The wide marketplace sentiment is usually determined by looking astatine semipermanent marketplace behavior. However, portion zooming retired tin enactment existent marketplace conditions into a overmuch amended perspective, sometimes the astir coagulated gauge of the market’s presumption lies successful the middle.

SOPR and its worth successful marketplace analysis

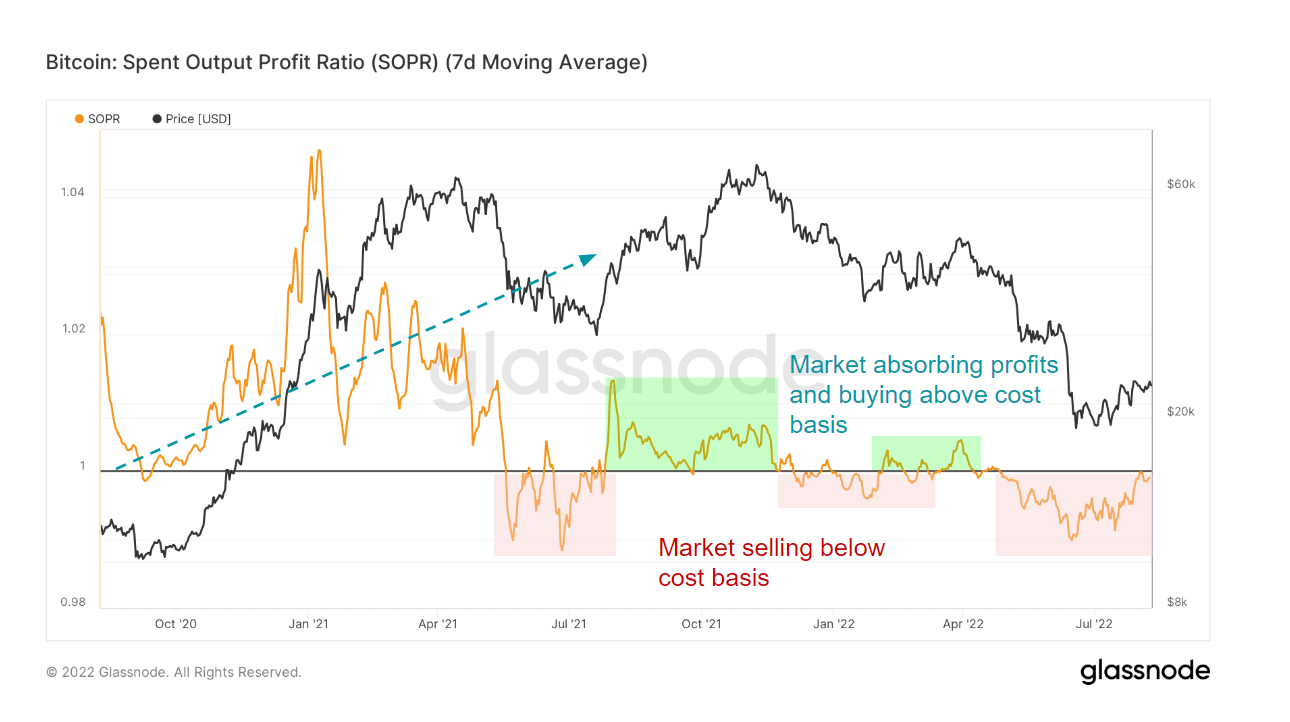

The Spent Output Profit Ratio (SOPR) is simply a useful metric for determining the wide marketplace sentiment. As its sanction suggests, the metric compares the worth of outputs erstwhile they were spent to erstwhile they were created. The metric shows the grade of realized nett for each coins moved on-chain successful a peculiar clip frame.

When SOPR exceeds one, the coins successful question are transacting astatine a profit. When the ratio is little than one, the coins are transacting astatine a loss. A SOPR ratio of 1 is called a SOPR reset and is often utilized to awesome the commencement oregon the extremity of a mid-term cycle. The SOPR reset tin besides enactment arsenic enactment successful bull markets oregon arsenic absorption successful carnivore markets.

While the metric is an simple and easy-to-interpret signal, it tin beryllium further modified to contiguous a overmuch much analyzable marketplace view.

For example, filtering transactions to region immoderate “in-house” enactment (e.g., transactions betwixt addresses belonging to the aforesaid owner) is done done aSOPR, which shows amended marketplace signals erstwhile compared to the raw-data SOPR. The SOPR and aSOPR metrics tin beryllium further segmented into cohorts of semipermanent and short-term holders.

Bitcoin’s SOPR

For the archetypal clip since May, Bitcoin’s 7-day MA SOPR has been trying to interruption supra 1. At the extremity of July, Bitcoin’s SOPR touched 1 and has been retesting it passim the archetypal week of August.

Every clip Bitcoin deed a SOPR of 1 and failed to interruption resistance; its terms saw a little uptick. Attempts to interruption the SOPR absorption person astir ever correlated with carnivore marketplace rallies, sometimes referred to arsenic dormant feline bounces.

