Bitcoin’s terms has been glued to the debased $20,000 levels for a portion now, showing small oregon nary motion of immoderate large upward question successful the adjacent future. The marketplace has been sporadically showing signs of capitulation with a deficiency of optimism for a bull reversal successful the coming weeks.

On the surface, aggregate on-chain and macro signs constituent to a implicit nonaccomplishment of assurance successful the market. However, diving deeper into these fundamentals shows that not everything is truthful bleak.

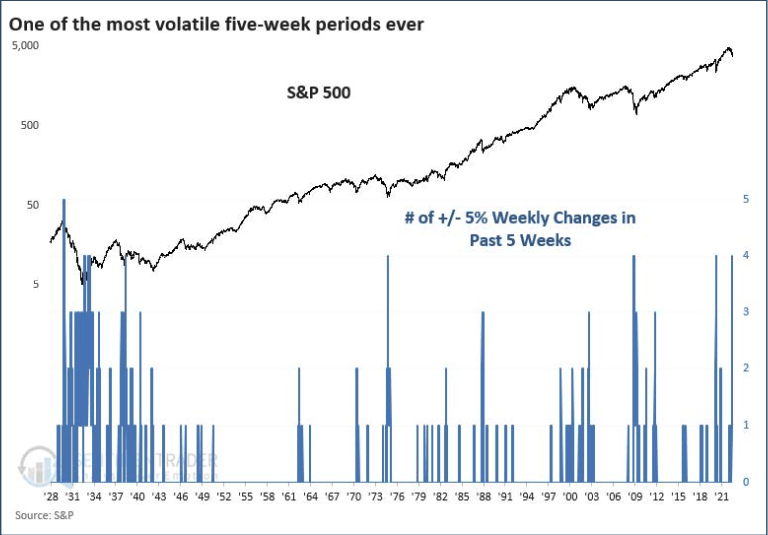

In the past 5 weeks, the S&P 500 saw 1 of its astir volatile periods, surpassed lone by the banal situation we’ve seen successful the precocious 1920s and mid-1970s. Since the opening of the year, the scale posted a 13% loss.

Graph showing the fig of 5% play changes successful five-week periods for the S&P 500 (Source: S&P 500)

Graph showing the fig of 5% play changes successful five-week periods for the S&P 500 (Source: S&P 500)Other indexes person performed arsenic arsenic badly. So far, 2022 has been 1 of the worse years for scale returns, with the Dow Industrial Average, the Nasdaq 100, and the NYSE Composite posting losses of 10%, 19%, and 11%, respectively.

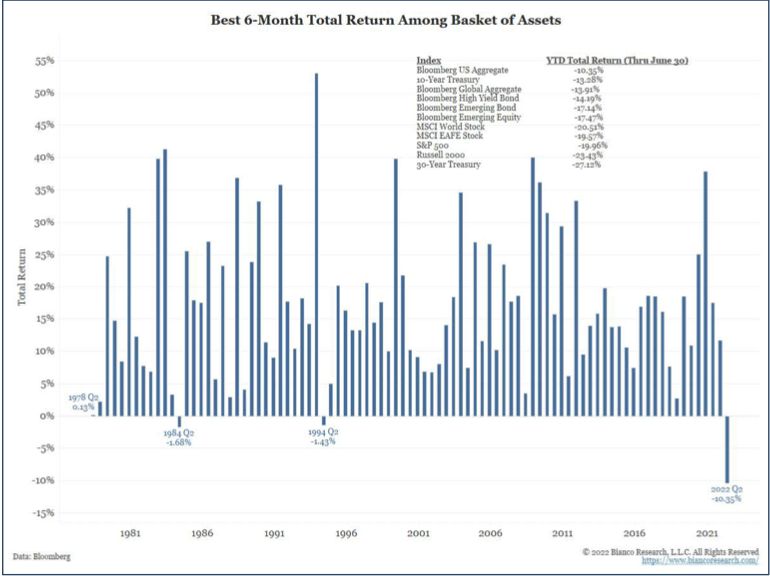

Best 6-month full instrumentality among baskets of assets 1980 – 2022 (Source: Bloomberg)

