Measuring the economical enactment of a marketplace requires looking astatine much than conscionable the full transaction volume, particularly erstwhile it comes to assets arsenic circumstantial arsenic Bitcoin. While the fig of transactions and transaction measurement are some affected by marketplace swings, they aren’t bully indicators of aboriginal performance.

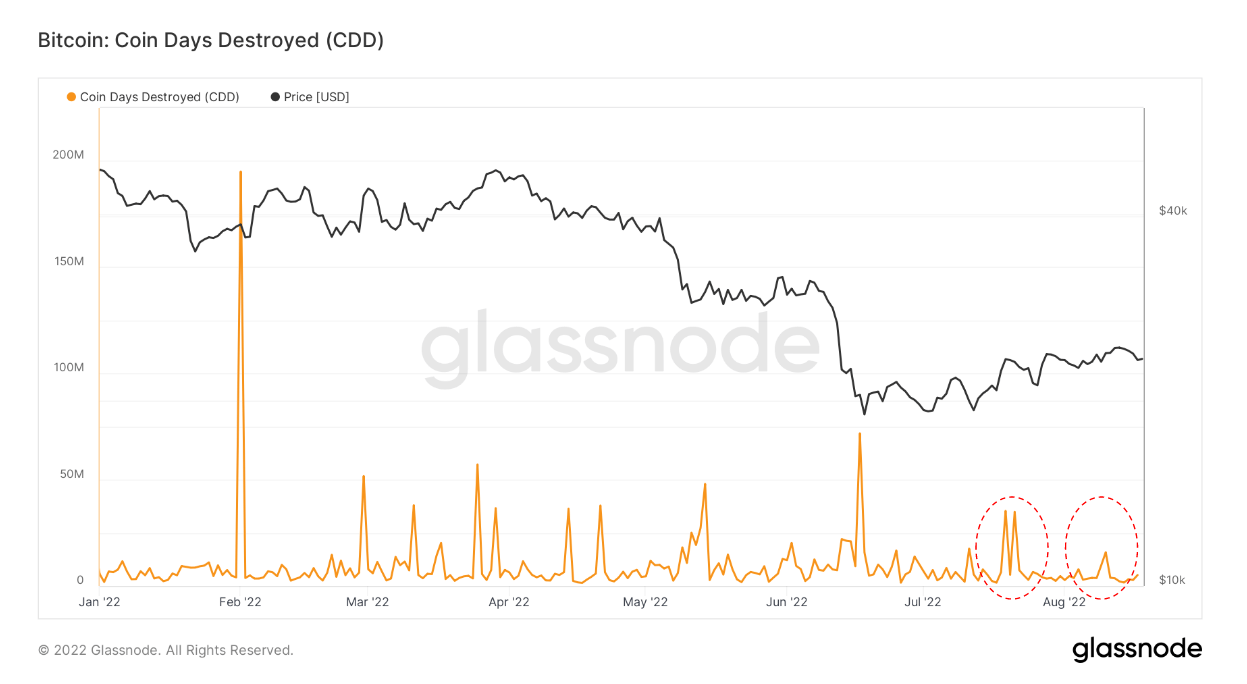

Given Bitcoin’s presumption connected the marketplace arsenic a semipermanent investment, Coin Days Destroyed (CDD) is simply a overmuch amended indicator of the market’s wide sentiment. Bitcoins held successful acold retention arsenic a semipermanent store of worth are considered much important than precocious acquired coins, arsenic their question signals a alteration successful hodler behavior.

Every Bitcoin accumulates 1 coin time each time that it remains unspent. As soon arsenic the coin is spent, the accumulated days are destroyed and registered by the Coin Days Destroyed (CDD) metric. The metric past shows the fig of coins spent successful a transaction multiplied by the fig of days passed since they were past spent.

For example, a transaction of 0.5 BTC that remained dormant for 100 days has accumulated 50 coin days, portion a transaction of 10 BTC that remained dormant for 6 hours accumulates lone 2.5 coin days. The larger the CDD metric, the much economically important the transaction is.

Since the opening of the year, determination person been respective ample spikes successful CDDs. Almost each of these spikes travel from accrued macro uncertainty and FUD connected the market, pushing semipermanent holders to exit the marketplace and instrumentality profits.