And portion Bitcoin’s unsuccessful attempts to interruption done the absorption mightiness look pessimistic, the outlook is positive. Historically, it has ever taken respective attempts for SOPR to interruption supra 1. The much it fought to interruption done the ratio of 1, the stronger the enactment it had aboriginal on.

Graph showing the 7-day MA for Bitcoin’s SOPR (Source: Glassnode)

Graph showing the 7-day MA for Bitcoin’s SOPR (Source: Glassnode)Ethereum’s SOPR

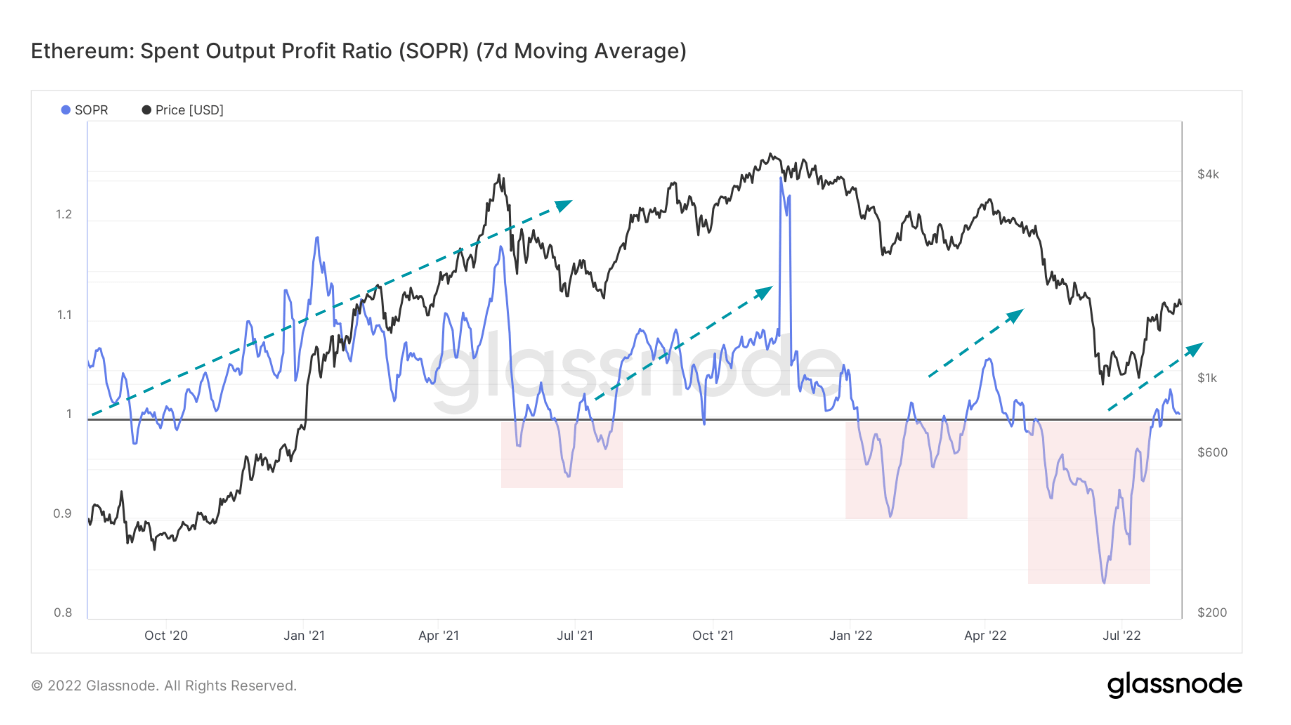

Unlike Bitcoin, Ethereum managed to pierce supra the SOPR of 1 astatine the archetypal attempt. As of August, Ethereum seems to person recovered enactment astatine 1, with information from Glassnode showing it rapidly recovered from its past drop. Ethereum’s rising SOPR is simply a nonstop effect of ETH’s rising price, which has been defying the broader marketplace inclination that’s keeping astir coins heavy successful the red.

However, portion Bitcoin has been retesting its resistance, Ethereum has been retesting its support, showing the 2 could beryllium moving successful other directions. Historically, for the spent output nett ratio to enactment arsenic beardown support, the ratio needed to spell done absorption respective times for it to enactment arsenic support.

As antecedently covered by CryptoSlate, Ethereum’s market-defying rally is mostly a effect of speculation astir the upcoming Merge. This is seen successful a important summation successful derivatives trading, which pushed the unfastened involvement connected Ethereum to $6.4 cardinal — $1.4 cardinal much than the unfastened involvement connected Bitcoin. The emergence successful derivatives trading stands successful opposition with the declining idiosyncratic enactment connected the network, seen successful the dropping state fees.

This magnitude of speculation puts the stableness of Ethereum’s SOPR successful danger. Any weaknesses successful Ethereum’s terms volition surely impact the ratio and propulsion it beneath 1. If it were to driblet suddenly, Ethereum’s SOPR could find beardown absorption if it were to effort to interruption supra the level again.

Graph showing the 7-day MA for Ethereum’s SOPR (Source: Glassnode)

Graph showing the 7-day MA for Ethereum’s SOPR (Source: Glassnode)

The station Research: The Merge is causing a divergence betwixt Ethereum and Bitcoin SOPR appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)