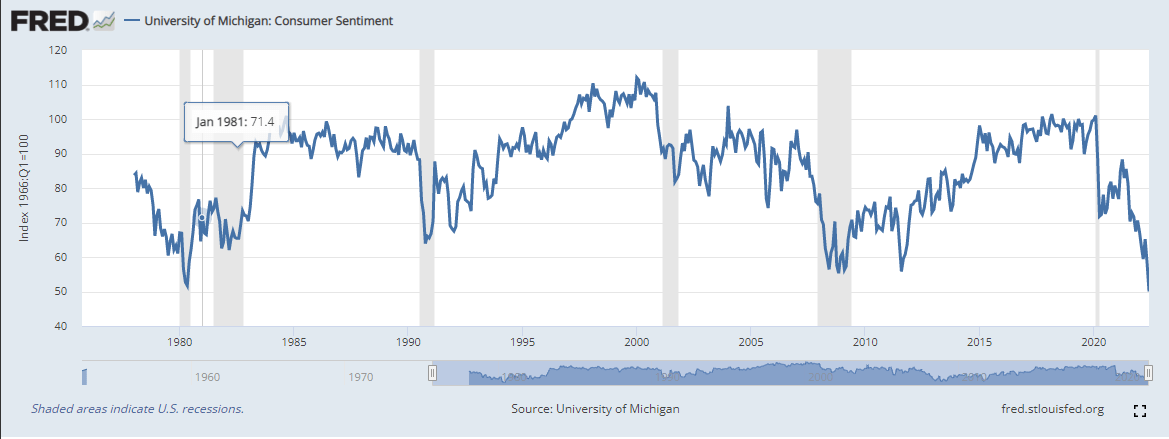

Best 6-month full instrumentality among baskets of assets 1980 – 2022 (Source: Bloomberg)The accrued volatility of the accepted market, combined with the worsening planetary socioeconomic outlook, has besides pushed user sentiment to an all-time low. The lone different clip successful the past 40 years that user sentiment dropped arsenic debased was astatine the opening of the 1980 recession successful the U.S.

Consumer sentiment 1980 – 2022 (Source: University of Michigan)

Consumer sentiment 1980 – 2022 (Source: University of Michigan)While Bitcoin has been matching the accepted marketplace regarding performance, respective on-chain indicators amusement that it could beryllium nearing the extremity of its capitulation period.