Coin Days Destroyed (CDD) metric for Bitcoin (Source: Glassnode)

Coin Days Destroyed (CDD) metric for Bitcoin (Source: Glassnode)The astir important spike successful CDD was seen successful February 2022, erstwhile Russia’s penetration of Ukraine devastated planetary markets. Fearing a further diminution and unwillingness to instrumentality connected the hazard of a prolonged slump, galore semipermanent holders (LTHs) exited their BTC positions. It started a domino effect that dragged the remainder of the marketplace down.

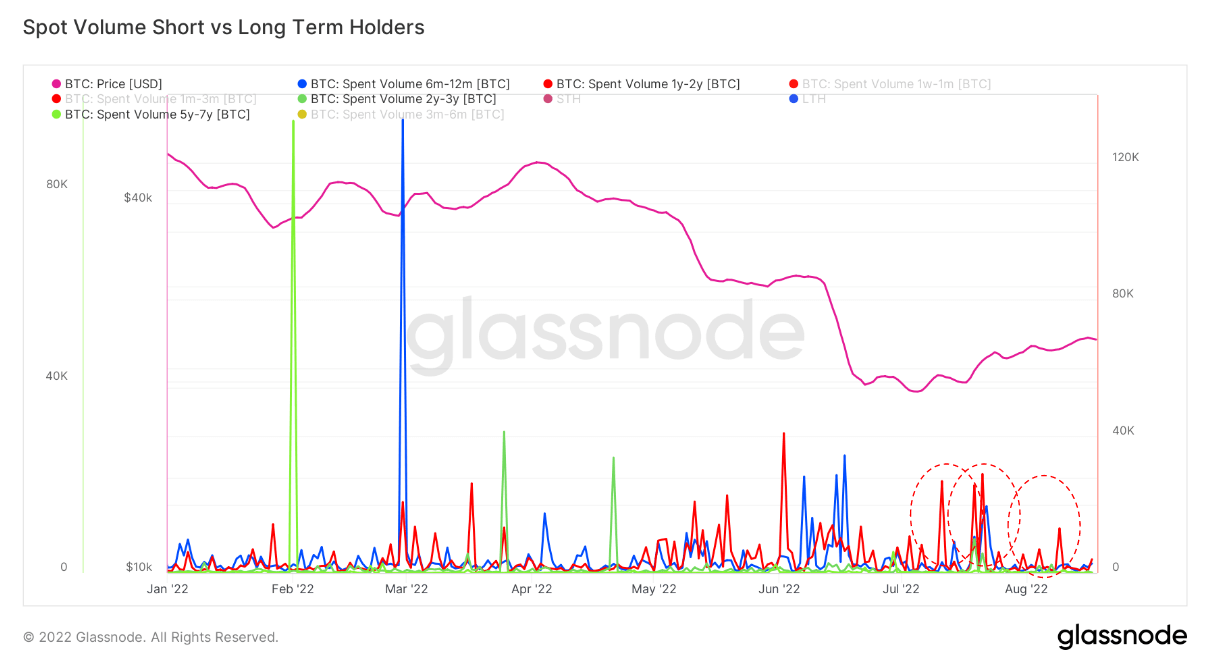

The metric tin beryllium breached down adjacent further to amusement which cohorts person been selling their BTC holdings. Analyzing Bitcoin’s spent measurement by property indicates that short-term holders usually initiate the bulk of BTC selling — some successful carnivore and bull markets. Looking done the CDD metric, short-term holders are defined arsenic a cohort of coins held for little than 155 days.

However, the latest alleviation rally that saw Bitcoin interruption done the $21,000 absorption pushed different cohort to merchantability their positions. According to information from Glassnode, users that held Bitcoin for betwixt 1 and 2 years dominated the astir caller Bitcoin sell-off. It’s highly apt that this cohort purchased Bitcoin during a highest successful January 2021 and saw their concern suffer implicit 64% of its value.

Spot measurement for Bitcoin for semipermanent holders and short-term holders (Source: Glassnode)

Spot measurement for Bitcoin for semipermanent holders and short-term holders (Source: Glassnode)The information besides shows that semipermanent holders sitting connected their Bitcoin for implicit 2 years were mostly unfazed by the caller alleviation rally. The lone clip semipermanent holders succumbed to the unit of the marketplace was successful June this twelvemonth erstwhile the Terra (LUNA) blowback pushed each cohort to sell.

Nonetheless, semipermanent holders remained a stabilizing origin during the June sell-off and are inactive holding the fort arsenic the marketplace enters its 3rd period of a downturn.

The station Research: This metric shows who has been selling Bitcoin successful the caller carnivore marketplace alleviation rally appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)