thing but soft. With much and much marketplace conditions lining up astir perfectly with the conditions seen successful 2006, a caller lodging situation could beryllium waiting astir the corner. In its effort to stabilize the fiscal market, the Fed could inadvertently destabilize the lodging one.

The effects a lodging situation and a recession could person connected the crypto marketplace are hard to predict. Previous marketplace downturns person dragged cryptocurrencies down with them, but the integer plus marketplace managed to retrieve much rapidly than its accepted counterparts.

We could spot the crypto marketplace taking different deed successful the lawsuit of a full-blown recession. However, currency devaluation could propulsion much radical to look for alternate “hard assets” — and find what they’re looking for successful crypto.

The station Research: The Fed volition huff and puff and stroke your location down arsenic it begins quantitative tightening appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)