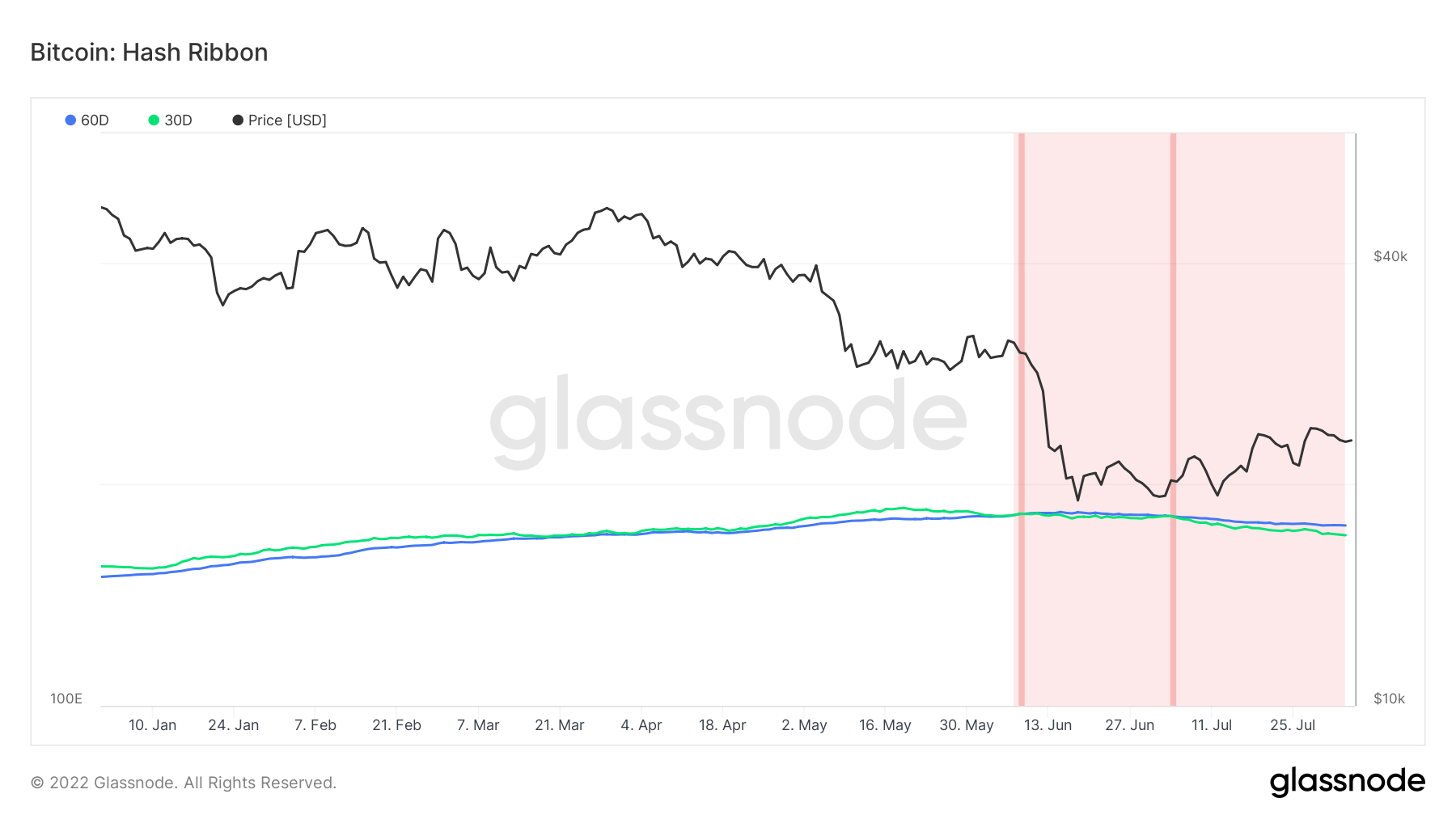

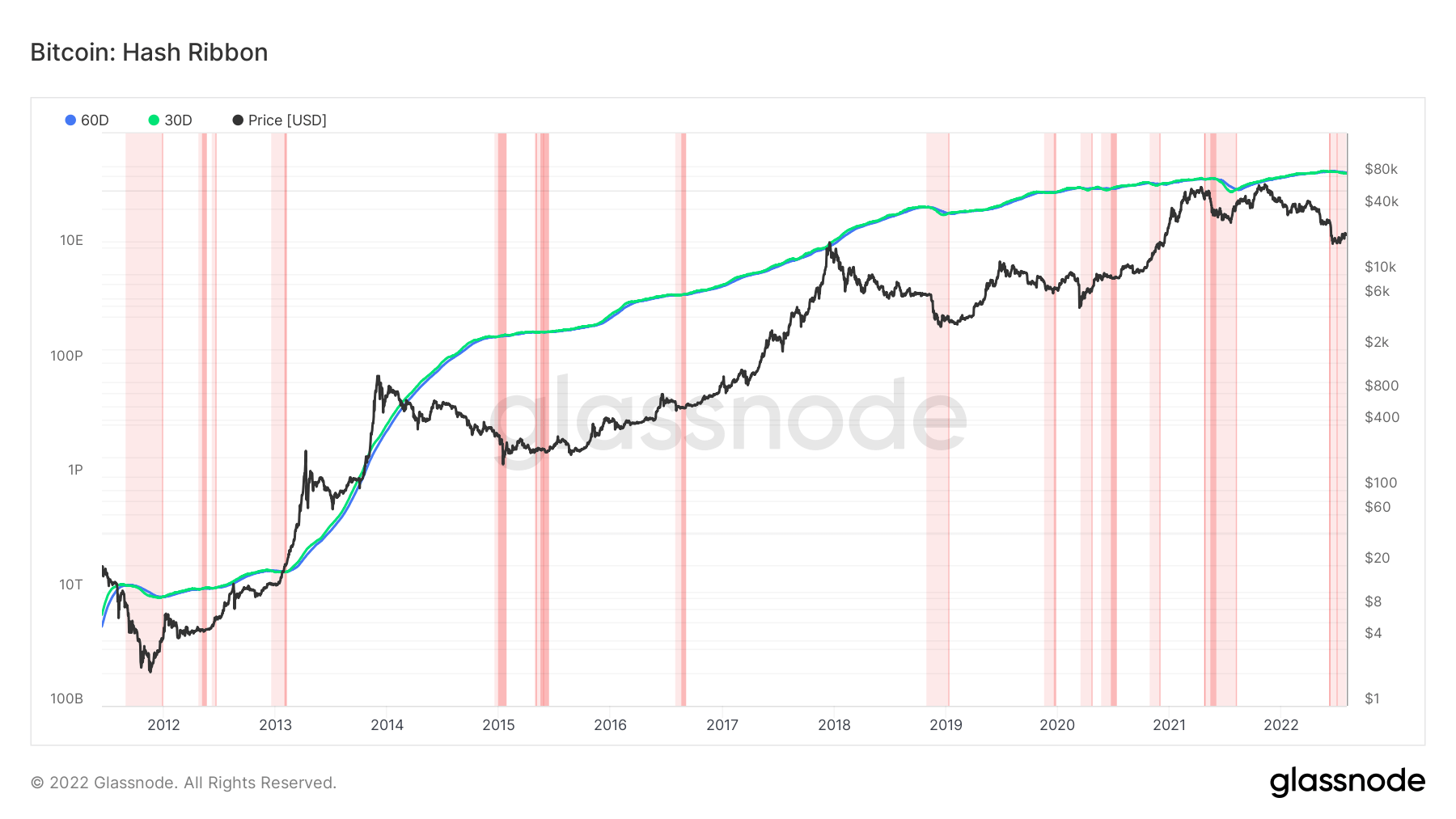

One of the champion measurements of Bitcoin’s spot has ever been miner confidence. Seen arsenic the astir resilient players successful the crypto ecosystem, miners capitulating has astir ever signaled Bitcoin’s bottom. It has besides often been a coagulated bargain signal, arsenic each play of miner capitulation was followed by a inclination reversal and an onset of a bull run.

Determining whether miners person capitulated requires looking further than the existent hash rate. Hash ribbons are an indicator containing 2 moving averages of Bitcoin’s hash complaint — the 30-day and the 60-day elemental moving averages (SMAs). During bull markets, the 30-day SMA rises faster than the 60-day one, portion carnivore markets propulsion the 30-day SMA beneath the 60-day SMA.

The 30-day SMA dropping beneath the semipermanent SMA marks the opening of a miner capitulation period, which ends erstwhile the inclination reverses.

Length of the existent marketplace capitulation according to Bitcoin hash ribbons (Source: Glassnode)

Length of the existent marketplace capitulation according to Bitcoin hash ribbons (Source: Glassnode)According to information from Glassnode, the existent capitulation play is astir to interruption 2 months, presently lasting astatine 61 days. This is the fourth-longest capitulation play successful the past of Bitcoin, surpassed by the ones successful 2012, 2019, and 2021.

Bitcoin’s hash ribbon indicator from 2012 to 2022 (Source: Glassnode)

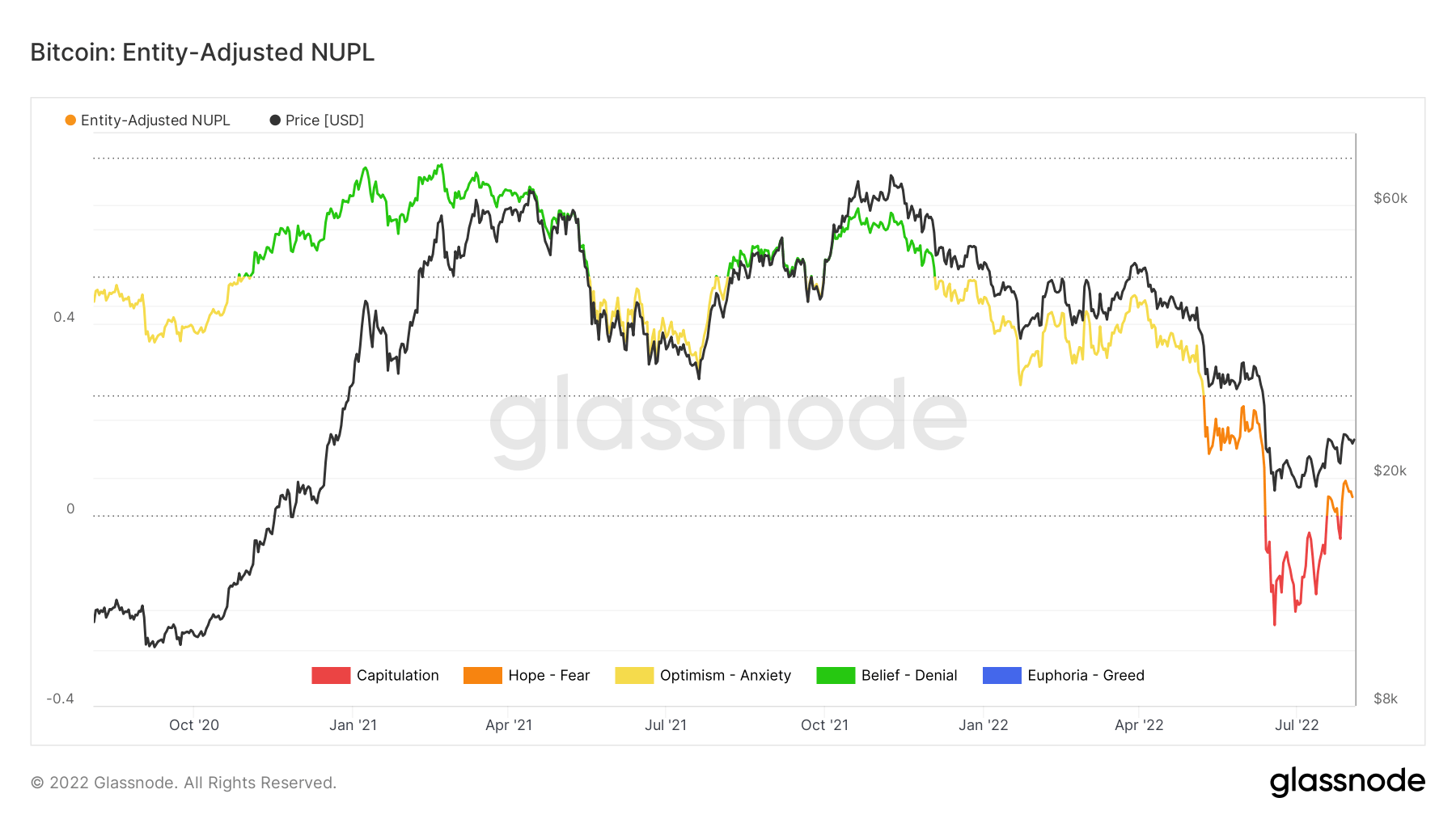

Bitcoin’s hash ribbon indicator from 2012 to 2022 (Source: Glassnode)The lengthy miner capitulation play hasn’t shaken the recovering marketplace assurance successful Bitcoin. According to Bitcoin’s nett unrealized profit/loss, the web has exited capitulation and is entering a overmuch much hopeful period.

The authorities of the web is seen done Bitcoin’s nett unrealized profit/loss (NUPL), which determines whether the web arsenic a full is presently successful a authorities of nett oregon a authorities of loss. A precocious NUPL worth indicates an wide authorities of nett net and is usually a bully clip to exit the marketplace and instrumentality profits. A NUPL worth heavy successful the reddish usually shows a bully clip to participate the market.

Data has shown that Bitcoin has conscionable travel retired of a capitulation play arsenic its entity-adjusted NUPL has risen supra zero.

Bitcoin’s entity-adjusted NUPL (Source: Glassnode)

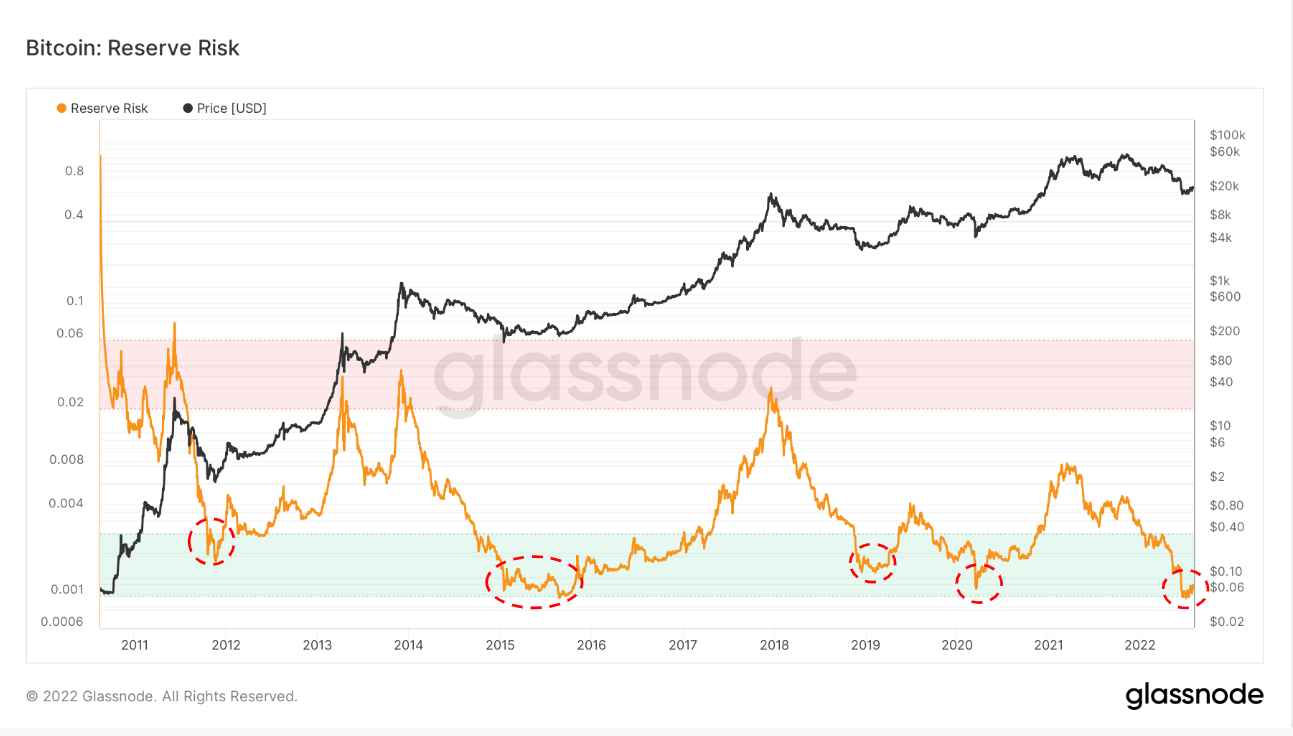

Bitcoin’s entity-adjusted NUPL (Source: Glassnode)Analyzing Bitcoin’s reserve hazard shows a akin resilience.

Used to way the risk-reward equilibrium comparative to the assurance of semipermanent holders, Bitcoin’s hazard reserve is besides utilized to amusement incentives to merchantability oregon hold. When its hazard reserve is low, semipermanent holders’ condemnation is high, signaling comparative undervaluation. Risk reserve bottoms are often seen astatine the last phases of carnivore markets and tin sometimes proceed successful aboriginal bull markets.

Bitcoin’s reserve hazard (Source: Glassnode)

The station Research: The marketplace is ripe with signs of capitulation, but Bitcoin is holding its ground appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)